Log In/Sign Up

Your email has been sent.

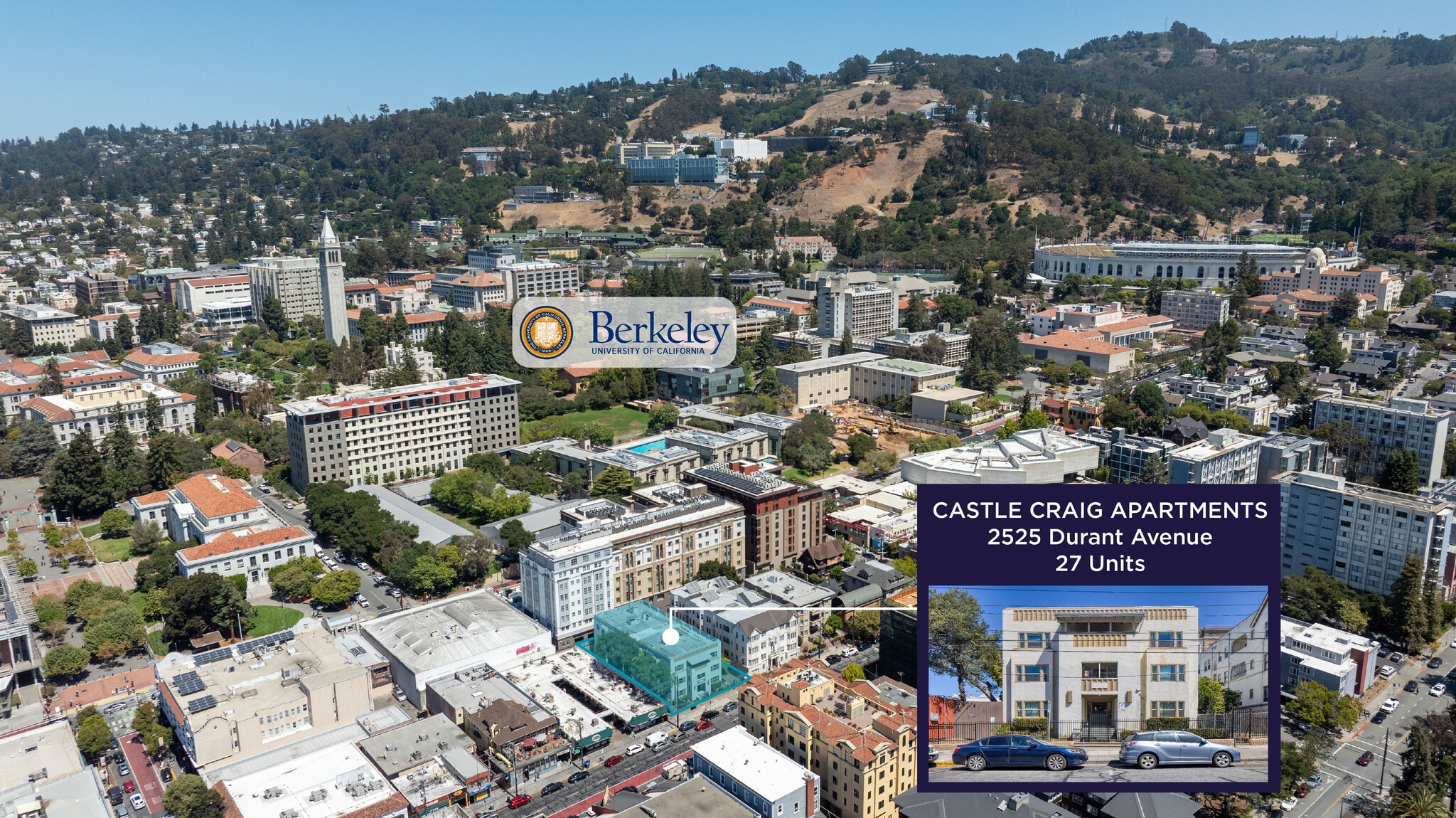

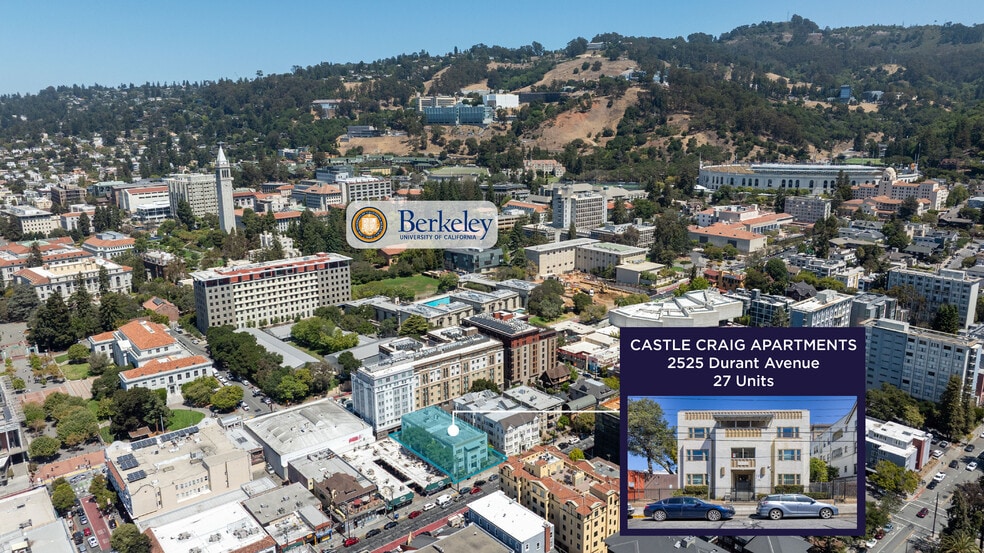

CASTLE CRAIG | 27 Units | Steps From Cal 2525 Durant Ave 27 Unit Apartment Building $7,900,000 ($292,593/Unit) 5.86% Cap Rate Berkeley, CA 94704

Investment Highlights

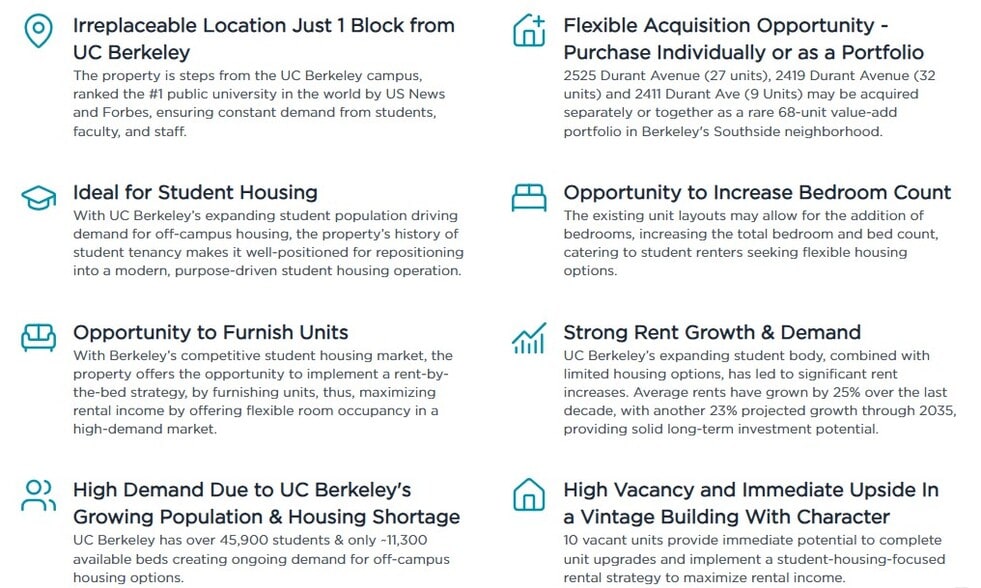

- Irreplaceable Location Just 1 Block from UC Berkeley

- Opportunity to Furnish Units

- Flexible Acquisition Opportunity - Purchase Individually or as a Portfolio

- Ideal for Student Housing

- High Demand Due to UC Berkeley's Growing Population & Housing Shortage

- Opportunity to Increase Bedroom Count

Executive Summary

Property tours are available by appointment.

Disclosure package & marketing flyer available upon request.

The Cushman & Wakefield Northern California Capital Markets Group is pleased to present The Castle Craig Apartments, a distinguished 27-unit multifamily asset located in an irreplaceable location at 2525 Durant Avenue in the highly sought-after Southside neighborhood of Berkeley, CA. Built in 1928, this 17,802-square-foot property boasts classic architectural character and presents a prime investment opportunity just steps away from the world-renowned UC Berkeley campus. Offered for the first time in more than 50 years, The Leroy Apartments represents a truly unique chance to secure a generational multifamily investment in one of the Bay Area's most dynamic rental markets.

The property’s unit mix consists of 13 studios, 12 one-bedroom units, and 2 two-bedroom units, catering to a diverse range of tenants, including UC Berkeley students, faculty, and local professionals seeking direct adjacency to UC Berkeley. Currently, 10 units are vacant,

providing immediate value-add potential for an investor to implement property upgrades and implement a modern purpose-driven student housing operation.

Castle Craig is offered at an attractive asking price of $7,900,000 ($292,593 per unit), with a stabilized cap rate of 5.86% and a proforma cap rate of 6.86%. The property’s stabilized rents average $2,506 per unit, while market rents average $2,785. This spread highlights strong rent growth trends and provides meaningful upside potential through repositioning and lease-up of the vacant units.

Operationally, the property is well-positioned for continued demand, featuring individually metered electricity, while the landlord is responsible for water, gas, sewer, and waste services. Each unit benefits from on-site card-operated laundry facilities, enhancing the

property’s appeal to the predominantly student renter demographic.

Located in a highly walkable area with a Walk Score of 97 and Bike Score of 89, Castle Craig offers excellent accessibility to UC Berkeley, major bus lines, and the BART system. The property’s proximity to Telegraph Avenue, Berkeley’s main commercial corridor, provides residents with convenient access to a wide range of retail and dining options.

Demand for centrally located, well-amenitized housing in Berkeley’s supply-constrained Southside submarket remains strong, driven by UC Berkeley’s ongoing bed shortage and consistent population growth. Rent growth in the area has increased by 25% over the past 10 years, and is projected to exceed 23% through 2035. This, combined with the Castle Craig's classic construction, irreplaceable location, high current vacancy, and significant rent upside, makes the Property an exceptional opportunity for investors seeking both stable in-place income and long-term capital appreciation.

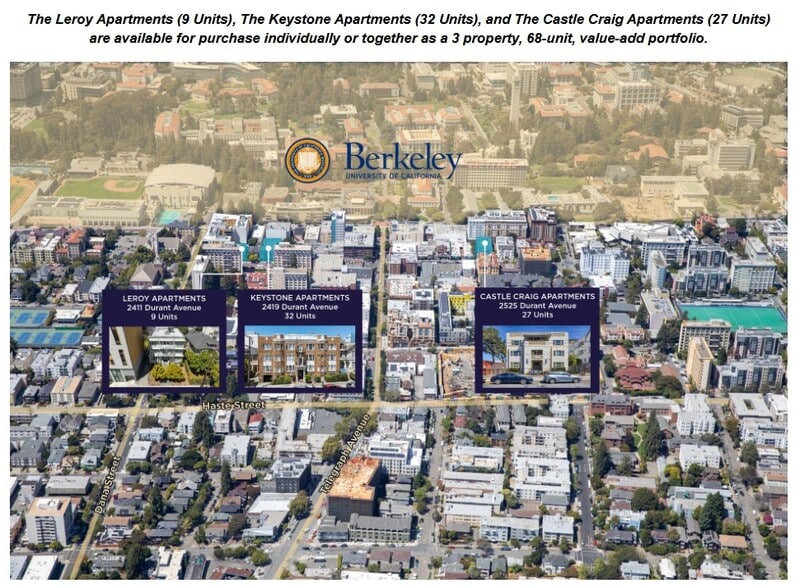

The property may be purchased individually or as a 3 property, 68-unit portfolio with The Keystone Apartments (2419 Durant Ave - 32 Units) and The Leroy Apartments (2411 Durant Ave - 9 Units).

Disclosure package & marketing flyer available upon request.

The Cushman & Wakefield Northern California Capital Markets Group is pleased to present The Castle Craig Apartments, a distinguished 27-unit multifamily asset located in an irreplaceable location at 2525 Durant Avenue in the highly sought-after Southside neighborhood of Berkeley, CA. Built in 1928, this 17,802-square-foot property boasts classic architectural character and presents a prime investment opportunity just steps away from the world-renowned UC Berkeley campus. Offered for the first time in more than 50 years, The Leroy Apartments represents a truly unique chance to secure a generational multifamily investment in one of the Bay Area's most dynamic rental markets.

The property’s unit mix consists of 13 studios, 12 one-bedroom units, and 2 two-bedroom units, catering to a diverse range of tenants, including UC Berkeley students, faculty, and local professionals seeking direct adjacency to UC Berkeley. Currently, 10 units are vacant,

providing immediate value-add potential for an investor to implement property upgrades and implement a modern purpose-driven student housing operation.

Castle Craig is offered at an attractive asking price of $7,900,000 ($292,593 per unit), with a stabilized cap rate of 5.86% and a proforma cap rate of 6.86%. The property’s stabilized rents average $2,506 per unit, while market rents average $2,785. This spread highlights strong rent growth trends and provides meaningful upside potential through repositioning and lease-up of the vacant units.

Operationally, the property is well-positioned for continued demand, featuring individually metered electricity, while the landlord is responsible for water, gas, sewer, and waste services. Each unit benefits from on-site card-operated laundry facilities, enhancing the

property’s appeal to the predominantly student renter demographic.

Located in a highly walkable area with a Walk Score of 97 and Bike Score of 89, Castle Craig offers excellent accessibility to UC Berkeley, major bus lines, and the BART system. The property’s proximity to Telegraph Avenue, Berkeley’s main commercial corridor, provides residents with convenient access to a wide range of retail and dining options.

Demand for centrally located, well-amenitized housing in Berkeley’s supply-constrained Southside submarket remains strong, driven by UC Berkeley’s ongoing bed shortage and consistent population growth. Rent growth in the area has increased by 25% over the past 10 years, and is projected to exceed 23% through 2035. This, combined with the Castle Craig's classic construction, irreplaceable location, high current vacancy, and significant rent upside, makes the Property an exceptional opportunity for investors seeking both stable in-place income and long-term capital appreciation.

The property may be purchased individually or as a 3 property, 68-unit portfolio with The Keystone Apartments (2419 Durant Ave - 32 Units) and The Leroy Apartments (2411 Durant Ave - 9 Units).

Financial Summary (Pro Forma - 2025) Click Here to Access |

Annual | Annual Per SF |

|---|---|---|

| Gross Rental Income |

$99,999

|

$9.99

|

| Other Income |

$99,999

|

$9.99

|

| Vacancy Loss |

$99,999

|

$9.99

|

| Effective Gross Income |

$99,999

|

$9.99

|

| Taxes |

$99,999

|

$9.99

|

| Operating Expenses |

$99,999

|

$9.99

|

| Total Expenses |

$99,999

|

$9.99

|

| Net Operating Income |

$99,999

|

$9.99

|

Financial Summary (Pro Forma - 2025) Click Here to Access

| Gross Rental Income | |

|---|---|

| Annual | $99,999 |

| Annual Per SF | $9.99 |

| Other Income | |

|---|---|

| Annual | $99,999 |

| Annual Per SF | $9.99 |

| Vacancy Loss | |

|---|---|

| Annual | $99,999 |

| Annual Per SF | $9.99 |

| Effective Gross Income | |

|---|---|

| Annual | $99,999 |

| Annual Per SF | $9.99 |

| Taxes | |

|---|---|

| Annual | $99,999 |

| Annual Per SF | $9.99 |

| Operating Expenses | |

|---|---|

| Annual | $99,999 |

| Annual Per SF | $9.99 |

| Total Expenses | |

|---|---|

| Annual | $99,999 |

| Annual Per SF | $9.99 |

| Net Operating Income | |

|---|---|

| Annual | $99,999 |

| Annual Per SF | $9.99 |

Property Facts In Escrow

| Price | $7,900,000 | Property Subtype | Apartment |

| Price Per Unit | $292,593 | Apartment Style | Low-Rise |

| Sale Type | Investment | Building Class | C |

| Cap Rate | 5.86% | Lot Size | 0.21 AC |

| Gross Rent Multiplier | 9.73 | Building Size | 17,802 SF |

| No. Units | 27 | No. Stories | 3 |

| Property Type | Multifamily | Year Built | 1928 |

| Zoning | CT | ||

| Price | $7,900,000 |

| Price Per Unit | $292,593 |

| Sale Type | Investment |

| Cap Rate | 5.86% |

| Gross Rent Multiplier | 9.73 |

| No. Units | 27 |

| Property Type | Multifamily |

| Property Subtype | Apartment |

| Apartment Style | Low-Rise |

| Building Class | C |

| Lot Size | 0.21 AC |

| Building Size | 17,802 SF |

| No. Stories | 3 |

| Year Built | 1928 |

| Zoning | CT |

Amenities

Unit Amenities

- Air Conditioning

- Heating

- Kitchen

- Vaulted Ceiling

- Refrigerator

- Oven

- Range

- Tub/Shower

- Freezer

Site Amenities

- 24 Hour Access

- Laundry Facilities

- Walk-Up

Unit Mix Information

| Description | No. Units | Avg. Rent/Mo | SF |

|---|---|---|---|

| Studios | 13 | $2,400 | 425 |

| 1+1 | 12 | $3,000 | 600 |

| 2+1 | 2 | $4,000 | 750 |

1 1

Walk Score®

Walker's Paradise (96)

Bike Score®

Very Bikeable (89)

Property Taxes

| Parcel Number | 055-1877-007-00 | Total Assessment | $1,220,297 |

| Land Assessment | $604,659 | Annual Taxes | ($1) ($0.00/SF) |

| Improvements Assessment | $604,703 | Tax Year | 2025 |

Property Taxes

Parcel Number

055-1877-007-00

Land Assessment

$604,659

Improvements Assessment

$604,703

Total Assessment

$1,220,297

Annual Taxes

($1) ($0.00/SF)

Tax Year

2025

1 of 41

Videos

Matterport 3D Exterior

Matterport 3D Tour

Photos

Street View

Street

Map

1 of 1

Presented by

CASTLE CRAIG | 27 Units | Steps From Cal | 2525 Durant Ave

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.

Your message has been sent!

Activate your LoopNet account now to track properties, get real-time alerts, save time on future inquiries, and more.