Duplex vs. Triplex vs. Fourplex for Investors

Key Takeaways

- Duplexes, triplexes, and fourplexes are two- to four-unit residential multifamily properties that qualify for easier residential financing than five-plus-unit commercial buildings.

- More units reduce vacancy risk and increase income potential, but also raise management complexity and capital requirements.

- Fourplexes offer the best income stability, while duplexes are simpler to manage and better for first-time investors.

- Owner-occupants can leverage FHA, VA, or low-down-payment conventional loans to "house hack" and build equity faster.

What is a Duplex vs. Triplex vs. Fourplex?

They are residential multifamily buildings with two, three, or four separate units on one parcel.

A duplex is a multifamily home with two units on it. A triplex has three units and a fourplex, also known as a quadplex, has four units. Each individual unit has its own kitchen, bathroom, entrance, and living space.

How are duplexes, triplexes, and fourplexes laid out?

Duplexes typically come in one of two variations: side by side or stacked. Side-by-side duplexes share a common wall vertically between both units, and each unit has its own front entrance and utilities. In stacked duplexes, one unit sits on top of the other.

Triplexes and fourplexes can also be side-by-side, stacked, or a mix of both. Hallways, stairs, and laundry rooms may be shared, or each unit may be fully self-contained.

Why does unit count matter?

Duplexes, triplexes, and fourplexes are three types of multifamily homes that qualify as residential real estate for lending and zoning purposes. That means you can secure a conventional mortgage with typically lower down payments than if you were to buy a commercial property such as an apartment building.

Appraisals rely on comparable sales, making valuation and financing simpler than with large multifamily assets.

How are duplexes, triplexes, and fourplexes different from single-family homes and apartments?

Single-family homes generate income from just one tenant. That means that if your tenant moves out, your rental income drops to zero until you can rent out the property again. With a triplex, on the other hand, you retain 66% of your rental income even with one vacancy.

If you're considering a multifamily property for sale with five or more units, be aware that it is considered a commercial property. That comes with more complexities around financing, insurance, regulation, taxes, and property management.

Duplexes, triplexes, and fourplexes give you the relative ease of residential financing you get with a single-family home, coupled with the multiple income streams that are a hallmark benefit of multifamily investing.

What Are the Pros and Cons of Duplexes, Triplexes, and Fourplexes?

| Property Type | Pros | Cons |

|---|---|---|

| Duplex |

|

|

| Triplex |

|

|

| Fourplex |

|

|

The right choice for you depends on your available time, capital, and experience level.

For example, say you're examining a Dallas duplex for sale versus a triplex or fourplex in the same area. If you can expect each unit of the property, regardless of unit count, to rent for $1,600 per month your annual gross rent will come out to $38,400 for the duplex, $57,600 for the triplex, and $76,800 for the fourplex.

After typical expenses, however, the duplex might net $22,000 annually while the fourplex nets $38,000, not the doubled income the gross rents suggest. Insurance, taxes, and maintenance costs on the fourplex consume a larger percentage of that rental income.

Key Insight: Doubling unit count doesn't double net income. The fourplex in this hypothetical example where each unit rents for $1,600 generates 2x the gross rent of the duplex, but only 73% more net income due to disproportionate expense increases in insurance, taxes, and maintenance.

Income potential, vacancy risks, and management workload.

A fully-rented duplex generates two rent checks per month, a triplex generates three, and a fourplex four. However, it's important to keep in mind that costs don't scale linearly with unit count, and location matters: A duplex in a strong neighborhood may generate more cash-on-cash return than a fourplex in a weaker area.

Review other residential income properties for sale in your area to get a better idea of what real-world income and costs you can expect.

Residential Income Homes For Sale

Vacancy risk is a simpler metric. Losing one tenant in a duplex drops your rental income by 50%, while the same scenario in a fourplex eliminates just 25% of your rental income.

Key Insight: A fourplex maintains 75% of rental income during tenant turnover, while a duplex drops to 50%. During a two to four-week transition period, that difference significantly affect cash flow stability.

Average tenant transition will vary depending on demand, but many landlords plan for roughly 30 days between tenants. During that time the duplex investor will feel the vacancy more acutely. These factors impact how much you should plan to have in reserves, so don't overlook what seems like an obvious metric in your planning.

Which Option is Best for Your Goals?

Choose based on your experience level, time availability, and risk appetite.

Duplexes make good entry points for new investors learning the ropes of real estate investing and property management. There tend to be more duplexes available to purchase, and sellers are more likely to be less sophisticated. That increases the likelihood that there will be easy value-add opportunities.

Investors with time constraints can benefit from fourplexes, despite the increased property management requirements. Four units on a single property keep management centralized, and four income streams are more stable even during vacancies.

Risk-averse investors should consider both income stability and exit strategy. Triplexes and fourplexes offer better vacancy protection, but come with smaller buyer pools than duplexes. That liquidity can make it more difficult to exit an investment on your timeline.

How Do You Finance a Duplex, Triplex, or Fourplex?

Duplexes, triplexes, and fourplexes qualify for residential loans with lower down payments and better terms than commercial loans.

Keep these factors in mind if you're weighing whether to invest in small vs. large multifamily real estate.

Unit count makes all the difference. Properties with five or more units are considered commercial assets, and require commercial financing, which comes with significantly higher down payments, shorter loan terms, and stricter qualification standards.

What are the main financing options for small multifamily properties?

| Loan Type | Down Payment | Key Points |

|---|---|---|

| FHA Loan | 3.5% |

|

| Conventional | 3-25% |

|

| VA Loan | 0% |

|

| DSCR Loan | 20-25% |

|

What are the advantages of house hacking?

House-hacking, where you live in one unit while renting the others, cuts your housing costs while building wealth and property management experience. FHA, VA, and conventional loans offer significantly lower down payments for owner-occupants who live in the property for at least a year.

House hacking applies equally to all three property types but unlocks different down payment thresholds.

Down payments vs. PMI tradeoffs

Lower down payments often trigger private mortgage insurance (PMI) that can add hundreds to your monthly payment.

It may seem prudent to increase your down payment to avoid PMI, but that's not always the case. The right choice comes down to your individual goals and whether you value liquidity or lower fixed costs.

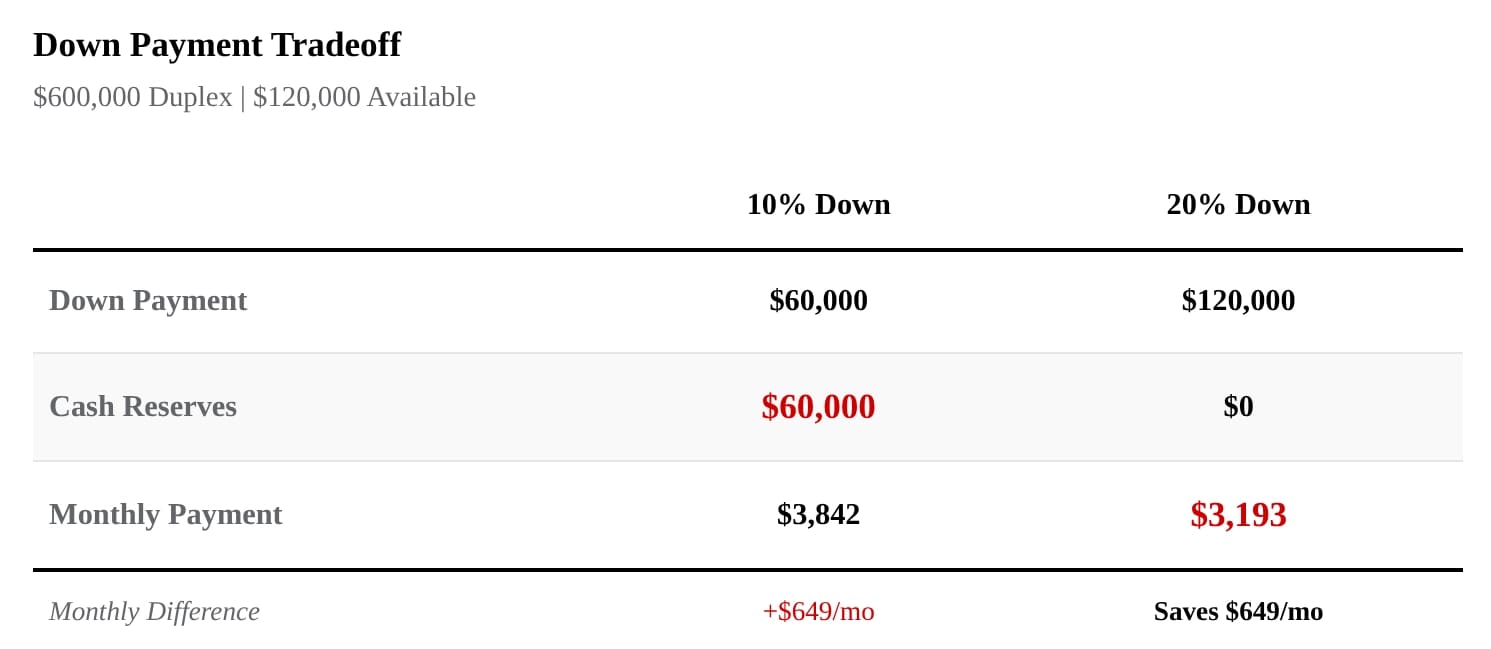

Compare two options for a $600,000 duplex:

- Option 1: You put 10% down. You put down $60,000, pay PMI of roughly $250 per month, and keep the remaining $60,000 in cash for upgrades, emergencies, or other investments. You preserve flexibility but pay more monthly.

- Option 2: You put 20% down. You put down $120,000, eliminate $250 in monthly PMI, and reduce your principal/interest payment by roughly $400, saving approximately $650 per month total.

Keep in mind that PMI drops off once you reach 22% equity through principal paydown or appreciation. That can happen as quickly as three to five years on a rapidly appreciating property.

How Does Property Management Differ Between Duplexes, Triplexes, and Fourplexes?

More units can boost income but add management complexity.

When you're considering a duplex for sale versus a triplex or fourplex, consider the differences in property management requirements. The fundamentals will stay the same regardless of unit count, but complexity will scale.

With just two tenants, you may be able to handle maintenance requests or payment collection personally. With a triplex or fourplex, however, turnover, repairs, and shared systems will require structured systems or property management support.

What are your responsibilities as a landlord of a duplex, triplex, or fourplex?

Tenant screening

Understanding how to screen tenants is crucial. One problem tenant in a fourplex affects 25% of your units, and can create friction with the remaining three. Use background, credit, and rental history checks while adhering to fair housing practices

Maintenance

Maintenance requests scale with unit count: A duplex might require two to three service calls monthly, while a fourplex might need four to six.

Lease enforcement

Enforcing leases becomes more complex with more units. Four tenants mean four renewal dates, four security deposits, and four potential eviction timelines. Digital tools and clear systems help avoid missed deadlines.

Managing tenant conflicts as a landlord

Parking arrangements, shared laundry rooms, and noise issues can all become headaches you'll be required to handle to retain long-term tenants. If avoiding risk is a high priority, consider looking for properties with minimal common areas. The right management setup doesn't just save time, it protects your sanity and keeps your tenants happy.

Learn how to find good tenants and try to head off common issues with clear policies. Define maintenance responsibilities, noise restrictions, and appropriate use of shared spaces in lease documents. When you do get a complaint, don't take sides and document the complaint as well as your response. That paper trail can help protect you legally and track common complaints.

If you plan to owner-occupy, set clear boundaries from day one. Establish clear communication protocols around maintenance requests, contact hours, and what constitutes an emergency. These challenges apply to all property types but intensify in fourplexes with more tenant interactions.

How does management time scale with property size?

If you're considering a triplex or fourplex for sale, you can expect to spend just 50-60% more time on property management, even at double the number of units of a duplex.

Key Insight: Management time increases with unit count, but not linearly. A fourplex might require only 60% more time than a duplex, not the 100% increase you'd expect from doubling units, thanks to single-location efficiencies and shared systems. Note: Hours are estimates and vary based on building age, tenant profile, and whether you use property management software.

Shared systems and single-location efficiencies mean you only need one property inspection, contractors only have to visit one address, and you only need to find one insurance policy. Compare that to owning two duplexes in different locations, where you have to drive to each one for inspections, create multiple schedules for contractors, and deal with two tax bills.

Four units is typically the upper end for self-management. Expect to spend about 8-12% on property management once you start expanding. The same rule applies if you decide to step back from owner-occupancy and treat the property purely as an investment.

How Do You Manage Risk in a Duplex, Triplex, or Fourplex Investment?

Plan for finances, insurance, and reserves that scale with unit count.

Aside from the changes in vacancy risk, repairs on larger properties tend to be more expensive, but those costs are also spread across more income-generating units. Replacing the roof of a duplex might cost $20,000, while the same work might cost $30,000 for a fourplex. But the per-unit cost for the duplex in this scenario comes out to $10,000, compared to $7,500 for the fourplex.

Calculate your break-even occupancy rate before purchasing. A fourplex with high expenses might need 85% occupancy to cover debt service while a well-located duplex breaks even at 70% occupancy.

Insurance and coverage requirements

Insurance costs typically increase with unit count, but it might not be a linear increase. Duplexes are typically insured as residential properties, and come with lower premiums. Triplexes and fourplexes come with expanded coverage requirements, including liability and loss-of-income protection.Requirements will vary by market, so underwrite using live quotes.

Loss-of-income coverage may not be required for duplexes, but it's worth pricing out regardless of unit size. A duplex losing two tenants during a post-claim rebuild loses 100% of its rental income, compared to 50% for a fourplex. Price coverage according to your vacancy risk tolerance.

Reserve requirements

Plan to set aside three to six months of operating expenses for duplexes, and at least six months for triplexes and fourplexes. If you plan to buy a building that was built more than 20 years ago, increase that to closer to 12 months of operating expenses.

Larger buildings spread your risk across more tenants, but also have more shared infrastructure and points of failure. More units mean more water heaters, more appliances, and more mechanicals that eventually fail. Without enough reserves to cover expenses, you risk losing your investment and the wealth you've built up.

What should you watch for in due diligence on a duplex, triplex, and fourplex?

Duplex sellers may be less sophisticated owners who didn't keep detailed financials. This creates headaches during due diligence but often means value-add opportunities through rent optimization or management improvements.

Triplexes and fourplexes are more likely to be held by investors who understand income valuation. Rent for these assets may already reflect stabilized performance, but you're also more likely to get up-to-date documentation.

If you're considering a fourplex or triplex for sale, pay extra attention to potential red flags. Look for upcoming major repairs, problem tenants, or other drags on property value. Verify legal unit counts as well. Unpermitted units create liability that you'll have to handle as the new owner, which can mean fines, unit removal, or costly permitting application.

During the inspection process, hire contractors with multifamily experience to inspect larger properties. Generalists can miss shared-systems issues.

Multifamily For Sale

Frequently Asked Questions

How does vacancy risk differ between duplex, triplex, and fourplex investments?

Vacancy risk decreases as you add more units, creating a significant financial safety net. With a duplex, one vacant unit means losing 50% of your rental income. In a triplex, a single vacancy reduces income by only 33%, and in a fourplex, you lose just 25% of your rental income.

This risk diversification is one of the primary advantages of larger multi-unit properties, providing more stable cash flow during tenant transitions. However, remember that while fourplexes offer the best vacancy protection, they also come with higher purchase prices, more complex management requirements, and potentially more stringent building codes.

What financing options are available for multi-unit properties, and how do down payment requirements differ?

Multi-unit properties with 2-4 units qualify for residential financing, offering several options:

- Conventional loans typically require 15-25% down for investment properties, but only 3-5% for owner-occupied scenarios.

- FHA loans require just 3.5% down for owner-occupants, making them excellent for house hacking, though they include mortgage insurance.

- VA loans offer 0% down options for eligible veterans.

- NACA loans provide 0% down with no closing costs for qualified buyers.

For investment-only purchases, DSCR loans qualify based on the property's income rather than your personal income. Remember that properties with five or more units are classified as commercial real estate with different financing terms. Always compare multiple lenders, as down payment requirements and interest rates can vary significantly.

Is it better to start with a duplex or go straight to a fourplex for my first investment?

While fourplexes offer higher income potential and better vacancy protection, duplexes are often easier to find, frequently owned by less experienced sellers who may underprice rents, and simpler to manage with only two tenants. Duplex investing also requires less initial capital and allows you to gain valuable landlord experience before scaling up.

That said, if you have property management experience, sufficient capital, and find a well-priced fourplex in a good location, the economies of scale might make it worthwhile to start larger. Consider your time availability, risk tolerance, and management capabilities when making this decision.

Should I be suspicious of a cash-flowing multi-unit property that's for sale?

A cash-flowing property being sold isn't automatically suspicious, but warrants thorough due diligence. Legitimate reasons sellers dispose of profitable properties include: retirement, relocation, portfolio rebalancing, capital needs for other investments, divorce/estate matters, or management fatigue. However, be vigilant for potential issues by:

- Verifying all income and expense claims with documentation

- Conducting professional inspections for hidden maintenance problems

- Interviewing current tenants independently about property conditions

- Confirming all units are legally permitted

- Checking for upcoming major expenses like roof replacement

- Reviewing utility bills directly

- Researching neighborhood trends that might impact future value. Properties where tenants report zero issues deserve extra scrutiny. Every property has some maintenance history.