What Is a Sale-Leaseback?

Every profession has its own unique lingo and commercial real estate (CRE) is no exception. CRE is riddled with hyphenated and compound terms that convey concepts in shorthand, and "sale-leaseback" is among one of the most colorful and least understood.

What is a Sale-Leaseback?

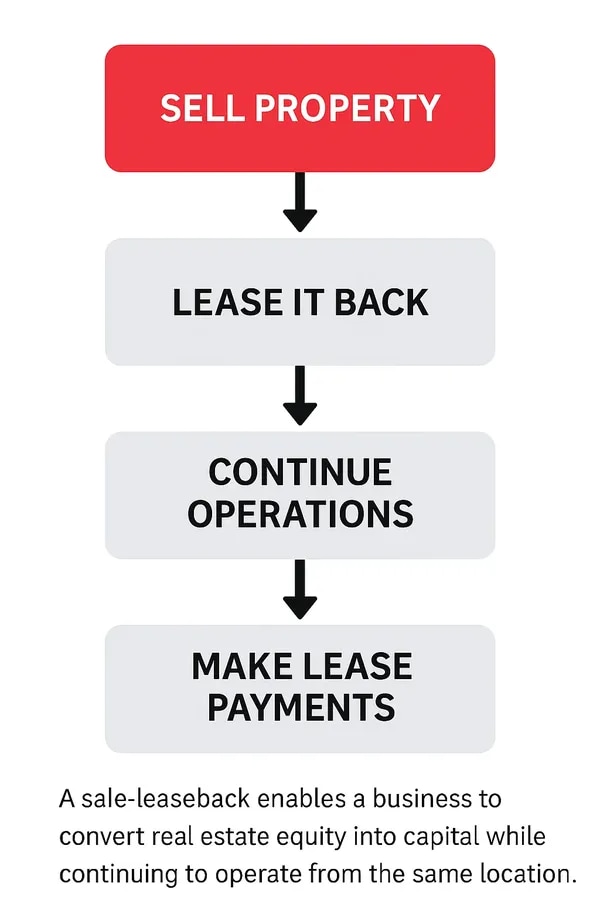

A sale-leaseback is a financing option that allows businesses to raise capital by selling a building and leasing it back from the buyer. This arrangement provides businesses with immediate access to cash, while still allowing them to use the building to operate their business.

According to Mark Fornes, president of Mark Fornes Realty, Inc., based in Dayton, Ohio, this transaction is carried out primarily to "raise cash that might be more useful in the operation of the business than tied up in the real estate asset."

How Does it Work?

In a sale-leaseback transaction, the business sells an asset, such as a property or equipment, to a third-party investor. The investor then leases the asset back to the business for a specified period of time. The business makes regular lease payments to the investor, which can be structured to fit their budget and cash flow needs.

Who Carries Out a Sale-Leaseback?

A sale-leaseback can be undertaken by a small business that owns and works out of just one building or by a large corporation with thousands of employees that owns and occupies numerous properties across many markets. In either case, the overarching objective is to monetize their real estate asset.

With a smaller company, the motivation to initiate a sale-leaseback might be an opportunity to open additional offices or locations. The cash infusion can help fund those efforts and a lease agreement with the new building owner enables the business to continue to operate from its existing location.

For a large company, Larry Fitzgerald, a commercial real estate broker based in Northern Virginia with Newmark Knight Frank, said that the enticement might be the realization that a building "is a non-essential asset and they want to get it off their balance sheet." Instead of having equity tied up in the real estate, the company can create liquidity, reallocate the funds and remain in the building.

Think of this as having your cake and eating it too: you sell your building and take the cash, while avoiding the disruption of relocating your business, thereby remaining easily accessible to clients, employees, suppliers, etc.

To see real world examples, explore potential sale-leaseback opportunities in your area to find properties with in place tenants and stable rental income.

Commercial Real Estate For Sale

Common Industries That Use Sale-Leasebacks

Sale-leasebacks are especially popular in asset-heavy industries where companies own valuable real estate but want to redeploy capital. Some of the most frequent users include:

- Quick Service Restaurants (QSRs) - Franchise operators convert equity in owned locations into growth capital.

- Healthcare - Medical offices and outpatient centers reduce ownership burdens while staying operational.

- Retail Chains - Grocery stores and big-box retailers unlock capital from owned storefronts.

- Industrial & Logistics - Distribution centers and warehouses monetize owned land while maintaining supply chain control.

- Hospitality - Hotels offload real estate to investors while continuing to operate the brand.

These sectors value the ability to stay in place, maintain customer access, and fund expansion without taking on new debt.

Seller Motivations Beyond Cash

How Sale-Leasebacks Affect Your Balance Sheet

A sale-leaseback allows a business to raise capital without taking on new debt or diluting equity. Instead of booking a liability, the sale generates cash and removes the asset from the balance sheet. Lease payments become operating expenses, potentially improving financial ratios like return on assets (ROA) and debt-to-equity. This structure makes it a hybrid financing tool, providing liquidity while keeping leverage low.

For both small and large companies, there are additional reasons beyond financial incentives for initiating a sale-leaseback.

Focus on mission not real estate. In some cases, business operators simply want to get out of the real estate business. Owning, operating and maintaining a real estate asset can be an unnecessary burden, especially for business owners that want to focus exclusively on their company mission. Many do not have the skills, interest or capacity to shovel snow from sidewalks and parking lots; monitor and pay utilities, insurance and taxes; or continuously fix things that break or wear out.

Flexibility. The need for flexibility, either immediately or in the future, is another significant driver of sale-leasebacks. Companies both big and small watch as conditions affecting their businesses change and locations come into or fall out of favor. Leasing space enables companies to expand and contract as necessary.

However, while they won't have the responsibility of managing and maintaining a building, this flexibility will present risks when the lease expires. Rental rates will likely be higher, the space the company wants may not be available, and the hassle of moving could be very disruptive for clients and employees.

Applicable to Retirement as Well as Corporate Strategy

Sale-leasebacks are tools that help companies of all sizes, from entrepreneurial firms with principals preparing for retirement to corporations continuously strategizing and managing their assets.

Lump sum and cash flow. For a small company, this type of transaction typically takes place when a small business, like a law firm or a restaurant, has operated from a building it has owned for many years. The long-time business/building owner wants to continue to operate their business in that location and wants to convert the equity they have accumulated in the asset into cash.

Fitzgerald provided the following example. Consider an entrepreneur that owns both a building and the operating company working in it. She sells her ownership stake in the building to an investor and her operating company rents the property back from the new purchaser. Fitzgerald said, "It's usually a situation where the building ownership wants to monetize the asset. Maybe the person who owns [the building and the company] is approaching retirement," so she wants to monetize the physical asset to get a lump sum for retirement, but retain ownership of the operating company, to maintain an income stream.

Corporate strategy and mitigating risks. A sale-leaseback can be part of a larger corporate real estate strategy that completely rearranges a real estate portfolio by disposing, acquiring and leasing assets in markets across the globe. Some large business owners initiate sale-leasebacks, occasionally or on an ongoing basis, as part of an overall real estate approach that enables them to modify their real estate portfolio as business needs change.

Corporate real estate divisions are charged with following economic and employment trends so they can readily access skilled workers, raw materials or other resources that are necessary for a company to function. They are also expected to follow real estate market conditions so they can optimize when to enter, renew or exit a market and sale-leasebacks are tools that help them do this. Timing a building purchase, sale or lease agreement perfectly is nearly impossible, but selling a building and leasing it back years in advance of a planned departure mitigates the risks associated with selling in future unknown market or economic conditions.

Key Conditions for a Purchaser

What makes a sale-leaseback attractive to a purchaser? Fornes identified four core characteristics: a long-term lease, a creditworthy tenant, a reusable building, and a strong location—each of which supports predictable income and long-term asset value.

Buyer Requirements Summary

| Requirement | Why It Matters |

|---|---|

| Long-Term Lease | Provides predictable income and spreads acquisition costs like broker fees and legal expenses. |

| Creditworthy Tenant | Reduces risk of default, increases payment reliability, and can justify a higher sale price. |

| Reusable Building | Minimizes re-tenanting costs if the tenant vacates; improves long-term value. |

| Strong Location | Drives future demand, supports leasing velocity, and enhances resale potential. |

In an ideal scenario, a sale-leaseback creates liquidity and fosters flexibility for business owners, while enabling them to focus on their core mission. At the same time, it provides property owners with a stable rental income stream and a long-term tenant in place.

In some cases, buyers may also negotiate a right of first offer to secure potential control over future sale or leasing opportunities tied to the property.