Loan to Value: Calculation, Analysis, and Strategic Approaches

Key Takeaways

- LTV ratio is calculated by dividing loan amount by property value, with commercial properties typically requiring 65-75% LTV for optimal financing terms

- Lower LTV ratios result in better interest rates and loan terms, while higher LTVs increase risk and may trigger additional requirements like mortgage insurance

- Different property types have varying LTV limits - industrial properties often allow 75% LTV while specialty properties may be limited to 60% due to risk factors

In commercial real estate financing, loan to value (LTV) is a fundamental metric that answers a simple question: "What percentage of a property's value am I borrowing?" It represents the relationship between how much you borrow and how much your property is worth.

Think of LTV as a risk indicator, both for you as an investor and for your lender. A lower LTV means you're putting more of your own equity into the deal, while a higher LTV means you're using more borrowed money to finance the purchase.

What is Loan to Value (LTV)?

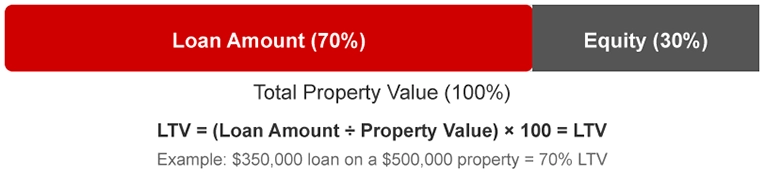

Loan to Value (LTV) is a ratio that compares the loan amount to the appraised property value. It is calculated by dividing the loan amount by the property value and then multiplying by 100.

For example, if a property is worth $500,000 and a loan of $350,000 is needed, the LTV is (350,000 ÷ 500,000) x 100 = 70%.

Loan to Value Visualization

Fundamental Components

LTV is a simple measure that shows how much financing a borrower needs relative to a property's worth. The main components are the loan amount and the property value. This ratio helps lenders decide on loan terms and risk levels.

Why LTV Matters

LTV directly impacts:

- Loan Approval: Determines if you qualify for financing

- Interest Rates: Lower LTVs typically secure better rates

- Cash Requirements: Affects how much money you need upfront

- Risk Profile: Influences your financial risk exposure

Loan to Value Formula

Basic Formula and Calculation

The LTV formula is simple: divide the current loan balance by the appraised value of the property, then multiply by 100. For example, for a commercial property appraised at $1,000,000 with a loan of $700,000, the LTV is (700,000 ÷ 1,000,000) x 100 = 70%.

Advanced Calculations for Special Situations

Some deals require more complex LTV calculations. Construction loans, value add properties, and distressed assets may need adjustments to the standard formula. These situations often incorporate additional factors such as projected income or expected property improvements. When evaluating different debt levels, an IRR calculator provides insights into how leverage decisions influence overall investment outcomes.

In commercial real estate, lenders may also review metrics like the debt service coverage ratio to ensure loan payments are sustainable. Investors can use a NOI calculator to assess property income and a debt yield ratio to evaluate loan performance.

Understanding the LTV Ratio Calculation

What is a Good Loan to Value?

Good LTV ratios vary by property type; commercial properties usually have ratios between 65% and 75%. LVT can also vary between residential and commercial real estate while residential properties can have higher ratios up to 97%.

Comparative Analysis of LTV Thresholds

Commercial properties face stricter LTV limits because they are seen as riskier. This influences financing options by limiting the available loan amount and often results in higher down payment requirements. Lenders require tighter ratios to manage risk, which means investors must plan their capital contributions carefully.

| LTV Threshold | Loan Term Impact | Risk Considerations |

|---|---|---|

| 65% | Favorable interest rates and terms | Lowest risk; strong equity position |

| 70% | Competitive loan terms | Moderate risk; balanced financing |

| 75% | Potential for negotiation on rates | Higher risk; may require additional collateral or guarantees |

| 80% | Less favorable terms; higher interest premiums | Highest risk; may trigger added costs such as mortgage insurance |

Note: These thresholds are examples and actual terms may vary by lender and market conditions.

LTV Considerations Specific to Commercial Real Estate

Application in Commercial Financing

While LTV is used across all real estate sectors, it plays a particularly crucial role in commercial real estate financing. In the commercial space, LTV directly influences underwriting decisions, determining not only if a loan will be approved but also its structure and terms. Unlike residential mortgages where standardized loan products are common, commercial real estate financing involves more nuanced evaluation where LTV serves as one of several key decision metrics.

Sophisticated investors analyze LTV alongside other metrics like debt service coverage ratios and cap rates when comparing potential acquisitions. Understanding how to accurately determine commercial property value becomes essential, as even small valuation differences can significantly impact LTV calculations and subsequently affect loan terms.

Property Type LTV Matrix

Investors should know that different commercial asset classes have set LTV limits, with retail, office, industrial, multifamily, and specialty properties each having maximum thresholds that guide financing strategies. Moreover, different property types demand varying equity contributions; for example, multifamily properties often require more equity than industrial properties to secure favorable financing.

| Property Type | Typical Maximum LTV | Equity Contribution |

|---|---|---|

| Retail | 70% | 30% |

| Office | 70% | 30% |

| Industrial | 75% | 25% |

| Multifamily | 65% | 35% |

| Specialty | 60% | 40% |

Note: These figures are examples and may vary based on market conditions and lender policies.

Compare these industrial properties to see how they're currently priced in your market:

Industrial Properties For Sale

LTV and Refinancing Strategies in CRE

Refinancing Qualification Framework

Target refinancing when your current LTV drops below 70% through principal paydown or property appreciation. Most lenders require 12-24 months of seasoning, minimum 1.25x DSCR, and stabilized occupancy above 85%. Calculate potential savings by comparing your current all-in cost of capital against prevailing market rates minus refinancing costs (typically 1-3% of loan amount).

LTV Optimization Through Value Creation

Execute capital improvements targeting 15-25% NOI increases to drive property revaluation and improve refinancing LTV. Focus on high-impact upgrades: HVAC system modernization (3-5% NOI boost), LED lighting conversion (2-3% expense reduction), and common area renovations that support 5-10% rent increases. Complete improvements 6+ months before refinancing to establish income stabilization for lender underwriting.

Cash-Out Refinancing Parameters

Structure cash-out refinancing to maintain 65-75% post-refinance LTV while extracting maximum equity. Calculate optimal extraction as: (New Property Value × Target LTV%) - Current Loan Balance - Refinancing Costs. Reinvest proceeds into assets yielding higher returns than your borrowing cost, maintaining a 200+ basis point spread between investment returns and debt cost.

Loan Transition Strategies

Plan loan transitions 12-18 months before maturity to avoid rushed decisions. Investors can use a balloon payment calculator to determine exact payoff amounts and plan refinancing timelines. Bridge-to-permanent transitions work best when property NOI has increased 20%+ since acquisition, justifying permanent financing at improved LTV. Construction-to-mini-perm transitions require achieving 85%+ stabilized occupancy and demonstrating 12+ months of operating history at projected income levels.

Using LTV in Decision Making

Evaluating Potential Properties

Compare LTV ratios when reviewing potential investments to identify properties with a better risk reward balance. A lower LTV means less debt relative to the property's value, which can make a property more attractive.

Explore current commercial properties for sale with varying LTV potential to practice applying these evaluation principles:

Commercial Properties For Sale

Negotiating Loan Terms

Use LTV as a negotiation tool with lenders to secure better interest rates and more flexible repayment options. Lower LTV levels can lead to higher loan amounts and improved loan terms.

Assessing Market Conditions

Monitor market trends because LTV becomes critical during fluctuations. In a rising market, a slightly higher LTV might be acceptable, but in a declining market, aim for a lower LTV to reduce risk.

Determining Down Payment Size

Calculate the required down payment based on the desired LTV. A lower LTV typically means a larger down payment, which influences your available cash for other investments.

Integrate your findings with strategies for buying commercial property and use a market comparison approach to benchmark your options.

Impact of Down Payment and Equity on LTV

Down Payment Optimization Analysis

Calculate optimal down payment using the LTV breakpoint method: target 65% LTV for premium rates, 70% for competitive terms, or 75% maximum for acceptable financing. Each 5% down payment increase typically reduces interest rates by 25-50 basis points and eliminates recourse requirements above certain thresholds. For a $2M property, increasing down payment from 25% to 30% ($100K additional equity) can save $15-30K annually in interest costs.

Equity Contribution Return Analysis

Evaluate equity contributions using opportunity cost analysis: compare the IRR of additional down payment (interest savings + risk reduction) against alternative investment returns. Additional equity becomes optimal when total return (interest savings + reduced default risk premium) exceeds your target investment yield by 200+ basis points. Factor in liquidity constraints and portfolio diversification when determining optimal equity allocation.

Creative Equity Structuring Methods

Structure equity through syndication targeting 15-20% preferred returns to limited partners while maintaining control. Use preferred equity layers at 8-12% returns to bridge equity gaps without diluting ownership significantly. Joint venture structures work when partners contribute 25-50% equity for proportional ownership, particularly effective when combining operational expertise with capital. Cross-collateralization across multiple properties can reduce individual LTV requirements while maintaining portfolio leverage targets.

LTV and Risk Management in Loan Approvals

Lender Risk Assessment Framework

Lenders use LTV ratios to gauge default probability and set pricing models. Analyze your LTV in the context of risk metrics and adjust your strategy to improve loan terms.

Commercial-Specific Risk Mitigation Factors

Consider tenant quality, lease structures, and property management efficiency to offset higher LTV ratios. Use this information to design risk management plans that safeguard your investment.

Strategic LTV Breakpoint Analysis

Identify critical LTV thresholds at 65%, 70%, 75%, and 80% where loan terms can improve significantly. This analysis enables you to negotiate better rates and conditions as market trends shift, especially when nnn cap rates affect property performance.

Leverage Optimization Strategies

Optimize your leverage by balancing maximum debt capacity with your risk tolerance. Run stress tests and consider a buying a distressed property analysis, and rely on commercial building appraisals for accurate valuations.

Frequently Asked Questions

How should investors adjust their LTV strategy during different market cycles?

Investors should lower their target LTV in expansion phases by accelerating principal payments to build an equity buffer. In distressed markets, a higher LTV might be acceptable if properties are discounted, but careful underwriting is essential. Monitoring market indicators and maintaining diverse capital sources are key to adjusting your strategy.

What are the tradeoffs between using a higher LTV financing structure versus a lower LTV with potentially better terms?

Higher LTV financing can boost returns through increased leverage but comes with greater risk, higher interest rate premiums, and stricter covenant requirements. Lower LTV reduces risk and offers more flexibility, though it may limit potential returns. The optimal balance depends on your investment horizon, risk tolerance, and market conditions.

How can investors effectively stress-test their investments for LTV covenant breaches in case of market corrections?

Investors should perform a sensitivity analysis that tests property value declines, NOI reductions, and interest rate increases simultaneously. This approach helps identify potential covenant breaches and informs strategies for maintaining adequate capital reserves. Regular monitoring and proactive adjustments are essential to mitigate risk.