Log In/Sign Up

Your email has been sent.

Multifamily and Retail Portfolio Opp. 2 Land Properties Offered at $900,000,000 in Multiple Locations

INVESTMENT HIGHLIGHTS

- Two multifamily and one retail portfolio offered at an impressive 7-9% cap rate.

- Developers and investors opportunity to generate a net income of $1.25.6 million per year.

- The multifamily complexes are located in Corona, while the retail asset is in Riverside, California.

EXECUTIVE SUMMARY

Project One: Off-market short sale: Cap 200%.

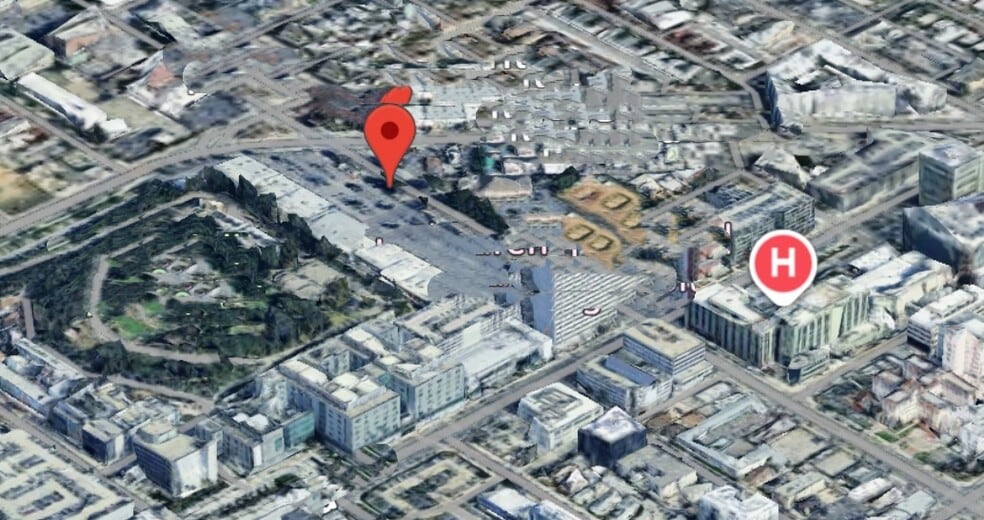

Project Two: Best location development in Beverly, Los Angeles, for sale for $70 million (or $25-$50 million equity financing). Total land area: 6.32 acres (1,275,299 square feet). The existing shopping center is 97,000 square feet (to be demolished). Rental income $2 million/year. Existing zoning: C-21; (FAR): 4.65, permitted height: 108 feet. Maximum residential density: 1,242 units (TOC-4 zoning) 2,500 square feet. Buildable commercial shopping center: 115,000 square feet. Includes a supermarket (Ralphs) of 55,000 square feet; a large drugstore (CVS) of 14,000 square feet; and an international food court of 25,000 square feet. Total retail/store area: 21,000 square feet. Estimated project net gross floor area ratio: 950,000 square feet to 1 million square feet (development commercial plan). Total project cost estimate: $850 million. Complete valuation: $2 billion.

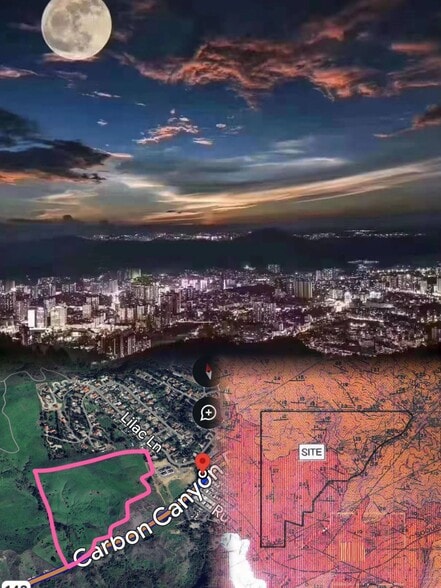

Project Three: 600-1000 single-family houses development land, RH zoning, 367 acres.

Project Four: 1000 units of student apartment development opportunities.

Project Five: Four buildings are for sale. The unit price is $246-260 per square foot, which is lower than the construction cost. The annual net income is $2.99 million, with a return rate of 7.5%. The seller is open to assuming low-interest loans and is asking $41 million.

Project SIX: The annual net income is $1.26 million, and the return rate is 7.2%

Project Two: Best location development in Beverly, Los Angeles, for sale for $70 million (or $25-$50 million equity financing). Total land area: 6.32 acres (1,275,299 square feet). The existing shopping center is 97,000 square feet (to be demolished). Rental income $2 million/year. Existing zoning: C-21; (FAR): 4.65, permitted height: 108 feet. Maximum residential density: 1,242 units (TOC-4 zoning) 2,500 square feet. Buildable commercial shopping center: 115,000 square feet. Includes a supermarket (Ralphs) of 55,000 square feet; a large drugstore (CVS) of 14,000 square feet; and an international food court of 25,000 square feet. Total retail/store area: 21,000 square feet. Estimated project net gross floor area ratio: 950,000 square feet to 1 million square feet (development commercial plan). Total project cost estimate: $850 million. Complete valuation: $2 billion.

Project Three: 600-1000 single-family houses development land, RH zoning, 367 acres.

Project Four: 1000 units of student apartment development opportunities.

Project Five: Four buildings are for sale. The unit price is $246-260 per square foot, which is lower than the construction cost. The annual net income is $2.99 million, with a return rate of 7.5%. The seller is open to assuming low-interest loans and is asking $41 million.

Project SIX: The annual net income is $1.26 million, and the return rate is 7.2%

PROPERTY FACTS

| Price | $900,000,000 | Number of Properties | 2 |

| Cap Rate | 25% | Individually For Sale | 0 |

| Sale Type | Investment | Total Land Area | 374.70 AC |

| Status | Active |

| Price | $900,000,000 |

| Cap Rate | 25% |

| Sale Type | Investment |

| Status | Active |

| Number of Properties | 2 |

| Individually For Sale | 0 |

| Total Land Area | 374.70 AC |

PROPERTIES

| PROPERTY NAME / ADDRESS | PROPERTY TYPE | SIZE | INDIVIDUAL PRICE |

|---|---|---|---|

| Train Road, Brea, CA 92823 | Land | 367.00 AC | - |

| unknow, Corona, CA 92883 | Land | 7.70 AC | - |

1 1

1 of 4

VIDEOS

MATTERPORT 3D EXTERIOR

MATTERPORT 3D TOUR

PHOTOS

STREET VIEW

STREET

MAP

1 of 1

Presented by

Multifamily and Retail Portfolio Opp.

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.