What is a Multifamily Home? Types, Loans, and Returns, Explained

Key Takeaways

- A multifamily home contains two or more separate living units under one roof. Two- to four-unit properties are classified as residential and properties with five or more units are considered commercial multifamily assets.

- Different types of multifamily real estate serve distinct strategies. Small properties offer house-hacking opportunities, while larger assets provide scale but require more capital.

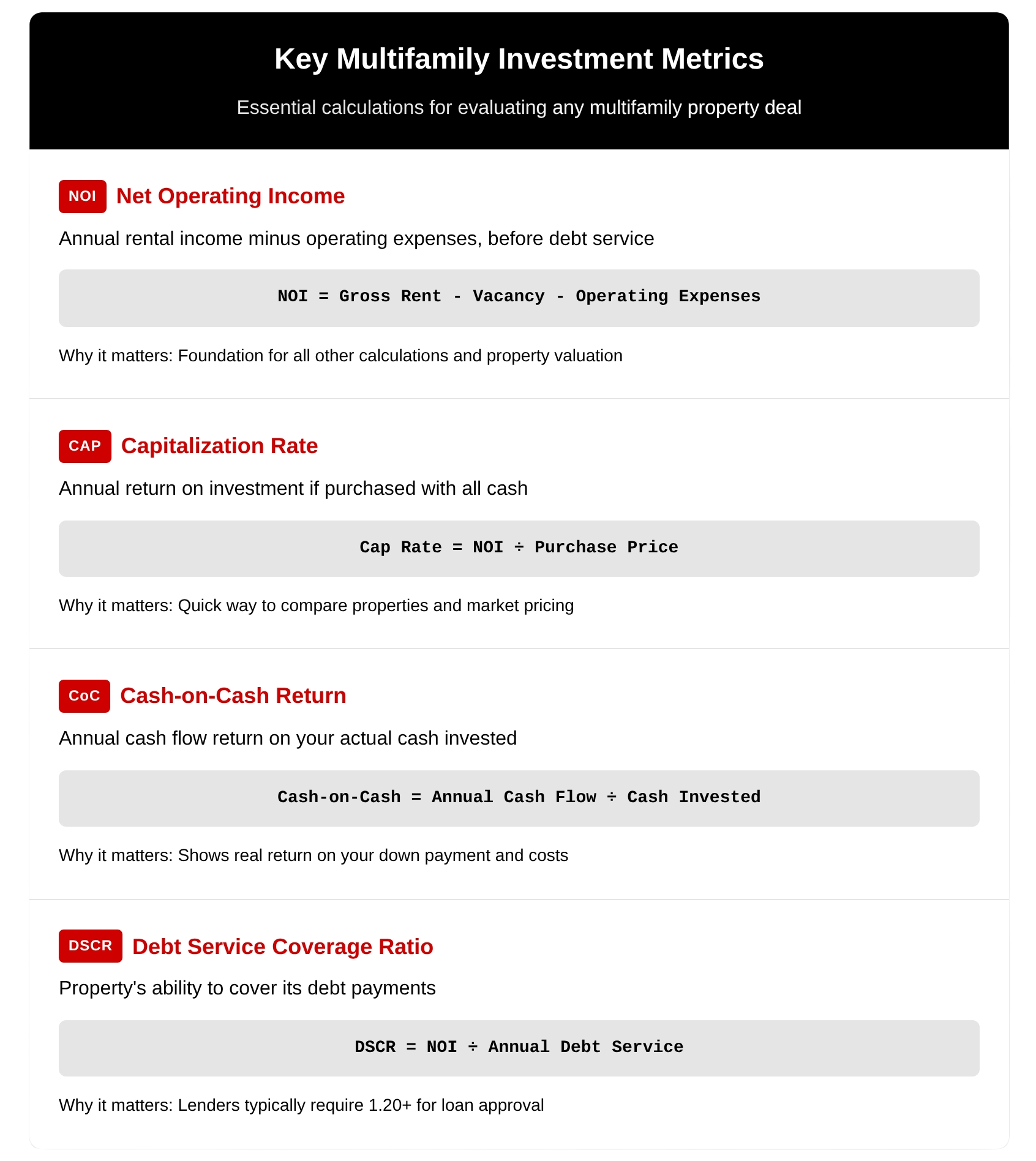

- Successful multifamily investing requires understanding core metrics (NOI, cap rate, DSCR) plus compliance with fair housing laws, building codes, zoning requirements, and local rent regulations.

Among the various types of commercial real estate, multifamily spans its own set of classification and subtypes. From small, residential duplexes to large high-rise apartment buildings, multifamily real estate comes with its own unique benefits and specifications.

In this article, we'll cover what qualifies as a multifamily home and the most common types of multifamily real estate. Then we'll dive into what you need to know about financing, calculating returns, and more.

What is a Multifamily Home and How is it Classified?

A multifamily home is one property with two or more separate homes in it.

A multifamily home has multiple self-contained units, each with its own kitchen, bathroom, and entrance. Properties with two to four units are considered residential multifamily homes. Anything with five or more units, such as an apartment building, is a commercial multifamily property. Keep these distinctions in mind as you review multifamily property for sale.

A duplex, triplex, or fourplex is considered a residential multifamily asset and usually financed like a home you live in. Investing in a duplex or other small property is a common first step for new real estate investors.

A property with five or more units is treated as commercial real estate. Lenders underwrite income and look at measures like debt service coverage ratio (DSCR), which is the net operating income (NOI) divided by annual debt service.

| Topic | 2-4 Units (Residential) | 5+ Units (Commercial) |

|---|---|---|

| Units & classification | Residential multifamily (2-4 units) | Commercial multifamily (5 or more units) |

| Typical buyers | Owner-occupants and small investors | Professional and institutional investors |

| Financing type | Conventional, FHA, VA for owner-occupants | Bank, agency (Fannie Mae, Freddie Mac), HUD, CMBS |

| Underwriting focus | Borrower income, credit, debt-to-income (DTI), reserves | Property income, DSCR, debt yield, NOI trends, rent roll quality |

| Valuation method | Sales comparables first; income is secondary | Income capitalization first; sales and cost approaches support |

| Typical down payment | Owner-occupied: 3.5% FHA or 0% VA if eligible; Non-owner: often 20%-25% | Often 20%-35% equity, varies by market and risk |

| DSCR or DTI benchmark | DTI and reserves drive approval; DSCR not primary | DSCR commonly 1.20-1.25 or higher, program dependent |

| Loan structure | Often 30-year fixed, full amortization, no balloon | 5-10 year term, 25-30 year amortization, balloons common |

| Appraisal approach | Sales comparison grid with income cross-check | Income approach with cap rate; sales and cost as support |

| Reserves and covenants | Lower formal reserves; simpler covenants | Replacement reserves and tighter covenants are common |

| Owner-occupant benefits | Possible lower down payment and rate if occupying a unit | No owner-occupant benefits; business underwriting applies |

| Closing timeline | Often faster once borrower documents are complete | Longer due to third-party reports and credit committee review |

Why Does Residential vs. Commercial Multifamily Matter?

The distinction shapes financing, valuation, and day-to-day operations.

Two- to four-unit properties use simpler underwriting. Expect lenders to look closely at your income and credit. At five or more units, the focus shifts to the asset itself.

NOI is the key number for commercial multifamily. NOI is rent minus vacancy and operating expenses, before debt. For example, a property with $200,000 in rent, $10,000 in vacancy costs, and $90,000 in expenses has an NOI of $100,000.

Commercial multifamily properties with lower unit counts (generally between five and 20 units) can fall into a "gray zone." At this range, assets are often run by mom and pop owners, rather than institutional investors, but still operate under commercial financing rules. They can be a good option for investors looking to make the jump from small to large multifamily investing.

What are Common Types of Multifamily Real Estate?

Duplexes, apartment complexes, and specialty housing are all common types of multifamily real estate.

Each comes with its own benefits and challenges, which can vary further depending on your unique market and whether they're considered small or large multifamily properties. Whether you're looking for a fourplex for sale or you're interested in a larger property, start by scanning your local market for available listings.

Multifamily Real Estate For Sale

| Property Type | Key Characteristics | Ideal For |

|---|---|---|

| Duplex | Single roof, individual financing metrics, house hacking opportunity, comparable sales pricing | First-time multifamily investors, owner-occupants |

| Triplex | Higher vacancy impact (33% per unit), house hacking opportunity, residential loan programs | Investors seeking cash flow with owner-occupancy benefits |

| Fourplex | Maximum residential financing units, still manageable individually, lower down payment options | Investors transitioning to commercial-scale properties |

| Garden Apartments | 1-3 stories, surface parking, modest amenities, third-party management potential, 35-50% expense ratios | Investors ready for commercial financing and professional management |

| Townhomes | Individual front doors and garages, HOA governance, potential special assessments, can sell individually | Investors comfortable with HOA rules and scattered site management |

| Mid-Rise Apartments | On-site leasing and maintenance teams, amenity packages, building systems management | Experienced investors with significant capital and management resources |

| High-Rise Apartments | Elevators, complex building systems, lobbies and corridors, major mechanical systems | Institutional investors and experienced operators with substantial capital |

| Mixed-Use Residential | Residential plus retail/office, complex zoning, separate underwriting for components | Sophisticated investors comfortable with mixed-use complexity |

| Student Housing | Lease by bed or unit, furnished units, parental guarantees, seasonal turnover | Investors near universities with stable enrollment trends |

| Senior Housing | Age restrictions (55+ or 62+), specialized amenities, compliance requirements | Investors focused on demographic trends and specialized operations |

| LIHTC Properties | Rent tied to area median income, annual certifications, program compliance, consistent demand | Investors seeking stable returns with affordable housing focus |

Residential Multifamily: Duplexes, Triplexes, and Fourplexes

The smallest types of multifamily properties are duplexes, triplexes, and fourplexes. These contain two to four units under one roof, and are a common first step into multifamily investing because owners can occupy one unit and rent out the others. When you buy a duplex, triplex, or fourplex, financing is often residential and some programs allow owner-occupiers to take advantage of lower down payments or simpler underwriting. Keep these factors in mind as you consider whether a duplex vs. triplex vs. fourplex is the right investment for you.

Pricing for these small multifamily assets leans on comparable sales, similar to single-family homes, so their location can have an impact on property values. Operations still matter, though. Light interior refreshes, pet fees, storage, and a ratio utility billing system (RUBS) to recover utility costs can help increase income without major capital expenditures.

Keep in mind that tenant concentration has more of an impact on small multifamily assets, so set aside at least three to six months of expenses.

Before you buy a triplex or other small multifamily property, confirm details like the age and condition of the roof, main plumbing lines, and electrical panels. Check local market rents and consider operational improvements that can help you retain tenants and increase your returns.

Garden Apartments

Garden apartments have between five and 40 units across one to three stories with surface parking and modest amenities. They often have one- and two-bedroom units, and can support third-party management to keep staffing lean. As an investor, you can often increase your returns with simple fixes, adding paid laundry or storage, and refreshing interiors.

Unlike small multifamily properties, which use individual financing metrics, lenders will underwrite garden apartments and other large assets according to NOI. That means that factors such as rent roll or expense control will have a significant impact on both property value and loan terms.

Expense ratios often fall between 35-50%, meaning that for every dollar you bring in, $0.35-0.50 will go toward operating costs, though this can vary by property age, location, and management efficiency. The largest share is often taken up by property taxes and utilities.

When you're conducting multifamily due diligence, focus on roofs, paving, main plumbing lines, and HVAC, which can be costly.

Townhomes

Townhomes can qualify as multifamily real estate if you own multiple units in a development and operate them as rental properties. They combine aspects of single-family rentals with multifamily scale, offering rent premiums over traditional apartments but requiring scattered-site management across the development.

Mid-Rise and High-Rise Apartments

These are much larger apartment buildings, usually with 50 or more units. They often include amenity packages and on-site management teams.

You may see apartment assets grouped as class A, B, and C based on relative age, condition, amenities, and location:

- Class A are the newest buildings with high-end amenities

- Class B assets are older with good, but not luxury, finishes

- Class C apartments come with the fewest amenities in less prime locations

These designations can be an easy at-a-glance metric, but keep in mind that class is market-relative and not an official rating. Class can vary with location, so review apartment buildings for sale in your area to compare assets.

Apartment Buildings For Sale

On-site leasing and maintenance teams can help retain tenants and reduce turnover. Include costs for regular inspections and building systems such as fire, elevators, and automation control into your budget.

When you're putting together a capital plan, don't forget to cover lobbies, corridors, roofs, elevators, and major mechanical, electrical, and plumbing systems. Like other commercial multifamily properties, underwriting will focus on NOI, DSCR, and, in some cases, debt yield.

Mixed-Use Residential

Mixed-use buildings combine apartments with retail or office spaces under a single roof. As a multifamily investor, you'll follow the same rules and processes of a multifamily asset for the apartments portion of the building, but be sure to check for any additional steps when it comes to the retail portion.

Operationally, set up separate access, manage noise and odors, and be sure to put protections for the residential experience in place to help retain tenants.

Specialized Housing

Some multifamily properties cater to specific tenants. These assets will come with unique operational requirements, but can also offer access to a motivated tenant pool.

Student Housing

Student housing is an apartment-style building run like a standard multifamily property, but with some key operational differences to attract student tenants. These properties often lease by the bed or by the unit, and may come pre-furnished.

Senior Housing

Senior housing caters to adults above a certain age threshold, generally either 55 years and older or 62 years and older. Independent living facilities will differ from assisted living facilities, and each will come with its own levels of staffing, licensing, and risk.

Low-Income Housing Tax Credit

Low-income housing tax credit (LIHTC) properties have rents restricted as a percentage of the Area Median Income (AMI). They come with higher operational load, but also tend to have consistent tenant demand as a tradeoff.

Why Invest in Multifamily Real Estate?

Multifamily units create steadier income and simple scale.

Multifamily assets pool rent from several homes under one roof, so your vacancy risk is spread across multiple units. You also get the efficiencies of one set of vendors, one roof to maintain, and one insurance policy.

Because of that structure, small changes in operations can move value. A $25 monthly fee across 30 units adds $9,000 to annual NOI. At a 6% cap rate, that supports about $150,000 of value.

Before you buy: Plan your finances with a vacancy and expense buffer. Be sure to use trailing actuals to get a sense of the property's real income and expenses over a recent period, rather than relying on a pro forma budget.

After you close: Track physical and economic occupancy, delinquency, and work order completion times. These help with tenant retention and drive rent growth.

What are the pros and cons of multifamily real estate investing?

Some of the pros of multifamily investing include diversified income streams and scalability, while the cons include higher capital requirements and market concentration risks. As with any investment, it's important to consider what fits your personal goals.

| Pros | Cons |

|---|---|

| Diversified income stream: In a 10-unit building, one vacancy still leaves 90% of rent while you backfill; vacancy risk spreads across units. | Higher capital requirements: Larger upfront equity; commercial deals often require 20%-35% down. |

| Operational efficiency: One vendor set, one roof, one insurance policy; economies of scale reduce per-unit management costs. | Complex regulations: Compliance with fair housing, building codes, ADA requirements, rent rules, and local inspections. |

| Scalable value creation: A $25 monthly fee across 30 units adds $9,000 annual NOI, supporting about $150,000 of value at a 6% cap rate. | Active management demands: Ongoing tenant screening, maintenance coordination, and compliance calendars. |

| Tax benefits: Depreciation and mortgage interest deductions, plus potential 20% QBI on qualified rental business income can improve after-tax returns. | Market concentration risk: Performance tied to local employment and neighborhood trends within one geographic area. |

| House hacking (2-4 units): Owner-occupancy can enable 3.5% FHA or 0% VA down while other units' rent offsets housing costs. | Higher transaction costs: Deeper due diligence (legal, financial, physical) and typically longer closing timelines. |

| Predictable cash flow: Multiple income streams and measurable metrics (NOI, DSCR) make returns more stable and analyzable. | Financing complexity (5+ units): DSCR thresholds (often ≥1.20), stabilized rent rolls, and detailed income underwriting vs. simpler residential loans. |

Single-family vs. multifamily investing

A single-family home is one dwelling on one parcel, unlike a multifamily home that contains two or more homes on one parcel.

Unlike single-family rentals where one vacancy eliminates 100% of your income, multifamily properties spread risk across multiple units. For example, when one tenant moves out of a 10-unit building, you still collect 90% of your rent while finding a replacement.

You also get the benefit of operational efficiencies, such as bulk purchasing for repairs and improvements, and an easier scaling process if you plan to expand your investment.

What is House Hacking?

House hacking is when you live in one unit and rent others to lower your payment.

In duplexes, triplexes, and fourplexes, you can live in one unit and rent out the rest to offset your mortgage, taxes, and insurance. If you plan to take this route, some owner-occupier loan programs might allow lower down payments and simpler qualifications.

House hacking is only an option for residential multifamily properties. Once you start investing in assets with five or more units, you won't be able to take advantage of the same benefits.

Before you buy: Stress test financials at market rent minus 10% with one vacant unit. If you can maintain the payment under those parameters, you will likely have a safe investment. Also, be sure to check local rules for owner occupancy and any short-term rental limitations.

After you close: Set clear maintenance response standards to help retain tenants and keep three to six months of expenses in reserve to avoid straining your cash flow.

What Tax Benefits Can Multifamily Real Estate Offer?

Depreciation and deductions can lift after-tax results.

As the owner of a multifamily asset, you can usually deduct the operating expenses, mortgage interest, and the annual depreciation of the building.

Depreciation takes the cost of the building and spreads it over 27.5 years under current tax law to come up with an annualized cost, which you can deduct from your taxable rental income. That calculation only includes the purchase price allocation of the building, not the land it's on, so be sure to check how your county or appraisal splits the total value between the two.

If you manage the property as a business, you may also qualify for pass-through deductions on qualified business income (QBI). This tax break allows you to deduct up to 20% of the profit you get from your property, as long as you run the rental as a business and meet income and IRS requirements. If you plan to house-hack, maintain separate finances and only claim QBI deductions on the rental business's qualified net income, not your personal unit.

Tax rules change and depend on your situation, so model scenarios with a licensed tax professional.

Before you buy: Ask your advisor to model after-tax cash flow with depreciation and your marginal tax rate.

After you close: Maintain a calendar with vendor 1099s and key filing dates.

How Do You Evaluate Returns on a Multifamily Deal?

Use core metrics and apply them differently for small vs. large properties.

Start by determining how much you'll earn each year on the cash you're investing and whether you're paying a sensible price that lenders will approve a loan for.

Metrics like NOI, cap rate, and DSCR are important to understand no matter what size your property is. Always conduct a multifamily break-even analysis before you buy to minimize your risk as an investor.

For small properties, appraisals rely on sales comps, so prices can be capped even when cash flow is strong. However, price and proceeds for large assets move directly with NOI and market cap rate. Build these numbers from trailing actuals, reset taxes to your purchase basis, and get a current insurance quote before you start.

Step 1: Find NOI

Add up rent and fees, then subtract vacancy and operating costs.

For example, if you collect $300,000 in rent and fees, vacancy costs are $15,000, and operating costs are $120,000, your NOI is $165,000.

Step 2: Find annual before-tax cash flow

Take your NOI and subtract your annual loan payments.

If your NOI is $165,000, and your loan payments are $130,000 annually, your before-tax cash flow is $35,000.

Step 3: Find your cash-on-cash return

You can find your cash-on-cash return by dividing your before-tax cash flow by your cash invested. Cash invested includes your down payment, closing costs, and any initial repairs. Use a cash-on-cash return calculator to simplify your calculations.

Continuing with our example, if your before-tax cash flow is $35,000 and you invested $800,000, your cash-on-cash return is 4.4%.

It's important to calculate cash-on-cash returns after you've funded reserves. Thin reserves can distort the real return of your investment.

Step 4: Use cap rate to sanity-check the price

Cap rate gives you a quick and easy way to compare price to income. Calculate it by dividing NOI by the purchase price.

With $165,000 NOI and a purchase price of $2.75 million, the cap rate is 6%. Take that metric and compare it to similar deals in the area.

Step 5: Use DSCR to size the loan

DSCR is NOI divided by your annual loan payments, and indicates how much the property is expected to generate after covering its debt obligations.

For example, a property with a DSCR of 1.25 is projected to generate 25% more income than needed to cover its debts. Lenders most often look for a DSCR of 1.20 or higher.

With annual debt service of $130,000 and NOI of $165,000, our hypothetical property has a DSCR of 1.27.

Step 6: Stress-test your underwriting

Pressure test your returns with interest rates one percentage point higher, rents 5% lower, and operating costs 5% higher. If your DSCR and cash-on-cash returns are still healthy with those numbers, you're in a safer zone.

How does the process differ for small multifamily properties?

Multifamily assets with two to four units are valued based on nearby comparable sales, so lenders won't require metrics like a cap rate or DSCR. However, these metrics are still valuable benchmarks as an investor.

Cash-on-cash tells you what your investment is earning. While cap rate is a reliable cross-check, it won't fully explain the price for small assets, and DSCR is a helpful gut check for risk. During the stress-test phase, be sure to include one vacant unit to get a full picture of the potential financials.

Keep in mind that if you plan to live in one unit, you should prorate income and expenses. Your personal unit isn't part of the rental NOI or cash-on-cash calculations.

What Financing Options Work for Multifamily Properties?

Small properties use residential loans. Larger assets use commercial financing.

Duplexes, triplexes, and fourplexes are usually financed like a single-family home. At five or more units, lenders underwrite the property's income and loan size is set by NOI and DSCR.

| Loan Type | Key Requirements | Best For | |||

|---|---|---|---|---|---|

| RESIDENTIAL FINANCING (2-4 Units) | |||||

| Conventional | Good credit score, stable income, debt-to-income ratios | Investors with strong personal finances | |||

| FHA (Owner-Occupied) | Must occupy one unit, 580+ credit score, mortgage insurance | First-time investors using house hacking strategy | |||

| VA (Owner-Occupied) | Military eligibility, must occupy one unit, funding fees | Eligible veterans and service members | |||

| COMMERCIAL FINANCING (5+ Units) | |||||

| Commercial Bank Loans | Minimum 1.20 DSCR, stabilized rents, full operating expenses | Experienced investors with established banking relationships | |||

| Agency Loans | Minimum 1.20 DSCR, property condition standards, long-term financing | Investors seeking competitive rates and long-term financing | |||

| HUD/FHA 223(f) | Existing properties, longer approval process, strict property standards | Investors focused on affordable housing with lower down payments | |||

| CMBS Loans | Minimum loan size typically $2M+, securitized, limited flexibility | Large-scale investors seeking competitive rates on major properties | |||

| Private/Hard Money | Higher rates, shorter terms, faster closing, asset-based | Investors needing quick closings or value-add opportunities | |||

Before you apply:

- Build a clean trailing 12 months, current rent roll, and simple capital plan.

- Reset property taxes to your purchase price and get an insurance quote.

- Know your credit, liquidity, and post-close reserves. Lenders will check all three.

How do government-backed loans help owner-occupants?

FHA and VA loans can lower down payments if you plan to house hack a property with two to four units. The FHA usually allows as little as 3.5% down if you plan to occupy one unit, and the VA can allow for zero down for eligible veterans and service members.

Rates and rules change, so be sure to check current guidelines with a lender and plan for mortgage insurance or funding fees where they apply.

What loans fit five-plus-unit properties?

For five or more units, agency and bank loans underwrite income with DSCR tests. Many lenders want a minimum DSCR of 1.20, although targets may vary by market and loan type. Expect lenders to underwrite for stabilized rents, realistic vacancy rates, and full operating expenses. If NOI falls short, either increase equity or reduce price.

It can be helpful to compare bank terms, agency debt, and other multifamily financing options before you make an offer. This helps you pick the loan that fits your plan for the property and avoid any surprises at closing.

What Legal and Regulatory Rules Apply to Multifamily?

Multifamily real estate is governed by housing laws, building codes, and local zoning.

From fair housing and building codes to zoning controls and rent regulations, multifamily real estate comes with rules you'll have to follow. Be sure to confirm the local regulations before you close on a deal.

Fair housing and landlord-tenant basics

The full leasing process, from advertising and screening tenants to repairs and evictions, will be governed by fair housing and landlord-tenant rules. Research them ahead of time to be prepared for your first tenants.

Fair housing rules bar discrimination in advertising, screening, leasing, and operating your multifamily asset. It's important to standardize renter criteria, keep clear records, and train anyone handling leasing on how to screen tenants properly.

Landlord-tenant laws set rules for notices, deposits, required notice to enter a unit, repairs, and evictions. The specifics will vary from city to city and state to state, so check for the rules that apply to your market. As a general rule, use current forms and post any required notices in the leasing office and common areas.

Buildings first occupied after 1991 must meet design and construction requirements set by the Fair Housing Act, including specific accessibility features for all units in elevator buildings and ground-floor units in walk-ups. Leasing offices and other public spaces must also meet ADA standards.

Building codes and safety systems

Apartment buildings must meet fire and safety codes. Plan for inspections of key safety features including sprinklers, alarms, and extinguishers. Create a compliance calendar for those as well as inspections of any elevators, boilers, pools, and backflow devices.

Don't rely on your seller representative for details about inspections or permits. Pull permit histories and any open code violations from your city to avoid any delays or fines at closing.

Zoning controls use, density, and parking

If you have plans to renovate or add units to a multifamily property, you'll need to understand local zoning rules. Zoning determines important factors including what you can build and how much parking you need.

Before you build, read local codes and verify the site plan with your city. If your plan doesn't fit the current code, you may need a zoning variance. Some buildings may have been legal when they were built, but no longer meet modern codes. These are considered legal nonconforming and, if you plan to expand or rebuild after damage, you may have to meet current code standards.

Rent regulations and local programs

Some cities cap rent increases to a certain percentage annually or set other limitations you'll need to follow. There may also be just-cause eviction rules, relocation fees, or periodic inspection requirements. Read local rules early in the process to ensure your pro forma and timeline are as accurate as possible.

What Should You Look for Before Buying a Multifamily Home?

Verify legal records, obtain a financial analysis, and inspect the physical property before you close.

Consider this checklist before you buy any multifamily property:

Legal verification

- Confirm legal unit count with the city to match what you're purchasing

- Pull permit history and check for open code violations

- Review rent control regulations that apply to your property

Financial analysis

- Obtain trailing 12-month financials with actual rent rolls and expenses

- Verify current market rents through local comparables

- Review all active leases for terms and tenant payment history

Physical assessment

- Inspect major systems including HVAC, plumbing, electrical, and roofing

- Document immediate capital expenditures needed after purchase

- Check recent safety inspections for fire systems, elevators, and boilers

Investment analysis

- Calculate key metrics (NOI, cap rate, cash-on-cash return, DSCR)

- Stress-test assumptions with higher vacancy and expense scenarios

- Get current insurance quotes and verify coverage requirements

Frequently Asked Questions

What's the difference between residential and commercial multifamily properties?

Residential multifamily properties contain two to four units and can be financed with conventional residential mortgages, FHA, or VA loans. Commercial multifamily properties have five or more units and require commercial financing with stricter qualification criteria, higher down payments, and different regulatory requirements.

This distinction affects everything from financing options and tax implications to property management approaches and exit strategies. If you're a new investor, starting with a small property that you can live in while renting the other units may provide an easier entry point into multifamily investing.

How does house hacking work with multifamily properties?

House hacking involves purchasing a multifamily property (typically two to four units), living in one unit while renting out the others. This strategy offers several advantages:

- You can qualify for owner-occupied financing with lower down payments (as low as 3.5% with FHA loans).

- Rental income from other units can offset or completely cover your mortgage and housing expenses.

- You gain hands-on landlord experience while living on-site to monitor your investment; and you build equity while generating income.

Rules and rates can vary depending on your location and qualifying factors. Be sure to check current guidelines and plan accordingly.

What financing options are available for multifamily property investments?

For small properties, you can access: conventional loans, FHA loans, VA loans, and state-specific first-time buyer programs offering favorable terms. For large properties, options include commercial bank loans, Fannie Mae or Freddie Mac multifamily programs, HUD/FHA 223(f) loans for existing properties, Commercial Mortgage-Backed Securities (CMBS) loans, and private money loans for short-term financing. Rules and rates vary, so check for up-to-date information during your planning process.

Owner-occupied strategies for smaller properties provide the most favorable terms, while larger properties require more substantial down payments but offer greater scale advantages.

What tax benefits do multifamily property owners receive?

Multifamily property owners can take advantage of numerous tax benefits, including: deducting operating expenses, depreciation deductions, mortgage interest deductions, pass-through income deductions, and capital improvements depreciation. Be sure to research income limits, IRS requirements, and other rules to get a clear picture of what benefits you can expect.

For owner-occupied properties, expenses must be prorated between personal and rental use. Consult with a tax professional experienced in real estate investments to maximize these benefits while ensuring compliance with current tax laws.