Office vs. Coworking Space: Returns, Risks, and Cash Flow Compared

Key Takeaways

- Traditional offices offer stable long term leases and simpler operations, but vacancy events are large and costly when tenants leave.

- Coworking spaces can earn higher revenue per square foot through memberships and services, but behave like an operating business with higher management and cash reserve needs.

- Location and layout quality drive returns: Coworking is more sensitive to walkability, convenience, and design, while offices lean on asset quality and tenant strength.

What's the Difference Between an Office and a Coworking Space?

Traditional offices are private, while coworking spaces are shared.

Traditional offices have one or more tenants under long-term leases and are often customized with fixed layouts and controlled access.

In coworking spaces, multiple businesses or individuals operate independently of one another, but share amenities such as conference rooms, lounges, and internet. They operate under flexible, potentially short-term membership agreements.

Both can generate predictable income when run well, but their cash flow stability, operating costs, and risk exposure differ significantly. Choosing the wrong one for your portfolio can mean losing out on returns while you're locked into an asset you can't exit.

The key differences for CRE investors

| Factor | Traditional Office | Coworking Space |

|---|---|---|

| Occupancy Model | Single tenant per suite or floor | Multiple short-term members |

| Lease Structure | 3-10 year leases, fixed rent | Month-to-month or annual memberships |

| Cash Flow Profile | Predictable, stable | Variable, depends on occupancy |

| Operational Involvement | Low: focus on maintenance and leasing | High: active management, marketing, community |

| Revenue per Square Foot | Moderate and limited by fixed lease | Potentially higher via tiered memberships and service add-ons |

| Vacancy Risk | Large but infrequent events | Frequent but small and offset by scale |

| Cap Ex & Build Out | Tenant-driven improvements | Operator-driven fit-outs and upgrades |

| Financing Appeal | Easier debt underwriting | Requires conservative leverage and liquidity |

| Adaptability | Slow to adjust to market shifts | Agile and can reprice and reconfigure quickly |

How spatial efficiency affects returns

Traditional offices often underutilize space because they're built around fixed desks, private offices, and meeting rooms that may sit idle. That creates stability as a landlord, but limits your ability to capture revenue from underutilized space.

Coworking spaces optimize every square foot. You can reconfigure space based on demand data, and that agility allows you to capture more revenue from the same footprint compared to traditional offices.

For an investor, that utilization gap directly affects revenue per square foot. A coworking floor with 120 members can produce more gross income than a similar office space leased to a single tenant, even if the nominal rent per square foot is lower. However, that comes with more hands-on operations. You'll be responsible for staffing, marketing, and member churn, all of which require active oversight.

Design drives tenant retention and asset value

In a traditional office, much of tenant retention hinges on factors outside the space itself, such as location or building class. As an investor, look for buildings that have efficient layouts, natural light, and reliable systems. These can lead to improved tenant satisfaction, lower turnover rates, and rent growth, which flows through to net operating income (NOI) and valuation.

Your value as an investor comes from the quality of the asset you choose to buy. Class A buildings in strong locations attract stable tenants and can command higher rents. Class B and C buildings compete more on price and may see more turnover.

Review current office listings in your market to get a sense of available layouts and designs.

Office Spaces For Sale

In a coworking space, you have more control over design, layout, and amenities. Coworking members choose a location based on the complete experience, not just the address. Interior design, lighting, acoustics, and amenity mix will impact member churn and revenue.

That control translates to more flexibility to meet demand and increase your coworking space profitability. You can evolve your space as market needs change and more quickly adapt to sustain occupancy and NOI.

Review coworking space for lease in your market to see what types of coworking spaces are nearby and what competitors offer. The costs to open a coworking space will differ from office startup costs, so plan to set aside more budget for interior improvements than you would for a traditional office. That upfront investment contributes to higher rent per square foot and more stable occupancy.

How Does Financing Differ Between Offices and Coworking Spaces?

Lenders view coworking income as riskier and less predictable.

Traditional office loans are underwritten on the strength of long-term leases. A lender can model five to 10 years of fixed rent, verify tenant credit, and size debt against a stable NOI.

Revenue from coworking spaces, on the other hand, comes from short-term memberships, which introduces turnover and operating volatility. As a result, lenders often classify them as a hybrid between commercial real estate and hospitality. That means lower loan-to-value (LTV) ratios, tighter debt service coverage requirements, and greater emphasis on the operator's track record.

Review other financing factors to determine which option is best for your goals:

| Financing Factor | Traditional Office | Coworking Space |

|---|---|---|

| Revenue Basis | Long-term leases with fixed rent and credit-rated tenants | Short-term memberships with variable income |

| Underwriting Approach | Lease-based NOI projection | Operating-business performance modeling |

| Lender Perception | Stable, predictable cash flow | Volatile, operationally intensive cash flow |

| Typical LTV | 65-75% | 55-65% |

| Typical DSCR | 1.20x-1.30x | 1.35x-1.50x |

| Financing Type | Conventional CRE loan | Hybrid CRE-business loan or hospitality-style facility |

| Operator Structure Impact | Single-tenant or multi-tenant leases treated uniformly | Master lease = bankable Management agreement = limited financing options |

| Capital Expenditure Profile | Tenant improvements funded at lease start or renewal | Higher upfront buildout and recurring refresh costs |

| Reserves Required | Moderate (TI/LC reserves) | High (working-capital and stabilization reserves) |

| Valuation Impact | Lower cap rates, easier debt sizing | Higher cap rates due to perceived risk |

| Refinancing Flexibility | Straightforward Lenders rely on lease roll and tenant credit |

Complex Depends on occupancy history and operator performance |

| Owner-User Eligibility (SBA) | Eligible if >50% owner-occupied | Typically ineligible Possible only if the operator meets owner-occupancy standards. |

How lease types impact financeability

As a building owner, traditional offices operate more like a bond: You sign one or a few tenants, lock in long term lengths, and underwrite around base rent plus recoveries. Most traditional offices will operate under either a net lease or a gross lease.

The appeal is simple: You only need to find one to a few creditworthy tenants. They sign leases with annual escalations, which produces stable, financeable cash flow. You can size debt cleanly and set reserves with confidence.

Coworking revenue is transactional. Instead of one lease, you have dozens or hundreds of memberships at different tiers with their own price point and term.

That structure can increase your effective revenue per square foot because the same space can be used by multiple members. The tradeoff is volatility. When demand softens, memberships can churn more quickly and your income statement will reflect that within a few cycles.

Because lease type determines how predictable income appears to lenders, offices with long-term net leases typically qualify for higher loan-to-value ratios and lower debt service coverage ratio (DSCR) thresholds. Coworking spaces, with shorter memberships and operational volatility, often need more equity and stronger working-capital reserves to secure conservative debt.

Capital reserves and improvement costs diverge sharply.

Office landlords budget for tenant improvements and leasing commissions at renewal, but the timing is predictable and usually funded through loan reserves.

Coworking spaces, however, demand higher upfront capex to fund improvements like furniture, demountable walls, shared amenities and ongoing reinvestment to maintain appeal. Most lenders require a working-capital reserve or line of credit to support that cycle.

Exit and valuation implications

Because of these financing nuances, coworking properties often trade at higher cap rates than stabilized offices. Debt terms and perceived income risk directly influence valuation. In the right scenario, that can present an opportunity: Assets with proven coworking performance but conservative lender assumptions may offer attractive yield spreads relative to traditional offices.

How Does Occupancy Volatility Affect Cash Flow?

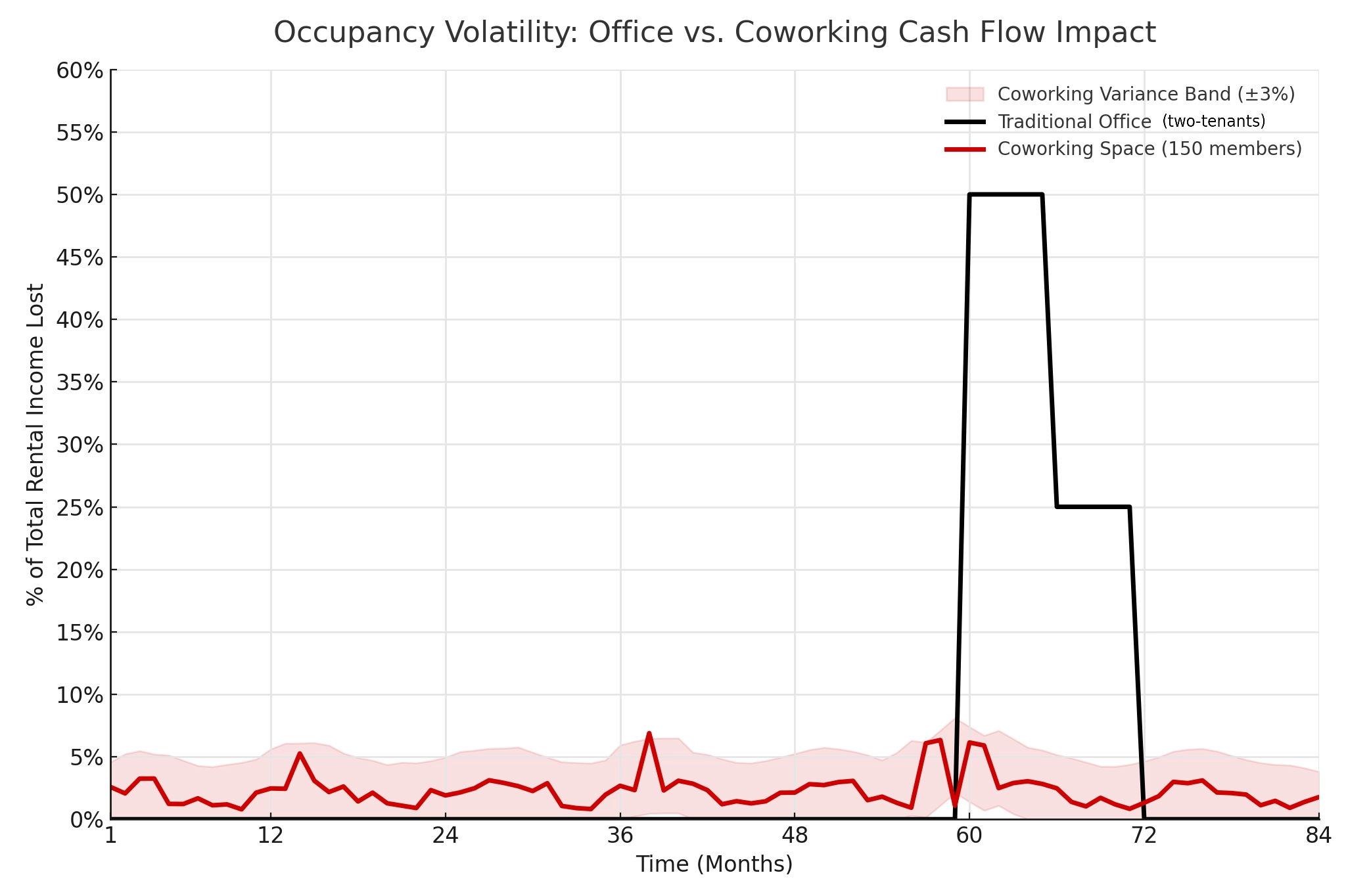

Traditional offices concentrate vacancy risk at lease end.

The financial impact of office leasing hits in waves. First, you lose a monthly tenant that likely made up a significant portion of your rental income. Then you have to invest in tenant improvements and leasing commissions to attract new tenants, and may have to offer concessions with the new lease. A single vacancy might cost you 12 months of lost and reduced income.

Coworking spaces fluctuate with demand.

Coworking spaces experience constant small-scale turnover instead. Individual members might cancel regularly, but they represent a relatively small proportion of your overall revenue. Member churn impact decreases and cash flow becomes more predictable as you scale. At 50 members, losing five in one month is a 10% hit. At 150 members it's only 3% and likely negated by regular new member signups.

The key question is which volatility profile fits your capital plan. Longer leases support higher leverage and lower touch operations. Coworking offers faster repricing and more upside potential, but it requires conservative debt and stronger liquidity.

How Do Market Downturns Affect Offices vs. Coworking Spaces?

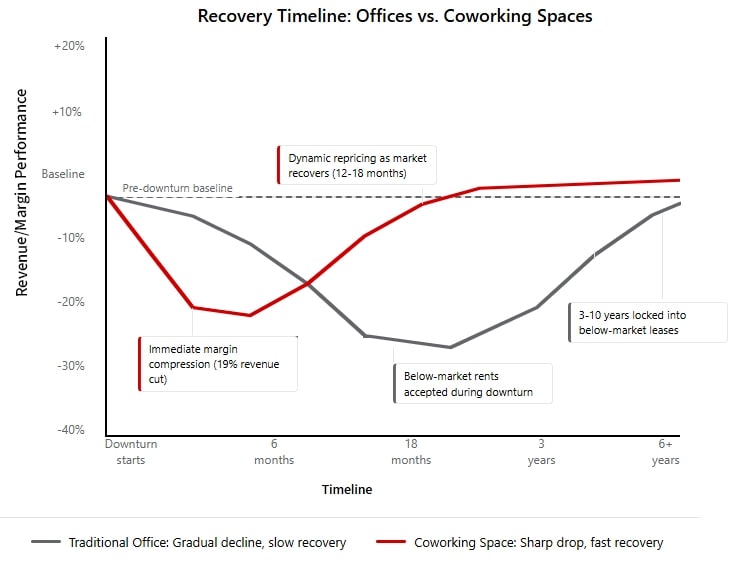

Offices face long recoveries, while coworking spaces adapt with margin impact.

During market downturns, risks cascade for traditional office owners. Tenant demand softens, which extends the time it takes you to fill vacant spaces. Then, asking rents fall while tenant improvement allowances and concessions increase as landlords compete for tenants.

Recovery can take years instead of months. Resetting to previous rent levels after lower rents and increased concessions requires sustained demand growth. And traditional offices' long-term leases mean you're locked into lower rent rates until those leases expire in three to 10 years.

Coworking spaces can adjust prices more dynamically to respond to a weak market, but the tradeoff is that your margins immediately compress. Lowering fees from $400 to $325 per month is a 19% revenue cut for every new member, and meanwhile your operating expenses stay the same. Falling below your break-even occupancy threshold means relying on reserves until the market recovers.

How Do Amenities Drive Returns in Offices vs. Coworking Spaces?

Traditional offices rely on strong locations and solid building features, while coworking spaces depend on extensive amenities to attract members.

For both offices and coworking spaces, basic amenities like reliable internet and secure access drive tenant satisfaction, which reduces turnover.

On-site management and responsive maintenance services can set your office building apart and help command higher rents. But for the most part offices justify premium rents through location and building quality rather than programmed amenities.

That's not necessarily the case for coworking spaces. When prospective members consider what to look for in a coworking space, they'll base their decision on the complete experience. Aesthetics, community and networking opportunities, a well-stocked kitchen, printing access, comfortable work areas, and other quality-of-life amenities help justify higher membership costs that drive improved margins. Familiarize yourself with what what members prioritize when they consider how to find a coworking space, and use that help decide what amenities to prioritize.

How do you calculate amenity ROI?

For office buildings, gauge amenities based on whether they either increase cost per square foot, or improve tenant retention. If renovating a fitness center costs $500,000 but adds $1.50 in a 50,000 square foot building, that's $75,000 in additional annual revenue and a 15% return. Even if rent growth is modest, retaining a large tenant can still be worth hundreds of thousands in avoided vacancy and re-lease costs.

In a coworking space, focus on how amenities decrease churn and increase occupancy rate. Say you invested $50,000 to upgrade to furniture and lighting in a 150-member space with an average $350 monthly membership. If it helps you move occupancy from 70% to 80%, that's an additional $63,000 in annual revenue.

How Does Location Affect Office vs. Coworking Returns?

Offices command premiums for CBD locations, and coworking spaces need walkable neighborhoods.

Office tenants will pay premium rents for access to premium addresses and nearby business infrastructure. Review office space for lease in those core markets to learn what tenants are willing to pay, and factor those estimates into your financial metrics.

Keep commutes and parking in mind when considering office buildings for sale. Parking ratios matter for tenants, especially in suburban markets. Urban properties can operate with fewer parking spaces if they're located near transit access, especially in gateway cities with high public transit usage.

Coworking spaces appeal to hybrid or remote workers who want locations near their homes. Locations with a high walk score are more likely to perform well, as they offer members convenient access to restaurants and other nearby amenities.

In the case of coworking, focus more on locations that will drive member satisfaction and where coworking space demand is high, rather than building class. A Class B building with plenty of nearby lunch options that's also close to the local daycare and gym will likely have lower member churn than a Class A building further from your members' day-to-day needs.

Established cores vs. emerging districts

Established business districts typically offer stronger tenant quality, deeper demand, and slower market swings. The tradeoff is higher property prices, but investors willing to accept lower initial yields in return for durable income and lower risk can benefit from these assets.

Emerging innovation districts can offer better yield and appreciation potential at the risk of thinner demand and sensitivity to employer moves. Bet wrong on an emerging district and you'll burn through reserves for years waiting for anchor tenants that never arrive. Expect more active management, conservative leverage, and real downside planning.

How Does Hybrid Work Affect Offices vs. Coworking Spaces?

Traditional offices struggle with underutilized space, while coworking benefits from hybrid work.

Understanding how hybrid work reshapes occupancy patterns helps investors project future cash flow and risk across both models.

Office tenants who adopted hybrid work policies likely no longer fully utilize their space. That can lead to downsizing when it's time to renew leases as they look for savings and more efficient space utilization. That can increase vacancy risk for you as a landlord, since you'll need to find a new tenant for that larger space.

This shift can mean shorter leases, smaller spaces, and more tenants per building in traditional offices. Investors who can reconfigure large floors into divisible, modern layouts can capture changing hybrid demand.

Conversely, coworking spaces benefit from the increase in hybrid work because the business model is built around variable occupancy. Operators can take advantage of the fact that hybrid workers likely won't be onsite five days a week by onboarding more members than there are physical desks.

Flexible leasing models are replacing rigid commitments

Some traditional office landlords are building flexibility into their leases to attract and retain tenants. They may offer hybrid leases where a tenant commits to a smaller private suite, but can reserve additional space as needed, for example, or they might carve out a portion of their building as a "flex floor" and partner with a coworking space to run it.

Adding flexible terms helps you as a landlord avoid long gaps between tenants at lease-end and helps adapt to changing market conditions.

Frequently Asked Questions

How do I calculate the true ROI when deciding between traditional office and coworking space?

To calculate the true ROI, look beyond the base rent or membership fees. For traditional offices, include lease costs, utilities, furniture, technology setup, maintenance, and security deposits. For coworking, factor in membership fees, additional charges for conference rooms, printing costs, and any premium amenities. Also consider the value of flexibility, networking opportunities, and productivity impacts. Create best and worst-case scenarios including potential growth or downsizing needs, as coworking spaces allow you to scale without penalties while traditional leases typically lock you in for three to 10 years.

What type of investor is better suited for offices vs. coworking spaces?

Traditional offices suit investors prioritizing passive income and simple operations. If you want predictable cash flow, minimal day-to-day involvement, and the ability to leverage properties at 70-75% LTV, traditional offices with creditworthy tenants align with your strategy. These work well for investors with limited time or those building portfolios where each property requires minimal oversight.

Coworking spaces fit active investors comfortable with hospitality-style operations. You need stronger reserves, operational expertise, and tolerance for variable monthly income. However, coworking can deliver higher revenue per square foot and faster repricing ability during market shifts. This model suits investors who can dedicate time to member management, marketing, and space optimization, or who have experience running operationally intensive businesses.

Your existing portfolio also matters. Investors with stabilized multifamily or retail assets often add coworking for diversification and higher returns despite increased management demands.