Leverage Ratio Explained: A Strategic Guide for Commercial Property Investors

What Is a Leverage Ratio?

A leverage ratio is a financial metric that compares a company's debt to another measure of its financial strength, such as equity, assets, or earnings. It shows how much borrowed money a business is using to finance operations or growth.

In commercial real estate, leverage ratios help investors understand how much of a property's purchase or operations are funded by debt versus how much comes from the investor's own capital. This ratio plays a central role in shaping both risk exposure and return potential.

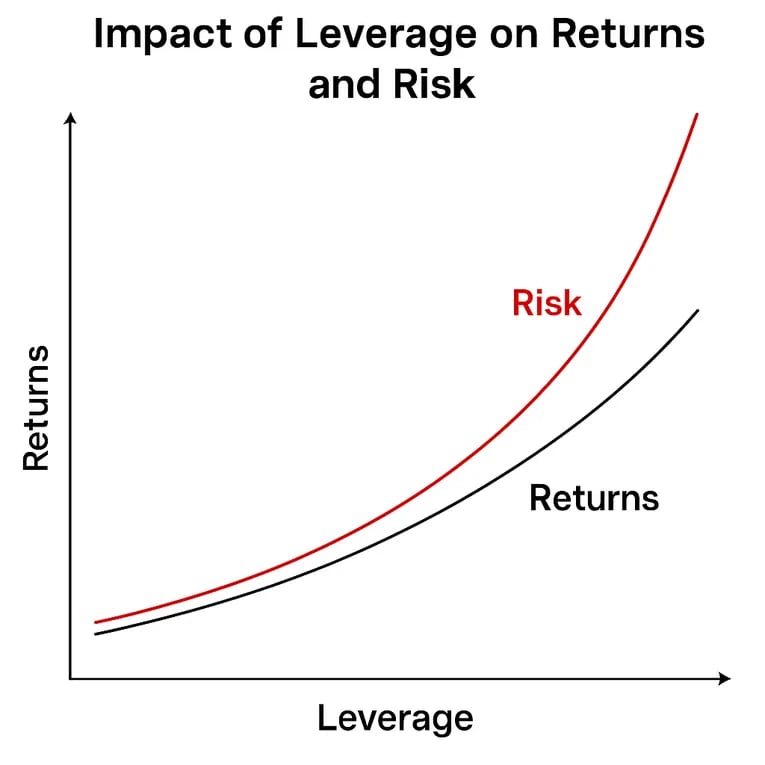

Leverage can increase returns but adds risk

When property values rise, using leverage means higher profits on the invested capital. But if income drops or values decline, debt magnifies losses too. That's why understanding your leverage ratio is key to managing downside risk.

Used alongside other metrics like loan to value

Leverage ratios work best when combined with other debt focused metrics like loan to value and financing cash flow. Together, they give a more complete view of financing structure, investor equity, and how much cushion exists if market conditions change.

What Does Leverage Ratio Measure?

Once you understand what a leverage ratio is, the next step is to consider what it reveals. This metric highlights how much of an investor's capital structure relies on borrowed funds versus equity. It's a direct indicator of financial risk and balance sheet strength, critical when evaluating debt exposure or planning long term strategy.

Financial risk and ability to pay

These ratios are often used to assess how well a property or company can meet its debt obligations. If your income stream shrinks or your interest rate goes up, a high leverage ratio could push you toward default. That's where complementary metrics like DSCR and debt yield come in. They help you gauge not just how much debt you have, but how well you can cover it.

Monitoring leverage with supporting tools

Real estate investors often track leverage ratios alongside performance tools like a DSCR calculator. This provides early warnings if coverage begins to slip, allowing you to adjust your strategy before problems escalate. While leverage ratios show how much debt you carry, DSCR tells you how comfortably your income can cover that debt, together, they create a full picture of financial stability.

What Is the Purpose of Leverage Ratios?

Leverage ratios play a key role in assessing how debt influences financial performance, risk, and decision making. For commercial real estate investors, they help gauge whether current financing levels are sustainable based on projected income, asset value, and market conditions.

Real estate uses leverage differently than other sectors

In property investing, leverage is often strategic. Investors commonly use debt to boost purchasing power, finance capital improvements, or increase return on equity. Unlike tech or service based businesses that may run lean on debt, CRE projects are structured with financing as a core element of the deal.

Translating ratios into cash flow and financing terms

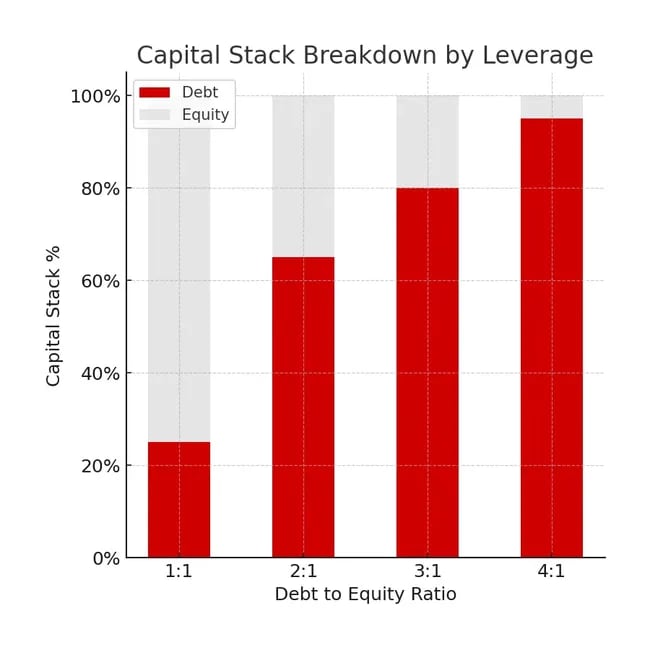

Understanding leverage ratios helps you anticipate how lenders will view your risk profile. High leverage can lead to tighter CRE loan terms, such as lower loan to value limits or stricter covenants. It also impacts your ability to refinance, your exit strategy, and the overall flexibility of your capital stack.

Investor risk exposure changes as leverage shifts

Strategic investors account for leverage ratios when shaping their broader commercial real estate investment strategies. As market conditions evolve, adjusting the capital structure helps maintain flexibility and long-term resilience.

Commercial properties also behave differently from residential ones when it comes to leverage. Commercial vs residential investing often involves larger loans, more complex debt structures, and greater reliance on projected income rather than personal credit. This makes ratio analysis even more essential.

Are There Different Types of Leverage Ratios?

Yes, there are several types of leverage ratios, each offering a different view of how debt impacts financial stability. These metrics help investors understand the structure and risk of a deal from multiple angles.

| Leverage Ratio | Formula | What It Measures |

|---|---|---|

| Debt-to-Equity | Total Debt ÷ Total Equity | Shows how much debt is used relative to investor capital. |

| Debt-to-Assets | Total Debt ÷ Total Assets | Indicates the portion of asset value funded by debt. |

| Debt-to-EBITDA | Total Debt ÷ EBITDA | Estimates how many years of earnings it would take to repay debt. |

| Interest Coverage | EBIT ÷ Interest Expense | Measures how easily earnings can cover interest payments. |

| loan to value (LTV) | Loan Amount ÷ Property Value | Evaluates how much of the property value is financed with debt. |

These ratios provide a starting point, but deeper analysis often requires modeling tools. Investors can use an NOI calculator, gross rent multiplier, cap rate model, or IRR calculator to layer on income analysis and assess how leverage affects returns over time.

Application of Leverage Ratios in Commercial Real Estate

Leverage ratios are more than just numbers on a spreadsheet. They directly shape how you finance, operate, and grow your commercial property portfolio.

To better understand how leverage ratios apply in practice, explore current commercial properties available in your area to see how financing and capital stack strategies vary by deal.

Commercial Real Estate For Sale

Financing strategy during acquisition

Investors use leverage ratios to assess how much debt makes sense based on property type, location, and income potential. A well structured loan with a strong loan to value ratio and moderate debt to equity can unlock bigger deals while keeping risk in check. Understanding leverage upfront is essential when planning how to purchase commercial property.

Planning for capital improvements

Value add strategies often involve renovations or repositioning. Adding debt to fund improvements can improve returns, if the increased income offsets the higher leverage. Monitoring your leverage ratio before and after improvements helps maintain long-term financial health.

Refinancing and capital stack optimization

Refinancing can reduce interest costs or free up capital, but only if leverage ratios remain lender friendly. A rising debt to EBITDA or a falling interest coverage ratio may signal it's time to restructure. This is especially important in multifamily deals, where multifamily financing rates and underwriting terms are directly influenced by your current leverage position.

This type of ratio analysis also plays a critical role when assessing how and when to scale a portfolio. Investors evaluating how to buy a multifamily property will often model multiple leverage scenarios to see how cash flow, risk, and loan terms shift over time.

What Do Leverage Ratios Tell You About Risk?

Leverage ratios offer early insight into financial risk. They help investors spot potential problems before they show up in missed payments or reduced property value.

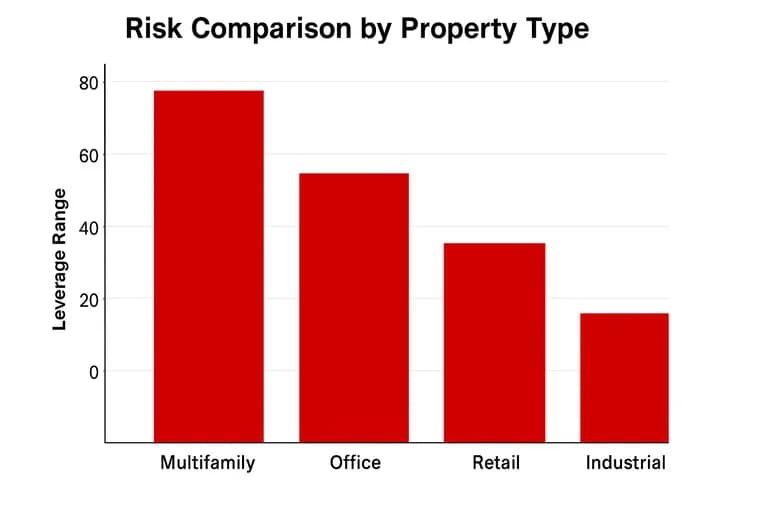

Healthy leverage ratios look different depending on asset class. For example, multifamily properties can typically support higher debt loads due to steady rental income. In contrast, office and retail properties may require more conservative leverage. Comparing ratios across different types of commercial real estate helps set appropriate benchmarks.

Risk tolerance often varies by property type. Explore apartment buildings for sale near you to see how leverage might apply differently across asset classes.

Apartment Buildings For Sale

Loan to value is one of the most widely used leverage ratios in commercial real estate. While other ratios like debt to equity or debt to EBITDA offer different views, LTV provides a clear, lender focused benchmark for how much debt is considered acceptable by asset class.

Context matters: tenants, leases, and location

A leverage ratio that looks aggressive on paper might be acceptable for a stabilized Class A asset with long term leases. But the same ratio could spell trouble for a secondary property with short term tenants. Understanding lease structure, tenant strength, and market dynamics is essential when interpreting ratio risk.

Spotting red flags early

A rising debt to EBITDA ratio or declining interest coverage could be early signs of distress. When these metrics trend in the wrong direction, it often means cash flow is being squeezed. This is especially relevant for investors evaluating distressed property opportunities or looking to exit before value erosion worsens.

Leverage should also be assessed against comparable deals. If your property's leverage ratios are out of step with similar assets in your area, it could signal financing risk or an overpriced acquisition. In some cases, lenders may prefer to extend and pretend to avoid forced sales. But as an investor, you should still prepare for downside protection.

Leverage Strategy Tips for Buyers and Owners

For Investors Looking to Buy

Start with the projected leverage ratio based on your planned financing. Stress test the model by simulating a 10% drop in rent, a 100 basis point rate increase, or a longer than expected lease up. If your ratios remain within lender guidelines under these conditions, your capital structure is likely durable enough to handle market shifts.

During periods of economic uncertainty, layer in more conservative assumptions around rent growth and interest rates. Avoid overly aggressive leverage unless backed by exceptionally strong income or risk-adjusted upside. Leverage can expand your buying power-but only if it leaves you room to maneuver.

For Current Property Owners

Reevaluate your leverage ratio quarterly as loan amortization, reinvestments, or market changes shift your capital stack. Use complementary metrics like DSCR and debt yield to monitor how your income supports your debt over time.

If you're in a volatile sector or facing economic headwinds, consider defensive adjustments. These might include paying down principal, raising equity, extending loan maturities, or increasing reserves. The goal is not just to stay within covenants-but to maintain long term financial flexibility regardless of the cycle.

Integrating Leverage Ratios with Complementary Financial Metrics

Leverage ratios reveal how much debt supports a deal, but they become more useful when paired with other metrics. Tools like discounted cash flow, exit cap rate modeling, and commercial real estate values help investors compare deals more accurately by factoring in financing structure.

For example, two properties with the same income may look identical, until you adjust for leverage. A higher LTV or lower debt coverage ratio often signals more risk. That's why experienced investors normalize deal comparisons by applying consistent capital stack assumptions across models.

Impact of Economic Uncertainty on Leverage Ratios

Leverage ratios tend to widen or compress depending on market conditions. During stable periods, moderate leverage may look low risk. But in times of economic stress, the same ratios can quickly signal vulnerability.

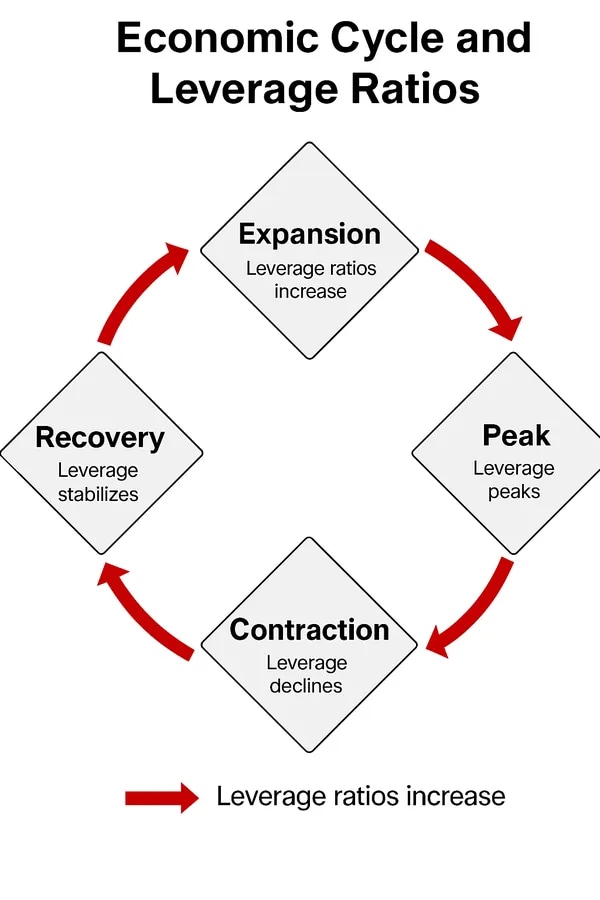

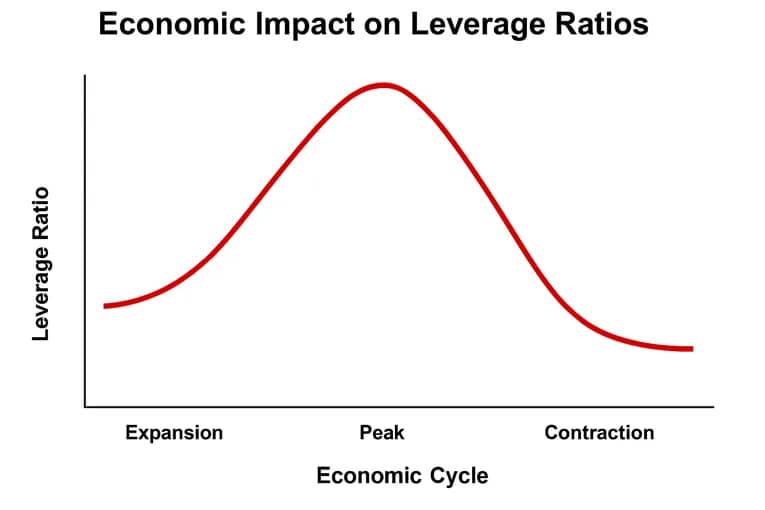

Leverage reacts to different stages of the economic cycle

In a downturn, falling income and declining values can cause debt to asset and debt to EBITDA ratios to spike, even if you're making payments on time. During recoveries, these same ratios may normalize as cash flow improves. Monitoring leverage through each phase helps investors time refinances, capital injections, or exits more strategically.

This graphic follows the four phases of the economic cycle - Expansion, Peak, Contraction, and Recovery. These stages reflect how leverage ratios like debt-to-EBITDA or DSCR can shift with changing income, property values, and borrowing costs as market conditions evolve.

Inflation and interest rate volatility can distort leverage

High inflation erodes real equity, even as nominal values hold steady. Rising rates increase debt service costs, putting pressure on coverage ratios. A property that looked healthy at 5 percent interest may become overleveraged at 7 percent. That's why modeling interest rate scenarios is essential, especially when using floating rate debt.

Tariffs, trade wars, and leverage pressure

Geopolitical tension, including tariffs and trade disruptions, can impact commercial real estate more than many investors realize. Industrial and logistics properties may see reduced tenant demand as supply chains shift or slow down. Retail centers that rely on imported goods may experience sales declines, impacting rent collections.

These operational hits reduce net operating income, which inflates leverage ratios like debt to EBITDA and suppresses debt yield. At the same time, uncertainty can tighten lending standards, making it harder to refinance or add capital. Even if your leverage ratio was acceptable at acquisition, macro shocks like these can push you closer to loan covenants or trigger refinancing risks unexpectedly.

How policy changes and tax incentives influence leverage

Public policy can temporarily shift leverage strategies. Programs like an opportunity zone tax break may justify higher initial leverage if the long term benefit offsets short term risk. But incentives don't eliminate exposure-they just change the timing and structure of returns.

Frequently Asked Questions

How do I determine the optimal leverage ratio for my commercial real estate investment?

The right leverage ratio depends on your asset type, market conditions, and risk tolerance. In general, a loan to value ratio below 65 to 70 percent and a DSCR above 1.25x are considered healthy. But more important than hitting a static target is stress testing your deal. Model what happens to your leverage if cap rates expand, rents fall, or interest rates rise. If your ratios hold up under pressure, you're in a safer position.

What are the warning signs that my commercial property is over-leveraged?

Some early red flags include a DSCR falling below 1.2x, an LTV above 75 to 80 percent, or a debt yield under 8 percent. Other signs include needing to inject capital for routine expenses, struggling to refinance, or brushing up against loan covenant thresholds. If your debt yield is shrinking while interest rates are climbing, it's time to reassess your capital stack.