How to Buy a Duplex: Comprehensive Insights for Successful Investment

Key Takeaways

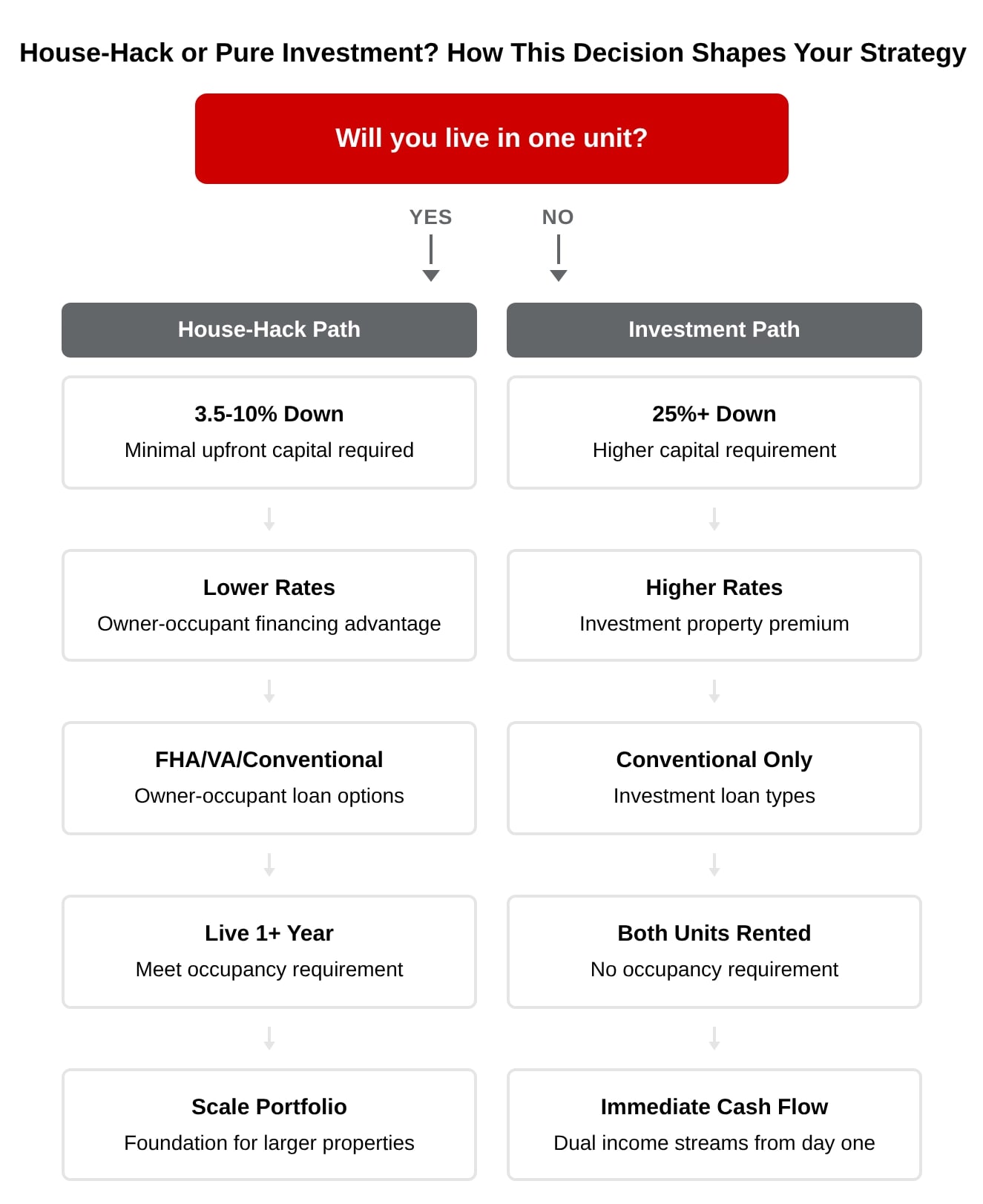

- Decide whether to house-hack first. Owner-occupancy affects financing structure and return profile.

- Duplexes provide income diversification that single-family homes can't: With two units you maintain 50% of your rental income during tenant turnover.

- Use the 1% rule for quick analysis. Monthly rent should equal at least 1% of the purchase price.

- Learn about fair housing laws, state-specific lease requirements, habitability standards, and potential rental licensing before you buy.

Buying a duplex provides a proven entry point into real estate investing, allowing you to build wealth while reducing or eliminating your housing costs. A two-unit property lets you learn landlording and property management at a scale where mistakes are more manageable, giving you the foundation to scale into larger commercial investments.

With the right steps, you can find the right duplex for sale to help you achieve your financial goals.

What Is a Duplex?

A duplex is a type of multifamily home with two units on one parcel under one deed. Each unit has its own entrance, living space, bathroom, and kitchen.

Why Buy a Duplex?

Duplexes offer a relatively low-cost entry point into real estate investing. You can live in one unit and rent out the other, a process known as house-hacking. Many investors use this as a stepping stone to building their real estate portfolios. You build equity, reduce (or eliminate) your housing cost, and learn the basics of being a landlord.

Understanding the investment benefits of duplex ownership helps you evaluate properties and structure offers during the buying process.

Tax benefits of owning a duplex

As a duplex owner, you can deduct mortgage interest, property taxes, insurance, repairs, and maintenance costs from your taxes. If you plan to occupy one unit, keep in mind that you can only deduct the costs from the unit you rent out.

If you rent out both units, you can also depreciate the value of the building over 27.5 years, which reduces your overall taxable income while your property appreciates.

Duplexes vs. single-family homes

Buying and renting out a single family home gives you a single source of rental income. A duplex gives you two. That makes all the difference during tenant turnover periods.

With a single-family home, once a tenant moves out you lose all your rental income until you can find a new tenant. That process can often take weeks, if not longer. With a duplex, you retain 50% of your rental income even when one tenant leaves.

Single-family homes will typically appreciate faster than duplexes, thanks to a larger buyer pool. As an investment, however, a duplex gives you double the monthly cash flow and increased efficiency thanks to shared systems.

Pros and cons of owning a duplex

| Consideration | Pros | Cons |

|---|---|---|

| Cash Flow & Financing |

|

|

| Risk & Management |

|

|

| Tax & Long-Term Wealth |

|

|

Step 1: Decide Whether to House-Hack

Your first decision should be whether you plan to house-hack and live in one unit, or keep the duplex as an investment property and rent out both. Don't put this decision off. Your decision shapes everything from the type of loan you pursue to the size of your down payment.

What are the benefits of house-hacking?

The opportunity to house hack is one of the key benefits of duplex investing. Imagine eliminating your largest monthly expense while your tenant builds equity for you. House-hacking turns your housing cost into an investment vehicle, freeing up cash flow most renters will never see.

Lenders view owner-occupied properties as lower risk, so loans come with lower interest rates and down payment requirements. With an FHA owner-occupier loan, for example, you can put as little as 3.5% down if you qualify and plan to live in one unit for at least a year. Eligible veterans can put 0% down with a VA loan if they plan to owner-occupy for a year or more.

Even with a conventional loan, owner-occupied properties can put as little as 5% down, compared to the 20-25% required for an investment property.

Consider your long-term goals

If your long-term goal is to scale into larger real estate properties, look for duplexes that might appreciate slower, but come with better cash-on-cash return. Consider properties in emerging areas or buildings that might need light renovation, and target duplexes where you can make minor improvements to increase equity.

On the other hand, if your goal is to build passive income by house-hacking, you can accept lower immediate cash flow in favor of quality of life improvements and better appreciation. Plan as if you'll live on-site for three to five years or more. That means prioritizing locations that work for your lifestyle and needs and focusing on higher-quality assets with lower maintenance needs.

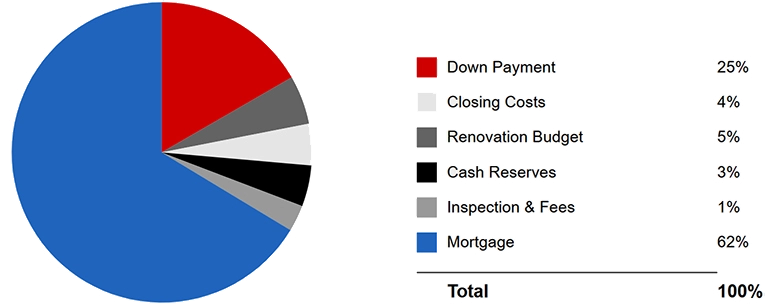

Step 2: Set Your Budget and Select Your Financing

Start by listing all costs you will face when buying a duplex. Include the purchase price, down payment, closing costs, and ongoing expenses such as property taxes and insurance. Use local market data to set clear numbers.

Understand key financial metrics

Loan-to-value ratio (LTV), debt-to-income ratio (DTI), and debt service coverage ratio (DSCR) are all key metrics to understand as part of the financing process.

LTV shows the percentage of a property's value being financed. It's part of how a lender determines your down payment. Calculate it by dividing the loan amount by the property value, then multiplying by 100. Lower LTV typically means you'll get a better interest rate from a lender, as it signals lower risk.

DTI helps lenders see how comfortably you can manage your monthly payments. Lenders divide your total monthly debt payments by your gross monthly income.

DSCR won't typically be required by a lender for a duplex purchase, but it's a useful sanity check as you determine whether a duplex is a good investment and may be required for some portfolio loans.

DSCR measures how much a property is expected to earn above its debt requirements. Calculate it by dividing the property's net operating income (NOI) by its debt payments. The resulting number indicates how much the property is expected to earn above its debt requirements. For example, a property with a DSCR of 1.30 is expected to earn 30% more than its debt requirements. Aim for a DSCR of at least 1.20.

Evaluate your financial readiness

Check your credit score. Typically, lenders will require a minimum credit score of 620 for conventional loans. Lenders will also typically require a DTI of 43% or less, although if you have strong credit or reserves some will allow up to 50%.

Save enough for both a down payment and cash reserves. Reserves shouldn't be a secondary consideration. Without the right reserves to cover unexpected expenses, you risk losing all your investment and the wealth you built up to one emergency repair.

Compare loan options

Duplex financing includes conventional, FHA, VA, 203(k) rehabilitation, and portfolio loans. Each option has its own requirements and benefits that suit different financial profiles.

Conventional loans often require higher credit scores and a down payment of at least 25% if you plan to keep the duplex as an investment property and rent out both units.

Financing changes if you plan to owner-occupy. FHA loans require a down payment as low as 3.5% for owner occupiers, and eligible veterans who plan to house hack can put 0% down. If you choose a duplex that needs renovations, consider a 203(k) rehabilitation loan, which lets you bundle your mortgage cost and the cost of renovations into one payment as long as you live in one unit for at least a year.

Compare rates and terms from three to five lenders to find the best option for you and your goals.

| Loan Type | Credit Score Requirement | Down Payment | Key Benefits |

|---|---|---|---|

| Conventional | 620-640+ | At least 25% | Ideal for investors with strong credit and stable income |

| FHA | 500+ (10% if 500-579; 580+ qualifies at 3.5%) | 3.5% to 10% | Attractive for owner occupied purchases with lower down payment |

| 203(k) Rehabilitation | 580+ | 3.5% on total project cost | Combines purchase and renovation costs |

| VA | Varies | 0% for eligible veterans | Best for owner occupied purchases with veteran benefits |

| Portfolio | Flexible | Varies | Custom financing for unique financial profiles |

Get pre-approved for a mortgage

Getting pre-approved shows you are a serious buyer and tells you how much you can borrow. This step narrows your search and strengthens your offer.

Document rental income

Research local rental rates and gather data on similar duplexes. Most lenders will require an appraisal that includes a similar rental income analysis done by an appraiser.

If you plan to use a conventional or FHA loan, you can count 75% of the market rent toward your qualifying income. Keep in mind that this only applies to the units you plan to rent out, and other loan options may not allow it.

Step 3: Hire a Real Estate Agent

An experienced agent simplifies your duplex purchase by offering clear market insights and strong negotiation skills. They guide you through legal details and help you avoid common pitfalls in duplex transactions.

If you do not know an agent, start by asking for referrals from trusted sources, lenders, real estate lawyers, or other professionals you trust. Visit potential agents' websites to learn about their experience, specialties, and approach, and prioritize those with strong local market and multifamily expertise.

Finally, interview multiple agents. Schedule meetings with at least three candidates to compare their skills, track record, marketing strategies, and fees. Evaluating their communication style and local knowledge will help you choose an agent who best fits your needs.

Step 4: Consider Market Analysis & Timing

Begin by evaluating key market indicators such as vacancy rates, price to rent ratios, and absorption rates. These factors help you gauge the income potential and risk of the duplex.

According to data from CoStar, as of March 2025, residential property prices continue to rise at 2.7% year over year, though this represents a slowdown from previous months. For duplex investors, this moderating price growth combined with increasing housing inventory suggests a potential shift toward more favorable buying conditions.

Pay attention to regional variations in price trends. Analyze neighborhood saturation by comparing the number of duplexes to other multifamily properties. This method aligns with the sales comparison approach and can reveal trends.

Step 5: Start Your Duplex Search

Begin your search by exploring online listings and working with an agent experienced in duplex transactions. Use LoopNet, the most trusted commercial real estate marketplace for over 30 years, to access duplex listings nationwide and connect with qualified sellers in your target markets.

Residential Income Homes For Sale

Consider property details and compare features and neighborhood profiles. Location can make a significant difference in market rents and resale value. Both are worth considering early in your search process.

Be sure you understand how to buy a multifamily property, from assessing cash flow potential to location benefits, to ensure you're touring properties that fit your financial goals.

Step 6: Conduct Investment Analysis

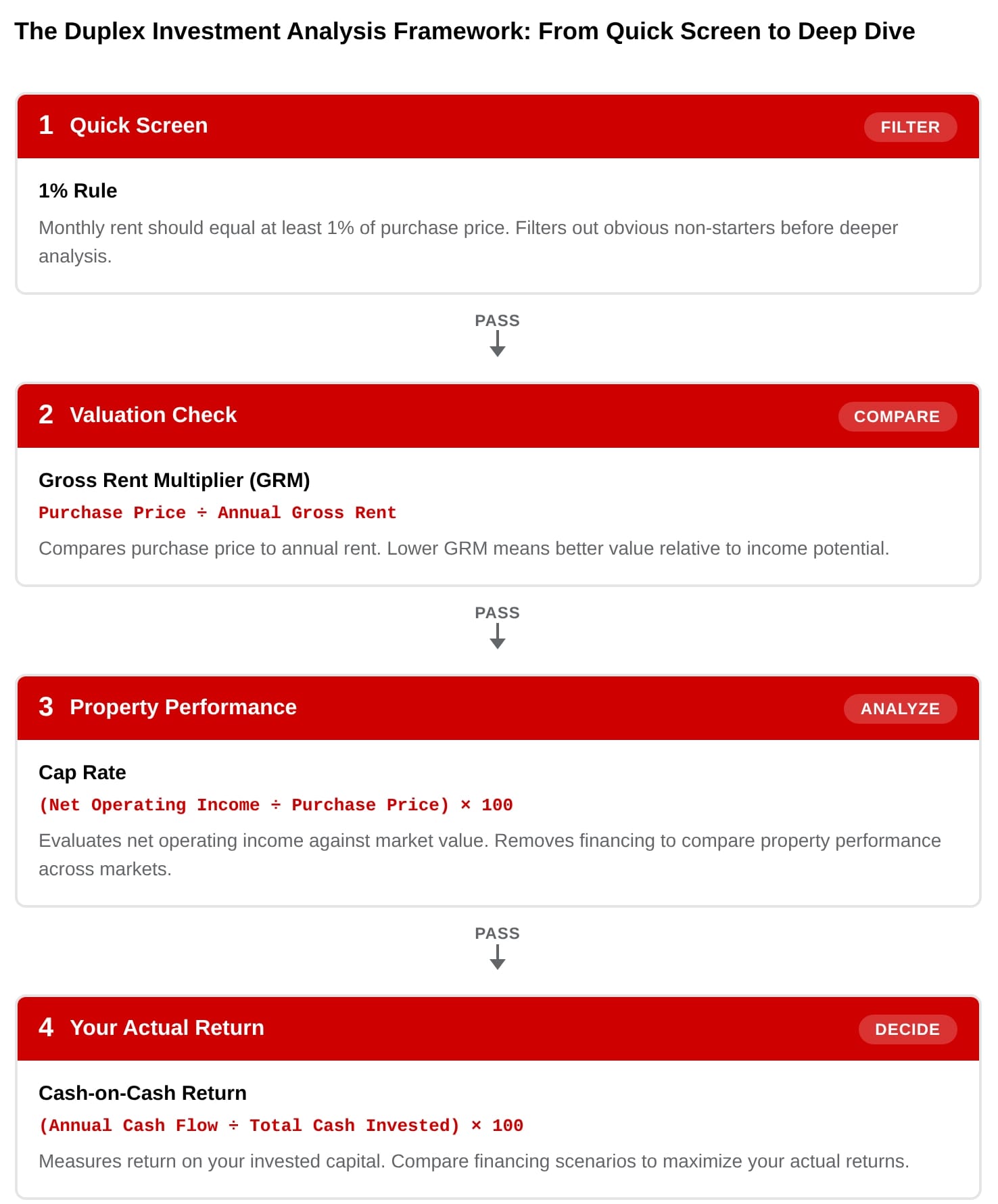

Once you've selected one or more properties you're considering, move on to calculating key investment metrics for your duplex. The difference between a wealth-building duplex and a money pit comes down to the analysis you do before you sign. Skip these calculations and you're gambling with your down payment.

Use the 1% rule for your duplex investment

To start, use the 1% rule for a quick analysis and starting point: The total monthly rent of the property should equal at least 1% of the purchase price. For example, if a duplex costs $500,000, it should generate $5,000 in rental income. The 1% rule is only a guideline, and properties that fail the test can still work if they come with stronger appreciation potential or below-market financing.

Calculate cash-on-cash return

From there, move on to cash-on-cash return to measure your return on the money you invest. Use cash-on-cash to compare financing scenarios. A property with 20% down might return 8% cash-on-cash, while the same property with 3.5% FHA financing might return 18% cash-on-cash due to higher leverage. The trade-off is higher debt and lower margin of safety. Aim for CoC of 8-12% for a stabilized investment in most markets.

FHA financing delivers 2.25 times the return on your cash investment

While conventional financing generates higher annual cash flow, FHA financing delivers superior cash-on-cash returns by requiring significantly less upfront capital. If you used conventional financing and put down $80,000 your cash flow would be $6,400 with an 8% cash-on-cash return. Compare that to an FHA loan with just $14,000 (3.5%) down and your annual cash flow is $2,520 but your CoC return is 18%. Data based on $400,000 duplex with $3,200 total monthly rent.

Find cap rate

Next, use a cap rate calculator to compare properties of different sizes and prices within the same market. Cap rate is the ratio between the property's net operating income (NOI) and its market value. A higher cap rate typically means higher risk or lower-quality markets, while lower cap rates can mean better appreciation potential but lower cash flow.

Find the gross rent multiplier

Finally, compare the property's price to its annual gross rental income to get the gross rent multiplier (GRM). GRM is the ratio of a property's price to its annual gross rental income, and gives you a rough measure of the value of a property. Lower GRM means better value relative to rental income.

Track income and expenses

Create a detailed cash flow analysis that tracks income and expenses for each unit separately while including shared costs like insurance, taxes, and maintenance. Keep in mind that you'll need a landlord insurance policy whether or not you plan to owner-occupy. Coverage and cost will vary depending on whether or not you plan to live in one unit, and factors such as property age can affect your premium. It's best to get multiple quotes to compare coverage and costs.

| Expense | How to Calculate | Where to Get Data |

|---|---|---|

| Property Taxes | Check actual tax bill for the property | County tax assessor website or listing documents |

| Landlord Insurance | Get minimum 3 quotes; compare to homeowners insurance on similar property | Local insurance agents; expect premium over standard homeowners policy |

| HOA Fees | Review HOA documents if applicable | Seller disclosure or HOA directly; not all duplexes have HOA |

| Utilities | Review seller's utility history for past 12 months | Request from seller; ask which utilities transfer to tenant vs. landlord |

| Landscaping & Snow Removal | Get quotes from 2-3 local contractors | Local service providers; seasonal variance matters in northern climates |

| Pest Control | Optional preventive service; get local quotes | Local pest control companies; quarterly vs. as-needed pricing |

| Routine Maintenance | Track actual costs for first year, then budget accordingly | Your own records; includes minor repairs, plumbing calls, appliance fixes |

| Capital Expenditures (CapEx) | Estimate replacement timeline for major systems (roof, HVAC, water heaters, appliances) | Home inspection report + contractor quotes for replacement costs |

| Turnover Costs | Get quotes for cleaning, painting, minor repairs in your market | Local contractors and cleaning services; cost per unit varies by condition |

| Vacancy Loss | Research average days on market for similar rentals in the area | Local rental listings, property managers, or MLS rental data |

One of the most common mistakes for new investors is underestimating capital expenditures and vacancy costs. At some point your water heater will fail or your roof will need repairs, and your tenant will eventually move out. Plan for that early or risk losing the wealth you've built up to surprise costs.

Finally, build a total return projection that compares potential appreciation against cash flow benefits. Adjust your estimates based on local neighborhood differences to see if the duplex meets your investment goals.

Step 7: Make a Formal Offer

Once you find a property that meets your needs, submit a formal offer. Structure the offer to reflect both the duplex's condition and its income potential. Include contingencies for repairs and financing to protect your investment.

Conduct thorough inspections

Arrange for a professional inspector to review both shared systems and unit specific features. Partner with an inspector who has multifamily experience. Generalists can miss features specific to multifamily homes, such as shared systems that can be costly to replace.

Review financials

Request rent rolls for occupied units showing payment history for the past 12-24 months to verify actual rental income against seller claims. Review utility bills, property tax statements, insurance policies, and maintenance receipts to validate operating expenses. Verify current lease terms, security deposit amounts, and any tenant agreements that transfer with the sale.

Step 8: Post Purchase Management & Exit Strategy

After purchasing a duplex, set up effective management systems to handle day to day operations. Track utilities separately, schedule regular maintenance, and maintain clear communication with tenants.

Understanding post-purchase management requirements and exit options before you buy helps you evaluate whether a duplex fits your capacity and investment timeline.

How do you efficiently manage a duplex?

Rely on digital systems for communication, maintenance requests, rent collection, and administrative tasks.

Rent collection and financial tracking

Set clear rent collection policies, including due dates, late fees, and grace periods. Then, use an online property management platform such as Apartments.com to collect rent automatically, track late payments, receive maintenance requests, and store lease documents.

Maintenance request management

Create formal systems for tenants to submit maintenance requests via your property management software, email, or dedicated request forms. This documentation can protect you if disputes arise about response times or repair quality.

Categorize requests by urgency, and address emergency or urgent requests more quickly than routine maintenance. Build a network or reliable contractors during calm periods to ensure you have trusted resources when you need them.

How do you set maintenance and inspection schedules?

Preventative maintenance can safeguard your investment and fix small issues before they become costly.

- Quarterly checks for smoke detectors, filters, gutters, and exterior drains.

- Twice-yearly inspections of plumbing, HVAC, roof, and foundation.

- Annual budgeting for capital reserves to replace big-ticket items including roofs and driveways.

Understand your legal obligations as a landlord

Fair housing laws prohibit discrimination based on race, color, national origin, religion, sex, familial status, or disability in each stage of the rental process, including advertising, tenant screening, lease terms, and maintenance decisions. Use standard screening criteria for all renters.

Your lease also needs to comply with state laws. Each state has its own requirements for factors such as security deposits, notice periods, entry rights, and evictions. Don't rely on generic lease documents without a legal review. They can miss crucial lease elements that leave you open to legal liabilities. Instead, hire a real estate attorney to review or provide a state-specific lease. That one-time cost can save you headache and financial issues down the road.

As a landlord, you must meet minimum habitability standards including working plumbing, heating, electrical systems, and required smoke and carbon monoxide detectors. Some cities require rental licenses or certificates of occupancy. Check with your local building department before advertising the unit.

How do you find and screen tenants for a duplex?

Understanding how to find good tenants and how to screen tenants is crucial to protecting your investment. List vacant units on major platforms with professional photos and key details such as square footage, bedrooms and bathrooms, and amenities. Price rents at or slightly below market rents to attract multiple qualified applicants, then move on to tenant screening.

Start your screening with basics such as income verification, credit checks, employment verification, and rental history. Then move on to more advanced metrics:

- For owner occupants, screen for lifestyle compatibility. Ask about noise tolerance, pets, and parking habits.

- For investment properties, focus on long-term stability to reduce turnover costs and vacancy risks.

Manage tenant relations as an owner-occupier

If you plan to house hack, set clear boundaries with your tenants early. Establish clear communication channels in your lease, including a specific email address or phone number for maintenance requests. Address parking assignments, any shared space use, and guest policies in your lease.

When issues arise, address them immediately through written notice. Never enter the rental unit without proper notice except for genuine emergencies. Your proximity does not override tenant privacy rights. Whenever possible, use written communication to maintain a paper trail.

Duplex exit strategies

Finally, plan your exit strategy early by considering options such as scaling (consider triplexes or fourplexes for sale for similar management and financing), selling to an investor or owner-occupier, or holding for long-term cash flow. In addition, keep an eye on the exit cap rate trends to evaluate potential resale value and overall return. Review multifamily exit strategies to help you adapt to market changes and maximize your investment.

Multifamily For Sale

Frequently Asked Questions

How can I determine the true rental income potential of a duplex before purchasing?

Start by researching 10 to 15 similar duplex rentals in your target area. Request rent rolls and payment histories from sellers to check for consistent income. Consult local property managers for insights on typical vacancy rates and turnover costs. Analyze the income potential for each unit separately and adjust your projections with realistic vacancy estimates.

How do I balance the cash flow advantages of duplexes against their potentially lower appreciation compared to single family homes?

Evaluate your investment goals and timeline. In the short term, steady rental income can cover expenses, while long-term, property value appreciation may be slower than with single family homes. Combining cash flow analysis with market trend reviews helps you determine the right balance for your portfolio.

What are the most effective ways to mitigate the higher tenant turnover rates typically experienced with duplexes?

Focus on thorough tenant screening by checking references and rental histories. Offer lease incentives and flexible terms to encourage long term occupancy. Additionally, maintain the property well and address maintenance requests promptly to keep tenants satisfied and reduce turnover.

How do lenders calculate rental income when qualifying for a duplex mortgage?

For conventional and FHA loans, lenders typically count 75% of the projected rental income when calculating your debt-to-income ratio for mortgage qualification.

For example, if you're buying a duplex with a $2,000 monthly mortgage payment and one unit will rent for $1,300, the lender would count $975 (75% of $1,300) toward your qualifying income. This effectively reduces your debt burden from $2,000 to $1,025 for DTI calculation purposes.

How can I buy a duplex with minimal cash using the house hacking strategy?

House hacking a duplex allows you to purchase with minimal cash by using owner-occupied financing while offsetting costs with rental income. Live in one unit while renting the other, using the rental income to cover most or all of your mortgage payment. After living there for the required minimum of one year, you can move out, rent both units, and potentially repeat the process with another property.

Start by getting pre-approved for an FHA loan, which requires just 3.5% down payment (compared to 20-25% for investment properties).

How do I analyze whether a duplex is a good investment before purchasing?

To analyze a duplex investment, start by calculating all income and expenses to determine cash flow and returns. Research comparable rents in the area for both units. Then, calculate all expenses including mortgage payment, property taxes, insurance, utilities, maintenance (budget 1% of property value annually), capital expenditures (another 1% for future replacements), vacancy (typically 5% of rental income), and property management (8-10% of rent even if self-managing).

Use the 1% rule as a quick screen: monthly rent should be at least 1% of purchase price. Calculate cash-on-cash return by dividing annual cash flow by your initial investment (down payment plus closing costs). Aim for at least 10% cash-on-cash return. Always analyze the property as a pure rental even if you plan to house hack, to ensure it will be profitable after you move out.