What is an Investment Property: Strategies, Financing, and ROI Metrics

Key Takeaways

- Investment properties generate returns through rental income, property appreciation, and positive cash flow from operations.

- Financing options range from conventional loans to alternative methods like DSCR loans and seller financing.

- Essential ROI metrics include cap rate, cash-on-cash return, NOI, and DSCR to evaluate profitability and compare investment opportunities.

What is an Investment Property?

An investment property is real estate bought mainly to earn a return through rental income or future sale profits.

Investment properties are not used as primary homes. They are bought to generate income or build wealth over time. Investors often face different loan guidelines and management needs with these assets. Learning about commercial vs residential can help clarify market differences.

Types of Investment Properties

Investment properties come in various forms, such as rental, commercial, and mixed use properties. Rental properties include single family homes, apartments, and multifamily units. These properties generate income from tenant rent and can build long term wealth through property appreciation. Many investors start with multifamily investing as it offers a steady income stream.

Commercial properties cover office spaces, retail outlets, and warehouses, to name a few. These properties often follow different financing guidelines and offer diverse income potentials. For more details, review the types of commercial property available in the market.

Mixed use properties combine residential and commercial spaces, such as a building with apartments above retail stores. Emerging models like co-living, short term rentals, and flex use spaces add to the variety.

For more context, browse available properties in your area to see examples of potential investment properties.

Commercial Real Estate For Sale

How Investors Make Money

Investors earn money from properties through rental income, property appreciation, and positive cash flow. Rental income comes from the rent paid by tenants each month.

Property appreciation means that the value of the property increases over time, allowing investors to sell for a higher price. Positive cash flow occurs when the income exceeds the expenses, creating extra profit.

Calculating your returns is key. Use a cash on cash calculator to see how much profit you make relative to your cash investment. Learn how to calculate NOI to understand your property's operating performance. Also, check the cap rate for a quick view of investment potential.

Investment Property Cash flow Breakdown (Sample Data)

Financing Options and Loan Requirements

Investors can choose from various loan types when buying an investment property. Traditional loans include conventional, FHA, VA, and portfolio loans. Each option has different qualification criteria and down payment requirements.

For example, conventional loans usually need higher down payments and credit scores. FHA and VA loans offer lower down payments if you qualify, but they have specific rules. Portfolio loans may provide more flexible terms if your financial profile meets lender standards.

Alternative financing methods also exist. DSCR loans, hard money, private lending, and seller financing are options for those with unique investment goals. These methods can help when traditional loans are not ideal. Learn more about CRE loans to see all financing paths available.

| Financing Type | Credit Score Requirement | Down Payment Requirement | Unique Features |

|---|---|---|---|

| Conventional | 620-640+ | 20-25%+ | Standard financing with competitive rates for qualified borrowers. |

| FHA | 580+ | 3.5% (if owner occupied) | Lower down payment for owner occupied multi-unit properties. |

| VA | Varies | 0% for eligible veterans | No down payment for qualified veterans. |

| Portfolio | Flexible | Varies | Customized financing based on unique borrower profiles. |

| DSCR | Depends on lender | Varies | Focus on property income to meet debt coverage ratio. |

| Hard Money | Flexible | Higher due to risk | Asset-based lending with fast approval; higher interest rates. |

| Private Lending | Flexible | Varies | Offers flexible terms based on personal arrangements. |

| Seller Financing | Flexible | Negotiable | Financing provided by the seller with flexible terms. |

For investors focused on rental properties, checking multifamily loan interest rates can be helpful. Also, consider owner financed real estate as an option when traditional loans do not meet your needs.

Financial Analysis and ROI Metrics

| Metric | Formula | Explanation |

|---|---|---|

| Cash Flow | Rental Income - Expenses | Net income after operating costs. |

| NOI | Rental Income - Operating Expenses | Shows property performance before financing costs. |

| Cap Rate | NOI / Property Value | Indicates the expected return on investment. |

| Cash on Cash Return | Annual Cash Flow / Initial Cash Investment | Measures profitability relative to cash invested. |

| GRM | Property Price / Gross Annual Rental Income | Assesses income potential against the purchase price. |

Start by running key financial calculations on your property. Calculate cash flow to see if your rental income exceeds expenses. Use NOI to pinpoint operating income after costs.

Next, compare properties by determining the cap rate, which tells you the expected return on the property's value. Calculate your cash on cash return to see how much profit you make relative to your initial investment.

Calculate the internal rate of return to project long term gains, as it helps you assess the overall profitability of your investment over time. Review DSCR data to assess how well your property income covers debts. Finally, use a GRM calculator to compare income potential among different properties.

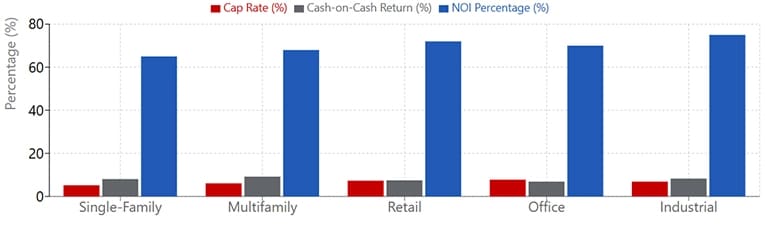

ROI Metrics by Property Type (Sample Data)

Investment Strategies

Begin by defining your investment goal and choosing a strategy that fits your budget and time. Consider buy and hold for steady rental income, fix and flip to quickly profit from renovations, or house hacking to lower your own housing costs.

If you aim for long term returns, study CRE investments to identify properties with strong rental potential. Look for properties that need minor updates to add value over time.

For quicker returns, explore buying a distressed property where you can renovate and resell. If you want to live on site while renting out units, consider purchasing a duplex to ease into house hacking, a common first step in duplex investing.

Risk Management and Exit Strategies

Start by assessing all risks associated with your property. Create a risk matrix that covers market changes, tenant defaults, property damage, financing terms, and regulatory shifts. This helps you plan ahead and protect your investment.

Develop an exit strategy before you buy. Decide if you will refinance, sell using a multifamily exit strategies plan, or use a 1031 exchange to defer taxes. Also, evaluate your exit cap rate to determine the potential resale value. A clear exit plan allows you to adjust your strategy when market conditions change.

Monitor your portfolio regularly. Adjust your risk management and exit plans as needed to stay aligned with your financial goals and market trends.

Frequently Asked Questions

How do I know if I'm financially ready to purchase my first investment property?

Begin by ensuring you have enough savings for both a down payment and a reserve fund for unexpected costs. Check that your credit score is above 680 and your debt to income ratio is below 50%.

How should I decide whether to self manage my property or hire a property manager?

Evaluate your location, experience, and time availability. If you live close to your property, can handle tenant issues, and have a few extra hours each week, self management might be best. Otherwise, hiring a professional manager can keep your income steady.