Understanding Tenancy in Common in Commercial Real Estate

What is Tenancy in Common (TIC)?

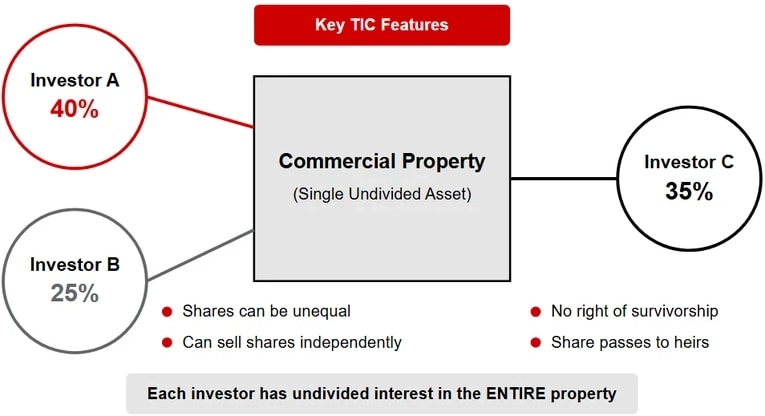

Tenancy in common is a form of property ownership where multiple individuals hold separate shares. Each owner can sell or transfer their share independently. This structure does not include right of survivorship, so a deceased owner's share goes to their heirs or as stated in their will.

Investors often use this model when purchasing investment properties. It also shares similarities with structures found in a land trust and a grant deed, both of which help ensure clear title and limited warranties.

In tenancy in common, multiple individuals share ownership of a property. Each owner holds an undivided interest in the entire property, and owners may hold different percentages based on how much each one invested.

Structure of Tenancy in Common

Owners can sell or transfer their share freely during their lifetime. In a TIC, each owner holds an undivided interest, meaning every investor has equal rights to use the entire property regardless of their investment percentage. This model is often used with different types of commercial real estate or when investors are learning the process of how to buy commercial property effectively.

Pros and Cons of TIC

Pros of TIC

TIC offers significant benefits for commercial real estate investors. It provides flexible ownership shares, allowing investors to contribute different amounts based on their capital. This structure enables partners to pool resources without being forced into equal shares.

Additionally, TIC can lower the entry barrier for commercial investments. Investors have the freedom to adjust their involvement as co-owners join or leave, making it an adaptable option in changing market conditions.

| Aspect | Advantages | Disadvantages |

|---|---|---|

| Ownership Flexibility | Allows unequal shares and tailored investments | May complicate estate planning and lead to disputes |

| Financial Benefits | Lowers entry barrier by pooling resources | All partners share liability for debts and taxes |

| Transferability | Owners can sell or transfer their share independently | Lack of automatic survivorship can disrupt continuity |

Cons of TIC

However, TIC arrangements require careful planning. The absence of automatic survivorship means an owner's share does not transfer directly to the remaining partners. This can complicate estate planning and lead to disputes if co-owners have different exit strategies.

Also, all partners share liability for debts, taxes, and financial obligations. This shared responsibility can increase risk if one co-owner encounters financial issues or management conflicts arise.

Investors should compare these advantages and challenges with those of other ownership models, such as joint tenancy or tenancy by entirety, to determine which structure best meets their long term goals.

Structuring a TIC Agreement

A strong TIC agreement lays out clear rules for all co-owners. It specifies each party's rights, responsibilities, and financial contributions. This clarity helps protect diverse investor interests.

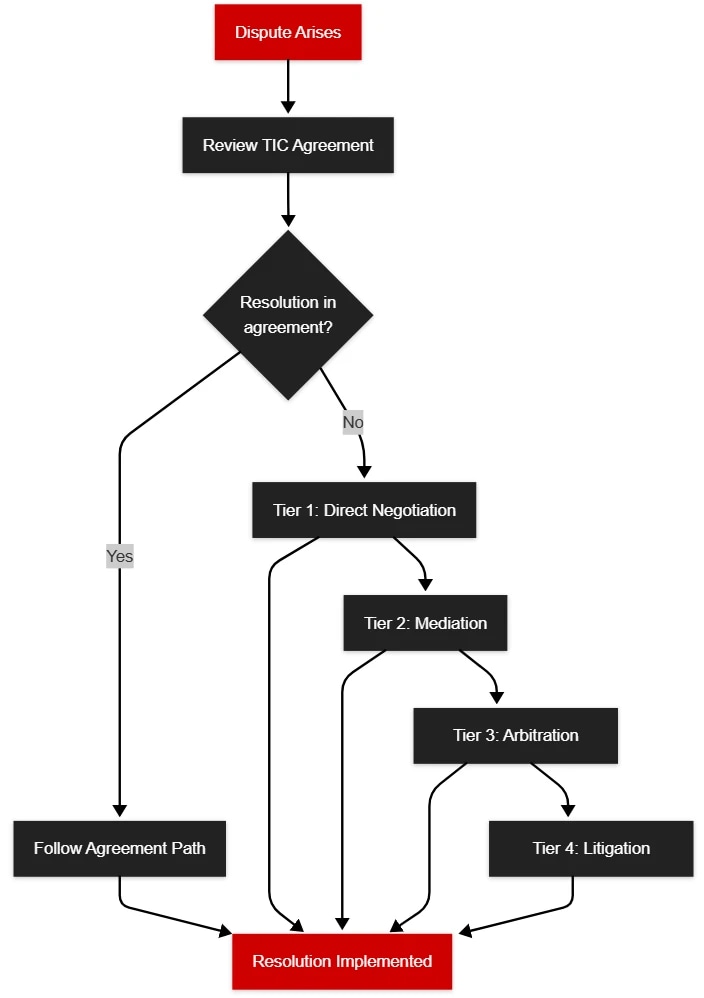

The agreement should include detailed legal components such as decision making processes and profit sharing. It must also outline steps for resolving disputes, which can prevent conflicts from disrupting operations.

Effective TIC agreements build multi-tiered dispute resolution systems. These systems may include mediation and arbitration steps before any legal action is taken. This structure minimizes delays and preserves property value.

Adaptive amendment procedures are also key. They allow the agreement to change in response to market conditions without requiring unanimous consent. This flexibility ensures the TIC remains effective as investor needs evolve.

Investors can also benefit from understanding various types of commercial leases, which can provide additional insights into protecting their interests. By understanding lease terms, rent escalations, tenant responsibilities, and termination clauses, investors can negotiate more secure contracts and mitigate financial risks.

Financial, Tax, and Liability Considerations

Investors must consider the financial, tax, and liability aspects of TIC arrangements. With this structure, partners share both benefits and risks, including mortgage and tax obligations.

TIC investors can leverage advanced tax strategies. For example, utilizing a 1031 exchange can help defer capital gains taxes. Such strategies are key to maximizing returns.

Liability is shared among co-owners, so it is crucial to adopt techniques that isolate financial risks. This means setting clear financial contributions and responsibilities to protect each investor's interests.

Exploring options like seller financing can offer alternative methods to secure favorable loan terms and minimize cross contamination of liabilities.

TIC vs. Joint Tenancy and Tenancy by Entirety

| Ownership Model | Ownership Shares | Survivorship Rights | Liability & Transfer Procedures |

|---|---|---|---|

| Tenancy in Common (TIC) | Unequal shares allowed | No automatic survivorship | Owners can transfer or sell their share independently |

| Joint Tenancy | Equal shares required | Includes automatic survivorship | Transfer may require breaking the joint structure |

| Tenancy by Entirety | Equal shares between spouses | Survivorship is inherent | Transfer requires mutual consent; offers additional legal protections |

TIC differs from joint tenancy and tenancy by entirety in key ways. Joint tenancy requires equal shares and includes automatic survivorship, while TIC allows for unequal shares and independent transfers. Tenancy by entirety is limited to married couples and offers additional protections not found in TIC.

In TIC, each owner's share can be sold or transferred without affecting the other owners. By contrast, joint tenancy links owners more closely, as one sale or dispute can alter the ownership structure. These differences have legal and tax implications that investors should consider carefully.

Investors often compare these models using a structured approach. For example, a ground lease strategy may pair well with TIC arrangements. Obtaining a commercial appraisal can help determine which model best meets investment needs. A commercial appraisal provides a clear market value and detailed analysis of a property's income potential, condition, and risks. By understanding the property's value and financial performance, investors can assess how different ownership models affect their return on investment. For example, if the appraisal indicates high market value and stable cash flow, an investor might favor TIC for its flexibility in ownership shares and tailored investment contributions. Conversely, if equal ownership and simplified transfer upon death are priorities, joint tenancy might be more attractive. Thus, the appraisal helps determine which model best meets specific investment goals. The valuation of the commercial property also plays a crucial role in decision making.

Exit Strategies of TIC Arrangements

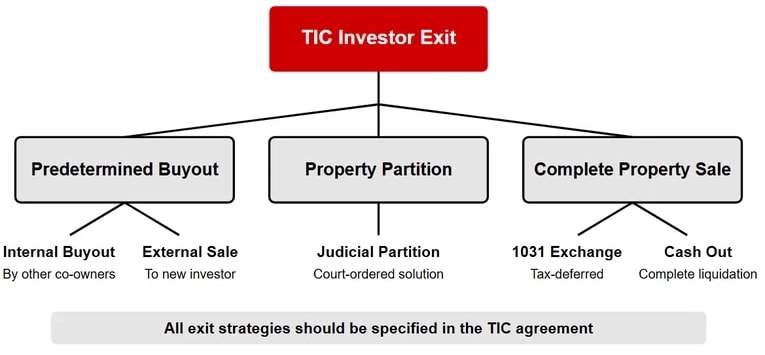

Exit strategies in TIC are essential for preserving asset value during changes in ownership. Investors benefit from predetermined buyout mechanisms that provide a clear path for leaving the arrangement. These frameworks help avoid disputes and maintain financial stability.

Tiered buyout structures and scheduled valuation formulas can simplify the dissolution process. Such methods offer a fair way for co-owners to exit without forcing an immediate sale of the property. These provisions are key to managing transitions smoothly.

For example, some investors use a multifamily exit strategy to structure a phased departure. Others prefer to sell commercial property outright when market conditions are favorable. In some cases, a sale leaseback arrangement can also offer liquidity while allowing continued use of the property.

Tenancy in Common Exit Strategy Options

Commercial Real Estate Focus

TIC arrangements can be tailored to different commercial asset classes. Investors may apply TIC to office spaces, retail properties, industrial buildings, or multifamily properties, each with its own challenges and opportunities.

Effective property management is key to balancing the interests of multiple owners. Guidance on managing multifamily assets can offer valuable insights for shared ownership, while understanding retail property investment strategies is crucial for maximizing returns in retail spaces.

Additionally, planning for specialized assets such as a commerce distribution center can diversify an investor's portfolio. Scaling TIC investments from single assets to diversified portfolios helps spread risk and capitalize on different market trends.

Explore current commercial property listings in your area that could be potential candidates for a TIC ownership structures.

Commercial Real Estate For Sale

Frequently Asked Questions

How do I determine whether a TIC arrangement is better for my investment goals than joint tenancy or other ownership structures?

To decide if TIC is right for you, consider your capital contribution, estate planning goals, and exit strategy. TIC allows for flexible, unequal ownership shares and offers options for individual exits, which may suit diverse investor profiles better than joint tenancy.

What specific protections should I include in a TIC agreement to limit my liability for other owners' financial problems?

Include clear financial roles and responsibilities in your TIC agreement. This may involve requiring separate insurance policies, establishing reserve accounts for shared expenses, and adding cross-indemnification clauses. Consulting with legal counsel can help tailor these protections to your needs.

What are my options if I need to exit a TIC investment before other co-owners are ready to sell?

You can rely on predetermined buyout provisions or a right of first refusal clause in your TIC agreement. In some cases, a judicial partition may be used to divide or sell the property. These strategies help ensure a smooth exit while protecting the investment's value.