Right of First Offer (ROFO): How It Works in Commercial Real Estate

Key Takeaways

- The right of first offer (ROFO) gives a named party the first chance to buy or lease before open marketing.

- ROFO differs from Right of First Refusal (ROFR). ROFO happens before the market and is more seller friendly, while ROFR lets the holder match a signed third-party deal and is more buyer protective.

- Price protections matter: many ROFOs bar the seller from taking third-party offers within 3-5% of the rejected bid, and "no worse than" terms compare financing, contingencies, deposits, and timing.

What Is The Right of First Offer (ROFO)?

A right of first offer is a contractual agreement that gives a specific party the first opportunity to purchase or lease an asset before the owner can market it to anyone else.

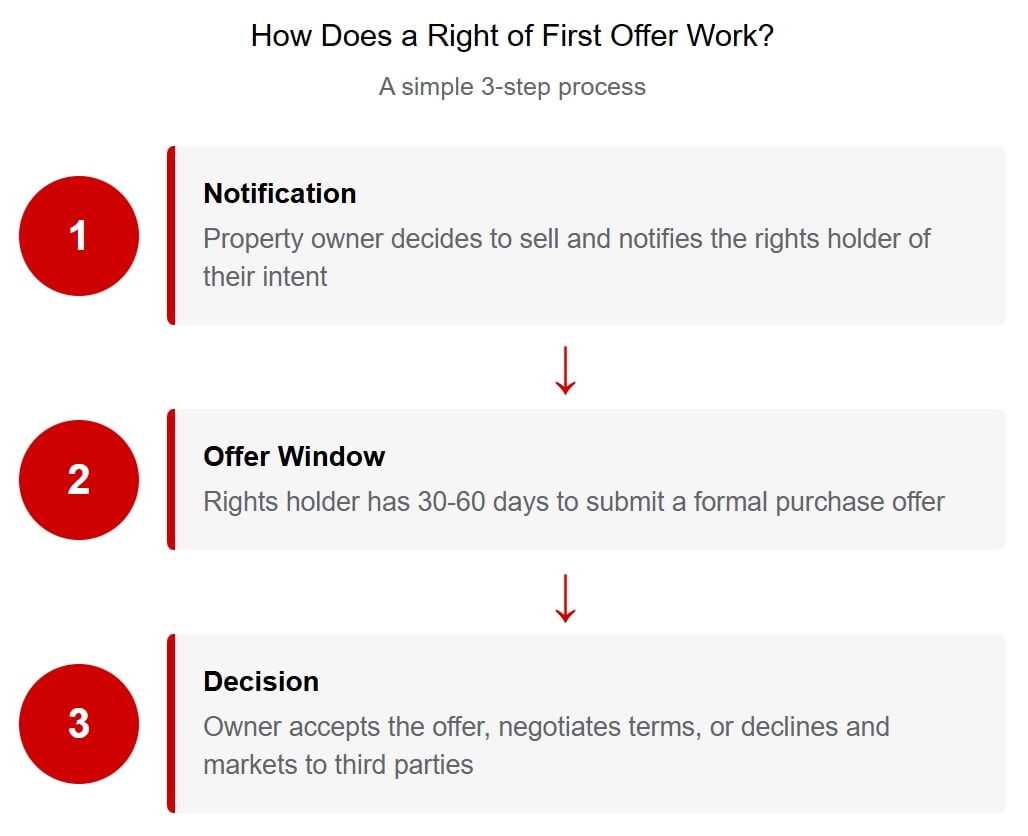

The owner must notify the rights holder when they decide to sell, and that holder gets a set window (typically 30 to 60 days) to submit an offer. If the owner rejects the offer or the parties can't agree on terms, the owner is free to market the property to third parties, usually with some pricing restrictions.

How does ROFO work in commercial real estate?

In commercial real estate, ROFO clauses most commonly appear in purchase scenarios where landlords grant tenants the right to buy the property they occupy if the landlord decides to sell. They also apply to lease expansions, where a tenant gets first rights to adjacent space before it's marketed to other tenants.

For tenants, this means you can potentially acquire the building you occupy without competing in a bidding war. For landlords, it offers a faster exit path with lower transaction costs if the rights holder steps up.

What Are the Pros and Cons of ROFO?

Pros and cons vary for rights holders and property owners.

| Perspective | Pros | Cons |

|---|---|---|

| Rights holder | First opportunity to purchase before facing competition No upfront payment required (unlike purchase options) Protects against forced relocation if landlord sells Avoids bidding wars and price escalation |

Must make offer without seeing market pricing Risk of offering too low and losing the opportunity No guarantee seller will accept your offer Rights typically don't survive property foreclosure |

| Property owner | Potential for faster sale with lower marketing costs Not obligated to accept rights holder's offer Can strengthen tenant retention and justify higher rents Maintains some flexibility to pursue better offers |

30-60 day delay before marketing to other buyers Price constraints after rejecting offer (typically 3-5% minimum increase) May deter some third-party buyers who prefer clean title Lenders may require ROFO subordination for financing |

What Is ROFO vs. ROFR?

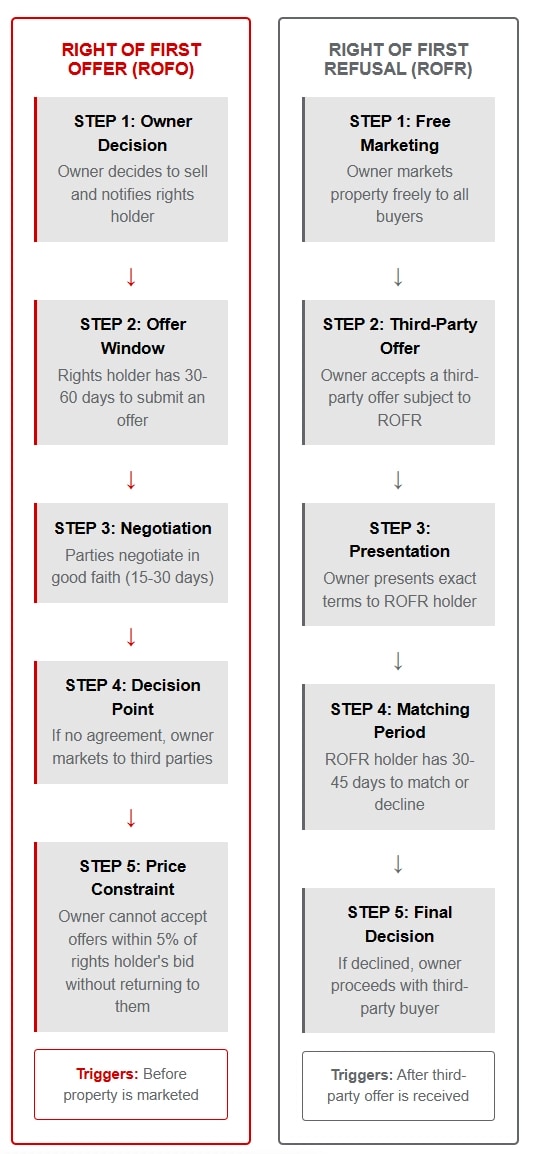

ROFO happens before you market a deal, while ROFR happens once you've received an offer.

Unlike ROFO, right of first refusal (ROFR), is a contractual clause that gives a party the right to match any third-party offer before an owner can complete a sale. The key difference is timing. ROFO happens before any marketing begins. ROFR happens after a deal is already on the table.

ROFR clauses can narrow your buyer pool and depress final offer prices. Experienced investors try to avoid situations where they commit to due diligence only to be overtaken by a matching offer.

ROFO generally favors sellers

ROFO preserves flexibility for the seller, letting you market faster if negotiations fail. Once you've given the rights holder their chance to make an offer and it falls through, you're free to pursue other buyers. You're not stuck waiting for someone to match a third-party offer before closing.

That can impact deal momentum. With ROFO, there's less uncertainty for a third-party buyer, which typically means you'll see offers faster from a wider buyer pool.

ROFO also lets you test whether a tenant or partner is serious without committing to a price. If they submit a lowball offer, you can reject it, then market the property as usual and potentially secure better terms.

ROFR offers stronger buyer protection

For rights holders, ROFR offers certainty. You see what a legitimate buyer is willing to pay and decide if that price works for your strategy. Some agreements use a hybrid approach called Right of First Negotiation (ROFN), which adds a 30-90 day exclusive negotiation window after ROFO rejection but before open market listing

This is particularly valuable in a volatile market or with assets where a price is hard to pin down. With ROFR, you know exactly what you need to match. Contrast that with ROFO, where you might offer $2.5 million, have your offer refused, then see the asset sell for $2.7 million and wonder if you should have bid higher.

The tradeoff is complexity. ROFR agreements can drag out closing timelines because the rights holder typically gets 30-45 days to respond, which can frustrate sellers looking for a fast close. ROFR can also kill deals as third-party buyers find other opportunities while waiting for the rights holder to decline an offer.

How ROFO and ROFR work in practice

ROFO Process

- Owner decides to sell and notifies rights holder

- Rights holder has 30 to 60 days to submit an offer

- Parties negotiate in good faith (typically 15 to 30 additional days)

- If no agreement, owner markets to third parties

- Owner usually cannot accept offers within 5% of rights holder's bid without returning to them

ROFR Process

- Owner markets property freely

- Owner accepts a third-party offer subject to ROFR

- Owner presents terms to ROFR holder

- ROFR holder has 30 to 45 days to match or decline

- If declined, owner proceeds with third party

What Are the Key Parts of a ROFO Agreement?

Each ROFO offer consists of four core elements.

A right of first offer must define:

- The trigger event that activates the right

- The notification procedure

- The information the seller must disclose

- The good-faith negotiation duties both parties must follow

The trigger event is typically the owner's decision to sell, but watch for carve-outs. Some agreements may exempt certain transfers like foreclosures, transfers to family members, or sales of controlling interests in an entity that owns the property.

Notification requirements must be specific regarding how the owner must notify the rights holder, and strong agreements will require information from documents any reasonable buyer would need to evaluate the property. That typically includes financial statements, rent rolls, and environmental reports.

Good-faith negotiation prevents gaming the system

Good-faith negotiation duties prevent sellers from using ROFO holders as a price discovery tool. These clauses typically require both parties to negotiate honestly and, in some cases, exclusively.

If there is an exclusivity provision, it will typically last for the duration of the ROFO window to protect the buyer from competing against unknown third-party bids the seller might be cultivating.

How Should You Structure ROFO Timeframes?

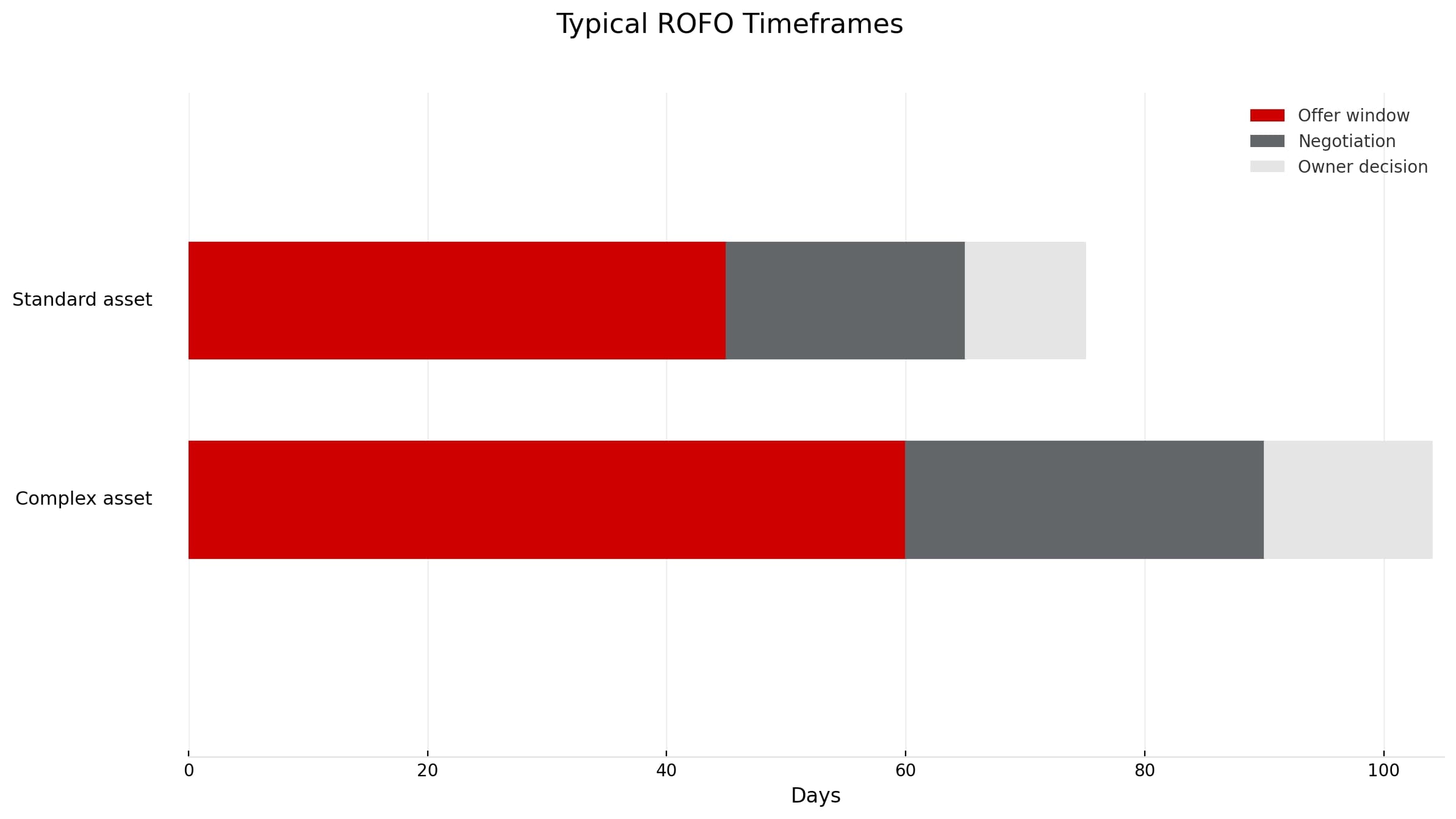

ROFO agreements need an offer window, a negotiation period, and a decision deadline.

The offer window typically lasts 30-60 days, depending on property complexity, and gives the rights holder time to evaluate the property and submit a written offer. A small retail building might only need 30 days, while a multi-tenant office building with environmental concerns might need 60 days or even longer.

The negotiation period starts once the rights holder submits an offer. This stage typically lasts 15-30 days, during which both parties work toward mutually acceptable terms. Then, once negotiations conclude, the seller has a firm timeline (usually seven to 14 days) to accept or reject the final terms.

What Terms Protect ROFO Rights Holders?

Price and material terms constraints prevent sellers from gaming the system

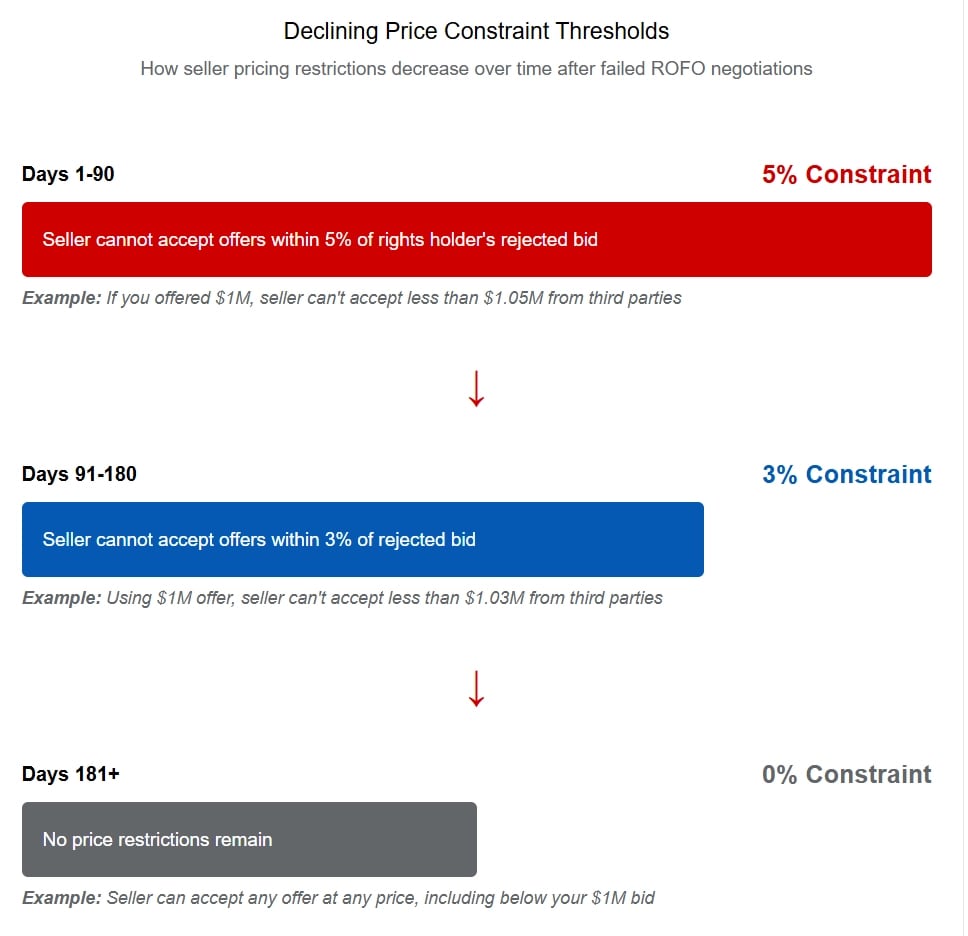

As a rights holder, price constraint terms prevent sellers from using your bid as a floor for third-party negotiations. Typically, these terms prevent sellers from accepting offers within 3-5% of a rights holder's bid without returning to them first. As a ROFO rights holder, review commercial property valuation methods and pressure test your bid before negotiating by reviewing nearby listings to get a sense of what's reasonable for your market and asset type.

Commercial Real Estate Properties For Sale

But keep in mind that price isn't the only part of a deal. Sellers care about total deal quality, including financing, structure, contingencies, and closing timeline. This is where a "no worse than" clause comes in. With this clause, a seller must consider all material items, not just price.

For example, say you were a tenant with ROFO rights, and offered $2 million with 20% down and seller financing on the balance. In most cases, the seller could reject that deal and accept a third-party offer for $2.1 million all cash with no contingencies and a 30-day close.

Even though that offer is within the 5% price constraint, the overall deal is more materially favorable to the seller. With a "no worse than" clause, however, the seller would have to go back to you before accepting the offer. Define "material terms" broadly: price, financing structure, deposit amount, contingency periods, and closing timeline.

Reset provisions address failed third-party sales.

In most cases, your offer as a ROFO rights holder expires once the seller rejects it. However, a well-structured reactivation clause gives both the rights holder and seller a clean path forward if they reject a rights holder's offer, then can't find a buyer.

If the seller returns to market within a defined window (typically 180 days) after failed negotiations, they must re-trigger the ROFO with fresh notice. The rights holder has a new offer window, but isn't bound by their previous bid.

One advanced approach uses declining thresholds. In the first 90 days after rejecting your offer, the seller can't accept bids within 5% of your price, which then drops to 3% from days 91 to 180. After 180 days, no restriction applies. This balances rights holder protection with seller flexibility as market conditions shift.

How Does Documentation Affect ROFO?

Without adequate documentation, unrecorded rights can vanish with a foreclosure.

In many cases, a foreclosure voids ROFO rights. However, with the right planning it's possible to secure them, but early documentation is critical. Understanding lien priority helps ROFO holders protect their rights from being extinguished in distressed sale scenarios, a key risk management concern when negotiating these clauses.

Secure lender recognition early to protect your ROFO. Pair that with a thorough property title search to confirm lien order and spot issues that could wipe the right at foreclosure. If the mortgage was recorded before your ROFO, the lender can eliminate your rights through foreclosure since senior liens take priority over junior interests.

Start by recording a short Memorandum of ROFO that names the parties and properties. Recording helps bind buyers, lenders, and successors, and puts the rights officer's radar.

Keep in mind that lender recognition isn't guaranteed. Commercial mortgage-backed securities (CMBS) lenders and government-sponsored agencies are less likely to agree than relationship banks, since they follow stricter underwriting guidelines. You can improve your odds when a ROFO is clearly subordinate, goes inactive during a default, and doesn't slow foreclosure.

How Do Tenants and Landlords Use ROFO?

Tenants secure acquisition rights without upfront capital, while landlords balance tenant relations and exit flexibility.

Commercial tenants use ROFO clauses to protect against forced relocation if their landlord decides to sell. Imagine if you'd invested $500,000+ in tenant improvements, built specialized HVAC or kitchen infrastructure, or spent years cultivating neighborhood foot traffic, only to be forced to relocate. Without a ROFO, a surprise sale could force you to abandon those investments and start over.

As a tenant, a ROFO gives you the first shot at buying a property. Negotiate it during the initial lease, and include it as a separate addendum with clear trigger events, notification procedures, and response windows. When it's time to make your offer, review similar properties, whether that's offices for sale, retail buildings for sale, or other commercial assets to ensure your bid is competitive.

For landlords, a ROFO can be a justification for higher rents and help with tenant retention, especially for triple-net lease assets. Long-term tenants who might want to purchase the property later are more likely to invest more in the space and stay longer. As the asset owner, structure the ROFO with reasonable timeframes so deal momentum doesn't stall if your tenant passes, and include carve-outs to preserve flexibility.

Tenants can use a ROFO to expand within a building

In some cases, tenants can negotiate ROFO rights for adjacent suites, entire floors, or other contiguous spaces within their building. This is most common in office and retail leases where expansion is more predictable.

In this case the ROFO works differently than a purchase ROFO. As a tenant with rental ROFO rights, when the space becomes available your landlord must offer it to you before marketing it to other tenants. If you're planning ahead for growth, scan current office space for lease and nearby retail space for lease to gauge rates and layouts before your ROFO window opens.

You typically have five to ten days to accept or pass, so having comparables ready helps you move fast. If you decline, the landlord can then market it to other tenants.

Negotiate the rights during the initial lease signing and specify exactly which spaces the ROFO covers. Also be sure to include language that the ROFO survives if you renew your lease or you risk it expiring with your current contract.

Can You Transfer a ROFO?

A ROFO can be personal to you or tied to the lease. Start with a label:

- A personal ROFO belongs only to the named tenant or buyer. It ends if the rights holder assigns the lease or sells their company unless the contract says otherwise.

- A ROFO tied to the lease follows a permitted successor under the lease. Say that clearly so the right doesn't vanish in a routine deal.

From there, clearly spell out which transfers are allowed. This typically includes affiliates, simple reorganizations, or mergers, where the new company keeps similar net worth and experience. Be sure to include specifics about what occurs if more than 50% of ownership changes.

Require advance written notice, basic legal documentation, and clear response deadlines. Protect financing and title work by stating if the right is personal or tied to the lease so lenders and title know what they're underwriting.

How Do Industry Regulations Affect ROFO?

Gaming, hospitality, and healthcare require special provisions.

If you're investing in regulated properties like gaming facilities or healthcare real estate, these carve-outs can suspend your ROFO rights during distressed sales, so factor them into your risk assessment. A property with a gaming license might exempt sales triggered by license violations, or a healthcare facility might have a carve-out preventing a sale for similar issues.

As a landlord, that carve-out protects if you need to sell the asset quickly under distressed circumstances. As a tenant, keep an eye out for these provisions as they mean your ROFO rights are suspended under these specific circumstances, when a property may be available at a potential discount.

How Do You Prevent Disputes in ROFO Agreements?

Eliminate vague language before signing.

ROFO disputes typically arise from three areas:

- Unclear notification requirements

- Ambiguous timeframes

- Undefined price determination methods

Notification requirements need precision

Notification is the first area where problems can arise, so it's important to define the exact delivery method. For example, will the notification have to come via certified mail to a specific address, email to designated recipients, or hand delivery with signed acknowledgement?

Also be sure the ROFO specifies what the notice must include. Typically it will cover property address, proposed terms, response deadlines, and supporting documents. Avoid vague phrases like "reasonable notice" or "prompt notification" since those can be interpreted differently and lead to confusion.

Timeframes must be explicit

Every deadline must have a clear start date and calculator method. For example, if the ROFO has a 45-day offer window, does that start when notice is sent or received? And do those 45 days include weekends and holidays?

Use clear language, such as "calendar days" or "business days" consistently. If the deadline falls on a holiday, be sure to specify whether the deadline extends to the next day.

Price determination requires objective standards

If the agreement references fair market value, specify the appraisal process. Include who selects the appraiser, required qualifications, the valuation method, and any dispute resolution procedures.

Require written waivers for declined rights

Requiring a ROFO rights holder to decline their rights in writing protects both the property owner and rights holder. The owner gets documentation that they can market the property freely, and the rights holder avoids any disputes where the owner claims they verbally declined.

Frequently Asked Questions

How does a Right of First Offer affect the marketability of my property compared to a Right of First Refusal?

A Right of First Offer (ROFO) generally has less negative impact on property marketability than a Right of First Refusal (ROFR). With ROFO, once you've given the rights holder an opportunity to make an offer and negotiations have concluded without agreement, you're free to market the property to third parties (often with some price constraints). Potential buyers are more willing to engage with ROFO-encumbered properties because they don't face the 'stalking horse' risk of having their offer matched after investing time and resources. ROFR, by contrast, often deters potential buyers who are reluctant to negotiate deals that could ultimately be matched by another party, potentially reducing both interest and offer prices. If maximizing marketability is important, ROFO provides a better balance between granting preferential rights and maintaining market flexibility.

What price constraint mechanisms should I include in my ROFO agreement to protect my interests?

The optimal price constraint mechanism depends on whether you're the seller or rights holder. If you're the rights holder, seek a provision that prevents the seller from accepting third-party offers within a specific percentage (typically 3-5%) of your original bid. For example, if you offer $1 million and the seller declines, they would be restricted from accepting less than $1.05 million from another buyer without returning to you first. If you're the seller, negotiate for flexibility by either: 1) Limiting the constraint period (e.g., 90-180 days after which you can accept any offer); 2) Establishing a declining threshold (e.g., 5% in the first 60 days, 3% for the next 60 days, then no restriction); or 3) Including specific carve-outs for distressed sales or other special circumstances. In either case, clearly define how material changes to terms (not just price) affect the agreement, and consider incorporating objective market value benchmarks to reduce disputes.

How can I structure a ROFO agreement that works with my financing needs as a potential buyer?

To align your ROFO with typical financing requirements, focus on these core provisions:

- Longer response windows (45-60 days) to allow lender review.

- Clear financing contingencies that give you time to secure funding.

- Deposit protections if financing falls through under defined conditions.

- Pre-arranged or contingent funding that can be activated quickly once the ROFO triggers.

- Terms covering major market shifts between signing and activation (such as rate spikes).

- Required seller disclosures so lenders receive all necessary documentation.

Work with a lender early to set pre-approval parameters and consider standby financing that can be deployed quickly when the ROFO is activated.