Log In/Sign Up

Your email has been sent.

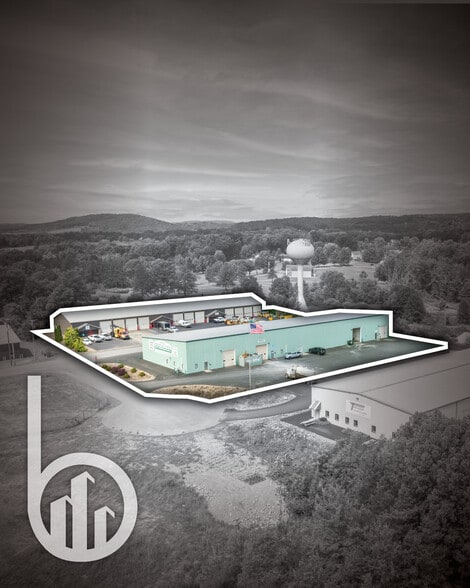

243 & 244 GREY FOX DRIVE, MONTOURSVILLE 2 Industrial Properties Offered at $4,403,371 in Montoursville, PA

INVESTMENT HIGHLIGHTS

- Highly desirable small bay warehouse format: Average tenant space is 4,000 sq ft.

- Market to Market Opportunity: Strong local tenant demand provides upside at existing tenant roll along with conversion to triple net.

- Rare opportunity to acquire two assets scale operations in Northern Central PA market-Supply constrained market with no new supply in development.

- Priced below replacement cost.

- 4.2% NOI CAGR over 5-year hold period.

- Favorable financing available.

EXECUTIVE SUMMARY

The subject portfolio is located within a major manufacturing hub. Surrounding manufacturers include Shop-Vac Corporation, Prysmian North America, Fedex, Frito-Lay West Pharmaceutical Services and Premier Tech. Located only 4 mins away from major retail and the Lycoming District (redevelopment ongoing). Bass Pro Shops currently in development as well as Starbucks, Target, Dicks Sporting Goods, Burger King and Wawa also in development.

The Williamsport industrial market contains roughly 19.0 million SF of inventory. The market has approximately 7.5 million SF of logistics inventory, 550,000 SF of flex inventory, and 11.0 million SF of specialized inventory. Market vacancy rate of 5.2% as of the third quarter of 2025. Over the past year, the market’s vacancy rate has

changed by 0.9%, a result of no net delivered space and -170,000 SF of net absorption. The Williamsport industrial market has roughly 730,000 SF of space listed as available, for an availability rate of 3.9%. As of the third quarter of 2025, there is no industrial space under construction in Williamsport. In comparison, the market has averaged 32,000 SF of under construction inventory over the past 10 years. Market rents in Williamsport average $9.30/SF. Rents average around $8.40/SF for logistics buildings, $12.70/SF for flex properties, and $9.70/SF for specialized assets. Market rents have changed by 2.7% in logistics buildings year over year and 1.8% in flex buildings. The rental market growth is mostly attributed to an available robust blue collar work force both in Williamsport and surrounding communities but bolstered by county and city investment in new business openings and generating jobs for the community. Existing skilled manufacturing companies make collocating desirable from companies looking for first or additional manufacturing locations.

Manufacturing, which accounts for more than $116 billion in gross state product, and agriculture, which contributes $132.5 billion annually to Pennsylvania’s economy, both play a crucial role in our Commonwealth’s economy and are included in the five key industries highlighted in Governor Shapiro’s Economic Development Strategy.

The Williamsport industrial market contains roughly 19.0 million SF of inventory. The market has approximately 7.5 million SF of logistics inventory, 550,000 SF of flex inventory, and 11.0 million SF of specialized inventory. Market vacancy rate of 5.2% as of the third quarter of 2025. Over the past year, the market’s vacancy rate has

changed by 0.9%, a result of no net delivered space and -170,000 SF of net absorption. The Williamsport industrial market has roughly 730,000 SF of space listed as available, for an availability rate of 3.9%. As of the third quarter of 2025, there is no industrial space under construction in Williamsport. In comparison, the market has averaged 32,000 SF of under construction inventory over the past 10 years. Market rents in Williamsport average $9.30/SF. Rents average around $8.40/SF for logistics buildings, $12.70/SF for flex properties, and $9.70/SF for specialized assets. Market rents have changed by 2.7% in logistics buildings year over year and 1.8% in flex buildings. The rental market growth is mostly attributed to an available robust blue collar work force both in Williamsport and surrounding communities but bolstered by county and city investment in new business openings and generating jobs for the community. Existing skilled manufacturing companies make collocating desirable from companies looking for first or additional manufacturing locations.

Manufacturing, which accounts for more than $116 billion in gross state product, and agriculture, which contributes $132.5 billion annually to Pennsylvania’s economy, both play a crucial role in our Commonwealth’s economy and are included in the five key industries highlighted in Governor Shapiro’s Economic Development Strategy.

PROPERTY FACTS

| Price | $4,403,371 | Number of Properties | 2 |

| Price / SF | $131.64 / SF | Individually For Sale | 0 |

| Cap Rate | 7% | Total Building Size | 33,450 SF |

| Sale Type | Investment | Total Land Area | 2.12 AC |

| Status | Active |

| Price | $4,403,371 |

| Price / SF | $131.64 / SF |

| Cap Rate | 7% |

| Sale Type | Investment |

| Status | Active |

| Number of Properties | 2 |

| Individually For Sale | 0 |

| Total Building Size | 33,450 SF |

| Total Land Area | 2.12 AC |

PROPERTIES

| PROPERTY NAME / ADDRESS | PROPERTY TYPE | SIZE | YEAR BUILT | INDIVIDUAL PRICE |

|---|---|---|---|---|

| 244 Grey Fox Dr, Montoursville, PA 17754 | Industrial | 19,000 SF | 2010 | - |

| 243 Grey Fox Dr, Montoursville, PA 17754 | Industrial | 14,450 SF | 2009 | - |

1 1

1 of 9

VIDEOS

MATTERPORT 3D EXTERIOR

MATTERPORT 3D TOUR

PHOTOS

STREET VIEW

STREET

MAP

1 of 1

Presented by

243 & 244 GREY FOX DRIVE, MONTOURSVILLE

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.