Quitclaim Deed Explained: Key Facts and Considerations

Key Takeaways

- Quitclaim deeds provide no title warranties or guarantees.

- Commercial investors use quitclaim deeds for rapid portfolio restructuring, intra-company transfers, and transactions between trusted business partners.

- Strategic applications include asset segmentation into separate LLCs, liability isolation, and streamlined transfers that complement 1031 exchange strategies.

What is a Quitclaim Deed?

A quitclaim deed is a legal document that transfers property interest from one person to another. It does not guarantee a clear title. Instead, the grantor gives up any claim they may hold.

This deed is simple and fast. However, it carries risks because it does not offer title protection for the grantee.

For instance, a grant deed provides more security with warranties. Similarly, using a land trust can offer different ownership benefits.

What is the Purpose of a Quitclaim Deed?

The purpose of a quitclaim deed is to transfer any property interest the grantor holds without offering title guarantees. It passes on what the grantor has, nothing more.

This deed is used when a fast transfer is needed and both parties trust each other. It fits well in family transfers or close business deals.

Many assume that a quitclaim deed offers full protection, but it lacks the warranties found in other deeds. This absence of title guarantees contrasts with the full assurances found in transactions such as owner financed deals, where clear title is essential.

What are the Use Cases?

Quitclaim deeds work best for transfers where the parties know and trust each other. They are common in family transfers, divorce settlements, and estate planning. They also help correct title errors.

In commercial real estate, quitclaim deeds are useful for intra-company transfers and restructuring. They can help move property into an LLC or trust without affecting mortgage obligations. This approach can complement a 1031 exchange strategy by streamlining the asset transfer process.

Investors may use these deeds as part of broader commercial real estate investment strategies to optimize their portfolio structure and protect assets in business transactions.

What is the Process and What are the Legal Requirements?

The quitclaim deed process starts with drafting the document following state rules. It must include a legal property description, the names of both the grantor and grantee, the date of transfer, and the county location.

Next, the document should note any monetary exchange related to the property. Signing and notarization are required to meet legal standards. Some states may also need witness signatures.

After preparing the deed, it is crucial to record it with the county clerk's office. Recording the deed makes the transfer official and protects both parties.

Understanding the proper process is as important as knowing how to buy commercial property, how to buy land, or sell commercial property when dealing with different types of real estate transactions.

What are the Risks & Limitations?

A quitclaim deed does not guarantee clear title, which poses risks for investors. Without title warranties, any existing issues or claims transfer along with the property.

Investors must investigate for any hidden encumbrances. For example, an unresolved commercial lien can lead to future disputes.

Accurate property assessment is key when using a quitclaim deed. A thorough commercial appraisal and a property valuation calculator can help evaluate the true investment risk.

When Should Commercial Investors Choose Quitclaim Deeds Over Other Options?

Commercial real estate investors typically choose between quitclaim deeds and warranty deeds based on transaction speed and title protection needs. Unlike warranty deeds that guarantee clear title, quitclaim deeds offer no title warranties but enable rapid transfers.

Quitclaim deeds excel in commercial scenarios where speed trumps protection: portfolio restructuring, intra-company transfers, and transactions between trusted business partners. When investors need maximum title protection for arm's-length transactions, special warranty deeds are often preferred in commercial deals.

The choice often parallels other commercial real estate strategies where speed matters, such as leaseback transactions. When investors prioritize security and control, they might combine quitclaim deed transfers with protective structures like triple net leases or single tenant triple net lease arrangements.

How are Quitclaim Deeds Applied in Commercial Real Estate?

Quitclaim deeds are useful tools for restructuring commercial property portfolios. They enable investors to quickly transfer property interests when reorganizing assets, which can help reduce transfer taxes and fees.

Investors often use quitclaim deeds for portfolio segmentation. This method allows for creating separate ownership entities, which can isolate liabilities while maintaining operational control. It also aids in joint venture modifications and partnership adjustments.

These strategies integrate well with broader exit plans and long term management goals. They complement approaches seen in various types of commercial real estate investments.

What are the Risk Mitigation Strategies for Investors?

| Risk Factor | Mitigation Strategy |

|---|---|

| Hidden Title Issues (Liens, encumbrances) |

• Obtain comprehensive title insurance • Conduct thorough title search before acceptance • Verify public records for existing claims |

| Defective Legal Description | • Hire a professional surveyor to verify property boundaries • Use precise legal descriptions from official records • Include parcel numbers and reference points |

| Unknown Prior Claims | • Create escrow arrangements for potential claims • Include indemnification clauses in separate agreements • Consider quiet title action for seriously clouded titles |

| Transfer Tax Assessment | • Consult with tax professional before transaction • Research state-specific exemptions for certain transfers • Time transfers strategically to minimize tax implications |

| Improper Execution | • Use attorney review for document preparation • Follow state-specific notarization requirements • Verify all required signatures and witnesses |

Investors can reduce risks by using title insurance when acquiring properties through quitclaim deeds. Title insurance protects against hidden title issues that may arise later.

A careful due diligence process is key. Investors should complete thorough title searches and verify that the deed meets all local legal standards. This approach helps avoid future disputes.

Additional risk strategies include evaluating specific property challenges. For instance, understanding a reciprocal easement agreement or assessing potential issues with a zone variance can add further protection.

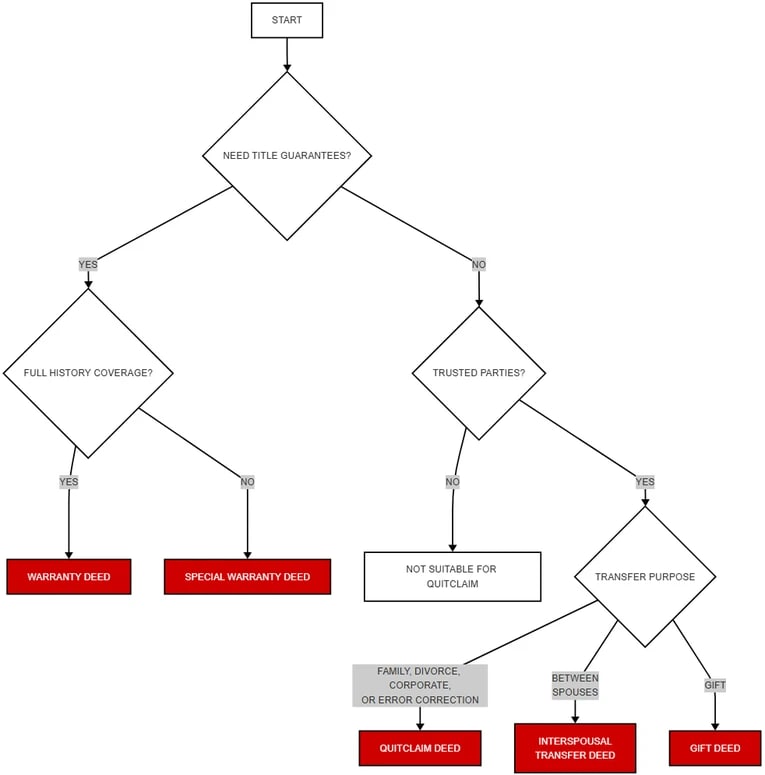

Decision Matrix for Choosing the Right Deed

Choosing the right deed depends on many factors. Investors need to consider the transaction purpose, the relationship between parties, and the property title history.

A decision matrix helps evaluate risk tolerance, budget, and timing. For instance, when investing in multifamily properties, knowing how to buy a multifamily property can guide deed selection.

Other important measures include the internal rate of return and DSCR. These metrics help balance cost, risk, and potential return.

Frequently Asked Questions

How can I strategically use quitclaim deeds to optimize my real estate investment portfolio structure?

Quitclaim deeds can help investors restructure their portfolios by transferring property interests quickly. They allow the segmentation of assets into separate LLCs or trusts, which isolates liabilities. This method streamlines asset transfers and supports portfolio rebalancing.

What hidden tax implications should investors be aware of when using quitclaim deeds for transfers to business entities?

Using quitclaim deeds may trigger tax consequences. For instance, transfers to multi-member LLCs or partnerships can lead to gain recognition if debt allocation changes. Additionally, such transfers might prompt property tax reassessments or gift tax implications.

When might accepting a property via quitclaim deed represent a strategic investment opportunity despite the inherent risks?

Accepting a property through a quitclaim deed can be a smart move in distressed seller situations. With proper due diligence, known title defects can be managed, allowing investors to acquire properties at a discount and later remedy title issues.

What combination of title insurance and legal protections should investors implement when acquiring properties through quitclaim deeds?

Investors should consider extended title insurance that offers broader coverage. Supplementing this with legal protections, such as additional warranties or escrow arrangements, can further mitigate risks associated with hidden title issues.