What is Title Insurance and Why do Commercial Property Investors Need it?

What Is Title Insurance?

Title insurance protects investors and lenders from financial loss tied to a property's ownership history. It covers past issues, like liens, unpaid taxes, or ownership disputes. These problems may appear after closing, even if the title looked clear at the time.

Unlike traditional insurance that protects against future risks, title insurance is legal coverage for pre-existing problems. These could include forged signatures, clerical errors in public records, or unresolved debts tied to the property. If someone later claims they have legal rights to the building you bought, your title policy helps cover legal fees and financial damages, up to the policy amount.

Before a policy is issued, the title company performs a title search, digging through deeds, court records, and tax filings to verify ownership. This is your first line of defense, but not a guarantee. If the search misses something, title insurance provides a financial safety net.

Most commercial investors buy two policies at closing:

- Lender's title insurance (required if you use financing).

- Owner's title insurance (optional but highly recommended).

These policies work alongside legal documentation like a warranty deed, which affirms the seller has the right to transfer ownership. But unlike a deed, which may still leave you exposed, title insurance absorbs the financial risk if that claim turns out to be false.

In commercial real estate, protecting legal ownership is just as important as maximizing returns. Title insurance is a one time cost, but it can save you from years of legal trouble.

Types of Title Insurance: Lender's vs Owner's

There are two main types of title insurance: lender's and owner's. Each protects a different party in a real estate deal and serves distinct purposes throughout the ownership lifecycle.

| Feature | Lender's Title Insurance | Owner's Title Insurance |

|---|---|---|

| Who It Protects | Lender's investment and security interest | Property owner's equity and ownership rights |

| Required? | Yes (if financing) | Optional but highly recommended |

| Coverage Duration | Until loan is paid off | As long as you own the property |

| Primary Coverage | Protects loan amount and lender's security | Legal costs and ownership challenges |

| Special Endorsements | Limited to loan-related protections | Zoning, access, environmental coverage available |

| Cost Responsibility | Usually buyer pays | Negotiable between buyer and seller |

Understanding these key differences helps you make informed decisions about coverage. Here's what each policy means for your investment:

Lender's title insurance

Lender's title insurance is non-negotiable if you're financing your commercial property purchase. This policy protects the lender's investment in case a title issue threatens their security interest, but it provides no protection for your equity in the property.

Owner's title insurance

Owner's title insurance is where smart investors focus their attention. While optional, this policy protects your equity and covers legal costs if someone challenges your ownership. In commercial deals, owner's coverage becomes even more valuable because you can add specialized endorsements for zoning violations, access disputes, environmental issues, and other commercial-specific risks.

This flexibility is especially important when your building has multiple tenants, shared utilities, or mixed-use zoning, situations that create unique title vulnerabilities.

Stacking both policies gives you complete protection. The lender's policy shields your financing, while the owner's policy protects your investment. If your deal involves CRE loans, remember that your loan to value ratio determines how much equity you have at risk, making owner's coverage a critical consideration for protecting that investment.

Commercial Title Insurance

Commercial title insurance operates in a different league than residential policies. The stakes are higher, the coverage is more complex, and the risks are unique to income producing properties.

Key differences at a glance

The gap between residential and commercial title insurance becomes clear when you compare them side by side:

| Feature | Residential Title Insurance | Commercial Title Insurance |

|---|---|---|

| Coverage Limits | $500K - $1M typical | $10M - $50M+ common |

| Endorsements Available | Basic coverage options | Zoning, environmental, access, subdivision compliance |

| Ownership Structures | Individual or joint ownership | LLCs, partnerships, REITs, corporations |

| Risk Factors | Basic title defects | Income loss, tenant liens, easement disputes |

Coverage limits and liability structures

Commercial policies routinely protect $10 million, $50 million, or more because they reflect the reality that commercial properties generate income streams extending far beyond the initial purchase price.

Commercial policies also handle liability differently. If you're buying a shopping center with multiple tenants, a title defect could affect rental income for years. Your policy needs to account for lost cash flow, not just the building's value.

Specialized endorsements for commercial properties

This is where commercial coverage really shines. Commercial policies can be customized with endorsements that address specific risks:

- Comprehensive zoning coverage protects against violations that could shut down operations

- Environmental lien coverage shields you from cleanup costs tied to previous owners

- Subdivision compliance protection ensures the property meets all development requirements

- Access and easement endorsements guarantee tenants and customers can reach the building

These endorsements typically add 10% to 25% to your base premium. But they can save you hundreds of thousands if problems surface later.

Complex ownership structures

Commercial deals often involve LLCs, partnerships, or REITs. Standard residential policies aren't designed for these structures. Commercial title insurance addresses pass-through liability concerns and succession planning.

If you're buying through a partnership, the policy needs to protect all partners individually. If you're planning to sell shares in your REIT, the coverage should transfer to new shareholders. These aren't concerns in residential real estate deals, but they're critical in commercial transactions.

Multi-tenant property considerations

Properties with multiple tenants create unique title challenges. Tenant improvements might include unrecorded liens. Shared facility agreements between neighboring properties could create easement disputes. Cross default provisions in one lease might affect the entire building's marketability.

Commercial title insurance can address these through specific endorsements. But you need to identify these risks during due diligence, not after closing.

The difference between residential and commercial title insurance isn't just about money. It's about understanding that different property types create different risks. And when you're ready to sell the property, having comprehensive coverage from day one makes the transaction smoother for everyone involved.

What Are the Most Common Title Defects in Commercial Properties?

Commercial properties face unique title challenges that rarely appear in residential transactions. The table below organizes the most common defects by likelihood and potential impact to help you evaluate risk and determine appropriate insurance coverage.

| Defect Type | Likelihood | Financial Impact | Typical Resolution |

|---|---|---|---|

| Easement Disputes | High | Medium to High | Negotiate new agreements or legal action |

| Access Issues | High | High | Establish legal access rights or renegotiate |

| Mechanic's Liens | Medium | Medium | Payment to contractors or bonding off |

| Contractor Claims | Medium | Low to Medium | Obtain proper lien waivers or settle claims |

| Zoning Violations | Medium | Very High | Obtain variance or cease non-compliant use |

| Unpermitted Improvements | Medium | Medium to High | Obtain retroactive permits or remove improvements |

| Unpaid Property Taxes | Low | Low to Medium | Pay outstanding taxes and penalties |

| Boundary Disputes | Low | Very High | Survey resolution or legal proceedings |

Let's examine the most problematic defects in detail:

Easement disputes and access issues

Easement problems top the list of commercial title defects because they're often inadequately documented. A previous owner might have granted utility access through a handshake agreement that was never properly recorded, or a neighboring property owner may produce a decades-old document claiming parking rights that your title search missed.

These disputes are particularly costly with multi-tenant buildings where blocked access means immediate rental income loss. That's why access endorsements on your title policy make sense for most commercial deals.

Mechanic's liens and contractor claims

Construction and renovation work creates lien risks that can surface months after completion. A subcontractor who wasn't paid by the general contractor can file a lien against your property, even if you paid the general contractor in full.

These liens often aren't discovered during the initial title search because they're filed after work begins but before the search is completed. That's why getting proper lien waivers during any construction project is critical.

Zoning violations and compliance issues

Zoning defects can shut down your operations overnight. The previous owner might have been using the building for purposes that violate current zoning laws. Or they might have made improvements without proper permits.

A zoning variance can sometimes solve these problems, but the process takes time and money. Reciprocal easement agreements add another layer of complexity in shared-use arrangements between neighboring properties.

The key is identifying these risks before closing, not after. Your title insurance provides financial protection, but prevention through thorough due diligence is always better than dealing with problems later.

How Much Does Commercial Title Insurance Cost?

Commercial title insurance costs vary significantly based on property value, location, and coverage type. Understanding the pricing structure helps you budget accurately and negotiate better terms.

Base premium calculation

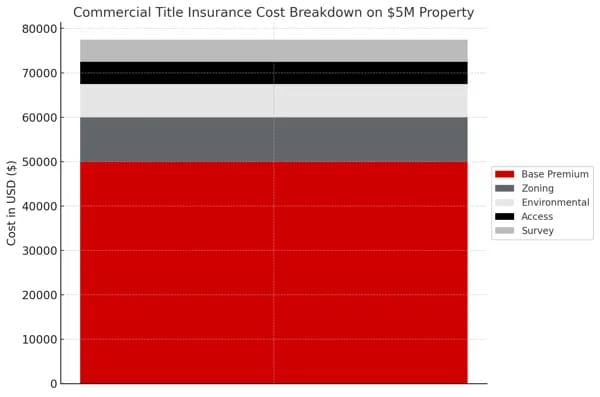

Most states use regulated rate tables that charge a percentage of the property's purchase price or loan amount. Typical rates range from 0.5% to 1.5% of the transaction value. A $5 million office building might carry a $25,000 to $75,000 premium.

Some states allow competitive pricing between title companies. In these markets, you can often negotiate lower rates, especially on larger transactions or when buying multiple properties.

Endorsement costs and add-ons

Standard policies cover basic title defects, but commercial properties often need additional protection. Common endorsements include:

- Zoning coverage: Adds 15% to 25% to base premium

- Environmental protection: Typically 10% to 20% additional

- Access and easement coverage: Usually 5% to 15% extra

- Survey coverage: Generally 5% to 10% more

These percentages stack, so comprehensive coverage can double your base premium. But the protection is typically worth the cost on complex commercial deals.

Strategies to reduce costs

Several approaches can lower your title insurance expenses without sacrificing protection. Negotiate for the seller to pay part or all of the premium during purchase negotiations. Volume discounts apply when you're buying multiple properties or working with the same title company regularly.

In competitive pricing states, get quotes from multiple providers. Rates can vary by 20% to 30% between companies. Consider whether all endorsements are necessary for your specific property and investment strategy.

The Title Search and Underwriting Process

The title search and underwriting process for commercial properties involves more complexity and scrutiny than residential transactions. I've seen deals fall apart because buyers didn't understand what they were getting into.

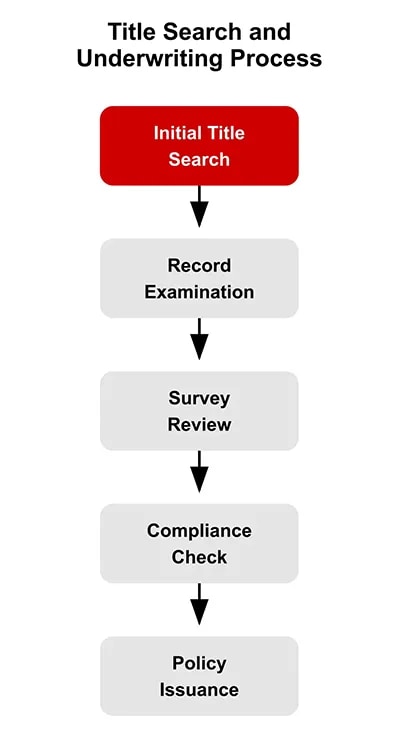

Initial title examination

The title company searches public records going back 30 to 60 years, examining deeds, mortgages, deeds of trust, tax records, and court judgments to trace ownership history. Commercial searches often take longer because of complex ownership structures, dissolved corporations or inactive partnerships require additional documentation.

Survey and compliance review

Most commercial deals require an updated survey to identify boundary disputes, encroachments, or easement conflicts. If the existing survey is outdated, you'll need a new one. This adds two to four weeks and costs $5,000 to $15,000.

Commercial underwriters also review environmental reports and zoning compliance, looking for environmental liens and unpermitted improvements that residential searches typically miss.

Timeline expectations

Commercial title searches typically take 10 to 20 business days, compared to 3 to 5 days for residential properties. Complex ownership histories or discovered defects can extend this significantly.

Plan for potential delays when structuring your due diligence period. The reality is that rushing the title process rarely ends well in commercial deals.

Negotiation & Selection Strategies for Title Companies

Choosing the right title company and negotiating favorable terms can save thousands on commercial transactions. Smart investors treat title insurance as a negotiable expense, not a fixed cost.

Who pays for title insurance?

In most commercial deals, title insurance costs are negotiable between buyer and seller. Common arrangements include seller paying owner's policy while buyer covers lender's policy, splitting costs 50/50, or rolling the entire premium into the purchase price negotiations. The key is addressing this early in your offer rather than assuming standard practice applies.

Selecting the right title company

Not all title companies handle complex commercial transactions equally well. Look for companies with specific commercial experience, especially in your property type and geographic market. A commercial broker can often recommend title companies they've worked with successfully on similar deals.

If you're planning multiple acquisitions, establishing a relationship with one title company can lead to better pricing and faster service on future transactions.

How Does Title Insurance Work During Due Diligence?

Title insurance integrates directly into your due diligence process, providing both protection and valuable information that influences your investment decision. Smart investors use the title search as a key component of their property evaluation.

Preliminary title reports

Most title companies issue a preliminary report within 5 to 10 days of your request. This document reveals existing liens, easements, and potential title defects before you're committed to the purchase.

The preliminary report is your roadmap for negotiations. If it shows unpaid property taxes, you can demand the seller clear them before closing. If there's an easement that affects your development plans, you can adjust your offer or walk away entirely.

Identifying deal breakers early

Some title issues are fixable. Others should send you running. Unpaid taxes, outstanding mortgages, and recorded liens can typically be resolved with money and time. But boundary disputes with neighboring properties or zoning violations that prevent your intended use? Those are much harder to fix. I've learned it's better to discover these problems during due diligence than after you own the building.

Frequently Asked Questions

How does title insurance differ for commercial properties versus residential properties?

Commercial title insurance typically involves higher coverage limits, more complex liability provisions, and specialized endorsements compared to residential policies. Commercial properties often present unique challenges including multi-tenant structures, complex ownership entities (like REITs or partnerships), and more extensive due diligence requirements for zoning compliance and development restrictions.

Is it possible to reduce title insurance costs while maintaining adequate protection?

Yes, you can negotiate for the seller to cover part or all of the owner's title insurance premium, leverage volume discounts for multiple properties, and comparison shop among providers in states without regulated pricing. Carefully evaluate which endorsements are truly necessary for your specific property rather than automatically purchasing all available options.