Log In/Sign Up

Your email has been sent.

Prime Real Estate - $6,500,000 495 E Holt Ave 14,490 SF Retail Building Pomona, CA 91767 $6,500,000 ($448.59/SF) 7.57% Cap Rate

Investment Highlights

- PRIME HARD CORNER SIGNALIZED INTERSECTION

- Absolute NNN lease – zero landlord responsibilities

- 7.5% cap rate with future repositioning or redevelopment upside

- ADT Volume over 47,000 Vehicles Per Day

- Prime Holt Ave frontage with drive-thru and signalized access

- Corporate tenant paying $41,000/month NNN through Aug 2028

Executive Summary

Contact broker for a detailed offering memorandum

• Prime real estate adjacent to McDonalds, hard corner signalized intersection.

• Corporate Credit Income – Walgreens Co. continues to pay $492,000 annually (NNN) with ~3 years remaining, offering predictable income from a Fortune 500 tenant.

• Absolute NNN Lease – No landlord expenses; tenant covers all property taxes, insurance, and maintenance, providing passive, bond-like income.

• High Yield Opportunity – At a $6.5M offering price, the property delivers an attractive 7.5% cap rate, exceeding current yields for comparable short-term credit assets.

• Prime Real Estate – Freestanding ±14,500 SF building with drive-thru and signalized Holt Avenue frontage (±47,000 vehicles per day at intersection).

• Flexible Exit Strategy – Near-term lease expiration allows for multiple repositioning options: re-tenanting, medical conversion, or redevelopment.

• Strong Underlying Land Value – ±1.25-acre parcel with high visibility and access in the core Pomona retail corridor, adjacent to national brands (McDonald’s, Smart & Final, AutoZone).

• 1031 Exchange Ready – Ideal for investors seeking stable NNN income with residual land upside and minimal management responsibility.

C-4 General Commercial allows a wide range of retail, service, office, and limited light commercial uses (think medical, restaurant, showroom, auto-related, or general merchandise).

Under the East Holt Corridor District overlay (Pomona Corridors Specific Plan), the city encourages reinvestment, adaptive reuse, and mixed commercial redevelopment along Holt Avenue. Pharmacy use is restricted only by Walgreens’ lease covenant, not by zoning.

Future potential uses include:

Medical / Urgent Care / Dental

Retail or Service Commercial

Restaurant or Drive-Thru

Fitness / Health / Training

Office or Administrative

Potential mixed-use redevelopment (with CUP)

All information contained herein is obtained from sources deemed reliable but is not guaranteed. Broker makes no representation, warranty, or guarantee as to the accuracy of the information, including but not limited to square footage, income, expenses, zoning, or condition of the property. Prospective buyers are advised to verify all information independently and conduct their own due diligence. Property is offered subject to prior sale, lease, or withdrawal without notice.

• Prime real estate adjacent to McDonalds, hard corner signalized intersection.

• Corporate Credit Income – Walgreens Co. continues to pay $492,000 annually (NNN) with ~3 years remaining, offering predictable income from a Fortune 500 tenant.

• Absolute NNN Lease – No landlord expenses; tenant covers all property taxes, insurance, and maintenance, providing passive, bond-like income.

• High Yield Opportunity – At a $6.5M offering price, the property delivers an attractive 7.5% cap rate, exceeding current yields for comparable short-term credit assets.

• Prime Real Estate – Freestanding ±14,500 SF building with drive-thru and signalized Holt Avenue frontage (±47,000 vehicles per day at intersection).

• Flexible Exit Strategy – Near-term lease expiration allows for multiple repositioning options: re-tenanting, medical conversion, or redevelopment.

• Strong Underlying Land Value – ±1.25-acre parcel with high visibility and access in the core Pomona retail corridor, adjacent to national brands (McDonald’s, Smart & Final, AutoZone).

• 1031 Exchange Ready – Ideal for investors seeking stable NNN income with residual land upside and minimal management responsibility.

C-4 General Commercial allows a wide range of retail, service, office, and limited light commercial uses (think medical, restaurant, showroom, auto-related, or general merchandise).

Under the East Holt Corridor District overlay (Pomona Corridors Specific Plan), the city encourages reinvestment, adaptive reuse, and mixed commercial redevelopment along Holt Avenue. Pharmacy use is restricted only by Walgreens’ lease covenant, not by zoning.

Future potential uses include:

Medical / Urgent Care / Dental

Retail or Service Commercial

Restaurant or Drive-Thru

Fitness / Health / Training

Office or Administrative

Potential mixed-use redevelopment (with CUP)

All information contained herein is obtained from sources deemed reliable but is not guaranteed. Broker makes no representation, warranty, or guarantee as to the accuracy of the information, including but not limited to square footage, income, expenses, zoning, or condition of the property. Prospective buyers are advised to verify all information independently and conduct their own due diligence. Property is offered subject to prior sale, lease, or withdrawal without notice.

Financial Summary (Actual - 2024) Click Here to Access |

Annual | Annual Per SF |

|---|---|---|

| Gross Rental Income |

-

|

-

|

| Other Income |

-

|

-

|

| Vacancy Loss |

-

|

-

|

| Effective Gross Income |

-

|

-

|

| Net Operating Income |

$99,999

|

$9.99

|

Financial Summary (Actual - 2024) Click Here to Access

| Gross Rental Income | |

|---|---|

| Annual | - |

| Annual Per SF | - |

| Other Income | |

|---|---|

| Annual | - |

| Annual Per SF | - |

| Vacancy Loss | |

|---|---|

| Annual | - |

| Annual Per SF | - |

| Effective Gross Income | |

|---|---|

| Annual | - |

| Annual Per SF | - |

| Net Operating Income | |

|---|---|

| Annual | $99,999 |

| Annual Per SF | $9.99 |

Property Facts

Sale Type

Investment or Owner User

Property Type

Retail

Property Subtype

Drug Store

Building Size

14,490 SF

Building Class

B

Year Built

2003

Price

$6,500,000

Price Per SF

$448.59

Cap Rate

7.57%

NOI

$492,000

Tenancy

Single

Building Height

1 Story

Building FAR

0.22

Lot Size

1.50 AC

Opportunity Zone

Yes

Zoning

POC4-T4* - Flexible C-4 General Commercial zoning within Pomona’s East Holt Corridor—ideal for retail, medical, or redevelopment with strong visibility.

Parking

60 Spaces (4.14 Spaces per 1,000 SF Leased)

Frontage

Amenities

- Bus Line

- Pylon Sign

- Signage

- Drive Thru

- Car Charging Station

Major Tenants Click Here to Access

- Tenant

- Industry

- SF Occupied

- Rent/SF

- Lease Type

- Lease End

-

- Retailer

- -

- -

-

Lorem Ipsum

-

Jan 0000

Walgreens is a U.S.-based retail pharmacy operator providing prescription drugs, health services, and consumer goods through neighborhood drugstores and digital platforms. The company was founded in 1901 by Charles Rudolph Walgreen in Chicago, Illinois. Over time, Walgreens expanded nationwide and became one of the largest pharmacy chains in the United States. In 2014, Walgreens became part of the newly formed holding company Walgreens Boots Alliance following the acquisition of Alliance Boots.

| Tenant | Industry | SF Occupied | Rent/SF | Lease Type | Lease End | |

|

Retailer | - | - | Lorem Ipsum | Jan 0000 |

Walk Score®

Very Walkable (83)

Nearby Major Retailers

Property Taxes

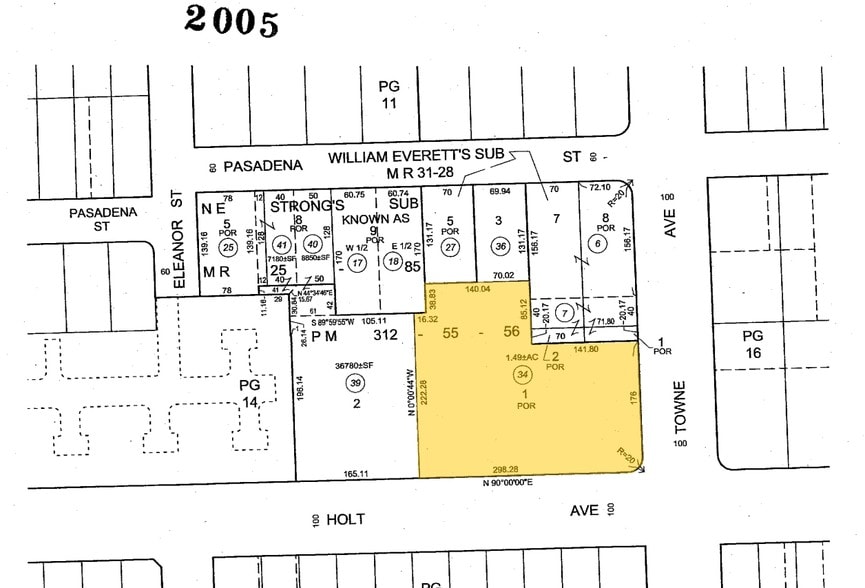

| Parcel Number | 8337-015-034 | Improvements Assessment | $3,845,954 (2025) |

| Land Assessment | $5,545,004 (2025) | Total Assessment | $9,390,958 (2025) |

Property Taxes

Parcel Number

8337-015-034

Land Assessment

$5,545,004 (2025)

Improvements Assessment

$3,845,954 (2025)

Total Assessment

$9,390,958 (2025)

1 of 20

Videos

Matterport 3D Exterior

Matterport 3D Tour

Photos

Street View

Street

Map

Presented by

Prime Real Estate - $6,500,000 | 495 E Holt Ave

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.

Your message has been sent!

Activate your LoopNet account now to track properties, get real-time alerts, save time on future inquiries, and more.