How to Sell a Multifamily Property: A Step by Step Guide

Step 1: Consult a Specialized Agent

Imagine turning your multifamily property sale into a smooth and profitable experience. A specialized agent knows the market well and understands the unique steps needed for a successful sale. They can connect you with the right buyers and offer tailored strategies.

A commercial property broker brings expertise that can simplify complex sales. Their guidance helps you navigate challenges and make informed decisions. An expert in selling commercial property uses market insights to boost sale's potential.

Step 2: Pre-Sale Preparation & Tenant Management

How Can You Prepare for a Successful Sale?

Clear communication with tenants is the first step. Let them know about the upcoming sale and set clear expectations early.

Review lease agreements and document current rental terms. This information builds trust with buyers by showing the property's income potential.

Keep an open dialogue with tenants to address any concerns. This minimizes disruptions and keeps the sale process on track.

Learn strategies for finding good tenants to maintain a strong tenant base. Also, review best practices in commercial real estate tenant screening to ensure smooth management during the sale.

Understanding Tenant Rights

Tenant rights are legally protected, and it is crucial to understand these regulations to avoid complications during the sale. In many regions, including California, strong tenant protections can impact lease terms and the overall sales process. Consulting with legal experts ensures that all pre-sale activities comply with local tenant rights laws, protecting both sellers and tenants.

Step 3: Property Value Optimization

How Can You Boost Property Value for a Better Sale?

Start by conducting a property audit to identify key areas for improvement. This audit helps you spot repairs and updates that offer strong returns.

Upgrade with smart home features and energy efficient systems to attract modern buyers. These improvements also support a higher asking price.

Learn more about the advantages of leed certification to further boost your property's value.

Additional strategies can further increase your property value:

- Perform minor cosmetic updates like fresh paint, modern fixtures, and new flooring to refresh interiors.

- Enhance curb appeal with improved landscaping, updated exterior lighting, and regular maintenance.

- Explore adding an accessory dwelling unit (ADU) to generate extra income and attract a broader buyer pool.

These targeted improvements can raise your property's market competitiveness and overall appeal.

Model Unit Renovation

Renovating one unit as a model apartment allows buyers to see the property's full potential. This approach not only highlights upgrade options and design possibilities but also demonstrates the achievable return on investment. A model unit can serve as a tangible example of the property's value, especially for investors considering renovation or redevelopment strategies.

Step 4: Get an Appraisal

How Do You Determine Your Property's True Value?

Hire a professional appraiser to assess your multifamily property's market value. An accurate appraisal sets the right price and builds buyer trust. Keep in mind that appraisal processes will depend on whether you are selling a small or large multifamily property and plan accordingly.

Use a commercial building valuation tool to compare your property against similar sales and market trends. This analysis helps you understand current pricing dynamics.

Professional commercial building appraisals add credibility to your asking price and provide clear insights for negotiations.

Step 5: Documentation

What Essential Paperwork is Needed for a Multifamily Sale?

Collect all documents needed to verify your property's performance and condition. This includes lease agreements, maintenance records, and financial statements.

Compile detailed rent rolls and income statements to show potential buyers the property's earnings history. This documentation builds confidence and transparency.

Thorough multifamily due diligence can make your property stand out in a competitive market.

Step 6: Pricing Strategy

How Do You Set a Competitive Price for Your Property?

Research market comparables and analyze sales of similar types of multifamily real estate. This data helps you set a competitive price that attracts buyers while maximizing your return.

Apply the sales comparison approach to compare your property with similar listings. This method ensures your price reflects current market conditions.

Calculate the cap rate by dividing net operating income by the property's value. This key metric guides buyers on potential returns and can be refined using a cap rate analysis.

Review exit capitalization rates to forecast long term returns for investors. Using insights from exit capitalization rate data supports a realistic pricing strategy.

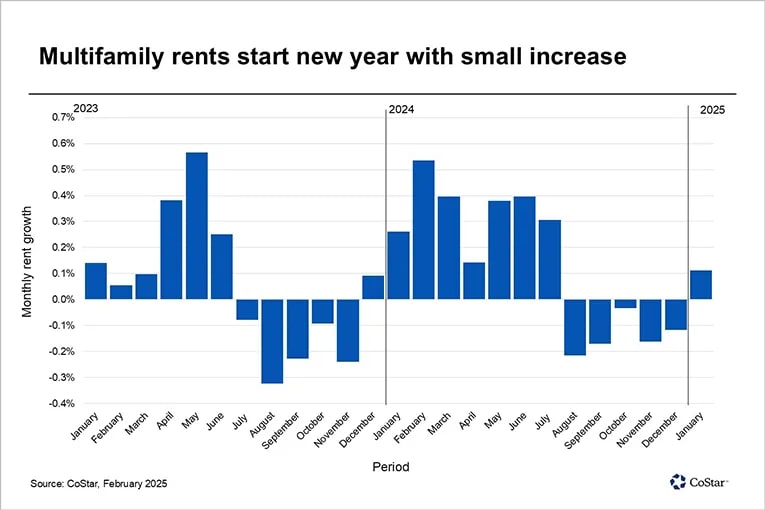

Stay informed on current rent growth trends to accurately position your property. Recent CoStar Analytics data shows multifamily rents experienced seasonal fluctuations, with growth patterns varying throughout the year. For example, in early 2025, rents grew by 1.1% in some markets, following similar patterns from previous years. Understanding these cycles can help you time your sale for maximum value.

Step 7: Marketing & Digital Strategies

How Do You Promote Your Property to Reach the Right Buyers?

Create a marketing plan that highlights your property's key features. Digital tools like professional photos and virtual tours help capture buyer interest.

List your property on LoopNet, the leading commercial real estate marketplace, to connect with serious buyers. This platform is essential for reaching a wide audience.

Utilize immersive digital experiences such as 3D tours and drone footage to showcase the space. These visuals help buyers understand the property's layout and potential.

Consider online commercial property auctions as an alternative selling method.

Explore currently available multifamily properties in your area to understand how similar listings are being marketed and priced:

Multifamily Properties For Sale

Step 8: Open Houses & Negotiation

How Do You Manage Open Houses and Negotiate Effectively?

Open houses allow potential buyers to view your property in person. They offer a chance to answer questions and highlight key features directly.

Create a timeline based checklist that covers all aspects of preparation, from staging to scheduling inspections. This approach keeps the process organized and efficient.

Coordinate with tenants, agents, inspectors, and appraisers to ensure smooth property access and clear communication. A structured process minimizes delays and misunderstandings.

Maintain open dialogue during negotiations to build trust and secure a fair deal. Leverage a solid multifamily exit strategy to guide your discussions and final agreements.

Frequently Asked Questions About Selling Multifamily Properties

How long should I expect the selling process to take from preparation to closing?

The typical timeline ranges from 3 to 6 months. Plan for 1 to 2 months of preparation, about 45 days on the market, and 30 to 45 days for closing. This timeframe can vary based on property condition, local market conditions, and financing type.

Should I renovate units before selling, and if so, which improvements offer the best return?

Focus on strategic improvements that boost your return on investment. Key updates include essential repairs, energy efficient upgrades, minor kitchen and bathroom improvements, and exterior curb appeal enhancements. Major renovations can be left to the new owner.

What financing options should I be prepared to discuss with potential buyers?

Be ready to discuss multiple financing options. This includes conventional residential loans for properties up to four units, VA and FHA loans for owner-occupant buyers (which may require one vacant unit), and commercial portfolio loans for investors. Seller financing may also be an option if applicable. Prepare detailed financial packages that include income statements and expense reports.