What Are Leasehold Improvements? Definition, Examples, and Tax Rules

What Are Leasehold Improvements?

Leasehold improvements are custom changes made to a leased commercial space to meet a tenant's specific needs. These modifications are usually fixed in place and stay with the property after the lease ends.

What Qualifies as a Leasehold improvements?

To qualify as a leasehold improvement, the change must be permanent and benefit only the individual tenant, not all building occupants. This separates it from general repairs or upgrades to common areas. Improvements like painting a wall, installing built-in shelving, or upgrading electrical wiring to support business operations count as leasehold improvements.

Common Leasehold Improvement Examples

Leasehold improvements range from cosmetic upgrades to major functional changes. Only certain types qualify, however, and it's important to understand both what it means to capitalize an expense and expense classification before you start. The table below highlights what typically counts and what does not.

| Qualifies as a Leasehold Improvement | Does NOT Qualify |

|---|---|

| Installing partitions or new flooring | Patching drywall or repainting for maintenance |

| Built-in lighting or security systems | Portable fixtures, furniture, or trade equipment |

| Plumbing or HVAC changes inside tenant space | Building wide HVAC or lobby upgrades |

| Tenant specific buildouts (e.g., exam rooms, display shelving) | Changes to common areas or shared utilities |

| Painting as part of a full tenant buildout | Standalone cosmetic touch ups |

Where Leasehold Improvements Commonly Occur

Buildouts often vary by property type. Retail tenants may install custom displays or storage, while medical offices often require plumbing, exam rooms, and specialized lighting. Restaurant spaces may involve HVAC or kitchen equipment that becomes part of the structure. In industrial settings, tenants might add built-in racking or conveyor systems.

If you're planning improvements, here are some available commercial spaces that may already support your buildout needs.

Commercial Real Estate For Lease

Why Starting Conditions Impact Improvement Strategy

The starting condition of a leased property plays a key role in planning improvements. Tenants who lease unfinished or shell space in office buildings often need to make more substantial upgrades, which directly affects budget, lease terms, and timing.

Who Owns Leasehold Improvements and Why It Matters

Why Ownership Impacts Exit Planning

Unless the lease states otherwise, leasehold improvements, whether paid for by the tenant or not, typically become the landlord's property when the lease ends. This is because improvements are considered part of the building's physical structure. If the lease doesn't allow removal, tenants may walk away from investments they can't reuse. For high cost buildouts, it's critical to address ownership rights early in the lease to avoid surprises at move-out.

How Leasehold Ownership Affects Both Parties

Landlords gain long term value when improvements stay with the property. Tenants, on the other hand, gain operational benefit but should factor in the loss of ownership when calculating ROI. This is especially important under an NNN lease, where the tenant covers most property expenses while still losing ownership at lease end.

Subleases and Improvement Responsibilities

In sublease scenarios, it's often unclear who owns which improvements. Understanding the difference between a sublease vs lease helps clarify which party controls or benefits from the upgraded space—and who may be responsible for removal, repair, or maintenance at the end of the term.

How to Classify Leasehold Improvements in Your Lease Strategy

Tenants can negotiate better lease terms by agreeing upfront on what qualifies as a leasehold improvement. Landlords may offer rent reductions or additional allowances if tenants agree to leave certain improvements behind. Classification becomes a bargaining chip when structured intentionally.

Why Classification Affects Valuation and Tax Strategy

Only permanent, tenant specific changes to interior space can be capitalized and amortized. Understanding what qualifies protects both landlords and tenants from misclassifying expenses and overvaluing improvements. For example, distinguishing between usable vs rentable square footage helps avoid assigning undue value to temporary or cosmetic upgrades.

If a law firm installs custom glass partitions that increase room count and function, those can be capitalized and used to justify rent increases. But if they bring in temporary desks or rolling file cabinets, those are not leasehold improvements and shouldn't be factored into long-term asset value or appraisals.

Structure Classification to Align with Tax Strategy

Some improvements may be structured as tenant assets to allow for accelerated depreciation. Others may be classified as landlord owned to reduce upfront tenant costs. Knowing how the IRS treats each category allows investors to decide which party should own which improvement.

For example, if a tenant installs specialized shelving for a retail operation, it might make sense to classify it as a tenant asset and depreciate it over five years. In contrast, a landlord funded HVAC upgrade could be amortized more slowly but used to justify a rent increase.

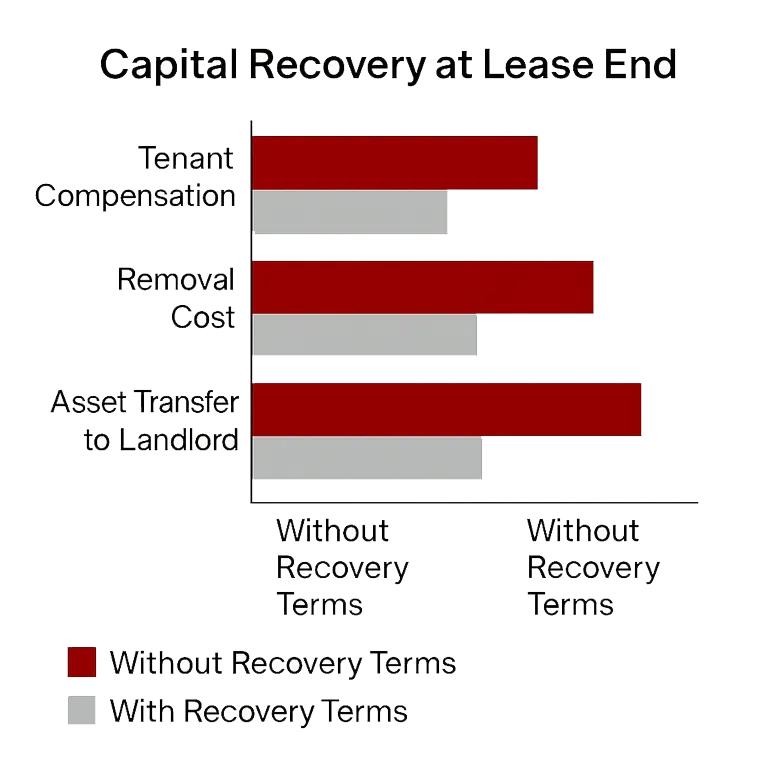

Plan for Capital Recovery at Lease End

Clear classification terms in the lease can determine whether tenants must remove improvements, leave them in place, or receive compensation. This affects capital recovery and exit planning, especially for expensive or industry specific buildouts.

Accounting and Amortization Rules for Leasehold Improvements

When you make a leasehold improvement, you don't count it as a regular expense. Instead, you treat it like a long term asset. This process is called capitalization. It reflects that the improvement will benefit the space for several years, not just one.

Spread the Cost Over Time

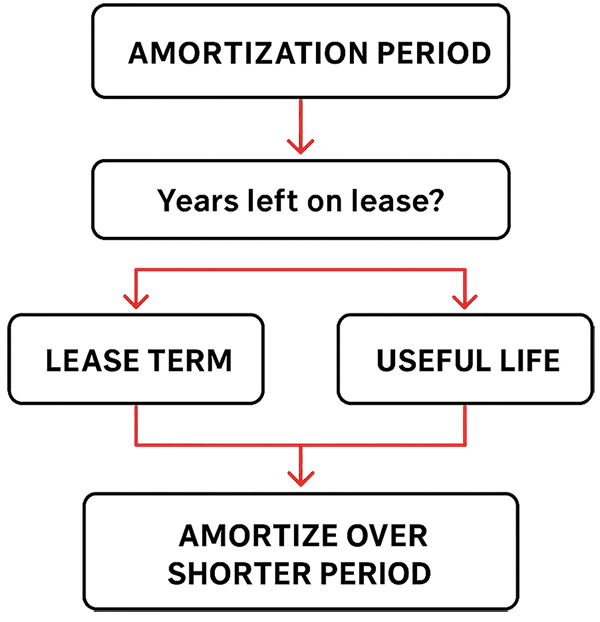

After capitalizing the cost, you spread it out using a process called amortization. You divide the total cost by the number of years the improvement will be useful, or the number of years left on the lease, whichever is shorter. This helps match your expenses with the time you use the improvement.

How to Determine the Amortization Period

Remove the Asset When It's Fully Amortized

Once the improvement has been fully written off, you need to take it off your financial records. This keeps your accounting clean and accurate and avoids overstating your property's value.

Connect Improvements to Investment Performance

Leasehold improvements can change how a property performs financially. They may raise rental value, reduce vacancy, or support higher tenant retention. Tools like a cash on cash calculator can help you measure how much return you're getting on the money you've invested in improvements.

Understand the Bigger Financial Picture

Amortization also affects how you value the property over time. A discounted cash flow analysis shows how future rental income from improved space compares to your upfront investment. This method helps you decide if the improvement was worth the cost.

For example, if a landlord spends $100,000 on leasehold improvements and secures a five year lease extension at a higher rent, a DCF model can project the increased cash flow and determine whether that upfront spend delivers an acceptable return over the lease term.

Use Property Valuation Tools to Measure Impact

Amortization schedules also tie into how appraisers value your building. Improvements that raise revenue or lower turnover can boost appraised value. A solid commercial appraisal reflects these changes, which can support better financing or resale outcomes. You can also use our property valuation guide and calculator to estimate how improvements may affect your property's worth using common approaches like cap rate or gross rent multiplier.

Tax Benefits and Depreciation Rules for Leasehold Improvements

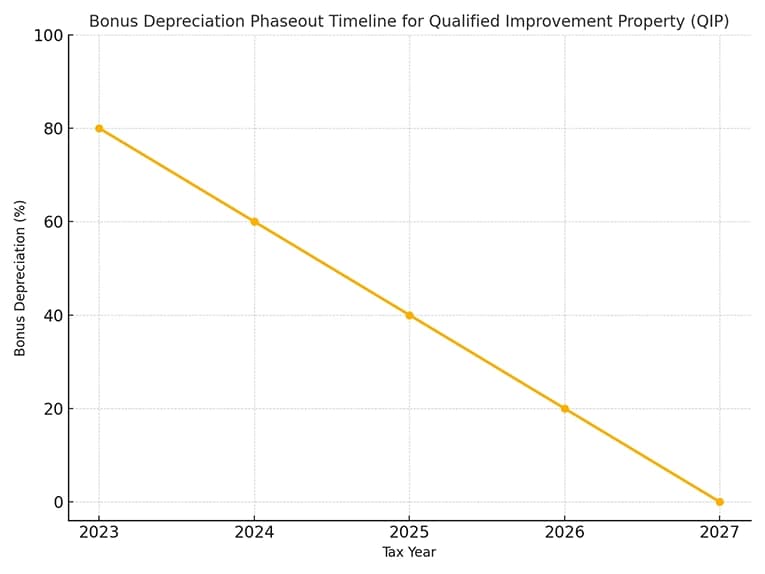

Most leasehold improvements that qualify as qualified improvement property are depreciated over 15 years. Instead of spreading deductions over time, you may still be able to write off a portion of the cost in the first year using bonus depreciation. This incentive is phasing out under current tax law, with the bonus rate now at 60% in 2025 and set to decline further before expiring in 2027. Acting soon can help maximize your deduction while the benefit is still available.

Take Advantage of Bonus Depreciation While You Can

The CARES Act allows you to write off 100% of qualified improvements in the first year, thanks to bonus depreciation. But this benefit is being phased out. The rate drops to 60% in 2024 and will be gone by 2027. Now is the time to act if you want to use this incentive.

Use Tax Planning to Maximize Savings

If you're planning to sell, consider pairing improvements with a 1031 exchange to defer capital gains taxes. You can also explore investing in an opportunity zone, which may allow you to reduce or delay taxes if your improvements support new business activity.

For example, an investor who renovates a retail property in a designated opportunity zone may qualify for deferral of capital gains on a prior sale. If the asset is held long enough, they may also avoid taxes on new appreciation from the upgraded property.

Leasehold Improvements and Tenant Retention Strategy

Improvements Can Reduce Turnover

Well designed leasehold improvements help tenants stay longer. When the space is customized to fit their operations, they're less likely to leave at the end of the lease. This reduces vacancy and turnover costs for landlords.

Boosting Property Value Through Strategic Buildouts

Spaces with high quality improvements are easier to lease to future tenants. Buildouts that appeal to a broad user base can increase demand, helping you raise rent and improve your exit cap rate. Targeted improvements also help with finding good tenants who are more likely to treat the property well and stay longer.

How to Measure ROI on Leasehold Improvements

Begin by calculating all costs tied to the improvement, materials, labor, design, permits, and project management. Include soft costs like construction delays or temporary loss of rent. This full number is your investment baseline.

| Input | Description | Why It Matters |

|---|---|---|

| Total Improvement Cost | Sum of construction, labor, permits, and design fees | Establishes your upfront investment amount |

| Rent Increase (Post-Improvement) | The monthly or annual rent gain after improvements | Indicates direct revenue impact of improvements |

| Lease Term Extension | Additional years secured from the tenant after buildout | Improves long-term stability and income projection |

| NOI Increase | Growth in net operating income from higher rent or lower vacancy | Drives higher property valuation and better cap rates |

| ROI Metric | Yield on Cost, IRR, or Cash-on-Cash Return | Used to evaluate project performance and compare investments |

Quantify Financial Returns

Track rent increases, lease extensions, or reduced downtime between tenants that result from the improvements. Use metrics like yield on cost or internal rate of return to estimate long term performance. These tools help compare the return from improvements against other capital investments and help you with future capital expenditure planning.

Use NOI Impact to Support Valuation

If improvements increase rental income or reduce vacancy, your net operating income (NOI) rises. This directly affects property value. Use a NOI calculator to track changes over time and understand how buildouts impact your overall asset performance.

Sustainability Focused Leasehold Improvements

Installing energy efficient lighting, low flow plumbing, or occupancy sensors can reduce utility bills for both tenants and landlords. These improvements often qualify as leasehold improvements if they're tenant specific and fixed in place.

Improve Compliance and Future Proof Your Asset

Many cities now require buildings to meet energy or emissions standards. Sustainable leasehold improvements help you stay ahead of regulations and avoid costly retrofits later. A strong LEED certification or energy score may also increase resale value.

FAQs About Leasehold Improvements

How should I time leasehold improvement projects to maximize tax benefits?

If your improvements qualify as Qualified Improvement Property (QIP), consider starting projects before bonus depreciation phases out. The bonus rate is 60% in 2025 and drops each year until it disappears after 2027. Completing major improvements now can create substantial first-year tax deductions.

What records should I keep for tax and accounting purposes?

Document everything: invoices, permits, architectural drawings, and photos. Break out labor, materials, and soft costs. This supports accurate capitalization, depreciation, and potential cost segregation. Also, keep landlord approvals and lease amendments that define ownership rights at lease end.

What happens if a lease ends early?

If the lease ends before the improvement is fully amortized, the remaining book value is written off as a loss. You can't carry the value forward unless the lease is renewed or extended. Planning amortization carefully helps reduce risk from early termination.