Is Coworking Real Estate Profitable? Margins, Costs, & ROI

Key Takeaways

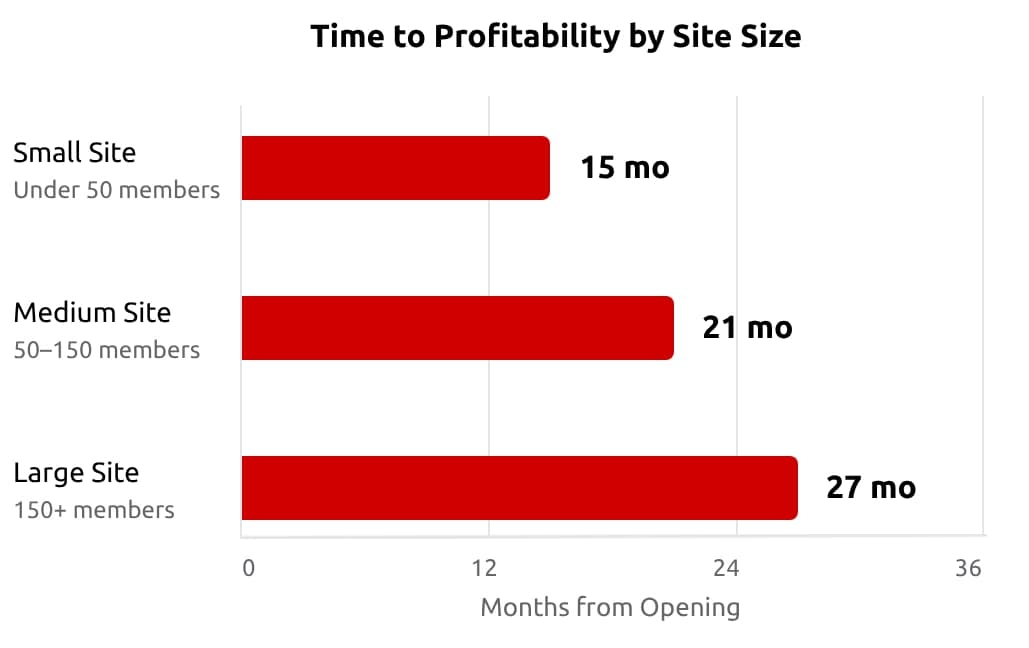

- Coworking real estate can be profitable, but most spaces need about 24 months to stabilize, with smaller footprints reaching break even in 12-18 months and larger sites in 18-36 months.

- Hitting roughly 100 members is the common break-even threshold, and many operators target 70-85% occupancy to cover fixed costs and start generating margin.

- Location drives profitability because submarket pricing and achievable occupancy set your desk rates, payback period, and long-term margins.

- Diversified revenue speeds returns: tiered memberships, meeting and event bookings, virtual office plans, and partner services create steadier cash flow and higher margins.

With the rise of hybrid and remote workforces, coworking space demand is also increasing. For CRE investors, they can be profitable assets, but various factors from location to the types of coworking spaces you operate will have an impact on your success.

How Long Does It Take for a Coworking Space to Become Profitable?

Most well-run coworking spaces take about two years to become profitable, but size determines your final margins.

Smaller spaces typically break even in 12-18 months, while larger spaces may take 18-36 months due to higher upfront costs, but come with better long-term returns.

The difference comes down to size, location, and how quickly you lock in the right mix of memberships.

Coworking memberships drive returns

Fixed costs like rent, utilities, insurance, and staffing stay constant whether you have 40 members or 140. Variable costs, like cleaning supplies or provided coffee, scale more slowly. Since returns scale directly with membership growth, your profit comes from that widening gap between fixed costs and growing revenue.

| Member Count | Typical Operating Margin Range | Considerations |

|---|---|---|

| Up to 50 | Break-even to low single digits | Often owner-operator with limited staff leverage |

| 50-150 | 10-20% | Mix shifts toward private offices and meeting rooms |

| 150+ | 20-30% | Scale efficiency and stronger pricing power |

The profitability threshold of 100 memberships

Profitability tends to kick in once you reach 100 members, and margins typically improve from there. At that point your fixed costs are likely covered, cash flow is steadier, and upgrades are value-adds rather than emergency fixes.

Hitting that critical mass early is essential. The more time you spend with fewer than 100 members, the more potential income you're losing out on. Keep that in mind as you plan for the costs to open a coworking space.

Start by pre-leasing private offices, bundle meeting credits into memberships, and create tiered membership options to appeal to a wide variety of budgets and work styles.

Once your space is up and running, use coworking management software to track which areas generate the most revenue per square foot. Then, reconfigure low-performing areas into more profitable options like private offices or bookable meeting rooms.

Finally, build revenue channels beyond memberships. Consider day passes, paid storage lockers, event hosting, or virtual office services to boost revenue.

Build a dashboard to track profitability

Successful coworking owners track key metrics regularly and adjust strategies based on data.

Start by tracking net operating income (NOI), debt service coverage ratio (DSCR), and cash-on-cash return. Track NOI per private office and NOI per desk monthly, keep DSCR above 1.20 and stress-test with a 10-15% revenue drop to protect cash flow, and target cash-on-cash that climbs quarterly, not just annually. Use digital tools like a DSCR calculator and cash-on-cash return calculator.

In addition to your financial tracking, include other key metrics in your dashboard to get an at-a-glance read on how your coworking space is performing:

- Occupancy by product type

- Effective average rate per desk

- Meeting room utilization

- Monthly churn

- New member pipeline

- Payroll as a percentage of revenue

Add early warnings for the number of accounts at risk of nonpayment and for zones below 40% weekday utilization. If a zone underperforms consistently, convert it to a higher-performing space type, such as offices or phone rooms.

What Locations Make for a Profitable Coworking Space?

Suburban coworking demand is rising, and outpacing urban growth.

Where you choose to open your coworking space has a direct impact on achievable pricing and occupancy. Those both have downstream impacts on margins and payback time.

Coworking has increased significantly in suburban markets thanks to increasing numbers of hybrid workers looking for spaces close to home. Overall flexible market inventory rose 11% year over year in 2025 according to Cushman & Wakefield, and inventory growth was especially strong in secondary markets.

For investors, this means that the downtown space might not immediately be the strongest purchase. Before you decide, review assets for sale in your area then set an eight to 10-mile radius around the major residential clusters you're considering. Then check for existing competitors, average pricing, and daytime population to get a sense of your target market.

Office Spaces For Sale

Price to value varies by region, so underwrite to local comparables

Like demand, prices vary depending on your market. As of Q3 2025, the average price for a monthly membership in the U.S. was $225, but there was significant variation based on market, according to Coworking Cafe. In New York City, for example, a monthly Manhattan coworking membership averaged $339, while smaller markets like Salt Lake City, Columbus, and Jacksonville averaged $150-$200 a month.

Keep your unique market in mind when comparing coworking office buildings for sale. Price variations reflect local economic conditions, cost of living, competition levels, and demand intensity. Review other coworking space for rent to evaluate nearby competitors and find any unmet demands.

Higher-priced coastal suburbs may justify more private offices and team rooms. In value markets, focus on efficient layouts, lean staffing, and strong meeting room use to keep your margins strong even when desk rates are lower.

Use a simple location matrix to compare sites

| Factor | What to Measure | Why it Matters | Target |

|---|---|---|---|

| Transportation | Drive time Transit stop within 0.25 miles Parking ratio |

Improves capture of hybrid workers and client visits | Under 25-minute median commute 3+ stalls per 1,000 SF |

| Amenities | Walk score Food and beverage within 2 blocks Gym/daycare nearby |

Supports pricing power and member retention | 3+ lunch options Daily needs within short walk |

| Competition | Existing operators Product gaps Occupancy signals |

Avoid oversupplied formats Find unmet demand |

No same-format competitor within 1 mile |

| Target Demographics | Household income Self-employed share Nearby SMB count |

Predicts private office vs. hot desk mix | High SMB density Strong five year population trend |

How Do You Operate a Coworking Space for Maximum Profitability?

Treat the floor plan as a living asset and optimize it based on usage data.

Utilization rate drives your profit. The more unused desks you have, the more money you're losing out on as an investor.

Every week, review seat, office, and meeting room usage. If one is consistently outperforming the others, consider converting space to increase that amenity to meet demand.

Use technology to reduce labor costs.

Use management software to automate time-intensive tasks such as onboarding, billing, and access control. By embedding access control apps, you can give your members 24/7 access with minimal staff.

Aim to automate the top five tasks that require staff time:

- Tours

- Contracts

- Invoicing

- Door permissions

- Renewals

Ensure that the solutions you choose integrate seamlessly for your members. For example, access control should sync with your membership database so new members can automatically start using their space.

Use the same management software to track utilization data and identify peak hours, underused amenities, and any relevant member behavior patterns. That data will help you make staffing and space changes when necessary.

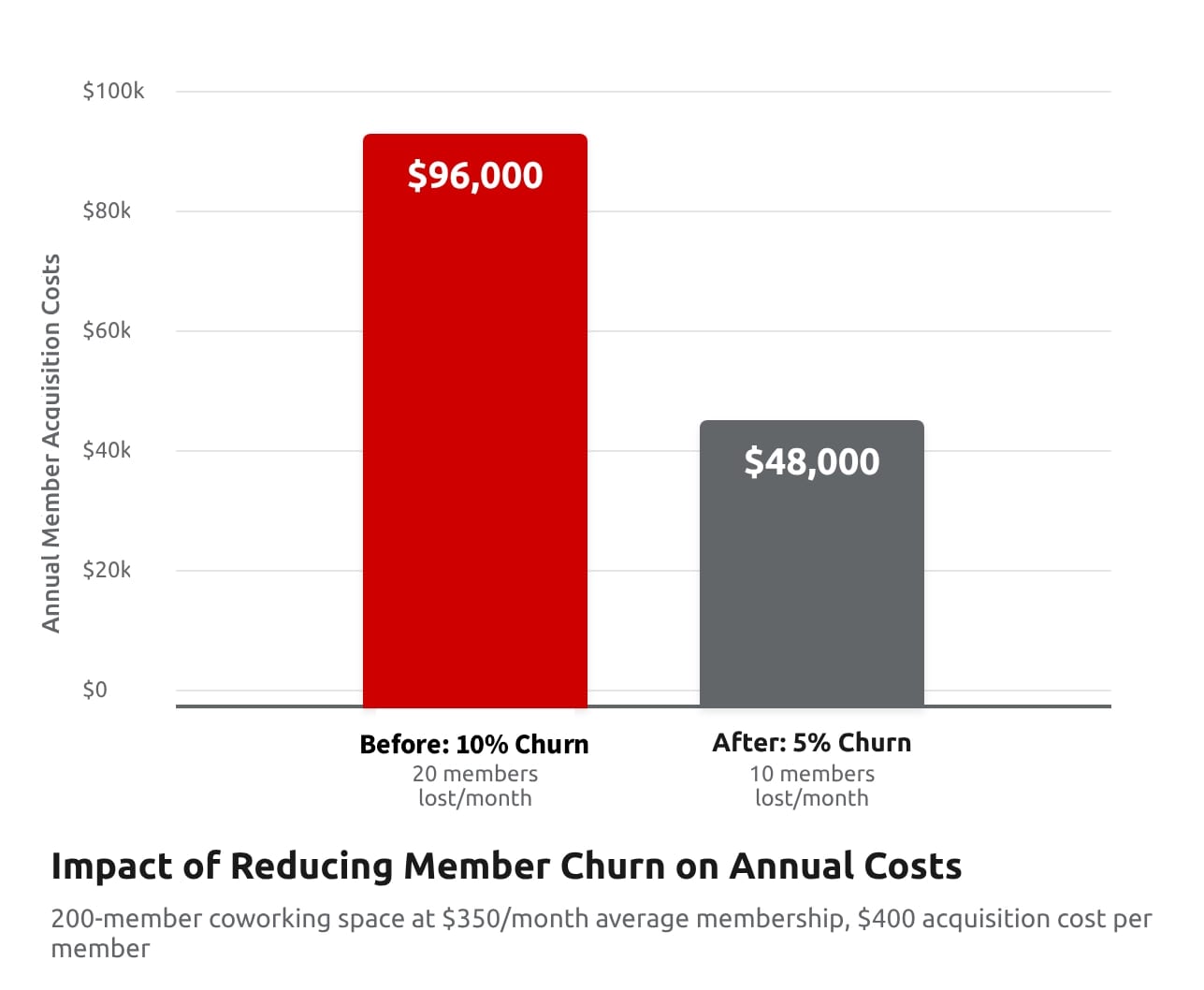

Keep member churn low

The share of customers who cancel each month, known as member churn, kills margin because finding new members takes time and marketing budget. Boosting your retention can seriously improve your bottom line.

For example, say you own a coworking space with 200 members paying $350 a month. If you normally lose 20 members a month (10% churn), and spend $400 on acquisition, you're left paying $8,000 a month in acquisition costs.

If you manage to drop your churn to 10 members a month (5% churn), that number halves. Your fixed costs stay constant, and you ultimately add $48,000 in annual profit.

Start early with thorough onboarding practices, and ensure you cover the key element of coworking agreement with new members.

Members rarely leave without warning signs. Keep an eye out for less frequent visits, declining desk bookings, or increased support requests. Reach out proactively before members cancel and keep them informed about available amenities and events.

Create an operational efficiency matrix

Track whether expenses such as staffing, utilities, and supplies scale with revenue. Check in every month and implement fixes quickly if a metric starts to drift off track.

| Metric | Target | Action If Off Track |

|---|---|---|

| Payroll as % of Revenue | Under 22% after month 6 | Automate tours Batch onboarding Trim low-value tasks |

| Office Occupancy | 90%+ | Resize large offices Add 1-2 phone rooms to unlock demand |

| Meeting Room Utilization | 35% weekdays and 20% evenings | Bundle credits with memberships Add dynamic pricing by time of day |

| Energy Cost per Square Foot | Trend down 5% by month 12 | Install smart thermostats Switch to LED lights Install occupancy sensors |

| Net Revenue per Seat | Rising 2%+ per quarter | Upsell team rooms Add mail, storage, and printing bundles |

How Do You Diversify Revenue in a Coworking Space?

Structure membership tiers to drive natural upgrades.

Membership fees will make up the bulk of your profit, but diversified revenue protects margins when desk demand wobbles, improving your overall profitability. Ancillary services can add significant gains in well-run spaces.

Start by designing your membership ladder to give members a natural upgrade path as their needs grow.

Include day passes, hot desks, dedicated desks, and private offices at increasing membership fees and build upsell opportunities into each tier. Someone who starts with a hot desk might need occasional private meeting space or a private office member may want to add desks for a growing team. Treat these natural inflection points as opportunities.

Give each tier a clear reason to exist. Add one or two high-value privileges per jump, like extra meeting credits, guest passes, or after-hours access. Keep posted prices firm and use time-boxed promos for launches only.

Track which upgrades convert most often and offer them proactively when members' usage suggests they'd benefit.

Use off-hours programming to generate revenue 24/7

Evenings and weekends go unused in most locations. Turn that downtime into profit by hosting evening networking events, weekend workshops, or corporate events. These minor changes can lift NOI and shorten your payback period.

The key is finding programming that fits around your daytime members while still tapping into local demand to generate income.

Build a service ecosystem that meets members' needs

Add options and amenities likely to be in-demand for your members. For example, consider steady revenue sources such as virtual office plans, storage lockers, and secure package pickup. Offer tech support, printing services beyond basic allowances, and food and beverage offerings in partnership with local providers.

How Do You Model Costs and Returns for a Coworking Space?

Separate fixed costs from scalable expenses to forecast margins.

Start by separating fixed and variable costs so you can see your break-even at a glance. Fixed costs won't change much with occupancy. Variable costs scale with membership and usage. Keep track of both and track trends over time to find areas to optimize.

| Cost | Fixed or Variable? |

|---|---|

| Debt Service | Fixed |

| Property Taxes | Fixed |

| Staff Salaries | Fixed |

| Building Insurance | Fixed |

| Property Management Software | Fixed |

| Internet | Fixed |

| Utilities | Variable |

| Cleaning Supplies | Variable |

| Office Supplies | Variable |

| Maintenance & Repairs | Variable |

| Marketing | Semi-Variable |

Anchor returns with three core metrics: yield on cost, real estate rate of return, and IRR.

Yield on cost compares stabilized NOI to total project cost. It shows the return on what you built or bought. Use it to benchmark coworking vs. offices or other potential uses of your space.

Real estate rate of return is a broad measure that can include cash yield and appreciation. It helps you compare coworking assets to alternatives like industrial or triple-net retail spaces for sale to find the right option for your portfolio and goals.

Internal rate of return (IRR) measures the time-adjusted return of an investment. Because IRR considers cash flow over time, you can more easily compare lease structures, debt options, and exit timing without losing accuracy to stalled early cash flow. Model it with an IRR calculator to can see if ramping up your coworking business still comes out positive after debt costs and reserve funding.

Develop three financial scenarios with clear pivot triggers

Many coworking operators target 70-85% occupancy to break even, depending on costs and rates. With this in mind, build a best-case scenario where occupancy is at 85%, an expected case at 70%, and worst-case scenario at 50% occupancy. In each scenario, include occupancy by product (hot desk vs. private office, etc.), average rates, add-on revenue, and monthly cost schedules.

For example, say you were considering opening a coworking space with 200 desks, an average monthly membership cost of $250, and monthly fixed operating costs of $25,000. Your worst, expected, and best-case breakdown would be:

| Metric | Worst Case | Expected Case | Best Case |

|---|---|---|---|

| Occupancy Rate | 50% | 70% | 85% |

| Member Count | 100 members | 140 members | 170 members |

| Monthly Revenue | $25,000 | $35,000 | $42,500 |

| Monthly Costs | $25,000 | $25,000 | $25,000 |

| Monthly Profit | $0 | $10,000 | $17,500 |

| Annual Profit | $0 | $120,000 | $210,000 |

| Profit Margin | 0% | 29% | 41% |

These thresholds will help you answer key questions about risk and whether running a coworking building is right for your portfolio. They'll also give you known benchmarks to make strategic decisions. If you hit month 12 and you're still at only 50% occupancy, the scenario planning tells you you're headed for the worst case scenario. That's your sign to put fixes into place or pivot toward other leasing options.

Schedule capital expenditures around cash flow peaks

Plan major capital expenditures during your strongest cash flow months. Scheduling your capital expenditures around peaks protects your margins and keeps profit targets on track. Set aside 3-5% of monthly revenues for capital reserves to prevent a scramble for cash when emergency fixes crop up.

Build occupancy risk into your operating model

Develop membership incentives, such as referral bonuses, you can activate during downturns and create relationships with nearby corporate clients. Keep about six months of operating reserves to get through slow periods without hurting member experience or driving churn.

Building occupancy risk into your operating model helps you stay resilient, attract long-term members, and keep revenue steady through every market cycle.

Commercial Real Estate Properties For Sale

Frequently Asked Questions

How long will it take for my coworking space investment to become profitable?

Most coworking spaces take approximately two years to achieve sustainable profitability, though your timeline will largely depend on your space's size and location.

Small spaces (under 50 members) typically only break even, while medium spaces (50-150 members) can achieve 10-20% profit margins, and large spaces (150+ members) may reach 20-30% margins.

To accelerate your path to profitability, focus on maximizing space utilization, implementing tiered membership options, developing multiple revenue streams beyond basic memberships, and implementing rigorous cost management practices. Tracking these metrics will help you determine whether you're on pace to be profitable on a reasonable timeline.

Beyond membership fees, what are the most effective additional revenue streams for coworking spaces?

While membership fees are the primary revenue driver, the most profitable spaces develop multiple complementary income streams:

- Meeting room and event space rentals, which can generate significant revenue during evenings and weekends when regular usage is low

- Virtual office services including mail handling, phone answering, and business address services

- Premium service add-ons such as dedicated storage, priority booking rights, or extended hours access

- Food and beverage services either directly operated or through revenue-sharing partnerships

- Technology support services including IT help, equipment rental, and printing/production services

- Educational programming like workshops and training sessions

The key is creating a service ecosystem that addresses your members' complete business needs while maximizing your space utilization around the clock.