Your email has been sent.

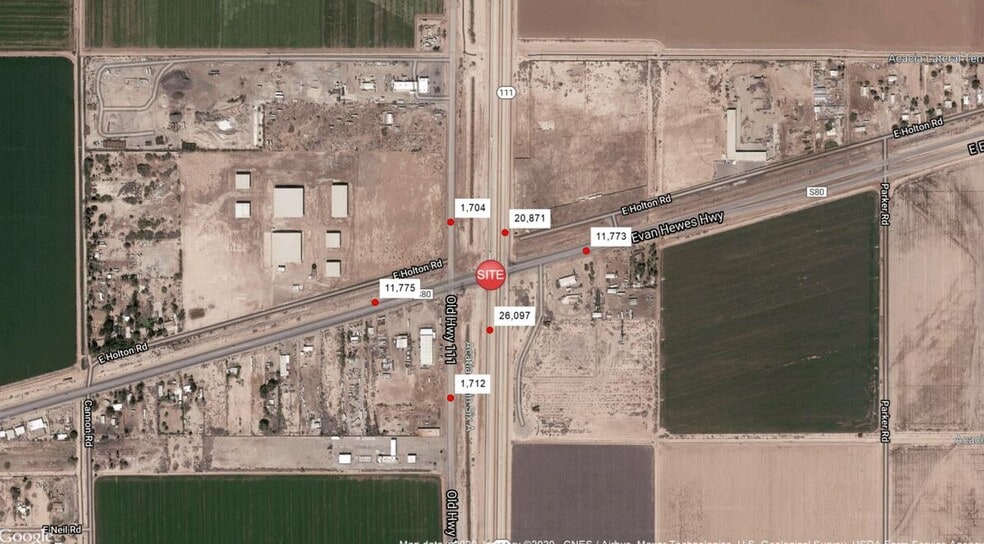

Highway 80 & Highway 111 NWC 11.39 Acres of Industrial Land Offered at $1,750,000 in El Centro, CA 92243

Investment Highlights

- Unobstructed visibility from Highway 111. Ideal for Self Storage and Truck Parking

- Just off of primary logistics/commuter artery into Mexico

- Highway 111 sees over 26,000 vehicles per day as of 2022

Executive Summary

Property Facts

| Price | $1,750,000 | Property Subtype | Industrial |

| Sale Type | Investment | Proposed Use | |

| No. Lots | 1 | Total Lot Size | 11.39 AC |

| Property Type | Land | Opportunity Zone |

Yes

|

| Zoning | M-2 | ||

| Price | $1,750,000 |

| Sale Type | Investment |

| No. Lots | 1 |

| Property Type | Land |

| Property Subtype | Industrial |

| Proposed Use | |

| Total Lot Size | 11.39 AC |

| Opportunity Zone |

Yes |

| Zoning | M-2 |

1 Lot Available

Lot

| Price | $1,750,000 | Lot Size | 11.39 AC |

| Price Per AC | $153,643.55 |

| Price | $1,750,000 |

| Price Per AC | $153,643.55 |

| Lot Size | 11.39 AC |

Address location shows El Centro, CA, however it lies within the Imperial County jurisdiction for its utilities. Site NWC Old Hwy 111 and Evan Hewes Hwy. TR#: 40 PAR 2 PM 1414 POR TR 40 T15S-R14E 11.36AC.City / Muni / Twp: EL CENTRO

Description

The purpose of the M-2 (Medium Industrial) zone is to designate areas for wholesale commercial, storage, trucking, assembly type manufacturing, general manufacturing, research and development, medium intensity fabrication and other similar medium intensity processing facilities. The processing or fabrication within any of these facilities is to be limited to activities conducted either entirely within a building or within securely fenced (obscured fencing) areas. Provided further that such facilities do not omit fumes, odor, dust, smoke or gas beyond the confines of the property line within which their activity occurs, or produces significant levels of noise or vibration beyond the perimeter of the site. § 90516.01 PERMITTED USES IN THE M-2 ZONE a) Alcohol and alcoholic beverage manufacturer b) All M-1 uses permitted under §90515.01 c) Asphalt and asphalt products manufacturing d) Automobile assembly e) Automobile body and fender works f) Automobile dismantling for used parts storage, only if operated and maintained entirely within a building g) Automobile painting h) Automobile upholstering i) Bag cleaning j) Boiler or tank works k) Brick, tile or terra cotta l) Building materials and manufacturing m) Candle making n) Carbon manufacturing o) Cargo Containers (provided they have an approved building permit) p) Celluloid or pyroxylin manufacturing q) Cement and cement product manufacturing r) Contractors equipment yards s) Contractors general t) Contractors storage yards u) Cotton gins or oil mills v) Crumb rubber processing w) Data centers x) Disinfectant manufacturing y) Electrical Vehicles Charging Stations as a Primary Use Division 5 Adopted November 24, 1998 (Amended December 16, 2003) (Amended August 3, 2004) (Amended October 31, 2006) (Amended January 29, 2008) (Amended July 2, 2013 MO#12) (Amended December 9, 2014) (Amended April 18, 2017) (Amended October 15, 2019) z) Feed mills aa) Fertilizer and insecticide manufacturing bb) Fish and meat packing plant cc) Grain elevators dd) Graphite manufacturing ee) Gypsum manufacturing ff) House movers or wreckers gg) Industrial Hemp: manufacturing into semi-finished and finished products, subject to Division 4 Chapter 6 of Title 9 Land Use Ordinance and Title 14 of the Imperial County Codified Ordinance hh) Ink, lime, linoleum, matches, paper and straw board, petroleum products, pickles, sauerkraut, soap, starch, sugar, tar and tar products, vinegar, accessory buildings and/or structures necessary to such use located on the same lot or parcel of land as the primary structure or use ii) Insulation materials manufacturing jj) Mini Storage (outside storage allowed provided it is screened) kk) Oil reclamation plant ll) Petroleum products storage mm) Railroad repair shop nn) Railroad yard oo) Seed mill pp) Solar energy extraction generation provided that it is for on-site consumption only. qq) Wool pulling and scouring

Property Taxes

| Parcel Number | 044-460-037-000 | Improvements Assessment | $0 |

| Land Assessment | $170,421 | Total Assessment | $170,421 |

Property Taxes

Presented by

Highway 80 & Highway 111 NWC

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.