Benefits and Challenges of Multifamily Investing

Multifamily investing offers a reliable path to building wealth through steady cash flow and portfolio diversification.

Recent market data supports this strength, according to a CoStar press release, prime multifamily markets gained 2.7% in the fourth quarter of 2024. While these investments can deliver strong returns through predictable income and operational efficiency, they also present unique challenges.

This guide examines both the advantages and potential hurdles of multifamily investing, providing actionable strategies to help investors succeed in this sector. If you're interested in buying a multifamily property, our comprehensive guide offers step by step insights to get you started.

| Criteria | Benefits of Multifamily Investing | Common Challenges |

|---|---|---|

| Cash Flow | Multiple units generate reliable, monthly income even if one unit is vacant. | Coordinating rent collection and managing vacancies can increase administrative demands. |

| Diversification | Income is spread across various units, reducing reliance on a single tenant. | Different tenant profiles require tailored management and retention strategies. |

| Appreciation | Strategic improvements and increased occupancy boost property value over time. | Economic downturns and market fluctuations can temporarily impact property values. |

| Scalability & Efficiency | Centralized management and bulk maintenance lower costs and improve profitability. | Managing larger portfolios can increase operational complexity and administrative tasks. |

| Resilience | Strong rental demand helps maintain occupancy even during economic slowdowns. | Market volatility can still affect rental rates and overall property performance. |

| Value-Add Potential | Renovations and operational improvements can lead to higher rental rates and increased property value. | Effective upgrades may require significant capital and careful planning. |

| Professional Management | Expert managers enhance tenant retention and streamline operations. | Hiring quality management increases operating costs and requires rigorous selection. |

| Financing | Steady cash flow and lower vacancy rates simplify financing compared to single-family homes. | High upfront costs and strict lender requirements can make financing challenging. |

Benefits of Multifamily Investing

Multifamily investing offers significant advantages that extend well beyond traditional single-family investments. The various types of multifamily real estate will each come with their own benefits, as well.

Enhanced Cash Flow

Enhanced cash flow means receiving reliable, monthly income from your property, one of the key drivers to consider when comparing multifamily vs. single-family rental roi. Multifamily investments earn rent from several units, so even if one unit is vacant, the other units keep the income steady.

Keep in mind that your break-even occupancy rate will vary in small vs. large multifamily properties, however. Conduct a multifamily break-even analysis before you buy.

This setup spreads your risk. If one tenant leaves, the loss is offset by rent from other tenants. As a result, your overall cash flow remains more predictable.

Stable cash flow helps cover operating costs like maintenance and utilities. It also makes it easier to budget and plan for improvements. Lenders favor investments with steady income, which can lead to better financing options.

Appreciation Potential

Multifamily properties often appreciate over time, especially when improvements are made and occupancy rates increase, offering solid long term capital growth. A key measure of this growth is the capitalization rate, which helps investors gauge a property's earning potential. By assessing the commercial property value, you can better understand how market trends and property improvements boost overall asset worth.

Diversification

With income spread across several units, your portfolio is less vulnerable to the loss of a single tenant, reducing risk and providing financial stability. Effective tenant management further supports diversification; learn how to screen tenants and discover tips for finding good tenants to secure steady rental income.

Scalability and Operational Efficiency

Multifamily investments allow you to grow your portfolio without a huge jump in operating costs. As you add more units, you can centralize management to handle everything from tenant communications to maintenance, which simplifies operations.

Bulk maintenance is another key benefit. When repairs and upgrades are done for several units at once, expenses drop and efficiency increases. This streamlined approach helps boost profitability and makes your overall investment more resilient.

Resilience in Economic Downturns

Even during economic slowdowns, rental demand remains strong because housing is a basic need. Multifamily properties tend to hold their value and maintain high occupancy even when other real estate sectors struggle.

Recent market data indicates that multifamily assets show remarkable resilience. For example, current distressed sale levels remain historically low at just 3.4% of total transactions, demonstrating the sector's stability:

This performance reflects the enduring demand for rental housing, making multifamily investments a safer bet during uncertain times.

Value Add Opportunities

Multifamily properties offer many ways to boost their value through upgrades and smart operational changes. Renovations such as modernizing units, updating common areas, or adding new amenities can justify higher rental rates and lift property value.

Operational enhancements also play a key role. Streamlining management processes and adopting energy-efficient measures can lower operating costs and increase net income. These improvements make your investment more attractive to tenants and can lead to stronger long-term returns.

Professional Management Leverage

The scale of multifamily properties makes them ideal for professional management. Hiring expert managers can boost tenant retention and ensure that operations run smoothly.

Professional management teams handle day to day tasks like maintenance, rent collection, and lease renewals. They also bring local market knowledge and strong vendor relationships, which can help reduce costs and improve service quality. This expertise allows you to focus on long-term strategies and growing your investment portfolio.

Easier to Finance Than Single Family

Lenders often view multifamily properties as a safer to finance than single family homes. This is because they offer more reliable income even when one unit is vacant.

Multifamily properties also tend to have lower vacancy rates and more consistent cash flow. This consistency can make it easier to secure financing. Many lenders favor properties with stable rental income and may offer more attractive terms.

If you're interested in purchasing an apartment complex, you'll find that these factors work in your favor. Exploring options like CRE loans can also open up more flexible financing opportunities.

Keep in mind that some lenders may have stricter requirements, especially if the property is not owner occupied. Additionally, owning a multifamily property can come with increased legal responsibilities compared to a single-family home.

Market Performance and Long-Term Resilience

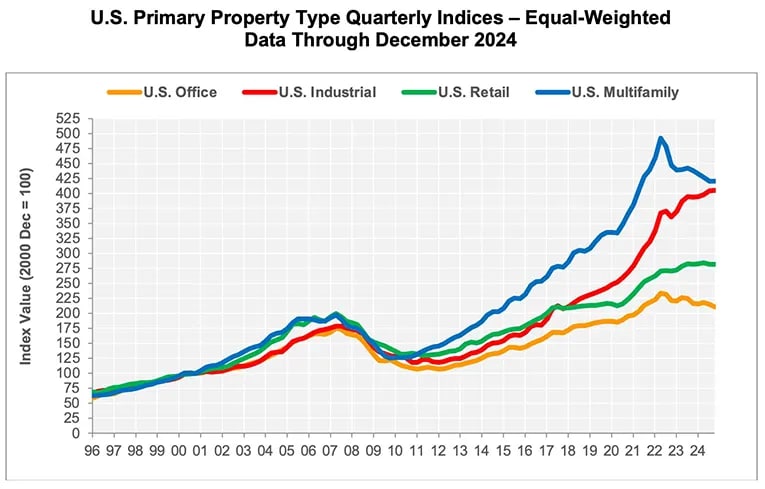

Recent market data further supports the strength of multifamily investments. The value weighted multifamily index increased by 2% from the third quarter to the fourth quarter of 2024. This figure is distinct from the 2.7% gain noted in prime multifamily markets in the introduction, offering a broader view of market performance.

The following chart illustrates how multifamily properties have historically outperformed other commercial real estate sectors, showing strong growth from 2010 to 2022.

This long term performance data highlights multifamily's ability to weather various market cycles, including the 2008-2009 financial crisis, and reinforces its position as a stable investment choice. While these strong fundamentals offer many benefits, it is equally important to understand the challenges multifamily investors face. In the next section, we will explore these challenges and discuss strategies to overcome them.

Ready to explore these opportunities? Browse current multifamily properties in your target market:

Multifamily Properties For Sale

While these strong fundamentals offer many benefits, it is equally important to understand the challenges multifamily investors face. In the next section, we will explore these challenges and discuss strategies to overcome them.

Challenges in Multifamily Investing

While multifamily investments offer strong rewards, they also come with several significant challenges:

- Operational Complexity: Managing multiple units increases administrative demands and property management responsibilities.

- Market Volatility: Shifts in market conditions can affect rental income and property values.

- High Initial Costs: Substantial upfront investment and careful financial planning are required.

- Market Competition: Experienced investors can make market entry challenging for newcomers.

- Inherent Risks: Commercial real estate investments carry potential for capital loss if not properly managed.

How to Overcome Them

| Challenge | Solution Strategy |

|---|---|

| Operational Complexity | Implement professional services and automation tools; standardize processes for efficiency |

| Market Volatility | Maintain reserve funds; monitor market trends; diversify tenant base across industries |

| High Initial Costs | Explore financing options; consider partnerships; develop detailed budgets |

| Market Competition | Build professional networks; seek mentorship; explore off-market opportunities |

| Inherent Risks | Conduct thorough due diligence; stay informed of regulations; consult with experts |

Operational Complexity

To reduce operational complexity, streamline property management with professional services and modern automation tools. Outsourcing tasks like tenant screening, maintenance scheduling, and lease renewals can lighten your workload and improve consistency.

Investing in technology, such as property management software, helps automate routine tasks. This allows you to standardize tenant communications and track maintenance requests efficiently. Clear processes ensure quicker response times and reduce errors, leading to better tenant satisfaction and overall performance.

Market Volatility

To manage market volatility, keep a close eye on local trends and economic indicators. Regularly check factors like rent levels, employment rates, and local supply and demand. This helps you stay informed and adjust your strategy as needed.

Building a reserve fund is essential. A solid financial cushion helps cover unexpected expenses during downturns and fills gaps when vacancies occur. This reserve keeps your cash flow steady even when the market shifts.

Adjust rental rates based on current market conditions. If demand increases, gradually raise rents to maximize income. Conversely, if vacancies rise, lowering rents slightly may attract new tenants.

Diversify your tenant base to spread risk. When tenants come from different industries or income groups, your overall rental income becomes more stable. This approach lessens the impact of market swings on your revenue.

High Initial Costs

High initial costs require careful financial planning. Start by creating a detailed budget that covers the down payment, closing costs, and any necessary repairs or improvements. This helps you understand the full upfront investment needed.

Explore various financing options to ease the burden. Consider traditional bank loans, CRE loans, or alternative lending sources. Looking into partnerships or fractional ownership models can also help share costs and reduce individual risk.

By pooling resources with partners, you may secure lower interest rates and more favorable loan terms. A well-structured financing strategy makes the high initial costs more manageable and sets your investment on a successful path.

Competition

Competition in the multifamily market can be intense. To gain an edge, build a strong network of local real estate professionals by attending industry events and joining local investor groups. These connections often reveal off market opportunities that aren't widely advertised.

Leverage the experience of seasoned investors by seeking mentorship. Their guidance can help you refine your strategy, navigate competitive bids, and spot hidden deals. Learning from their real world experience gives you a valuable advantage in a crowded market.

Inherent Risks

Every investment carries some level of risk, and multifamily properties are no exception. It is crucial to mitigate these risks by conducting thorough due diligence. This means carefully reviewing financial records, inspecting property conditions, and analyzing local market trends before you commit to an investment.

Staying informed about regulatory changes and industry standards is vital. Laws and local ordinances can influence operating costs and property performance. Consulting with legal and financial experts ensures you understand these factors and can make adjustments to protect your investment from potential capital loss.

Explore Apartment Buildings for Sale

Now that you're equipped with in depth insights into multifamily investing, take the next step and browse our listings of apartment buildings for sale to find the perfect opportunity for your investment portfolio.

Apartment Buildings For Sale

Frequently Asked Questions

What should a first time investor focus on when evaluating a multifamily property?

A first time investor should look at the property's location, condition, and cash flow potential. They need to check the current rents, vacancy rates, and future growth prospects. Doing thorough due diligence and consulting with experts helps ensure a sound investment.

What kind of multifamily property should I invest in?

Consider your preferred level of involvement, available capital, and target returns. The best option is the one that aligns with both your investment strategy and long-term vision. If you’re weighing the pros and cons of these properties, it might help to start with something smaller. Buying a triplex or exploring duplexes for sale is a great way to get started without the complexity of managing a large apartment building.

How do I decide between self managing my property or hiring a property management company?

The choice depends on your experience, time, and the size of the property. Self-managing may save money but can be time consuming. Hiring a management company can ease the workload and improve tenant satisfaction, especially for larger or more complex properties.