Log In/Sign Up

Your email has been sent.

Investment Highlights

- HIGH-IMAGE INDUSTRIAL OWNER-USER OPPORTUNITY IN CORPORATE LOCATION

- KEARNY MESA HAS THE HIGHEST PERCENTAGE OF ITS BASE BUILDINGS OWNED BY OWNER/USERS

- SAN DIEGO’S LEADING MARKET FUNDAMENTALS

Executive Summary

HIGH-IMAGE INDUSTRIAL OWNER-USER OPPORTUNITY IN CORPORATE LOCATION

* Attractive freestanding Corporate HQ/Office/R&D/Industrial Flex in a business park environment with abundant nearby amenities.

* Adjacency to workforce housing and easy access to executive housing.

* Walking distance to public transit and excellent access to SR-163, SR-52, I-15, I-805, I-8 Freeways.

* New "Cool" roof installed Dec. 2020 with a 15 year warranty.

* OWNER-USER ADVANTAGE: This is an ideal corporate headquarter investment that provides an attractive lease-saving trade-off. As opposed to leasing space, a purchase provides protection against future rental market uncertainty and rate hikes. It further offers occupancy control, certain tax benefits and after-tax equity accumulation.

* BONUS DEPRECIATION ADVANTAGE: Given the new tax legislation passed July 2025, a buyer would not have any occupancy cost in the first year given the estimated depreciation benefits providing an approximate $77,011 monthly tax savings or loss carry forwards. (See Lease vs. Own Analysis on page 29 of OM)

SAN DIEGO’S LEADING MARKET FUNDAMENTALS

* Kearny Mesa has the highest percentage of its base buildings owned by owner/users, currently sitting at 79%. Therefore, these types of buildings rarely trade hands which offers an owner/user a unique opportunity to enter the Kearny Mesa submarket.

* Kearny Mesa has long been the real estate backbone for San Diego, providing the region with more than 23 million square feet of office and industrial space. Its central location is a magnet for commercial activity and jobs, leading to one of the region’s lowest vacancies and best absorption through every business cycle.

* Attractive freestanding Corporate HQ/Office/R&D/Industrial Flex in a business park environment with abundant nearby amenities.

* Adjacency to workforce housing and easy access to executive housing.

* Walking distance to public transit and excellent access to SR-163, SR-52, I-15, I-805, I-8 Freeways.

* New "Cool" roof installed Dec. 2020 with a 15 year warranty.

* OWNER-USER ADVANTAGE: This is an ideal corporate headquarter investment that provides an attractive lease-saving trade-off. As opposed to leasing space, a purchase provides protection against future rental market uncertainty and rate hikes. It further offers occupancy control, certain tax benefits and after-tax equity accumulation.

* BONUS DEPRECIATION ADVANTAGE: Given the new tax legislation passed July 2025, a buyer would not have any occupancy cost in the first year given the estimated depreciation benefits providing an approximate $77,011 monthly tax savings or loss carry forwards. (See Lease vs. Own Analysis on page 29 of OM)

SAN DIEGO’S LEADING MARKET FUNDAMENTALS

* Kearny Mesa has the highest percentage of its base buildings owned by owner/users, currently sitting at 79%. Therefore, these types of buildings rarely trade hands which offers an owner/user a unique opportunity to enter the Kearny Mesa submarket.

* Kearny Mesa has long been the real estate backbone for San Diego, providing the region with more than 23 million square feet of office and industrial space. Its central location is a magnet for commercial activity and jobs, leading to one of the region’s lowest vacancies and best absorption through every business cycle.

Taxes & Operating Expenses (Actual - 2025) Click Here to Access |

Annual | Annual Per SF |

|---|---|---|

| Taxes |

-

|

-

|

| Operating Expenses |

-

|

-

|

| Total Expenses |

$99,999

|

$9.99

|

Taxes & Operating Expenses (Actual - 2025) Click Here to Access

| Taxes | |

|---|---|

| Annual | - |

| Annual Per SF | - |

| Operating Expenses | |

|---|---|

| Annual | - |

| Annual Per SF | - |

| Total Expenses | |

|---|---|

| Annual | $99,999 |

| Annual Per SF | $9.99 |

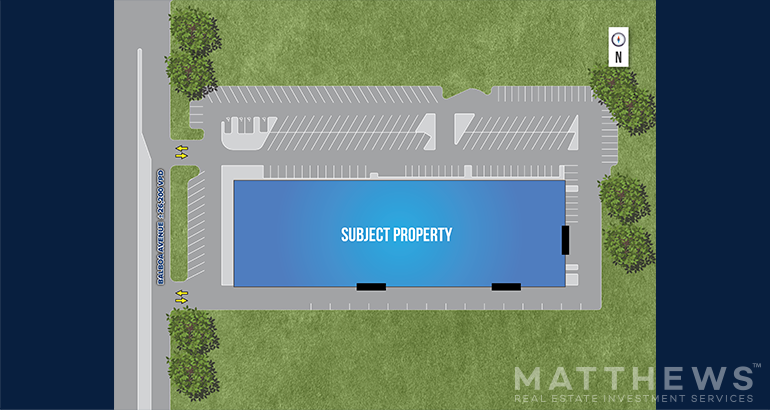

Property Facts

| Price | $15,504,000 | Rentable Building Area | 45,600 SF |

| Price Per SF | $340 | No. Stories | 1 |

| Sale Type | Owner User | Year Built/Renovated | 1980/2000 |

| Property Type | Flex | Tenancy | Single |

| Property Subtype | Light Manufacturing | Parking Ratio | 4.21/1,000 SF |

| Building Class | B | Clear Ceiling Height | 17’6” |

| Lot Size | 2.94 AC | No. Drive In / Grade-Level Doors | 3 |

| Zoning | M-1b - Manufacturing and Industrial Uses | ||

| Price | $15,504,000 |

| Price Per SF | $340 |

| Sale Type | Owner User |

| Property Type | Flex |

| Property Subtype | Light Manufacturing |

| Building Class | B |

| Lot Size | 2.94 AC |

| Rentable Building Area | 45,600 SF |

| No. Stories | 1 |

| Year Built/Renovated | 1980/2000 |

| Tenancy | Single |

| Parking Ratio | 4.21/1,000 SF |

| Clear Ceiling Height | 17’6” |

| No. Drive In / Grade-Level Doors | 3 |

| Zoning | M-1b - Manufacturing and Industrial Uses |

Amenities

- Bio-Tech/ Lab Space

Utilities

- Gas - Natural

- Water - City

- Sewer - City

Property Taxes

| Parcel Number | 369-161-11 | Improvements Assessment | $3,189,588 |

| Land Assessment | $1,729,634 | Total Assessment | $4,919,222 |

Property Taxes

Parcel Number

369-161-11

Land Assessment

$1,729,634

Improvements Assessment

$3,189,588

Total Assessment

$4,919,222

1 of 17

Videos

Matterport 3D Exterior

Matterport 3D Tour

Photos

Street View

Street

Map

Presented by

9244 Balboa Ave

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.

Your message has been sent!

Activate your LoopNet account now to track properties, get real-time alerts, save time on future inquiries, and more.