Log In/Sign Up

Your email has been sent.

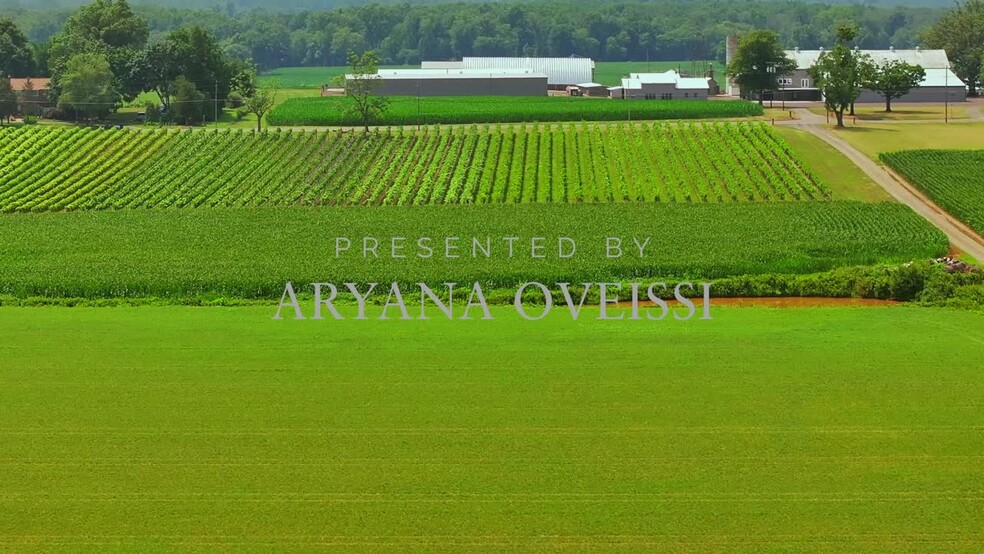

27058 Mount Pleasant Rd 90,000 SF Specialty Building Offered at $5,500,000 in Columbus, NJ 08022

Investment Highlights

- 185 Acre Vineyard and Winery, 165 Tillable Acres, Beautiful location for Weddings or Bed and Breakfast, Preserved Farmland

Executive Summary

Exclusively represented by Christie's International Real Estate, this 185-acre preserved estate in Columbus, NJ represents something extraordinarily rare in today's market: a fully licensed, substantially complete vineyard and hospitality platform poised to generate millions as the region's wine industry explodes onto the international stage.

Eighty percent of the critical infrastructure is in place. The heavy capital expenditures have been made. The federal licenses have been secured. The vineyard is established and producing. What remains is approximately 20% of finishing work, primarily focused on completing the tasting room and finalizing interior spaces. For the sophisticated investor, this represents an optimal entry point: past the risk and uncertainty of initial development, yet early enough to imprint your vision on the final product.

New Jersey's wine industry is experiencing a fundamental shift. The state's wines are winning international competitions. Critical recognition is accelerating. Tourism infrastructure is maturing. Yet land values remain a fraction of established regions, creating a rare arbitrage opportunity for those who understand market timing.

This property sits less than an hour from NYC, Philadelphia, Princeton, and the Jersey Shore, within reach of approximately 25 million affluent consumers. The accessibility advantage is profound. While remote wine regions struggle with the economics of attracting visitors, this estate benefits from proximity to dense concentrations of high-net-worth individuals who regularly seek premium experiences within convenient driving distance. The trajectory is clear. The question is simply whether you position yourself ahead of wider market recognition or wait until valuations reflect what is already becoming evident.

This property holds federal winery and import licenses that represent years of regulatory navigation and create genuine competitive moats. Immediate production capability. International import authorization. Interstate distribution rights. The winery farm license includes approvals for up to 15 retail salesrooms, enabling a multi-location hospitality model that most operators cannot replicate.

For the experienced investor, the value proposition is straightforward: licensing represents the most significant barrier to entry in this industry, and this property eliminates that barrier entirely. You acquire not just land and buildings, but operational permissions that would require substantial time and capital to secure independently.

Eleven premium grape varieties across 10.5 meticulously maintained acres. An additional 165 tillable acres of preserved farmland offering multiple development pathways: expanded vineyard cultivation, diversified organic agriculture, or integrated agritourism operations.

The preserved farm status provides both protection and prestige. Your investment operates within a framework that maintains land value, prevents adverse surrounding development, and positions any brand built here as authentically committed to sustainable, earth-conscious agriculture. This matters increasingly to the demographic that pays premium prices for wine and hospitality experiences. Current agricultural leases generate $42,175 annually, providing immediate cash flow while you execute your broader vision. The infrastructure supporting these operations is substantial: commercial-grade facilities including processing areas, equipment storage, farm offices, and support buildings designed for scaled agricultural enterprise.

An 11,000-square-foot historic manor presents multiple high-value use cases: luxury boutique inn, private membership club, exclusive event venue, or personal estate residence. The structure's bones are sound. The scale is impressive. The transformation potential is significant. The 5,000-square-foot tasting room, currently in final construction phases, is designed to contemporary hospitality standards with the capacity to deliver premium wine experiences that justify premium pricing. Two Residual Dwelling Site Opportunities carry no size restrictions, enabling construction of custom guest accommodations, private villas, or residential compounds. Three potential subdivisions provide strategic flexibility for future partnership structures or selective development. Supporting facilities include specialized agricultural buildings positioned to serve both wine production and diversified farming operations, creating operational efficiency across multiple revenue streams.

The sophisticated buyer evaluates properties through the lens of revenue potential and margin structure. This estate supports multiple high-margin revenue streams:

Luxury weddings in the region command five to six figures per event. Corporate retreats seeking private, exclusive venues represent recurring high-value bookings. Wine club memberships generate predictable subscription revenue with strong retention economics. Culinary programming and agricultural tourism attract consumers willing to pay premiums for authentic experiences. Brand partnerships and private events create additional revenue without corresponding capital intensity.

The hospitality economics are well-established in comparable markets. Event venues with authentic agricultural narratives and preserved land positions command pricing power. Wine sales through direct-to-consumer channels carry margins that wholesale distribution cannot match. The infrastructure here supports all of these models simultaneously.

Realistically, seven-figure annual revenue is achievable within the first several years of operation, scaling from there as brand recognition compounds. The fundamentals support it. The market demonstrates it. The infrastructure enables it.

The base offering includes all physical infrastructure, federal and state licensing, the established vineyard, and 185 acres of preserved farmland. For buyers seeking immediate full-scale operation, the seller offers an optional acquisition package including $2 million in wine inventory, comprehensive farming equipment, and commercial winemaking equipment. This structure allows you to calibrate your initial capital deployment and operational approach according to your specific strategy and timeline.

Eighty percent complete means the hard work is done. The regulatory approvals are secured. The agricultural systems are established. The major capital investments are behind you. What remains is finishing construction and executing go-to-market strategy.For the buyer with vision and operational capability, this represents optimal timing: late enough to avoid development risk, early enough to capture market appreciation as the region's reputation accelerates. The opportunity is significant. The infrastructure is substantially complete. The market dynamics are favorable. The decision is whether you act while the opportunity remains available.

Eighty percent of the critical infrastructure is in place. The heavy capital expenditures have been made. The federal licenses have been secured. The vineyard is established and producing. What remains is approximately 20% of finishing work, primarily focused on completing the tasting room and finalizing interior spaces. For the sophisticated investor, this represents an optimal entry point: past the risk and uncertainty of initial development, yet early enough to imprint your vision on the final product.

New Jersey's wine industry is experiencing a fundamental shift. The state's wines are winning international competitions. Critical recognition is accelerating. Tourism infrastructure is maturing. Yet land values remain a fraction of established regions, creating a rare arbitrage opportunity for those who understand market timing.

This property sits less than an hour from NYC, Philadelphia, Princeton, and the Jersey Shore, within reach of approximately 25 million affluent consumers. The accessibility advantage is profound. While remote wine regions struggle with the economics of attracting visitors, this estate benefits from proximity to dense concentrations of high-net-worth individuals who regularly seek premium experiences within convenient driving distance. The trajectory is clear. The question is simply whether you position yourself ahead of wider market recognition or wait until valuations reflect what is already becoming evident.

This property holds federal winery and import licenses that represent years of regulatory navigation and create genuine competitive moats. Immediate production capability. International import authorization. Interstate distribution rights. The winery farm license includes approvals for up to 15 retail salesrooms, enabling a multi-location hospitality model that most operators cannot replicate.

For the experienced investor, the value proposition is straightforward: licensing represents the most significant barrier to entry in this industry, and this property eliminates that barrier entirely. You acquire not just land and buildings, but operational permissions that would require substantial time and capital to secure independently.

Eleven premium grape varieties across 10.5 meticulously maintained acres. An additional 165 tillable acres of preserved farmland offering multiple development pathways: expanded vineyard cultivation, diversified organic agriculture, or integrated agritourism operations.

The preserved farm status provides both protection and prestige. Your investment operates within a framework that maintains land value, prevents adverse surrounding development, and positions any brand built here as authentically committed to sustainable, earth-conscious agriculture. This matters increasingly to the demographic that pays premium prices for wine and hospitality experiences. Current agricultural leases generate $42,175 annually, providing immediate cash flow while you execute your broader vision. The infrastructure supporting these operations is substantial: commercial-grade facilities including processing areas, equipment storage, farm offices, and support buildings designed for scaled agricultural enterprise.

An 11,000-square-foot historic manor presents multiple high-value use cases: luxury boutique inn, private membership club, exclusive event venue, or personal estate residence. The structure's bones are sound. The scale is impressive. The transformation potential is significant. The 5,000-square-foot tasting room, currently in final construction phases, is designed to contemporary hospitality standards with the capacity to deliver premium wine experiences that justify premium pricing. Two Residual Dwelling Site Opportunities carry no size restrictions, enabling construction of custom guest accommodations, private villas, or residential compounds. Three potential subdivisions provide strategic flexibility for future partnership structures or selective development. Supporting facilities include specialized agricultural buildings positioned to serve both wine production and diversified farming operations, creating operational efficiency across multiple revenue streams.

The sophisticated buyer evaluates properties through the lens of revenue potential and margin structure. This estate supports multiple high-margin revenue streams:

Luxury weddings in the region command five to six figures per event. Corporate retreats seeking private, exclusive venues represent recurring high-value bookings. Wine club memberships generate predictable subscription revenue with strong retention economics. Culinary programming and agricultural tourism attract consumers willing to pay premiums for authentic experiences. Brand partnerships and private events create additional revenue without corresponding capital intensity.

The hospitality economics are well-established in comparable markets. Event venues with authentic agricultural narratives and preserved land positions command pricing power. Wine sales through direct-to-consumer channels carry margins that wholesale distribution cannot match. The infrastructure here supports all of these models simultaneously.

Realistically, seven-figure annual revenue is achievable within the first several years of operation, scaling from there as brand recognition compounds. The fundamentals support it. The market demonstrates it. The infrastructure enables it.

The base offering includes all physical infrastructure, federal and state licensing, the established vineyard, and 185 acres of preserved farmland. For buyers seeking immediate full-scale operation, the seller offers an optional acquisition package including $2 million in wine inventory, comprehensive farming equipment, and commercial winemaking equipment. This structure allows you to calibrate your initial capital deployment and operational approach according to your specific strategy and timeline.

Eighty percent complete means the hard work is done. The regulatory approvals are secured. The agricultural systems are established. The major capital investments are behind you. What remains is finishing construction and executing go-to-market strategy.For the buyer with vision and operational capability, this represents optimal timing: late enough to avoid development risk, early enough to capture market appreciation as the region's reputation accelerates. The opportunity is significant. The infrastructure is substantially complete. The market dynamics are favorable. The decision is whether you act while the opportunity remains available.

Property Facts

1 1

Property Taxes

| Parcel Number | 18-00022-0000-00004-01 | Improvements Assessment | $269,700 |

| Land Assessment | $156,000 | Total Assessment | $425,700 |

Property Taxes

Parcel Number

18-00022-0000-00004-01

Land Assessment

$156,000

Improvements Assessment

$269,700

Total Assessment

$425,700

1 of 107

Videos

Matterport 3D Exterior

Matterport 3D Tour

Photos

Street View

Street

Map

1 of 1

Presented by

27058 Mount Pleasant Rd

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.

Your message has been sent!

Activate your LoopNet account now to track properties, get real-time alerts, save time on future inquiries, and more.