What is an ADU and Its Impact on Investment Properties

Key Takeaways

- ADUs generate additional rental income streams with construction costs ranging from $50k-$250k.

- Financing options include home equity loans, construction to permanent loans, and FHA renovation loans.

- Successful ADU investments require understanding local zoning regulations, calculating ROI using NOI and cap rates.

What is an ADU (Accessory Dwelling Unit)?

An accessory dwelling unit (ADU) is a self contained residential space built on the same property as an existing home. It includes essential living components like a kitchen, bathroom, and separate entrance, which legally distinguishes it from the primary residence. ADUs serve as independent living quarters while remaining secondary to the main structure in both size and function.

ADUs represent a unique opportunity for investors looking to maximize property value and generate additional income streams. Understanding the differences between residential real estate vs commercial is important when considering ADUs as investments. While not traditionally categorized among types of commercial real estate, ADUs offer investors a hybrid approach that combines residential property features with commercial-level returns.

The defining legal characteristic of an ADU is the kitchen, which distinguishes it from other additional spaces like bonus rooms or home offices. To qualify as an ADU, the unit must provide all essential elements for independent living, including cooking facilities, sleeping space, and bathroom amenities.

What is the Purpose of ADUs?

ADUs expand living options, generate rental income, and address housing shortages by increasing density on existing lots.

ADUs offer versatile solutions that serve multiple purposes. They can provide additional housing for family members or be rented out to generate extra income, making them a practical choice for property owners, even those involved in commercial real estate investments.

By maximizing the use of available land, ADUs can complement larger commercial portfolios, offering a hybrid strategy that blends residential features with commercial income potential. For those looking to invest in land, ADUs represent an innovative way to enhance property value while meeting current market demands.

What are the Types of ADUs?

The six main ADU types include detached new construction, garage conversions, above garage units, additions, basement conversions, and internal ADUs.

Each type offers unique benefits. Detached units provide greater privacy and higher rental premiums, though they come with higher construction costs. Garage conversions and basement adaptations typically require a lower initial investment and can deliver faster returns.

Above garage units, additions, and internal ADUs offer space efficiency and simpler construction processes, making them attractive in areas with tighter zoning restrictions. Investors looking for practical rental solutions may also benefit from learning how to find tenants to optimize their returns.

Types of ADUs: Comparison Chart

Costs are rough US-dollar ranges and complexity/privacy are relative. Detached builds tend to cost more but deliver the most privacy.

| ADU Type | Cost Range (USD) | Privacy Level | Construction Complexity |

|---|---|---|---|

| Detached New Construction | $150,000-$250,000 | High | High |

| Garage Conversion | $80,000-$150,000 | Medium | Medium |

| Above Garage | $100,000-$180,000 | Medium-High | Medium-High |

| Addition / Bump-out | $100,000-$180,000 | Low-Medium | Medium-High |

| Basement Conversion | $80,000-$150,000 | Low | Low |

| Internal ADU | $50,000-$100,000 | Low | Low |

Privacy levels, construction complexity, and cost ranges for the six main ADU options available to investors. *Costs and characteristics may vary by location, market conditions, and specific property constraints.

What are the Benefits & Use Cases of ADUs?

ADUs provide investors with a unique opportunity to diversify their portfolios. They offer steady rental income and long term appreciation potential without the complexity of large scale commercial developments.

Market trends show strong rental demand among single and two person households, making ADUs an effective solution for smaller housing needs. This demand can result in competitive returns, which investors can evaluate using a cash on cash return calculator.

ADUs also serve as a strategic alternative to traditional multifamily investments, offering benefits similar to the benefits of multifamily investing while reducing scale and management complexity. Additionally, ADUs create flexible exit strategies, presenting multiple disposition options that adapt to changing market conditions.

Financial Analysis

Investors must assess development costs, expected rental income, and tax benefits to determine the financial viability of ADUs. Construction expenses can vary based on design, location, and quality. Accurate budgeting is essential to project long term returns and guide financing decisions.

It is important to calculate key performance metrics such as internal rate of return and capitalization rate to measure profitability. Comparing these figures with similar commercial investments can help investors ensure competitive performance.

Financing options for ADUs vary in loan-to-value (LTV) ratios, flexibility, and underwriting standards. This table compares common choices, their pros, and their tradeoffs.

| Financing Option | Typical LTV Range | Pros (summary) | Cons (summary) |

|---|---|---|---|

| Home Equity Loan / HELOC | Up to 80% | Potentially lower interest rates; Easier qualification with strong equity | Primary residence is collateral; May limit future borrowing capacity |

| Construction-to-Permanent Loan | Up to 90% | Single loan covers build + mortgage; Lock in rate early | Strict underwriting; Requires detailed construction plans |

| FHA Renovation Loan | Up to 96.5% | Low down payment; Projected ADU rent can count as income | Mortgage insurance adds cost; Must meet FHA property standards |

| Portfolio Loan | Varies, often 70-80% | Flexible terms; Relationship-based lending | Often higher interest rates; Approval depends on bank risk appetite |

| Commercial Real Estate (CRE) Loan | Up to 70-75% | Access to larger capital; Structured terms for investors | Commercial underwriting standards; Rates often higher than residential |

Approximate ranges and features; actual terms vary by lender, borrower qualifications, and market conditions.

Regulatory & Zoning Considerations

Investors must understand local rules before developing an ADU. Regulations often cover requirements like owner occupancy and restrictions on short term rentals. Proper research helps avoid legal issues and project delays.

Checking zoning for land is the first step to determine what is allowed on a property. This process ensures that ADU designs meet local building and safety codes.

Additionally, understanding the need for a zone variance can be crucial when standard zoning rules limit ADU options. Investors should also research land entitlements to ensure the project complies with all regulatory requirements.

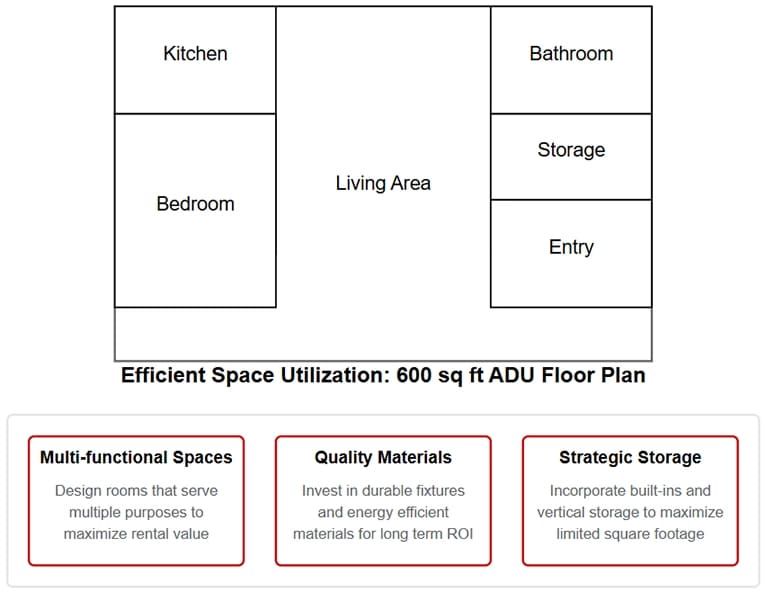

ADU Design & Construction Considerations

Designing an ADU requires a focus on efficient use of space while ensuring all essential living functions are met. Investors should consider the layout carefully to maximize rental appeal and functionality.

Space optimization plays a critical role in keeping construction costs manageable. Smart designs can reduce the overall footprint while still providing all necessary amenities, which is key for achieving competitive rental returns.

ADU Design & Construction Considerations

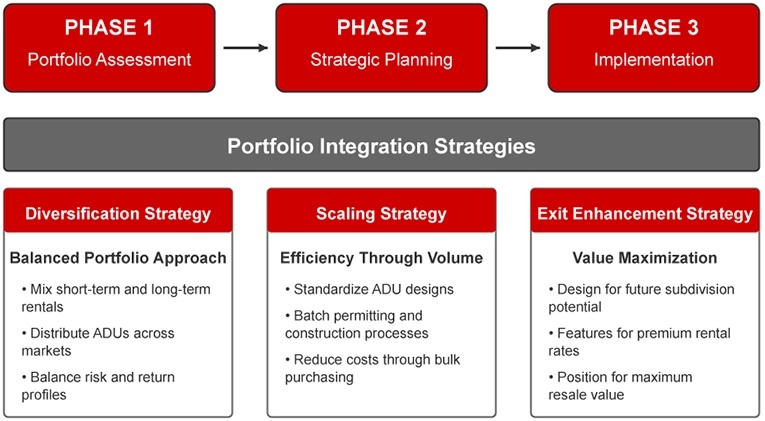

Investor Specific ADU Strategy & Portfolio Integration

Developing an ADU portfolio starts with a careful assessment of properties to identify those with optimal ADU development potential. Investors must evaluate lot characteristics, zoning requirements, and market dynamics to determine the best opportunities.

Strategically phasing multi property ADU developments can leverage economies of scale in design, permitting, and construction. This approach aligns with proven methods seen in a multifamily exit strategy and enhances overall investment efficiency.

ADU Portfolio Integration Strategy

Explore current investment properties in your area that offer strong ADU development potential to begin building your portfolio.

Investment Properties For Sale

Advanced ROI and Cash Flow Modeling

Accurate ROI and cash flow modeling is essential for evaluating ADU investments. Investors need a clear picture of how each unit contributes to overall portfolio performance and long term cash flow.

An investor grade pro forma template can help integrate variable inputs such as construction costs, rental income projections, and tax benefits. This detailed analysis provides a comprehensive view of potential returns over various investment horizons.

Sensitivity analysis enables investors to stress test ADU investments against market downturns, regulatory changes, and unexpected cost increases. By simulating different scenarios, they can adjust strategies to maintain robust cash flow even when conditions shift.

Utilizing tools like a NOI calculator, evaluating the DSCR, and using a GRM calculator can offer data driven insights for more informed decision making.

ADU Investment ROI and Cash Flow Model

10 Year Projection for an Accessory Dwelling Unit

Risk Management and Mitigation Strategies

Managing risk is critical when investing in ADUs. Investors should assess potential challenges, ranging from regulatory hurdles to unforeseen construction costs, early on and conduct thorough due diligence to minimize issues.

Implementing strategic tenant screening and understanding key processes like how to screen a tenant and lien waivers reinforces a solid risk management framework, ensuring long term cash flow stability and reducing operational challenges.

Frequently Asked Questions

What's the best way to finance my ADU project, and how do different loan options compare?

ADU financing typically involves a combination of options. Home equity products, FHA renovation loans, portfolio loans, and construction-to-permanent loans each offer unique benefits. Investors should prepare detailed construction documentation and market-based rental projections to secure favorable terms.

Which type of ADU will give me the best return on investment for my property?

ROI depends on property specifics and local market conditions. Garage conversions and basement adaptations generally offer faster returns due to lower costs, while detached units may provide higher rental premiums and long term appreciation. Detailed cost per square foot analysis and local rental rate comparisons are key.

How do I navigate conflicts between state ADU laws and local zoning restrictions?

Begin by reviewing both state laws and local ordinances. Creating a jurisdiction-specific checklist and consulting with local planning departments or legal advisors can help clarify requirements and prevent costly mistakes.

What systems should I implement for managing ADU tenants efficiently?

Develop tailored lease agreements and use property management software designed for ADU operations. Standardized tenant screening and separate utility metering can streamline operations and enhance cash flow management.