What Does It Mean to Capitalize an Expense in Real Estate?

Key Takeaways

- Capitalizing an expense means recording it as a long-term asset on your balance sheet instead of an immediate deduction, spreading the cost over multiple years through depreciation.

- The decision protects your debt service coverage ratio (DSCR) and net operating income (NOI), preventing loan covenant violations during major improvement years.

- Standard depreciation (39 years for commercial buildings) is simple but leaves tax benefits on the table; component-based depreciation requires upfront investment but accelerates deductions.

What Does it Mean to Capitalize an Expense?

Capitalizing an expense means recording the cost as a long-term asset instead of deducting it as an expense.

When you capitalize an expense, you record it on your balance sheet as a long-term asset, rather than an expense on your income statement. By capitalizing, you spread the cost of the asset over multiple years through depreciation or amortization.

For example, if you spend $50,000 to replace an entire HVAC system during an office build out, that system will serve tenants for more than a decade. Capitalizing it creates an asset on your balance sheet that matches its cost to the revenue it generates. Expensing it creates an unnecessary $50,000 hit to this year's net operating income (NOI).

The decision to capitalize hinges on whether the expenditure provides value beyond the current year. Getting it wrong can not only cost you thousands in unnecessary taxes, but trigger loan violations that jeopardize your property.

For commercial real estate investors, understanding the difference between CapEx and OpEx is the first step to strategic capital expenditure planning and making sound financial decisions about acquisitions.

How capitalization creates long-term asset value.

When you capitalize improvements, renovations, or acquisitions, you build equity and reduce profit fluctuations on your financial statements. This affects how lenders evaluate your property.

Lenders evaluate your balance sheet during loan applications or refinancing. A property with $2 million in capitalized improvements shows stronger asset value than one where those same costs were expensed once without any long-term financial benefit.

Capitalization also protects your debt service coverage ratio (DSCR) during major improvement years. If you expense a $200,000 roof replacement immediately, NOI drops by $200,000 that year, potentially violating loan covenants. Capitalize it over 25 years, and your NOI remains unaffected, which keeps your DSCR healthy.

The matching principle in commercial real estate

The accounting concept behind capitalization is the matching principle: Expenses should be recorded in the same periods as the revenues they help generate.

When you spend $75,000 on tenant improvement allowances (TIA) to secure a tenant for a long-term lease, that expense has a direct impact on your ability to generate a decade of rental income. By depreciating it over time, you match the cost to its benefit.

This is especially important in commercial real estate, where assets generate revenue over decades. If you were to immediately expense renovations that add decades' worth of value, you would misrepresent the economic reality of those long-lived improvements.

Understanding capitalization is crucial when you're comparing potential acquisitions. If you're evaluating a value-add opportunity like an apartment building for sale that needs unit upgrades, you can model how capitalizing renovation costs will affect your finances. Investing $300,000 in capital improvements enhances property value in a way that spending $50,000 in deferred maintenance doesn't.

Capitalizing vs. Expensing: $300,000 Property Improvement

| Financial Impact | Capitalized (Year 1) | Expensed (Year 1) |

|---|---|---|

| Balance Sheet - Assets | +$300,000 (asset created) | No change |

| Income Statement - Operating Expenses | No immediate impact | +$300,000 (expense recorded) |

| NOI | No change | Decreases by $300,000 |

| Annual Depreciation Expense | $10,000/year (over 30 years)* | N/A |

| Year 1 Tax Deduction | $10,000 | $300,000 |

| Impact on DSCR | None | Significant reduction (full $300,000) |

| Asset Value for Refinancing | Strengthened (+$300,000) | Unchanged |

| Long-Term Tax Benefit | $300,000 spread over 30 years | $300,000 in Year 1 only |

Assumes a 30-year useful life for the improvement. Actual depreciation period depends on asset type and IRS classification.

How Do Depreciation and Amortization Work After Capitalizing an Expense?

Depreciation and amortization systematically allocate that cost across the asset's useful life.

Depreciation applies to physical assets like buildings, HVAC systems, and parking structures. Amortization applies to intangible assets like tenant acquisition costs and property management software.

Both methods convert your capitalized asset into periodic expenses that reduce taxable income while matching costs to the revenue those assets create.

Standard vs. component-based depreciation

When it comes to commercial real estate depreciation, you can either choose standard or component-based depreciation.

With standard depreciation, you depreciate the entire building over 39 years for non-residential properties, or 27.5 years for multifamily residential properties with four or more units. You divide the building's cost by the appropriate number of years to calculate the annual depreciation deduction. For example, if you paid $3.9 million for an office for sale, you could depreciate the building over 39 years for $100,000 in annual depreciation expenses.

This approach is simple and requires minimal record-keeping, which is why many smaller investors stick with it despite leaving tax benefits on the table.

If instead you chose to depreciate individual elements of the building separately, that would be component-based depreciation. You might depreciate the HVAC system over 15 years, the roof over 25 years, and the elevator over 20 years.

Standard depreciation spreads a $3.9M building evenly over 39 years ($100K annually). Component-based depreciation breaks the building into systems with shorter useful lives (HVAC: 15 years, flooring: seven years, etc.), accelerating $424,000 in additional deductions over the first five years.

Component-based depreciation accelerates tax deductions by moving portions of your building into shorter depreciation schedules, but requires a cost segregation study to properly classify and value each building system, which involves upfront costs and more complex record-keeping than standard depreciation.

Amortization for intangible assets

Intangible assets follow similar logic but use amortization instead of depreciation. When you pay $50,000 in leasing commissions to secure a 10-year tenant, you amortize that cost over the lease term at $5,000 annually. The same applies to lease improvement depreciation for tenant-specific buildouts that have value only during that tenant's occupancy.

Property management software and tenant relationship management systems also get amortized over three to seven years depending on expected technology lifecycle.

How Do You Determine What Expense to Capitalize?

Set capitalization thresholds to establish the minimum dollar amount at which you'll capitalize an expense.

A capitalization threshold saves you from wasting hours on administrative work tracking depreciation on small purchases, while still ensuring large expenditures get the proper accounting treatment.

Many commercial real estate investors set thresholds between $2,500 and $10,000, but the right amount will depend on your specific financial reporting needs and operational complexity. Your threshold should capture expenditures that would meaningfully distort financial statements if expensed immediately, while letting truly minor costs flow through as period expenses.

Determine thresholds based on portfolio size and property type

A single-property investor might use a $2,500 threshold to capture significant improvements while expensing minor repairs and maintenance. Someone with a $20 million portfolio might set a $10,000 threshold to reduce the administrative overhead of tracking depreciation schedules for thousands of unit upgrades.

Property type will have an impact as well. Office buildings with frequent tenant improvements might use lower thresholds to properly capitalize building costs that enhance property value. If you were to buy industrial property, on the other hand, you might plan on fewer but larger capital projects, and use a higher threshold.

Develop a comprehensive capitalization policy

Your capitalization policy should address any potential areas where you'll need to make a judgment call about capitalizing vs. expensing. This can be especially important in assets with tenants with common area maintenance (CAM) charges, when it's time to decide what costs to pass through to tenants.

Your policy should document these decisions to maintain consistency across properties and accounting periods. Lenders will evaluate these when calculating metrics like debt yield.

Review your threshold annually as your portfolio grows to ensure it still matches your operational scale.

How Does Capitalization Affect Financial Metrics?

Capitalizing an expense increases assets without immediately reducing NOI, which improves key metrics.

Capitalization directly impacts the financial ratios lenders use to evaluate loan applications and monitor existing loans. By increasing the assets on your balance sheet without bringing down NOI, it can improve key metrics like debt service coverage ratio (DSCR), operating cash flow, and return on assets.

Impact on DSCR and NOI

DSCR in real estate measures your property's ability to cover its debt payments with its operating income. By capitalizing a major expense, you protect DSCR by keeping the cost out of your operating expenses entirely.

For example, say you paid $200,000 to replace a roof. By depreciating it over 25 years, the cost doesn't drive down your NOI because the cost never factors into the NOI real estate formula as an operating expense. If you instead expensed the full $200,000, your NOI would drop by that entire amount. If your loan requires a minimum DSCR of 1.25, you're now in default. Your lender can demand immediate payment, refuse to refinance, or force a sale, all because of an accounting decision

Balance sheet and leverage considerations

Capitalized expenses strengthen your balance sheet by increasing total asset value without adding liabilities, which can improve leverage ratio. The purpose of leverage ratio is to compare total debt to assets, so a property with $2 million in capitalized improvements has stronger asset coverage than one where identical costs were expensed.

Cash flow statement treatment

On your cash flow statement, capitalized expenses appear in the investing activities section as asset purchases, while expensed items reduce operating cash flow. This matters because lenders and investors evaluate operating cash flow as a measure of property performance. Moving large expenditures to the investing section preserves the appearance of strong operating performance, though the actual cash outlay is identical either way.

How Does Capitalization Affect Tax Planning?

Capitalization spreads deductions over multiple years for predictable tax benefits that align with long-term goals.

When deciding between capitalizing and expensing, the right choice depends on your tax situation, expected future rates, and cash flow needs.

Capitalization can be better for long-term investment horizons, because it spreads deductions over many years. Immediate expensing delivers full tax benefits in year one, which maximizes your short-term tax savings.

Immediate Tax Deduction vs. Long-Term Benefits

If you're in a high tax bracket now and expect lower rates in future years, immediate expensing maximizes current-year savings. If you're showing losses currently or expect higher income in future years, capitalizing preserves those deductions for when they provide more value.

You can also consider cash flow timing. If you know you'll need more liquidity in the coming year, expensing a large improvement can reduce your immediate tax liability, freeing up more funds in the near term. Expensing a $100,000 improvement might save $25,000 in taxes immediately, freeing up capital for your next acquisition.

How Do You Apply Capitalization to CRE Scenarios?

Capitalize tenant improvements when they add lasting value or extend the lease term.

Knowing when to capitalize tenant improvements helps investors prioritize some of the largest capital expenditures in various types of commercial real estate. When it comes to landlord-funded tenant improvements, capitalize them when they add value beyond routine maintenance, whether for a specific tenant or for the property generally.

For example, say you planned to buy an office and undertake a $100,000 buildout to entice a tenant to sign a 10-year lease. That buildout gets capitalized and depreciated over the term of that lease or the improvement's useful life, whichever is shorter.

Generic improvements, however, like an HVAC replacement or electrical work, benefit future tenants as well as current ones. Those should be capitalized over their physical useful life.

Highly tenant-specific buildouts like custom retail fixtures or specialized medical equipment may need to be expensed if they have no value to future tenants.

Allocate shared expenses in mixed-use assets based on which property components benefit.

Mixed-use properties require careful allocation of shared expenses across residential, retail, and office components. When your property combines multiple types of spaces, you'll need to allocate capitalized expenses across each component based on which areas benefit.

A new roof benefits all components equally, so capitalize it and allocate depreciation based on square footage. HVAC systems serving only the retail portion get capitalized and depreciated against retail operations alone.

Maintain separate depreciation schedules for each component to ensure accurate financial reporting and proper tax treatment across different property classifications.

Commercial Real Estate Properties For Sale

Frequently Asked Questions

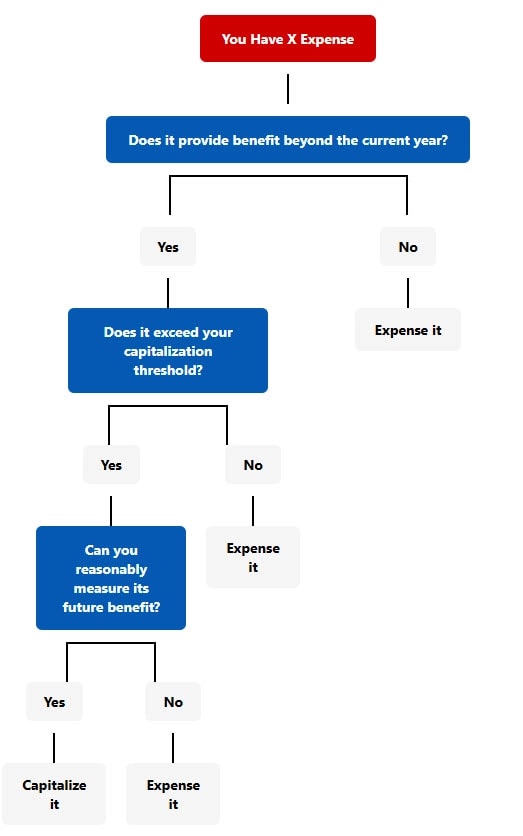

How do I determine if an expense should be capitalized or immediately expensed?

Capitalize costs that provide benefits beyond the current year, exceed your capitalization threshold, and measurably improve the property, such as major HVAC replacements or structural upgrades. Expense routine maintenance and repairs, and document your decision when classification is unclear.

How does capitalizing expenses affect my tax situation compared to immediate expensing?

Immediate expensing delivers a full deduction in year one, while capitalizing spreads deductions over time through depreciation. For commercial real estate investors, cost segregation can accelerate depreciation on certain components, and capitalization also affects adjusted basis, which influences 1031 exchange outcomes. Your tax bracket, future rate expectations, and holding period should guide the decision, with professional advice recommended for deal-specific planning.

What capitalization threshold should I establish for my commercial real estate portfolio?

Thresholds typically range from $2,500 for smaller portfolios to $10,000+ for larger ones, but the right amount depends on your specific needs. Consider: materiality (what's financially significant for your operation), administrative burden (lower thresholds mean tracking more assets), lender requirements (loan covenants may influence your approach), and property type (office buildings with frequent tenant improvements might warrant lower thresholds than industrial properties). Document your threshold in a formal capitalization policy and review it annually as your portfolio grows.