Discounted Cash Flow Analysis in Commercial Real Estate Investment

Key Takeaways

- DCF converts future property cash flows into present value using discount rates that reflect investment risk.

- Terminal value represents 60-80% of total property value in DCF models.

- Use unlevered cash flow for property performance analysis, levered cash flow for equity return evaluation.

What is Discounted Cash Flow (DCF)?

Discounted cash flow is a method used to estimate the value of an investment. It converts future cash flows into today's money.

DCF calculates the present value of expected cash flows. This helps investors decide if a property is worth its price. For example, when comparing future income to current costs, DCF can reveal if an asset is undervalued. It is a key tool to understand commercial real estate values.

Discounted Cash Flow Formula

Where:

- CF₁ = The cash flow for year one

- CF₂ = The cash flow for year two

- CFₙ = The cash flow for additional years

- r = The discount rate

The DCF formula sums future cash flows and discounts them back to today. It divides each cash flow by one plus the discount rate raised to the power of the period number.

This formula helps investors compare future income with current costs. It works well with tools like a NOI calculator, cap rate, and a DSCR calculator.

What are DCF Fundamentals?

DCF analysis converts future cash flows into present value to reveal an asset's true worth. For example, $100K in net operating income in year five is worth less than $100K today because money loses value over time.

The internal rate of return is closely linked to DCF since it identifies the discount rate that sets net present value to zero, offering a complementary view of investment performance. Investors frequently use an IRR calculator alongside DCF models to evaluate different holding periods and cash flow scenarios.

DCF provides a structured method to compare projected cash flows with acquisition costs, helping commercial real estate investors make informed decisions about whether properties meet their return requirements.

DCF in CRE Investment Decision Making

DCF analysis helps investors turn complex financial numbers into clear decisions. It shows if a property meets a set return threshold for acquisition, hold, or sale. This process creates a practical roadmap to decide when to move forward with an investment.

Investors can set personalized hurdle rates based on risk tolerance and alternative options. This means they establish minimum acceptable returns before committing funds. Using these thresholds guides investment choices and helps filter out projects that do not meet expectations.

DCF insights also reveal property value drivers that may go unnoticed. This competitive edge helps identify market trends and hidden opportunities by quantifying how different property characteristics impact cash flows and terminal values.

Browse current commercial property listings that illustrate how discounted cash flow analysis can guide investment decisions.

Commercial Real Estate For Sale

Discounted Cash Flow Model

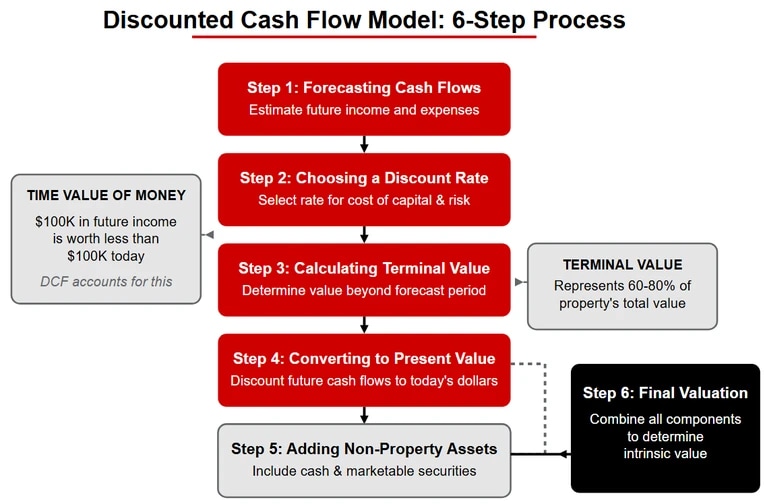

The DCF model is built in six steps:

| Step | Description |

|---|---|

| 1. Forecasting Cash Flows | Estimate future income and expenses based on property performance. |

| 2. Choosing a Discount Rate | Select a rate that reflects the cost of capital and investment risk. |

| 3. Calculating Terminal Value | Determine the value of cash flows beyond the forecast period using exit cap rate or debt yield methods. |

| 4. Converting Cash Flows to Present Value | Discount future cash flows to today’s dollars. |

| 5. Adding Non-Property Assets | Include additional assets like cash or marketable securities in the valuation. |

| 6. Determining Final Valuation | Combine all components to arrive at the intrinsic value of the property. |

Each step creates a clear investment picture. Forecasting cash flows and choosing discount rates establish the foundation, while terminal value and present value calculations convert future returns into today's dollars for direct price comparison.

DCF models accommodate property-specific adjustments for lease rollover risk, tenant improvement costs, and capital expense timing to ensure accurate valuations for each asset's unique characteristics.

Free Cash Flow Analysis: Unlevered vs. Levered

Free cash flow shows the money a property makes after paying operating expenses and capital costs. It tells investors how much cash is left for debt payments and profit.

Unlevered cash flow measures earnings before financing costs. Levered cash flow subtracts interest and debt payments to show cash for equity holders.

Choose unlevered cash flow if you want to see the property's raw performance. Use levered cash flow to understand returns after financing. This analysis works well with tools like the DSCR and LTV.

| Metric | Unlevered Cash Flow | Levered Cash Flow |

|---|---|---|

| Definition | Earnings before financing costs, showing raw property performance. | Earnings after deducting interest and debt payments, showing cash available to equity holders. |

| Risk Sensitivity | Less sensitive to financing changes. | More sensitive to debt structure and financing costs. |

| Focus | Assesses overall property performance. | Highlights returns available after financing. |

| Usage | Used for fundamental analysis of property value. | Used for evaluating investment returns to equity holders. |

Terminal Value Calculation Methods

Terminal value is a key part of DCF. It can represent 60-80% of a property's total value by estimating cash flows beyond the forecast period.

The exit cap rate approach uses current market trends and property class to set a cap rate that determines terminal value. The debt yield approach looks at cash generation relative to debt levels to achieve a similar goal.

Determining Discount Rates: WACC, Cost of Equity & Risk Adjustments

Discount rates set the required return by combining a base rate with risk premiums that reflect property-specific factors. Use WACC for unlevered DCF models and cost of equity for levered cash flow analysis.

Common risk adjustments include 50-100 basis points for secondary markets, 25-75 basis points for shorter lease terms, and 100-200 basis points for value-add strategies. These adjustments ensure the discount rate accurately reflects each property's risk profile in your DCF valuation.

Actionable Decision Making Framework

DCF results help guide clear investment decisions by linking financial outputs to specific actions. One common framework starts with setting return thresholds and risk tolerances.

This framework typically includes these steps:

- Establish a minimum acceptable net present value (NPV) or internal rate of return (IRR).

- Map DCF results to decision categories such as "buy," "hold," or "sell."

- Compare the DCF outcome against these benchmarks to decide if the property meets investment criteria.

Using this decision matrix, investors can choose when to pursue a deal, maintain an asset, or sell. It also supports strategies on how to sell commercial property when market conditions shift.

Frequently Asked Questions

When should I use DCF analysis versus simpler valuation methods like direct capitalization for commercial real estate investments?

Use DCF when future cash flows are expected to vary or when a property has complex lease structures, planned renovations, or repositioning needs. DCF is ideal for properties where a detailed forecast is needed, while direct capitalization works well for stabilized assets with steady income.

How can I make my DCF projections more reliable given market uncertainties, especially for longer-term forecasts?

Improve reliability by using tiered confidence levels and scenario modeling. Focus on near-term projections with high certainty, adjust long-term forecasts conservatively, and update your model regularly with current market data.

How do I determine the appropriate discount rate for different types of commercial real estate investments?

Start with a risk-free rate and add premiums for factors like property type, location, and tenant quality. Adjust for financing costs and market trends so the discount rate accurately reflects the investment's unique risk profile.