Log In/Sign Up

Your email has been sent.

17105 Madison Ave 12 Unit Apartment Building $1,600,000 ($133,333/Unit) 8.12% Cap Rate Lakewood, OH 44107

Investment Highlights

- 17105 Madison Avenue offers 10 oversized two-bedroom units and two spacious one-bedroom units.

- Building features include a gable rood, a covered garage, and low expense load as there are separately-metered furnaces.

- This is a timeless investment asset opportunity in Lakewood's premier submarket.

- At the heart of Lakewood's Hilliard triangle, a stones throw from Ohio's renowned Rocky River Reservation.

Executive Summary

Situated in the most sought-after sub-market of Lakewood, 17105 Madison is a well-maintained 12-suite property featuring a highly desirable unit mix (10 two-bedroom units), rare building features (gabled roof and covered garage), and a low operating cost structure (individually metered gas furnaces). The property is located within the Hilliard Triangle, directly across from the Rocky River Reservation, ensuring strong rental demand.

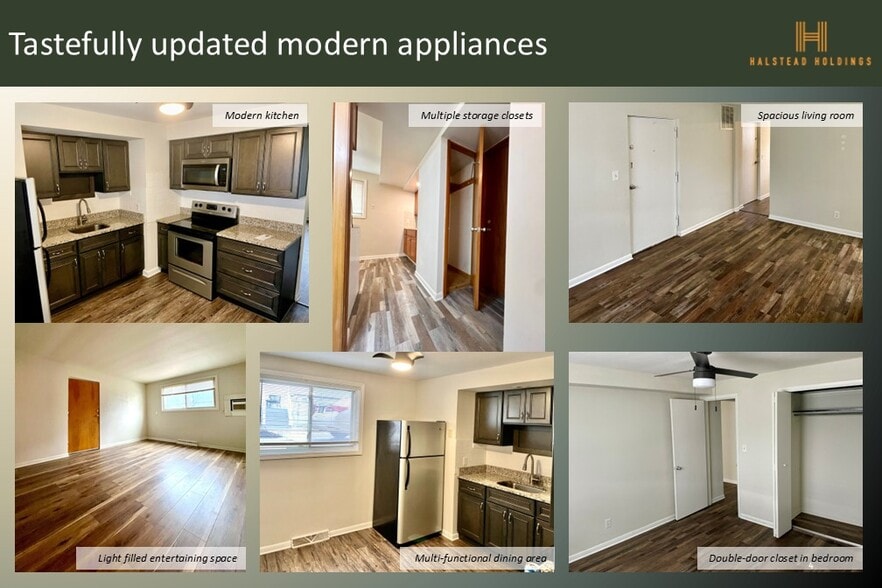

There have been modern unit upgrades of granite countertops and modern bathroom vanities(one unit remains un-updated as a long-term legacy tenant has occupied it). There are low operating costs as tenants pay for both gas and electricity. Each unit enjoys its own garage space, with individual storage space on-premises. The on-site laundry is a significant value-add, as well as an additional source of income. High rental demand is seen via the demand-over-supply interests for rental opportunities, especially from March through October. This area has a high walk score and exceptional accessibility to local dining, boutiques, and amenities.

This offering presents an attractive entry point at a competitive cap rate. It has significant potential for value enhancement by aligning legacy rents with current market rates and monetizing the remaining parking spaces. This investment-grade property is 100% turnkey and ready for its next owner.

There have been modern unit upgrades of granite countertops and modern bathroom vanities(one unit remains un-updated as a long-term legacy tenant has occupied it). There are low operating costs as tenants pay for both gas and electricity. Each unit enjoys its own garage space, with individual storage space on-premises. The on-site laundry is a significant value-add, as well as an additional source of income. High rental demand is seen via the demand-over-supply interests for rental opportunities, especially from March through October. This area has a high walk score and exceptional accessibility to local dining, boutiques, and amenities.

This offering presents an attractive entry point at a competitive cap rate. It has significant potential for value enhancement by aligning legacy rents with current market rates and monetizing the remaining parking spaces. This investment-grade property is 100% turnkey and ready for its next owner.

Financial Summary (Actual - 2025) |

Annual | Annual Per SF |

|---|---|---|

| Gross Rental Income |

$173,100

|

$17.40

|

| Other Income |

$7,800

|

$0.78

|

| Vacancy Loss |

-

|

-

|

| Effective Gross Income |

$180,900

|

$18.18

|

| Taxes |

$24,444

|

$2.46

|

| Operating Expenses |

$26,041

|

$2.62

|

| Total Expenses |

$50,485

|

$5.07

|

| Net Operating Income |

$130,415

|

$13.11

|

Financial Summary (Actual - 2025)

| Gross Rental Income | |

|---|---|

| Annual | $173,100 |

| Annual Per SF | $17.40 |

| Other Income | |

|---|---|

| Annual | $7,800 |

| Annual Per SF | $0.78 |

| Vacancy Loss | |

|---|---|

| Annual | - |

| Annual Per SF | - |

| Effective Gross Income | |

|---|---|

| Annual | $180,900 |

| Annual Per SF | $18.18 |

| Taxes | |

|---|---|

| Annual | $24,444 |

| Annual Per SF | $2.46 |

| Operating Expenses | |

|---|---|

| Annual | $26,041 |

| Annual Per SF | $2.62 |

| Total Expenses | |

|---|---|

| Annual | $50,485 |

| Annual Per SF | $5.07 |

| Net Operating Income | |

|---|---|

| Annual | $130,415 |

| Annual Per SF | $13.11 |

Property Facts

| Price | $1,600,000 | Apartment Style | Low-Rise |

| Price Per Unit | $133,333 | Building Class | C |

| Sale Type | Investment | Lot Size | 0.31 AC |

| Cap Rate | 8.12% | Building Size | 9,950 SF |

| Gross Rent Multiplier | 8.29 | No. Stories | 2 |

| No. Units | 12 | Year Built | 1959 |

| Property Type | Multifamily | Parking Ratio | 1/1,000 SF |

| Property Subtype | Apartment | ||

| Zoning | R2 | ||

| Price | $1,600,000 |

| Price Per Unit | $133,333 |

| Sale Type | Investment |

| Cap Rate | 8.12% |

| Gross Rent Multiplier | 8.29 |

| No. Units | 12 |

| Property Type | Multifamily |

| Property Subtype | Apartment |

| Apartment Style | Low-Rise |

| Building Class | C |

| Lot Size | 0.31 AC |

| Building Size | 9,950 SF |

| No. Stories | 2 |

| Year Built | 1959 |

| Parking Ratio | 1/1,000 SF |

| Zoning | R2 |

Amenities

Unit Amenities

- Air Conditioning

- Storage Space

- Washer/Dryer

- Heating

- Vinyl Flooring

Site Amenities

- 24 Hour Access

- Controlled Access

- Tenant Controlled HVAC

- Smoke Free

- Smoke Detector

Unit Mix Information

| Description | No. Units | Avg. Rent/Mo | SF |

|---|---|---|---|

| Studios | 12 | - | - |

1 1

Walk Score®

Very Walkable (71)

Property Taxes

| Parcel Number | 313-09-005 | Total Assessment | $236,775 (2024) |

| Land Assessment | $27,825 (2024) | Annual Taxes | $24,444 ($2.46/SF) |

| Improvements Assessment | $208,950 (2024) | Tax Year | 2025 |

Property Taxes

Parcel Number

313-09-005

Land Assessment

$27,825 (2024)

Improvements Assessment

$208,950 (2024)

Total Assessment

$236,775 (2024)

Annual Taxes

$24,444 ($2.46/SF)

Tax Year

2025

1 of 9

Videos

Matterport 3D Exterior

Matterport 3D Tour

Photos

Street View

Street

Map

1 of 1

Presented by

Halstead Capital LLC

17105 Madison Ave

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.

Your message has been sent!

Activate your LoopNet account now to track properties, get real-time alerts, save time on future inquiries, and more.