Small vs. Large Multifamily Real Estate Investing, Explained

Key Takeaways

- Small means two to four units with residential rules. Large starts at five units and comes with commercial financing rules. The five to 20 unit “gray zone” blends traits from both and is often the best bridge for investors transitioning from small to large properties.

- Financing drives strategy. Small properties can offer lower down payments and 30-year terms. Large assets rely on property income, debt coverage, and shorter terms with higher equity.

- Scale changes the math. Bigger buildings spread fixed costs, withstand vacancies better, and can support professional management. Smaller assets trade scale for flexibility, simpler operations, and easier exit options.

As an investor, choosing the right property from among the various types of multifamily real estate can be a daunting task. One of your first steps should be narrowing down the general size of the commercial real estate property you plan to buy. A good place to start is deciding whether to purchase a small multifamily property or a large asset like an apartment complex.

In this article we'll explain the differences in small vs. large multifamily investing in practical terms. We'll cover how to define property sizes and how financing rules change depending on size. Additionally, we'll detail how these factors can influence value, leverage, and risk. It's important to consider both the benefits and challenges of multifamily investing, whether you're considering duplex investing or want to purchase a high-rise apartment building.

How Do You Define Small vs. Large Multifamily Real Estate?

Small means two to four units, while large multifamily properties have five or more units.

The difference matters for financing reasons: Small multifamily properties can use residential financing, while buildings with five or more units require commercial loans.

The Practical Differences Between Small and Large Multifamily Properties

For investors, the difference between a small and large multifamily property comes down to how many units the property has. A small property has two to four units (think a duplex vs. triplex vs. fourplex). A large property has five or more units, like you might find in an apartment building.

While these numbers might seem arbitrary, they have real-world implications for financing. Lenders typically finance two- to four-unit properties with residential loans that rely on comparable sales, much like single-family homes. Large multifamily properties are valued based on income, using net operating income (NOI) and a market capitalization rate.

The “Gray Zone” Between Five and 20 Units

In practice, there's often a gray zone for properties between five and 20 units. These properties will still require commercial underwriting, but are more likely to be run by individual “mom and pop” owners. Operations feel closer to small assets, but financing follows large asset rules.

As an investor, this gray zone can come with additional multifamily due diligence work. However, it can also translate to opportunities for easy wins to increase ROI. These owners are more likely to have incomplete records or rent rolls and less likely to optimize for cost-savings with preventative maintenance and small improvements.

Depending on the market, that can mean a smaller buyer pool, less competition and, as the new owner, potentially easy operational wins. Standardizing rent collection or improving resident experience is linked to lower turnover, for example, and preventative maintenance can mean lower operating costs and higher NOI.

Be sure to plan extra time to verify income, reconcile deposits, and collect missing service contracts. For new or less experienced CRE investors, these opportunities can offer a manageable step up from small properties without the complexity of a large apartment building.

What Size Fits Your Goals?

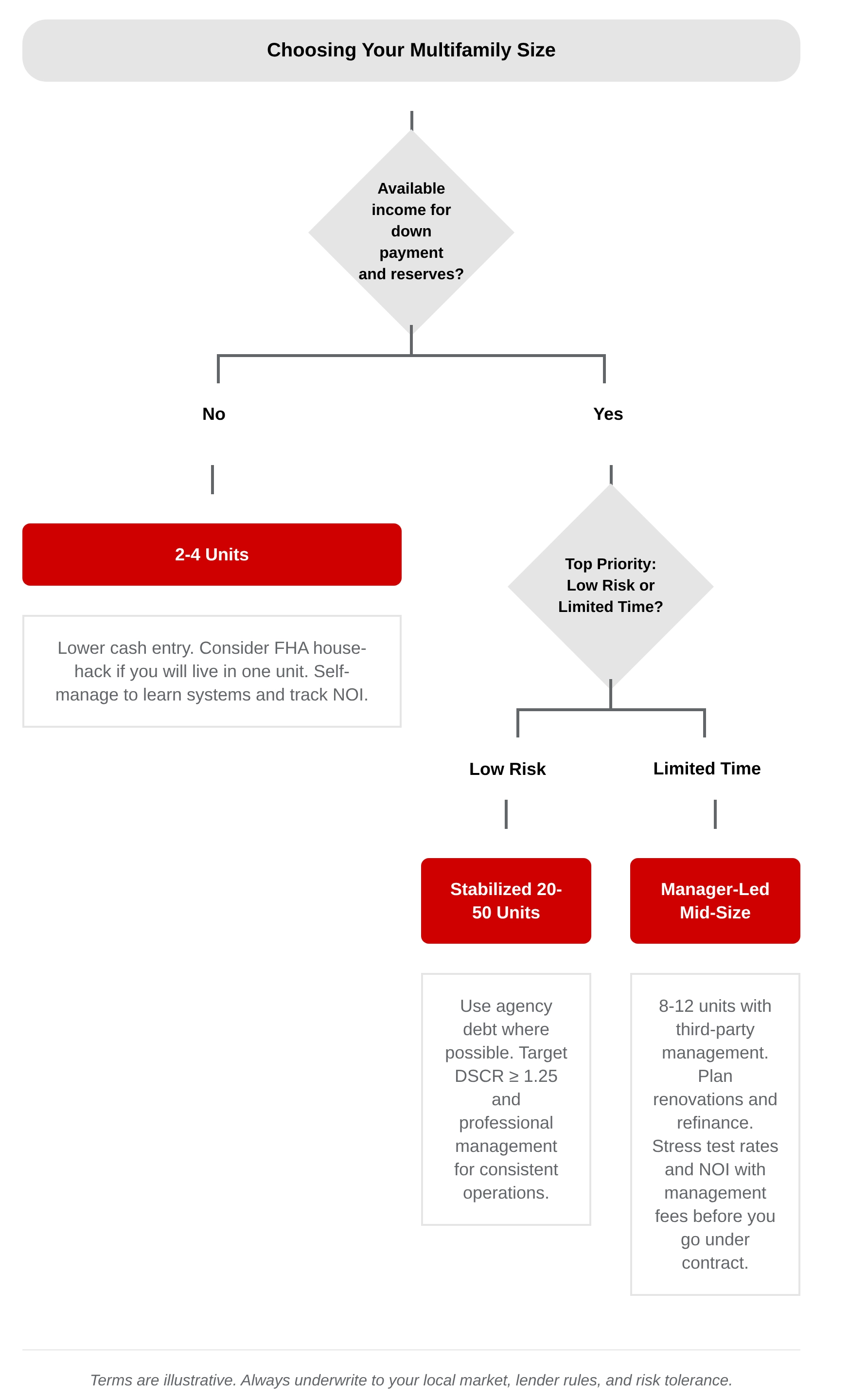

When weighing a smaller multifamily property against a larger apartment complex, consider not only your financial goals but also the capital and time you can commit.

If you're a first-time investor with limited capital, compare multifamily vs. single-family rental roi to determine if multifamily investing fits your goals, then consider buying a duplex, triplex, or fourplex to finance with simpler loans. Use an NOI calculator and track it from day one so you're ready for commercial underwriting when it's time to scale up.

If you have more capital but limited time, look at eight to 12 units that can support a manager. Scan your market for multifamily properties for sale. These buildings can often support third-party management and deliver ROI without full-time oversight.

If your priority is low risk levels and long-term income, look for stable locations and clean historicals. Decide whether you prefer a small, low-touch fourplex you can manage alone, or a larger property with professional management and clear policies.

How Does Financing Differ in Small vs. Large Multifamily Properties?

Small multifamily properties generally use residential loans. That means lower down payments, 30-year fixed terms, and interest rates tied to your personal credit. Large properties use commercial loans, which come with higher down payments and where lenders focus on property strength, debt service coverage ratio (DSCR), and sponsor experience.

This split means small assets are better for entry-level investing and house hacking. Large assets fit business plans that rely on professional management and scale.

Small vs. Large Multifamily Financing

| Financing Feature | Small Multifamily (2 to 4 units) | Large Multifamily (5+ units) |

|---|---|---|

| Loan type | Residential conventional; FHA for owner-occupants | Commercial (bank, agency, life company, CMBS) |

| Underwriting focus | Borrower income and credit; comparable sales | Property income (NOI), DSCR, LTV, sponsor strength |

| Typical down payment | 20%-25% for investors; FHA 3.5% if you live in a unit | 25%-35% equity (LTV often capped 65%-75%) |

| Amortization | 30-year fixed common | 20-30 years |

| Loan term | Up to 30 years, fully amortizing | 5-10 year term; refinance or balloon at maturity |

| DSCR test | Not primary driver; use 1.20-1.30 as an internal check | Required; many lenders target ≥ 1.20-1.30 |

| LTV cap | Often 75%-80% for investor loans | Commonly 65%-75% depending on asset, market, lender |

| Recourse | Usually full recourse to borrower | Bank loans often recourse; agency/life co can be non-recourse with carve-outs |

| Prepayment | Light or none on many loans | Common; step-down, yield maintenance, or defeasance |

| Assumability | Rare | Possible (agency loans) subject to approval and fees |

| Third-party reports | Appraisal; home-style inspection as needed | Appraisal, environmental (Phase I), property condition (PCA), sometimes zoning/survey |

| Owner-occupant option | FHA allows low down payment on 2 to 4 units if you live in one | Not applicable |

Small Multifamily = Residential Terms and Lower Barriers to Entry

Multifamily properties with four or fewer units can often qualify for conventional residential financing, similar to how you would finance a home purchase. Terms for these loans usually run 30 years and come with lower down payment requirements than commercial loans.

Owner occupancy offers additional benefits in small multifamily properties. If you plan to buy a fourplex or triplex and live in one of the units for at least a year, FHA loans can provide you with a “house-hack” opportunity. FHA loans come with lower down payment requirements but include specific criteria for the owner-operator:

- For owner-occupied three- and four-unit properties, 75% of the appraiser's market rent from all units must be at least equal to the total monthly payment of principal, interest, taxes, insurance, and any HOA/association dues (PITIA). The 75% reflects HUD's standard 25% vacancy and maintenance deduction.

- You must have documented cash reserves equal to three months of the principal, interest, taxes, and insurance (PITI) for triplexes and quadplexes.

- The FHA requires an upfront mortgage insurance premium (UFMIP) of 1.75% of the base loan amount plus an annual MIP. The annual MIP lasts for the life of the loan when the starting loan-to-value (LTV) ratio is greater than 90% or 11 years when the starting LTV is less than or equal to 90%.

- You must meet minimum property standards. For instance, if the property you're considering needs repairs, closing may be delayed.

If you plan to scale your multifamily portfolio, keep in mind that, for loans that conform to Fannie Mae's guidelines, the Selling Guide caps borrowers at 10 financed properties, including the primary residence. Once you have four properties, many lenders will require stricter guidelines, such as higher credit score minimums or larger down payment requirements.

Keep these factors in mind if you plan to scale your multifamily portfolio. Plan ahead to either pay off existing mortgages or move into larger properties with commercial financing, where the 10-property cap doesn't apply

Large Multifamily = Commercial Requirements and a Focus on Property Income

Large multifamily properties, including apartment buildings, require commercial underwriting that focuses on property income

For commercial loans, lenders determine how large of a loan they'll provide based on the potential property income, not comparable sales (like they would for a residential property). Their core tests are DSCR, LTV, and sponsor strength.

DSCR, LTV, and Sponsor Strength

- DSCR: A comparison of the building's yearly profit to yearly loan payments.

- LTV: How much of the purchase price the lender will finance.

- Sponsor strength: The lender's view of the people behind the deal, including credit, net worth, and cash on hand.

DSCR is the NOI divided by the annual debt service to determine how much income a property generates above its financing costs. For example, if the DSCR is 1.25, the property makes 25% more than the loan payments cost. Lenders generally look for DSCR of 1.20 or higher. You can use tools like a DSCR calculator to ensure you know the DSCR of a property you're considering before you start the CRE financing process.

LTV is your loan amount divided by the property value. Lower LTV means lower risk for lenders. For agency loans on properties with five or more units, max LTVs commonly reach 80%. For bank or CMBS executions, caps often land around 65-75%. However, exact thresholds will depend on your market.

Lenders use sponsor strength to gauge whether a borrower can execute the business plan and manage the demands of a multifamily property.

Investor Tip: If you're looking to make your first large multifamily purchase, consider increasing your sponsor strength by partnering with a more experienced investor, hiring a third-party manager for the property, or establishing your track record with smaller deals first.

Creative capital can bridge gaps at both sizes when pricing and rates do not line up

In some cases, you can make use of other factors beside down payment or traditional lending to help you finance a multifamily property.

Seller financing, for example, is when a seller agrees to let you pay part of the purchase price over time. This might be the case for properties in the five to 20-unit gray area, where mom and pop owners might be willing to trade financing flexibility for something they want, like a specific closing date or the ability to spread out their taxes.

If you need more flexibility for larger deals, consider assumable agency loans, earnouts, or staged equity.

- Assumable agency loans: You assume the seller's existing Fannie Mae or Freddie Mac loan, potentially taking advantage of a lower interest rate.

- Earnouts: The lender holds back extra loan dollars, then releases them after you raise income to a set target.

- Staged equity: Investors give you cash in phases. You'll get a smaller amount up front, then more once you hit milestones such as finishing renovations or increasing rents.

What are the Differences Between Small and Large Multifamily Cash Flow, Operations, and Risk?

Larger multifamily properties absorb fixed costs more easily, while smaller ones face higher per-door costs and risk.

Depending on the size of your multifamily property, vacancies affect fixed and variable costs in different ways.

Fixed costs are bills that don't change no matter how many tenants you have, like property taxes or insurance. Variable costs, on the other hand, change with occupancy, such as the utilities you cover as an owner. When you add units, each one carries a smaller share of the fixed costs. That generally improves your margins.

As a rule of thumb, you can calculate per-unit fixed costs by dividing the fixed costs by unit count. So, if you have a ten-unit building with $60,000 in fixed costs, that comes out to $6,000 per door. If you have the same costs but a 50-unit apartment building, however, that comes out to only $1,200 per door.

Break-even occupancy is an indication of how fragile your cash flow is. For example, if expenses and debt are $250,000 and your gross potential rent is $320,000, then you need about 78% occupancy to break even. Smaller properties need a higher percentage of occupied units to break even, while larger apartment buildings can absorb the cost of vacancies more easily.

Smaller properties require higher occupancy to cover the same fixed costs. Larger buildings spread those costs across more doors. Assumptions for illustrations only: $1,500 monthly rent per unit; variable expenses 30% of collected rent; fixed expenses $20,000 per property; annual debt service 25% of gross potential rent. Break-even = (debt service + fixed) ÷ (0.70 x gross potential rent).

Management Thresholds Vary with Size

If you're planning to buy a triplex or other small multifamily property, you may be able to manage the building on your own. Larger properties will require professional management to keep them running smoothly, however, and you should factor the cost of third-party management into your finances.

If you'd like to buy a multifamily property in the eight to 12-unit range, third-party management can cost about what many new owners spend in time and stress. Above that range, and especially once you reach 50 units or more, onsite staff can speed up leasing and maintenance, which protects NOI.

To determine if outsourcing management is right for you, add an 8% management fee to your pro forma (a budget that forecasts income, expenses, NOI, debt payments, and cash flow after financing) and then check your DSCR. If it holds, outsource. Then check your returns with a cash-on-cash calculator to verify that the deal is worth what you're putting into it.

Risk and Leverage

Because small and large multifamily properties use different financing, the appropriate amount of leverage will vary with property size as well. For smaller assets, favor smaller leverage. These will likely be residential loans tied to your personal assets. Larger multifamily properties purchased with commercial financing are valued according to NOI and cap rate. If you execute well, value growth can support a refinance at your maturity date, but only if you planned for higher rates.

Risks vary with property size as well. A duplex, triplex, or quadplex comes with greater month-to-month volatility because a single vacancy can wipe out 25% or more of your monthly return. Large properties can withstand vacancies more easily, but come with timing risks. Commercial loans generally come with shorter terms and a maturity date when you'll need to either make a balloon payment or refinance, so you'll be more susceptible to rate changes than with a residential loan.

How do Exit Strategies and Scalability Differ in Small vs. Large Multifamily Real Estate?

Small assets sell like homes while large ones sell like businesses, which shapes buyers, timelines, and value.

Whether you're considering a duplex for sale, want to buy a garden apartment building, or you're interested in larger properties, it's important to consider how to scale your portfolio even before you close. Multifamily exit strategies and scalability aren't secondary concerns, they're direct downstream consequences of your decision and worth planning for well in advance.

Take the buyer pool, for example. If you buy a fourplex for sale or purchase a similar small unit, you can sell to homeowners or small investors, which usually means more potential buyers, simpler inspections, and faster escrow. Large buildings sell to experienced investors and institutions. That's a smaller buyer pool, and you can expect more due diligence on a longer timeline.

Small vs. Large Multifamily: Exit & Process Comparison

| Consideration | Small Multifamily | Large Multifamily |

|---|---|---|

| Buyer Pool |

|

|

| Valuation Mechanics at Exit |

|

|

| Timeline, diligence, and certainty |

|

|

| Prepayment Penalties |

|

|

| 1031 Exchange Mechanics |

|

|

Scalability

You can scale with several small exits or one large one. Several small exits give you flexibility and more timing options, but they take more work per dollar of equity recycled. A single large exit can recycle a lot of equity at once, but it ties your plan to one buyer and one closing. Choose the path that matches your time, capital needs, and risk tolerance.

Is a Small or Large Multifamily Property Better for Your Investment Profile?

To decide between small or large multifamily properties, consider your time, risk tolerance, and capital compared to how each asset performs. Small properties are hands-on and sensitive to vacancies. Large properties are system-driven and depend on clean operations and refinance planning.

Time and Attention

If you want to learn by doing and have the time in your schedule, it could be a good time to buy a duplex, triplex, or fourplex. If you only have a few hours each week, consider eight to 20 units with third-party management. If you plan to scale, don't forget to block off time for asset management and lender reporting. That time grows with the number of units in your portfolio.

Risk Tolerance

Match your personal risk tolerance with the risk size of the small or large multifamily property you're considering. Small properties come with tenant vacancy risks. Larger ones have refinance and execution risk because loans mature sooner and operations are more complex.

If your risk tolerance is low, consider smaller properties that lend themselves better to conservative investing. Prioritize fixed, fully amortizing loans, and aim for 60-70% LTV. Be sure to keep six months of PITI on hand in addition to a modest per-unit repair reserve.

If your tolerance (and available capital) are higher, larger properties might be better for you. Don't forget that they come with their own unique risks, however. Plan around the balloon payment common in commercial loans and keep an eye on rates for fluctuations that can impact you once it's time to refinance. Stress test your refinance at a higher rate and slightly lower NOI before you go under contract.

Capital Availability

Small deals need less cash to enter, but can be harder to scale. Larger deals need more up-front equity, but spread fixed costs across more units and can return capital faster after income improves or with operational fixes.

When you're considering a loan, it's vital not to chase the largest amount or the biggest property. Look for a DSCR near 1.25 to 1.35. Even for a residential loan, where your lender won't consider DSCR, it can be a helpful internal benchmark for you to evaluate a property and the financing you'll need to buy it.

Why two to four-unit properties can make a smart entry point for first-time multifamily investors

For new investors, small multifamily properties typically offer the benefits of lower purchase prices without sacrificing available inventory.

For example, as of December 2025, there were just over 3,700 listings on LoopNet for small multifamily properties, with an average purchase price of $1.25 million. Compare that with an average sale price of $3.3 million for large multifamily properties, and $5.62 million for assets with at least 20 units.

How do Market Changes and Economic Conditions Impact Small vs. Large Multifamily Investments?

Small properties feel tenant swings faster, while large properties feel rate and finance shifts more. Markets can have an impact on your income, debt costs, and property value. Plan ahead of time and include stress-testing in your multifamily break-even analysis so a rough patch doesn't force a sale.

Interest Rates and Debt Costs

Smaller properties are less vulnerable to rate changes, since they most often use 30-year fixed residential loans. Large properties use shorter terms, so there's a risk that when it's time to refinance rates will be higher.

To plan for that before you purchase, size debt to a healthy DSCR, then stress test a future refinance by adding 1% to rates and trimming NOI by 5%. If DSCR stays above 1.20, then you have a healthy cushion.

Cap Rates and Value

Large multifamily properties are valued according to their NOI divided by cap rate. When cap rates rise, values fall unless you can grow the NOI by increasing rent, improving operations, or some other method.

For example, say you buy an apartment building with 50 units. It has $600,000 NOI at a 5.5 % cap, which sets its worth at about $10.9 million. If market cap rates move to 6.5 percent, value drops to about $9.2 million unless you lift income. Know your local commercial real estate cap rate trend before you set hold and exit plans.

Demand, Downturns, and Demographics

Demand will vary according to your market based on factors like job growth and household formation. Small assets in family-friendly suburbs may benefit from longer stays and lower turnover. Large assets near job hubs can fill faster but may see more move-ins and move-outs.

Market downturns will affect small and large properties differently as well. Small buildings will feel vacancies more harshly. Large properties can spread that cost across units, but it's possible that a downturn will align with your balloon date.

When you're weighing market impacts, focus on your specific submarket, not the city as a whole. Pressure-test demand and pricing by reviewing multifamily properties for sale in your area.

Multifamily Real Estate For Sale

Geography and Policy Risk

Taxes, insurance, rent rules, and permitting speed will vary by city. Duplexes, triplexes, and quadplexes can be more liquid in suburban areas with strong school districts and single-family demand. Large assets often fit best where you can hire reliable onsite staff and where lender appetite is strong.

Build your budget with realistic future numbers for taxes, insurance, and allowable rent raises. Cities and counties can raise property taxes after a sale or annual reassessment. Insurance premiums can change with natural disasters or carrier changes. Local regulations might cap how much you can raise rent each year. Keep all of that in mind so you don't accidentally set your margins too thin to absorb changes.

Frequently Asked Questions

How do financing options differ between small and large multifamily properties?

Small multifamily properties (two to four units) typically qualify for residential financing with more favorable terms, including lower down payments (as low as 3.5% for FHA loans if owner-occupied), longer amortization periods (30-year fixed), and better interest rates. Large multifamily properties (five or more units) require commercial financing with stricter underwriting standards, higher equity contributions (typically 25-30% down), and more focus on the metrics like debt service coverage ratio rather than personal income. After reaching the 10-loan conventional limit, small multifamily investors face similar commercial financing challenges as large multifamily investors, though sometimes with less favorable terms due to the smaller scale of their properties.

How does vacancy risk differ between small and large multifamily investments?

Vacancy risk has a dramatically different impact based on property size. In small multifamily, vacancies create concentrated risk. A single vacant unit in a fourplex represents a 25% revenue loss, which can quickly turn a profitable property cash-flow negative. Large multifamily properties benefit from statistical averaging, where a few vacant units among dozens have minimal impact on overall performance. For example, three vacancies in a 50-unit building only reduces revenue by 6%. Additionally, large properties typically maintain dedicated marketing systems and can absorb turnover costs more efficiently. However, small multifamily properties often experience longer tenant retention and lower turnover rates, partially offsetting this risk. To mitigate vacancy risk in small multifamily, maintain higher cash reserves (at least six months of expenses), develop efficient marketing systems, and be sure you understand how to screen tenants.

What's the best strategy for transitioning from small to large multifamily investing?

The most successful transitions happen when investors recognize that large multifamily properties require different systems and skills and aren't simply 'more of the same.' A strategic transition from small to large multifamily typically follows these steps:

- Master small multifamily fundamentals first by learning property management, tenant relations, and maintenance systems with lower stakes.

- Build your track record with two to four successful small multifamily investments to demonstrate competence to lenders and potential partners.

- Develop relationships with commercial lenders early, understanding their requirements before you need financing.

- Consider mid-sized properties (eight to 20 units) as a stepping stone to learn commercial financing and professional management.

- Build your professional network by connecting with experienced large multifamily investors, property managers, and commercial brokers.

- Explore partnership structures or syndication to access larger deals without needing all the capital yourself.

- Prepare for the mindset shift from hands-on management to business operations and asset management.

How much should I hold in reserves?

For two to four units, keep at least six months of PITI (principal, interest, taxes, and insurance) plus a modest per-unit repair reserve. For five or more units, target nine to 12 months of debt service plus per-door operating and capital expenditure reserves.

When should I hire a third-party manager?

If your pro forma budget with an 8% management fee still shows DSCR near 1.25 or better, consider outsourcing. Many owners self-manage two to four units, but eight to 12 units is often the point where a manager saves time without eating too far into your returns. Around 50 units, onsite leasing and maintenance usually pay for themselves through faster turns and fewer lost days.

What prepayment penalties should I watch for?

Residential loans on two to four units often have light or no prepayment penalties. Commercial loans can include step-down penalties, yield maintenance, or defeasance that make early payoff costly. Check your loan documents before setting your hold period so your exit plan lines up with the prepay schedule.

Are FHA or VA loans an option for small multifamily?

Yes, for owner-occupants buying two to four units. FHA allows low down payments but requires mortgage insurance and, on three and four units, a self-sufficiency test that about 75 % of market rents cover PITI. FHA also requires minimum property standards and cash reserves on triplexes and quadplexes. VA can finance up to four units for eligible borrowers with no monthly mortgage insurance, and you must occupy one unit. Most loans also include a one-time VA funding fee.