Log In/Sign Up

Your email has been sent.

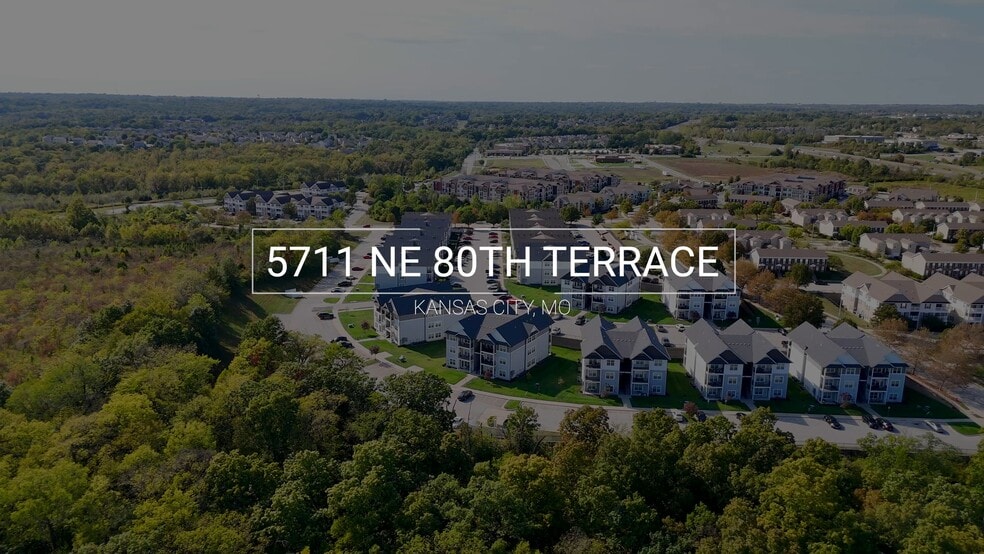

Brighton Crossing Apartments 5711 NE 80th Ter 18 Unit Apartment Building $2,750,000 ($152,778/Unit) 6.17% Cap Rate Kansas City, MO 64119

Investment Highlights

- Built in 2020, this turnkey property offers modern design, premium finishes, and low-maintenance operations

- 100% Occupied

- Conveniently situated Off of 152 & N. Brighton Ave, we’re just minutes away from Downtown Kansas City and the Kansas City International Airport.

Executive Summary

Turnkey Class A Multifamily | 18 Units in KC Growth Corridor

Midwest CRE Advisors is pleased to present a rare opportunity to acquire a virtually new, 18-unit Class A multifamily asset located in one of Kansas City’s most dynamic and rapidly growing corridors. Built in 2020, this turnkey property offers modern design, premium finishes, and low-maintenance operations — perfectly positioned for both stability and immediate revenue optimization.

With Kansas City leading national rent growth at 3.1% annually and new multifamily deliveries slowing (only 861 units delivered YTD 2025 vs. 2,001 during the same period in 2024), this submarket is experiencing tightening supply and sustained rental demand. The combination of below-market rents, strong fundamentals, and limited new competition creates a compelling value-add scenario for investors seeking both current cash flow and future upside.

Residents benefit from MGC’s Resident Benefits Package ($33/month), which enhances retention and revenue through added-value services — including liability insurance, $10K personal coverage, credit reporting, identity protection, and rewards programs.

This offering represents a unique chance to acquire a modern multifamily investment in a market that continues to outperform national averages. With strong market fundamentals and clear operational upside, this property is poised to deliver long-term value to investors.

Investment Highlights

- Virtually New Construction (Built 2020)- Premium Class A multifamily asset with modern design, high-end finishes, and minimal maintenance requirements.

- Strong Market Fundamentals - Kansas City continues to outperform nationally with 3.1% annual rent growth, sustained absorption, and limited new supply.

- Deliveries Slowing, Demand Rising - Only 861 multifamily units delivered YTD 2025, compared to 2,001 during the same period in 2024 — driving rental rate stability and absorption.

- Immediate Value-Add Potential - Below-market rents and strategic management opportunities allow for NOI growth and enhanced investor returns.

- Resident Benefits Package Revenue Stream - Each resident enrolled in a $33/month RBP, adding ancillary income and promoting resident satisfaction through insurance, credit reporting, and rewards.

- Prime Location in Rapid-Growth Corridor - Positioned within one of Kansas City’s most dynamic growth areas — proximity to major employment hubs, retail, and new developments strengthens long-term appreciation.

- Stabilized Yet Scalable Investment - Attractive current cash flow with operational efficiencies and upside through rent optimization and potential expansion opportunities.

Midwest CRE Advisors is pleased to present a rare opportunity to acquire a virtually new, 18-unit Class A multifamily asset located in one of Kansas City’s most dynamic and rapidly growing corridors. Built in 2020, this turnkey property offers modern design, premium finishes, and low-maintenance operations — perfectly positioned for both stability and immediate revenue optimization.

With Kansas City leading national rent growth at 3.1% annually and new multifamily deliveries slowing (only 861 units delivered YTD 2025 vs. 2,001 during the same period in 2024), this submarket is experiencing tightening supply and sustained rental demand. The combination of below-market rents, strong fundamentals, and limited new competition creates a compelling value-add scenario for investors seeking both current cash flow and future upside.

Residents benefit from MGC’s Resident Benefits Package ($33/month), which enhances retention and revenue through added-value services — including liability insurance, $10K personal coverage, credit reporting, identity protection, and rewards programs.

This offering represents a unique chance to acquire a modern multifamily investment in a market that continues to outperform national averages. With strong market fundamentals and clear operational upside, this property is poised to deliver long-term value to investors.

Investment Highlights

- Virtually New Construction (Built 2020)- Premium Class A multifamily asset with modern design, high-end finishes, and minimal maintenance requirements.

- Strong Market Fundamentals - Kansas City continues to outperform nationally with 3.1% annual rent growth, sustained absorption, and limited new supply.

- Deliveries Slowing, Demand Rising - Only 861 multifamily units delivered YTD 2025, compared to 2,001 during the same period in 2024 — driving rental rate stability and absorption.

- Immediate Value-Add Potential - Below-market rents and strategic management opportunities allow for NOI growth and enhanced investor returns.

- Resident Benefits Package Revenue Stream - Each resident enrolled in a $33/month RBP, adding ancillary income and promoting resident satisfaction through insurance, credit reporting, and rewards.

- Prime Location in Rapid-Growth Corridor - Positioned within one of Kansas City’s most dynamic growth areas — proximity to major employment hubs, retail, and new developments strengthens long-term appreciation.

- Stabilized Yet Scalable Investment - Attractive current cash flow with operational efficiencies and upside through rent optimization and potential expansion opportunities.

Data Room Click Here to Access

Property Facts

| Price | $2,750,000 | Apartment Style | Low-Rise |

| Price Per Unit | $152,778 | Building Class | B |

| Sale Type | Investment | Lot Size | 0.92 AC |

| Cap Rate | 6.17% | Building Size | 15,581 SF |

| No. Units | 18 | Average Occupancy | 100% |

| Property Type | Multifamily | No. Stories | 3 |

| Property Subtype | Apartment | Year Built | 2020 |

| Price | $2,750,000 |

| Price Per Unit | $152,778 |

| Sale Type | Investment |

| Cap Rate | 6.17% |

| No. Units | 18 |

| Property Type | Multifamily |

| Property Subtype | Apartment |

| Apartment Style | Low-Rise |

| Building Class | B |

| Lot Size | 0.92 AC |

| Building Size | 15,581 SF |

| Average Occupancy | 100% |

| No. Stories | 3 |

| Year Built | 2020 |

Amenities

Unit Amenities

- Air Conditioning

- Balcony

- Cable Ready

- Dishwasher

- Disposal

- Microwave

- Washer/Dryer

- Ceiling Fans

- Granite Countertops

- Hardwood Floors

- Refrigerator

- Oven

- Stainless Steel Appliances

- Range

- Deck

- Family Room

- Pantry

Site Amenities

- 24 Hour Access

- Controlled Access

- Laundry Facilities

- Tenant Controlled HVAC

- Private Bathroom

Unit Mix Information

| Description | No. Units | Avg. Rent/Mo | SF |

|---|---|---|---|

| Studios | 6 | - | 497 |

| 1+1 | 12 | - | 650 - 731 |

1 1

Property Taxes

| Parcel Number | 14-120-00-02-012.00 | Improvements Assessment | $0 |

| Land Assessment | $0 | Total Assessment | $348,120 |

Property Taxes

Parcel Number

14-120-00-02-012.00

Land Assessment

$0

Improvements Assessment

$0

Total Assessment

$348,120

1 of 17

Videos

Matterport 3D Exterior

Matterport 3D Tour

Photos

Street View

Street

Map

1 of 1

Presented by

Brighton Crossing Apartments | 5711 NE 80th Ter

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.

Your message has been sent!

Activate your LoopNet account now to track properties, get real-time alerts, save time on future inquiries, and more.