Duplex Investing Guide: Financing, Returns, and Risk Management

Key Takeaways

- Duplex investing offers two income streams under one roof, reducing vacancy risk while keeping maintenance costs manageable.

- Flexible duplex financing options like FHA, VA, and conventional loans make it easier for first-time investors to build equity through house hacking.

- Knowing how to analyze cash flow, cap rates, reserves, and risk scenarios helps investors make smarter, more resilient property decisions.

What is a Duplex?

A duplex is a type of multifamily home that has two separate living units with their own entrance, kitchen, bathroom, and living space on one parcel with one deed. You can live in one unit and rent the other, or rent out both.

For first-time investors with limited capital, duplexes offer a proven path to building wealth while eliminating your housing costs. Miss the fundamentals, however, and you could lose thousands to vacancy, unexpected repairs, or unfavorable financing.

What are the Pros and Cons of Duplex Investing?

Duplexes offer pros and cons when it comes to income, financing, and operating costs.

| Factor | Pros | Cons |

|---|---|---|

| Income |

|

|

| Financing |

|

|

| Operating Costs |

|

|

| Accessibility |

|

|

| House Hacking |

|

|

| Appreciation & Liquidity |

|

|

| Tax Treatment |

|

|

| Cash Flow Stability |

|

|

| Scalability |

|

|

| Regulation & Insurance |

|

|

Note: Financing terms, taxes, and insurance vary by lender and jurisdiction. Verify current requirements before applying them to a specific property.

What Are the Fundamentals of Duplex Investing?

Duplex investing fundamentals include capitalizing on dual rental income, lowering vacancy risk, and evaluating returns with key metrics.

With a duplex, like with other types of multifamily real estate, you get the benefit of two income streams from one roof. That lowers vacancy risk compared to single-family investments and concentrates maintenance on a shared structure, which can reduce per-unit cost over time.

How is a duplex different from single-family or larger multifamily properties?

On the spectrum of small vs. large multifamily real estate, a duplex falls into a narrow range that gives you multiple income streams but also still allows for residential financing. Many investors consider duplexes vs. triplexes vs. fourplexes for similar benefits.

Single-family homes offer only one income stream. Large multifamily properties require commercial financing that comes with stricter qualification standards and larger down payments. Duplexes sit in the middle.

When it's time to consider your exit, keep in mind that single-family homes will typically attract more buyers. Over a 10-year hold, duplexes generate steadier cash flow than single-family homes because shared systems reduce per-unit capital expenditures by 30-40%.

How do two units change your risk and return?

Leasing two units spreads risk. If one of your tenants moves out, you can still use the income from the other unit to help cover mortgage and expenses, which makes your cash flow less volatile than a single-family rental.

You also get the benefit of shared systems. Both units are served by one roof, foundation, sewer line, and other key elements. That lowers the per-unit cost of capital expenditures you're responsible for.

How Do You Analyze a Duplex Investment?

Evaluate an investment with GRM, NOI, and DSCR before moving on to more extensive financial modeling.

Analyzing your investment is an important step when you're considering how to buy a duplex. Before you tour a duplex for sale, use basic calculations to filter opportunities. Then, run detailed projections on promising properties to confirm investment viability and track actual performance against projections after purchase.

Quick Screening: Three Essential Metrics

Use these calculations to determine if a property warrants deeper analysis.

Step 1: Calculate the Gross Rent Multiplier (GRM)

To get your annual gross rent, first research average market rents for comparable units in the area. Then, multiply that by 12 for each unit you plan to rent. From there, divide the purchase price by the annual gross rent to get your GRM, or gross rent multiplier.

For example, say you're considering a Los Angeles duplex for sale that costs $1 million. If the units will rent at $3,500 each, the property generates $84,000 annually and yields a GRM of 11.90. Compare that to similar nearby residential income properties in your area to see if the purchase price is reasonable.

Residential Income Homes For Sale

The limitation of GRM lies in what it ignores: operating expenses, financing costs, and property condition. Use GRM to narrow your search, then dig deeper with more comprehensive metrics.

Step 2: Estimate Net Operating Income (NOI) and Cap Rate

Estimate operating expenses at 35-45% of your gross rent, using the lower rate for newer properties and the higher rate for older properties or those with deferred maintenance. Subtract those expenses from gross rent to get your NOI, or net operating income. Then divide NOI by the purchase price to find the property's cap rate.

Continuing with our example, if we assume a 40% expense rate, or $33,600, the NOI for the property is $50,400, and the cap rate is 5.04%.

Cap rates vary significantly by market and property type. Higher cap rates often signal higher risk through deferred maintenance, challenging tenant markets, or declining neighborhoods.

Step 3: Verify the Deal's Viability

Compare NOI to your expected annual mortgage costs. If it's lower, the deal doesn't work without clear value-add plans. If NOI exceeds the mortgage by 20% or more, it's worth continuing with more analysis.

Comprehensive Financial Modeling

After a property passes initial screening, build detailed projections that incorporate conservative assumptions and account for all expense categories.

Income Projection Models

Start with conservative rent estimates based on comparable nearby properties. Find the best case, expected case, and worst case scenarios to get a range of possible rents. Multiply those numbers by 12, then subtract 5-8% in vacancy costs to get a range of potential effective gross incomes.

You can consider other income streams besides rent such as pet fees, parking charges, or laundry income, but it's best to use conservative assumptions at this stage. After all, just one vacancy wipes out 50% of your rental income in a duplex.

Expense Planning

Build comprehensive expense templates including property taxes, insurance, capital expenditures, utilities, and maintenance. For maintenance, budget 8-12% of gross income or 15-20% for older properties. As a quick overall estimate, budget 35-45% of gross rental income for total expenses.

You should also budget about 12% for property management costs, even if you plan to self-manage. This helps you create a fair comparison with properties that have professional management and prevents you from undervaluing your own time.

Advanced Return Metrics

If a property seems worth pursuing after your initial review, move on to more advanced analysis with cash-on-cash return and debt service coverage ratio (DSCR).

- Cash-on-Cash Return= Annual Cash Flow ÷ Total Cash Invested

- DSCR= NOI ÷ Annual Debt Service

Cash-on-cash return measures your actual return on invested capital. Calculate it by dividing annual pre-tax cash flow by your total cash invested, including down payment, closing costs, and immediate repairs or improvements. This metric accounts for mortgage payments, making it the most relevant measure for leveraged investments.

Positive cash-on-cash returns of 6-10% are typical targets in most markets. Returns above 10% might signal undervalued properties, below-market rents with room to increase, or markets with higher risk profiles.

DSCR tells you how much the property is expected to earn above its debt requirements. It typically isn't necessary for residential financing, but it's still a useful sanity check on a deal. Aim for 1.20 or higher under normal conditions. Then recalculate assuming 20% rent decline and 10% expense increase.

Exit Strategy Modeling

Model multiple exit strategies as well. Consider what selling after five or 10 years vs. holding as a long-term asset might yield. Include estimated appreciation, mortgage payments, accumulated cash flow as well as sales costs and capital gains taxes. Then compare total returns across multiple timeframes to see which holding period helps you achieve your goals.

Digital Tools and Templates

Rely on readily available tools like a cash-on-cash return calculator or property analysis spreadsheets to help model scenarios by adjusting metrics such as down payment, purchase price, interest rates, and more. Use these tools to implement the analytical framework above efficiently.

Once you understand these metrics, use them to evaluate residential income property for sale to find opportunities that meet your investment criteria.

Track Actual Performance

Track actual vs. projected performance monthly and quarterly. If one metric, such as vacancy or maintenance, consistently exceeds your initial estimate, start by looking into why that's the case and finding solutions. If vacancy is consistently high, for example, you may need to adjust your leasing strategy or rental rates. Tracking performance ensures your duplex continues meeting projected financial goals.

Also calculate your returns quarterly or annually to determine whether the investment is performing as expected. With that information you can determine if you need to raise rents, reduce expenses, or even sell sooner than expected.

What Financing is Available for Duplexes?

Duplex investing spans conventional mortgages, government-backed loans, and alternative funding sources.

Owner-occupied duplexes qualify for residential mortgages, while investment duplexes require investment property financing with stricter requirements.

The difference can be significant. On a $400,000 duplex the distinction between residential and investment financing can easily add $60,000 to $80,000 in extra down payment and $200 to $300 per month in loan payments.

This table compares duplex financing options, showing credit requirements, down payment minimums, and key features to help you select the best loan program for your situation.

| Loan Type | Requirements | Key Features |

|---|---|---|

| Conventional Owner-Occupied |

|

|

| Conventional Investment |

|

|

| FHA |

|

|

| VA |

|

|

| 203(k) Rehabilitation |

|

|

Conventional Loans

Conventional mortgage loans are flexible and widely available. Most require credit scores of 620+, although borrowers with a score of 680+ typically secure better rates. In most cases, your debt-to-income ratio must be below 43%, but some lenders allow up to 50% with strong credit or reserves.

If you plan to live in one unit, your down payment could be as low as 5-15%, whereas down payments for investment properties typically run closer to 20-25%.

With a conventional loan, you can count 75% of the market rent (based on an appraisal or active lease) toward your qualifying income. For owner-occupied duplexes, this only applies to the unit you're renting out. For investment properties, you can use that portion of the market rent from both units.

FHA Loans for Owner-Occupied Duplexes

FHA loans are ideal for first-time buyers with limited capital, because they offer 3.5% down if you have a credit score above 580. Like conventional mortgages, you can use 75% of the market rent from the unoccupied unit to count toward your qualifying income, but you must live in one unit for at least a year to qualify, and your property must meet minimum standards verified with an FHA appraisal.

If you plan to use an FHA loan, be sure to budget for mortgage insurance costs. FHA adds an upfront mortgage insurance premium of 1.75% of your loan, and annual premiums range from 0.45% to 1.05% of your balance.

VA Loans

VA loans allow eligible veterans and active-duty service members to purchase a duplex with 0% down and no monthly mortgage insurance. However, there is typically a one-time funding fee that depends on how much you plan to put down (fees are higher with 0% down, for example), and how many VA loans you hold.

Unlike conventional or FHA loans, you cannot use projected rental income to help qualify, unless you can show landlord experience or significant reserves. Like an FHA loan, you will need to live in one unit for at least a year and your property must meet certain standards, verified with a VA appraisal.

203(k) Rehabilitation Loans

If you plan to buy a duplex that won't meet the property standards of a FHA or VA loan, a 203(k) rehabilitation loan may be worth considering. 203(k) loans are offered by the FHA, and bundle the purchase price and renovation costs into one mortgage.

You can finance up to $35,000 in repairs with a limited 203(k) or more extensive renovations with a standard 203(k), subject to appraisal and HUD oversight. In either case, all your renovations must start within 30 days and be completed within six months after closing.

Loan rates will be slightly higher than standard FHA loans, so budget for an additional 0.25-0.5% in addition to consultant fees, supplemental origination charges, and other procedural costs.

Alternative financing

Investors with credit issues, employment gaps, or higher debt-to-income ratios may not qualify for traditional lending options. In these cases, it can be worth examining owner financing or hard-money loan options. These options work when traditional financing isn't available.

How Does House-Hacking Work with a Duplex?

By living in one unit and renting the other, you can offset or eliminate your housing costs.

Imagine covering your entire mortgage, property taxes, and insurance with rental income while building equity in an appreciating asset. House-hacking, where you live in one unit and rent the other, makes this possible.

This setup works well for first-time investors who want to lower their cost of living while learning tenant management.

What are the financing advantages for owner-occupants?

Living in one unit of your duplex unlocks more favorable loan terms than you might get for a pure investment property. Lenders view owner-occupied properties as lower risk because borrowers are more likely to prioritize payments on homes they live in.

As a result, you may be able to access more favorable FHA, VA, and conventional loan terms.

- FHA Loans: Down payments as low as 3.5% with a credit score of at least 580. You must occupy one unit as your primary residence for at least a year

- VA Loans: Eligible veterans and service members can put as little as 0% down. You must live in one unit, but the other unit's rent can help you qualify.

- Conventional Loans: Owner-occupied duplexes often qualify for 5-10% down, compared to 20-25% typically required for non-owner-occupied properties.

Rules and rates can change, so be sure to verify current requirements.

If you decide to move out of one unit and rent out both, you have the option to pull out equity through a cash refinance. You can extract up to 75% of the property's value to use as capital for your next purchase, but that can come with higher interest rates.

If you refinance after moving out, lenders will treat the new loan as an investment property, typically adding 0.5-0.875 percentage points to the rate compared to owner-occupied financing.

How do you decide if house-hacking fits your lifestyle?

House hacking is an effective way to save money, but it isn't for everyone. Living next door to your tenant can test your privacy and personal boundaries.

Consider your tolerance for privacy, tenant proximity, and noise to decide if house-hacking is right for you, and be honest about your boundaries before you commit. Be sure to understand how to find good tenants and how to screen tenants to minimize potential conflicts.

What are the Primary Risks in Duplex Investing?

The primary risks in duplex investing include tenant conflicts, property issues, and market risks.

Some common risks directly impact the financing, returns, and management stability of duplex investments.

This table identifies the most common risks duplex investors face, their potential impact on your investment, and specific strategies to mitigate each risk before it affects your returns:

| Risk | Impact | Mitigation Technique |

|---|---|---|

| Tenant Turnover | Losing one tenant removes 50% of your income |

|

| Maintenance Shocks | Systems such as your roof, plumbing or HVAC can create large, unexpected expenses |

|

| Liability Exposure | Tenants, guests, or contractors can trigger injury or damage claims |

|

| Market Volatility | Rising rates or declining rents can pressure cash flow or valuations |

|

| Extended Vacancy | One unit vacant for 3+ months eliminates 50% of income while expenses continue |

|

| Insurance Gaps | Inadequate coverage leaves you personally liable for major losses |

|

| Insufficient Reserves | Unable to cover expenses during vacancy or major repairs forces distress sale or default |

|

| Interest Rate Increase | Higher rates reduce cash flow (ARMs) or property value and buyer pool (sale) |

|

| Property Value Decline | Reduces equity, prevents refinancing, may create negative equity in severe downturns |

|

| Regulatory Changes | New rent control, mandatory inspections, or habitability requirements increase costs or limit income |

|

| Natural Disasters | Fire, flood, earthquake, or severe weather can cause total or partial loss |

|

| Tenant Non-Payment | Tenant stops paying rent but eviction takes 2-6 months depending on jurisdiction |

|

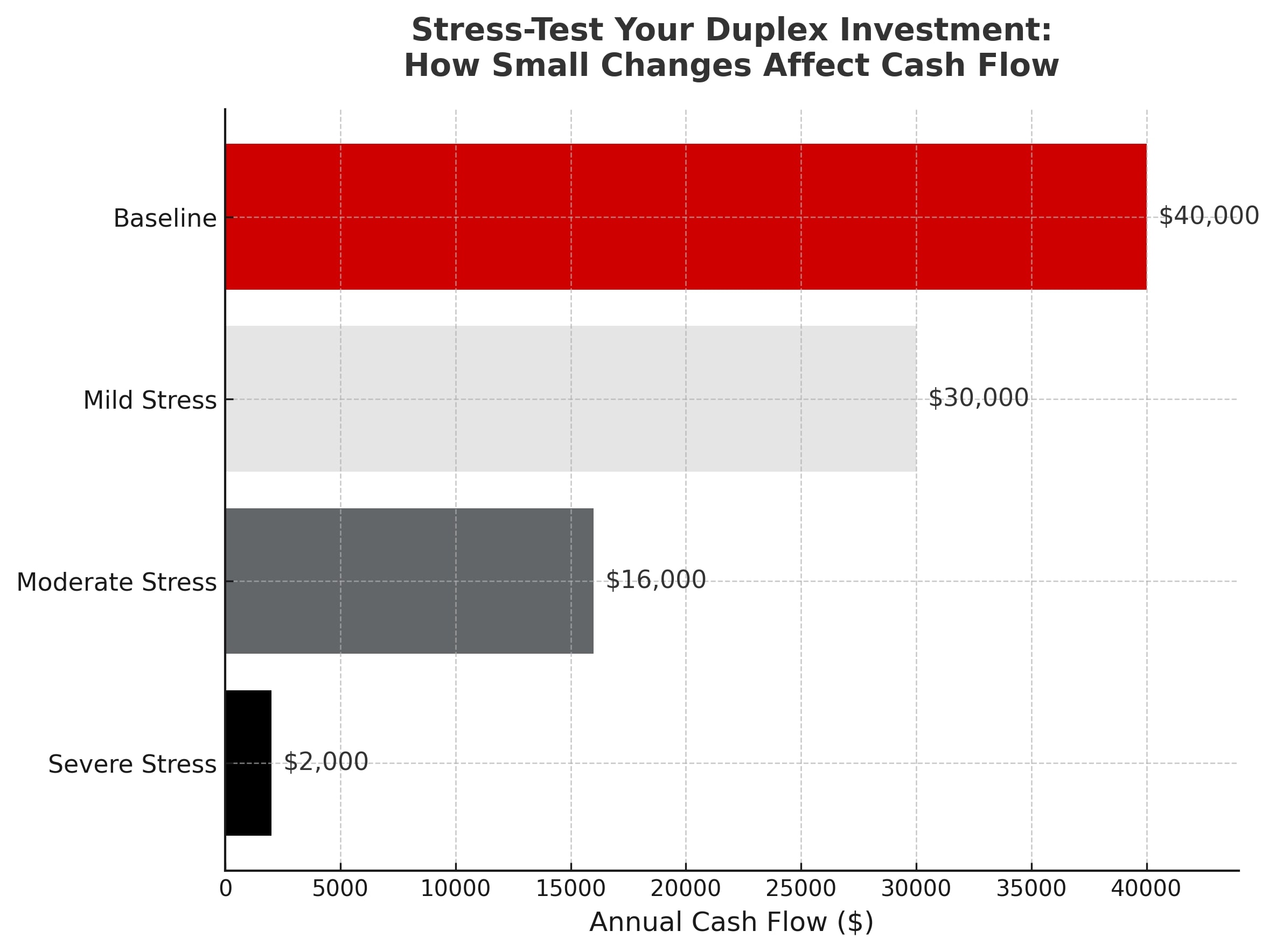

How Do You Stress-Test Your Duplex Investment?

Model vacancies, emergency repair costs, and rent declines to gut-check your investment.

Before you decide on a duplex, run simple tests to see if the investment can withstand realistic adverse scenarios. Small changes can have significant impacts on your investment.

The single-unit vacancy test

Calculate whether you can cover all your property expenses with only one unit rented. Add your monthly mortgage payment, property taxes, insurance, maintenance reserves, and any utilities you cover.

Properties where a single-unit income can at least cover the mortgage payment offer manageable downside protection. If the duplex requires significant subsidies during vacancies, the risk may be too high.

The major expenses test

Check whether you can fund $10,000-$15,000 in emergency repairs without selling the property or missing mortgage payments. If you would need to sell or go into debt to fund the expense, your reserves are likely too thin.

The rent decline test

Model rents 10-15% lower than current rates and calculate the corresponding cash flow. If that scenario eliminates all positive cash flow or creates negative cash flow, then you face significant market risk.

How Much Should You Keep in Reserves for a Duplex?

Three to 12 months, depending on the age of the building.

A $15,000 emergency repair can force you to sell your property at a loss or miss mortgage payments if you lack adequate reserves. Strong cash reserves turn potential crises into manageable expenses and protect the equity you've worked years to build. Include your mortgage payment, property taxes, insurance, typical maintenance, management fees, and utilities costs in your operating expense calculations.

For properties built within the last 10-15 years, or recently renovated, aim for reserves of three to six months of your total operating expenses. Major systems at these properties are likely newer and there's a reduced likelihood of emergency repairs.

If the asset was built more than 20 years ago or comes with deferred maintenance needs, increase your reserve levels to six to 12 months. Older buildings need more ongoing maintenance and major systems have a greater chance of failing.

As a rule of thumb, expect to spend 1-1.5% of the property value in repairs each year. Digital tools or property management software can help you track reserve levels and alert you if they drop below your target.

What Insurance Coverage Should You Have for a Duplex?

A homeowner's policy won't protect a rental duplex. Instead, you'll need landlord insurance.

Your policy should include:

- Dwelling coverage for both units

- Loss-of-rent coverage for income interruptions after a covered claim

- Liability protection for at least $1 million

It may also be prudent to add an umbrella policy that extends your liability coverage to $2 million or more. If your property is in a flood, earthquake, or wildfire zone, add those riders separately. Standard policies rarely include them, and your risk losing your investment without coverage.

Multifamily For Sale

Frequently Asked Questions

How much cash flow can I realistically expect from a duplex investment?

Cash flow varies significantly based on location, property condition, purchase price, and financing terms. For a typical duplex, investors might expect $200-$500 per month in cash flow when both units are rented, after accounting for all expenses including mortgage, taxes, insurance, maintenance reserves, and potential vacancy periods (budget for one to three months annually).

In high-cost markets, immediate cash flow might be minimal, with wealth building occurring over a five to 10 year horizon through loan paydown, appreciation, and gradually increasing rents.

When house hacking (living in one unit), your personal housing costs might be reduced by 50-80%, effectively creating "implicit cash flow" through savings rather than direct income.

What financing options are available for duplex investments, and how do they compare?

Several financing options exist for duplexes, each with distinct advantages:

- Conventional loans typically require 20-25% down payment for investment properties but only 5-10% for owner-occupied duplexes.

- FHA loans offer just 3.5% down payment for owner-occupants with minimum 580 credit score and one-year occupancy requirement.

- VA loans provide 0% down payment options for eligible veterans who will occupy one unit.

- 203(k) loans combine purchase and renovation costs into one loan with 3.5% down for owner-occupants.

- Seller financing allows flexible terms negotiated directly with the property owner, often with lower down payments and less stringent qualification requirements.

- Hard-money loans provide quick funding with 10-18% interest rates and 20-30% down payments, typically used for short-term acquisitions before refinancing. Owner-occupied financing generally offers the most favorable terms with interest rates typically 0.5-0.875% lower than investment-only loans.

What are the tax advantages of owning a duplex?

Duplex ownership offers significant tax benefits, particularly when house hacking. You can deduct expenses related to the rental portion including mortgage interest, property taxes, insurance, maintenance costs, and depreciation.

For a $400,000 duplex where half is rented out, you could deduct approximately $7,273 annually in depreciation alone (calculated as $200,000 ÷ 27.5 years). When both units are rented, all property-related expenses become deductible business expenses.

These deductions can significantly reduce your overall tax liability. Consult with a tax professional to maximize these benefits and ensure compliance with current tax laws.

How do I manage the challenges of living next to my tenants when house hacking a duplex?

Successfully managing tenant proximity requires clear boundaries and proactive systems:

- Implement thorough tenant screening including background checks, credit reports, income verification, and previous landlord references to find compatible, reliable tenants.

- Create a comprehensive written lease that clearly outlines expectations regarding noise, privacy, common areas, parking, and maintenance responsibilities.

- Invest in soundproofing between units to minimize noise transfer and enhance privacy.

- Establish professional communication channels (email, property management software) rather than allowing tenants to knock on your door with issues.

- Set specific office hours for non-emergency matters.

- Create separate entrances and clearly defined outdoor spaces where possible.

- Consider installing separate utility meters to avoid disputes over usage.

- Maintain professional boundaries by avoiding overly personal relationships with tenants while remaining respectful and responsive. Remember that while proximity has challenges, it also allows for better property oversight and faster response to maintenance issues, which can be marketed as a tenant benefit.