Special Warranty Deed: What It Covers, When to Use It, and Investor Risks

What is a Special Warranty Deed?

A special warranty deed is a legal document that transfers property ownership and guarantees the title is clear only for the period the seller owned it.

This type of deed offers limited protection. The seller, also called the grantor, promises there were no title issues like liens or claims during their ownership, but they do not cover anything that happened before they took possession. This makes the buyer responsible for any older title defects.

Why It's Called "Special," and Why That Can Be Misleading

The word "special" may sound like extra protection, but it's actually the opposite. A general warranty deeds covers the full title history. A special warranty deed only covers a slice of it-the time the current seller held the property. It sits between a quitclaim deed, which offers no guarantees at all, and a general warranty deed.

A Tool for Risk Allocation

A special warranty deed shifts more risk to the buyer. It's often used when the seller has limited knowledge of the property's full history or doesn't want full liability. Because of that, it is frequently seen in commercial transactions and foreclosure sales, not standard residential deals.

| Timeframe | General Warranty Deed | Special Warranty Deed | Quitclaim Deed |

|---|---|---|---|

| Before Seller Owned the Property | Covered by the seller | Not covered | Not covered |

| During Seller's Ownership | Covered by the seller | Covered by the seller | Not covered |

| After Buyer Takes Ownership | Buyer is responsible | Buyer is responsible | Buyer is responsible |

Related Document Terms You Might See

Depending on the state, a special warranty deed may also be called a limited warranty deed or a grant deed. While the language may differ slightly, the core idea is the same: the warranty only covers the time the grantor owned the property.

Where Are Special Warranty Deeds Used in Commercial Real Estate?

Special warranty deeds are commonly used in commercial real estate deals, especially when the seller has limited knowledge of the property's full title history.

Why They're Standard in Commercial Transactions

In commercial deals, buyers and sellers often treat the deed as a negotiation tool for managing legal risk. A special warranty deed limits the seller's responsibility to only the time they owned the property. This setup is preferred when properties change hands frequently, or when sellers are corporate entities that want to cap liability.

How Financial Institutions Use Them in Foreclosures

Banks and lenders often use special warranty deeds when selling foreclosed properties. This lets them offload assets quickly while limiting exposure to title issues they didn't cause. In these situations, buyers take on the risk of problems that may have occurred before the foreclosure. That's why title insurance becomes critical.

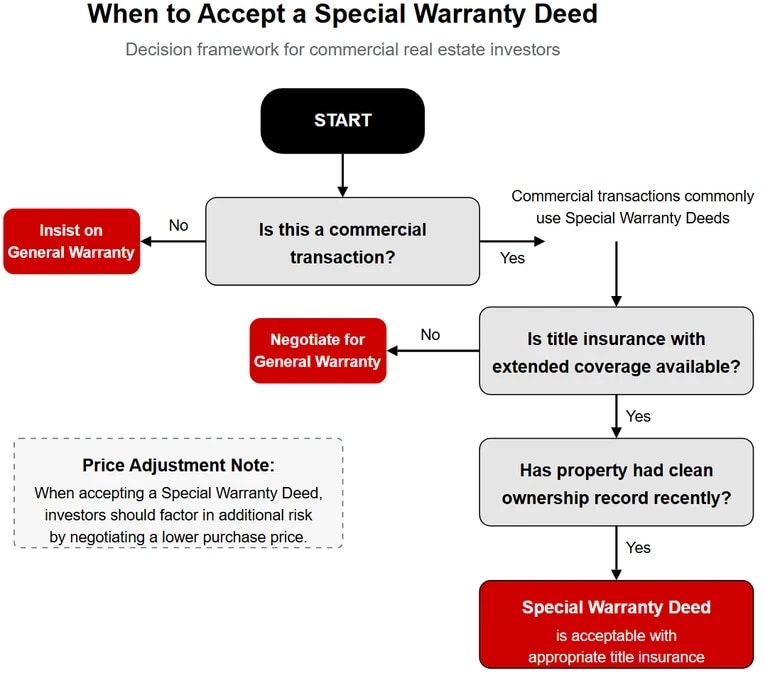

When Investors Should Accept a Special Warranty Deed

It makes sense to accept a special warranty deed if:

- The property has had a clean recent ownership record.

- The buyer plans to purchase strong title insurance.

- The price reflects the added risk.

For example, when buying distressed property, the deed type is often non-negotiable. Investors should budget for deeper title research and possible legal costs if claims arise.

If you're considering properties that may use a special warranty deed, explore available commercial properties in your area.

Commercial Real Estate For Sale

What Are the Pros and Cons of Special Warranty Deeds?

A special warranty deed gives limited legal protection to the buyer, which can be helpful for sellers but risky for investors who don't prepare.

| Pros of Special Warranty Deeds | Cons of Special Warranty Deeds |

|---|---|

| Limits seller's legal liability to their ownership period | Buyer assumes responsibility for title defects from prior owners |

| Easier and faster to use in foreclosure or owner-financed sales | Offers less protection than a general warranty deed |

| Commonly accepted in commercial property transactions | Not typically accepted in residential deals due to lender requirements |

| Reduces seller risk in forced sales or distressed situations | Requires strong due diligence and title insurance for buyer protection |

Advantages for Sellers

Sellers prefer special warranty deeds because they reduce long term liability. The seller only guarantees there were no title problems during their time of ownership. This makes it easier to transfer properties quickly, especially in situations like owner financing or forced sales.

Disadvantages for Buyers

Buyers get less protection. The deed does not cover title issues that happened before the seller took over. If there's a lien or dispute from a previous owner, the buyer has to deal with it-even if they didn't cause it.

That's why title insurance and due diligence are critical when accepting a special warranty deed. Without them, the buyer could inherit hidden problems.

Liability Is Limited to the Grantor's Ownership Period

With this deed, the grantor is only responsible for title issues that happened while they owned the property. If a title defect occurred before that, the grantor has no legal obligation to fix it.

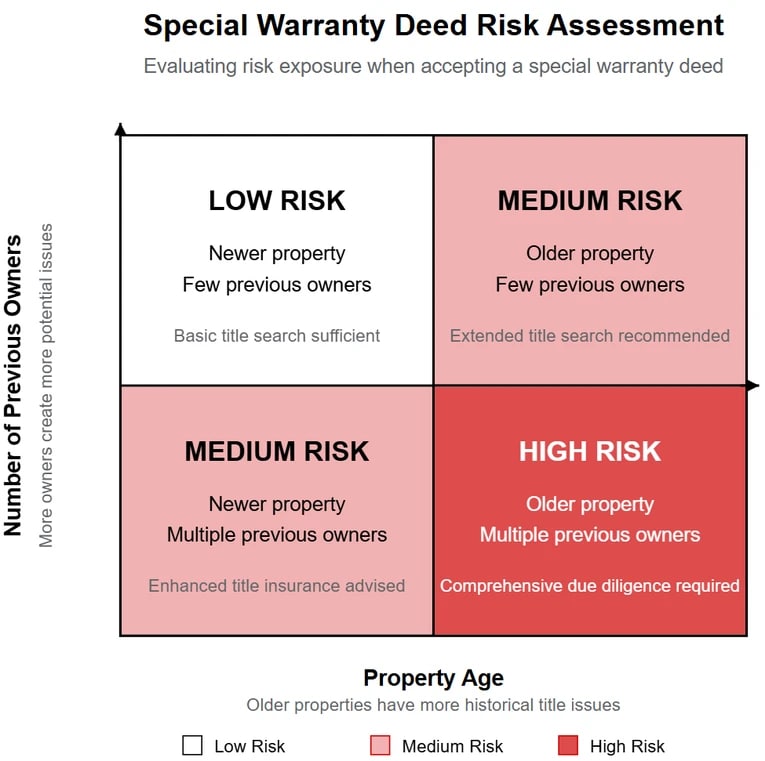

Buyer Assumes Responsibility for Older Issues

The buyer takes on the risk for anything that happened before the grantor owned the property. This risk increases with older properties or those with multiple prior owners.

If you're buying a commercial building, you'll often see this deed used. It's common in commercial deals but rare in residential ones, which usually require broader protection.

How Do You Manage Risk with Title Searches and Title Insurance?

When accepting a special warranty deed, you need to manage risk for time periods the deed does not cover. That starts with title searches and insurance.

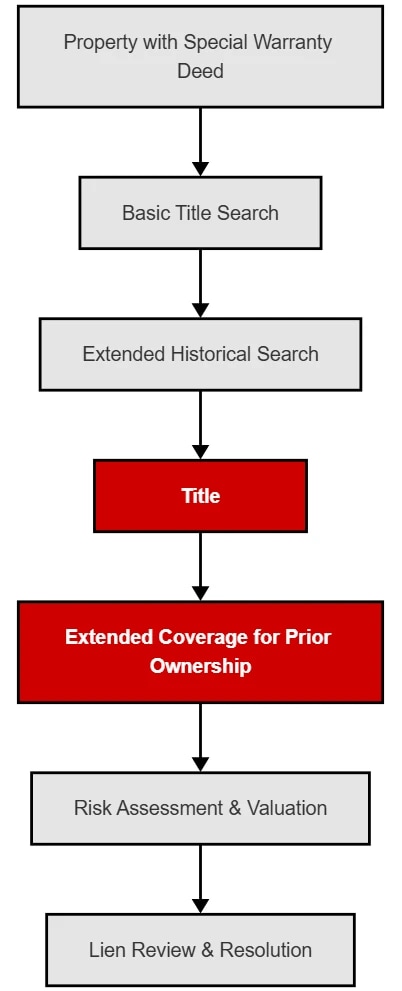

Layered Title Searches Help Identify Vulnerabilities

A basic title search looks for current liens or claims. But with a special warranty deed, you need to go deeper. Look at ownership records before the seller took over. Ask the title company to extend the search back several decades, especially if the property has changed hands often.

In depth title research is especially important during multifamily due diligence, or when buying distressed or inherited assets.

Why Title Insurance Is Non-Negotiable

Title insurance protects you from hidden title issues that were not found during the search. These can include fraud, boundary disputes, or prior liens. With a special warranty deed, it's your safety net.

Ask for extended coverage that includes protection for title defects from before the grantor's ownership. You can also add endorsements that cover survey problems or access rights.

Pair Insurance with Strong Valuation Support

If you're unsure how title defects could impact your investment, get a professional commercial real estate valuation. It helps you understand how much risk is priced into the property and whether you're overpaying.

Also, be aware of any lien exposure. Review the property for prior mechanics liens, back taxes, or unresolved disputes. A lien waiver can help clear some of these risks before closing.

What Are the Required Elements of a Special Warranty Deed?

To be legally valid, a special warranty deed must include specific elements that define the transfer and limit the warranty to the seller's ownership period.

Basic Required Elements

Every special warranty deed must clearly identify the grantor and grantee by name and address. It must also include the legal property description, which is usually pulled from a prior deed or survey. The deed must state that the grantor intends to transfer ownership to the grantee.

Time Limited Warranty Language

The deed should include language that limits the warranty to the time the grantor owned the property. Without this language, the seller could unintentionally take on broader liability. This clause is what separates a special warranty deed from a general one.

Verification Before Acceptance

Before closing, investors should review the deed for accuracy. Confirm that the legal description matches public records, all parties are correctly named, and the date of transfer is included. Also verify that any existing encumbrances are disclosed.

Integrating with Broader Deal Terms

If the transaction involves a triple net lease, or is part of a 1031 exchange, make sure the deed aligns with the leasing terms and tax structures of the deal. Inconsistent or incomplete documentation can trigger legal or tax issues later.

Use a checklist or legal review tool to catch issues early. This is especially important in deals with complex leasing terms or layered ownership structures.

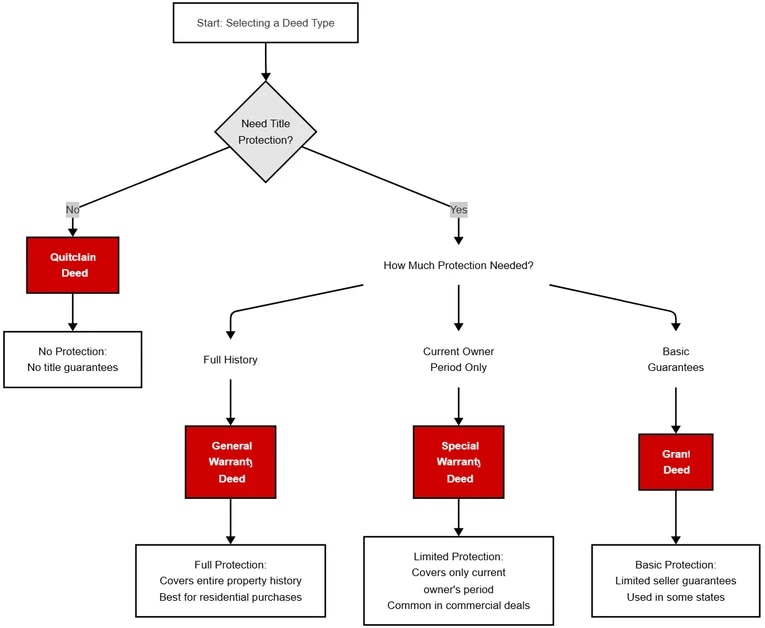

How Does a Special Warranty Deed Compare to Other Deed Types?

Special warranty deeds fall in the middle when it comes to title protection. They offer more security than a quitclaim deed but less than a general warranty deed.

| Deed Type | Title Guarantee Scope | Seller Liability | Common Use Cases |

|---|---|---|---|

| General Warranty Deed | Entire history of the property | Seller is responsible for all title defects, past and present | Residential property sales, buyer-friendly commercial deals |

| Special Warranty Deed | Only during seller's ownership period | Seller liable for title issues that occurred while they owned the property | Commercial real estate, foreclosures, bank-owned sales |

| Grant Deed | Limited to seller's actions during ownership | Seller guarantees they haven't transferred the property or caused defects | Common in California and a few other states |

| Quitclaim Deed | No guarantees at all | Seller makes no promises about ownership or title status | Family transfers, divorce settlements, clearing up title defects |

Special Warranty Deed vs General Warranty Deed

A general warranty deed guarantees the title is free of defects for the property's entire history. The grantor is responsible for any issues, even those from before they owned the property. This is the strongest form of title protection and is standard in residential sales.

In contrast, a special warranty deed only guarantees the title during the seller's ownership period. Any earlier issues are not covered.

Special Warranty Deed vs Grant Deed

A grant deed is similar to a special warranty deed but is typically used in specific states like California. It ensures the seller hasn't transferred the property to someone else and hasn't allowed any title issues during their ownership. However, it doesn't guarantee against earlier defects unless explicitly stated.

Special Warranty Deed vs Quitclaim Deed

A quitclaim deed provides the least protection. The seller makes no promises at all-not even that they own the property. This type of deed is often used in transfers between family members or to clear up title after divorce or inheritance issues.

Unlike a quitclaim deed, a special warranty deed does include limited guarantees, but only during the grantor's period of ownership.

Deed Type Selection Guide

Do Special Warranty Deed Rules Vary by State?

Yes. While the basic idea behind a special warranty deed is consistent, the language, naming, and legal weight can vary depending on the state where the property is located.

Naming Differences Across States

Some states refer to a special warranty deed as a limited warranty deed, covenant deed, or even a statutory warranty deed. Despite the different names, these all function similarly by limiting the seller's liability to the period of their ownership.

Before signing, verify how your state defines these terms and whether the deed type matches your expectations. This is especially important if you're working across state lines or acquiring a portfolio in multiple jurisdictions.

How to Know When Legal Counsel is Necessary

Use a simple rule of thumb: if the deed language doesn't match what you expected, or if it includes custom clauses that narrow or expand the warranty period, get legal help. Some deals may require tailored language that isn't captured in a basic deed template.

If you're unsure whether the property complies with local land use rules, review the area's zoning for land or check if a zone variance is in place that could affect property value or future development rights.

Commercial Deeds Across Asset Classes

Special warranty deeds are most common in commercial property types, but state practices can differ by asset class. For example, office and industrial properties may follow one deed convention, while mixed-use or specialized properties might use another. Familiarize yourself with deed norms based on the types of commercial real estate you're targeting.

Special Warranty Deed Due Diligence

When accepting a special warranty deed, your due diligence should focus on uncovering risks outside the seller's ownership period. These steps help protect against title issues the deed doesn't cover.

1. Review the Full Chain of Title

Start by examining the property's full ownership history. Look for gaps, conflicting transfers, or inconsistencies in how the title changed hands. This helps identify potential claims that predate the current seller.

2. Search for Pre-Existing Encumbrances

Investigate prior liens, easements, or restrictions that could affect future use or sale. Many of these issues aren't the seller's fault but still become your responsibility after closing. A lien waiver can help mitigate some of these risks before you finalize the deal.

3. Analyze Property Value with Deed Limitations in Mind

Understand how limited title protections could affect the property's resale or financing potential. Use a professional commercial real estate valuation to model different scenarios based on possible title complications.

4. Study Zoning, Restrictions, and Prior Use

Verify that the property's current zoning and historical usage align with your intended plans. Cross check this against any easements, recorded agreements, or restrictions from prior owners. If you're buying undeveloped property, understanding how to buy land strategically can help you identify long-term risks tied to entitlement, access, or incompatible land use.

5. Assess Land Value Beyond Surface Price

If you're buying undeveloped property, analyze the location, entitlement status, infrastructure access, and local comps. Pair this analysis with the deed type to understand risk exposure. Here's a breakdown of how to evaluate the value of land before you buy.

6. Secure Title Insurance with Expanded Coverage

Make sure your title insurance covers defects from before the seller's ownership period. Request endorsements that address survey gaps, boundary lines, or prior legal claims. This creates a backup layer of protection not included in the deed.

How Can You Negotiate Better Protections When Offered a Special Warranty Deed?

If a seller insists on using a special warranty deed, you still have options. The key is to shift some of the risk back to the seller or neutralize it through third party protections.

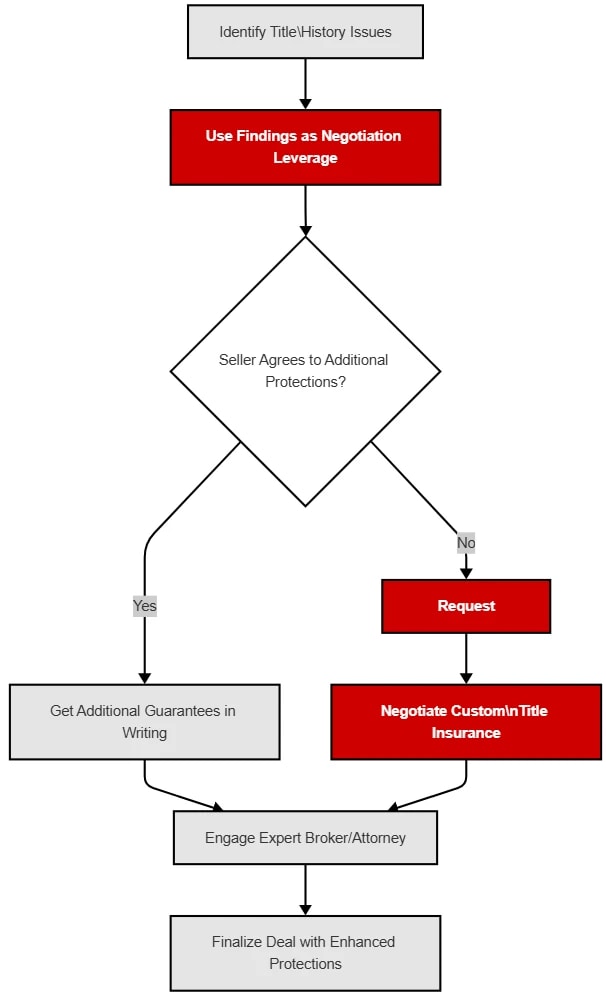

Use Title Findings as Leverage

Start by identifying gaps or red flags in the title history. If there are missing records or signs of prior liens, use those findings to negotiate stronger protections. You may not be able to secure a general warranty deed, but you can request specific seller guarantees in writing outside the deed itself.

Request Escrow Holdbacks or Custom Endorsements

If the seller won't extend the warranty period, ask for an escrow holdback. This holds a portion of the sale proceeds until a certain time passes without title claims. You can also negotiate for custom title insurance endorsements that cover specific concerns like prior easements or undocumented access rights.

Supplement Limited Protections with Expert Help

Hire a broker who understands the nuances of deed negotiation. A skilled realtor for commercial property can help you structure the offer and highlight areas for negotiation that protect your downside.

In tenant-occupied buildings, consider how the deed language could affect occupancy risks. If you're new to this process, learning the basics of commercial tenant representation can help you ask the right questions and protect your future cash flow.

Frequently Asked Questions

How can I assess if accepting a property with a special warranty deed is too risky for my investment strategy?

Start by reviewing the age of the property and the number of previous owners. The older the property and the more times it has changed hands, the more history falls outside the deed's protection. Request a title report that goes beyond the current owner's tenure and calculate how much of the title history is unwarranted. If you're a conservative investor or planning a short-term hold, budget 1 to 3 percent of the purchase price as a contingency fund or negotiate for additional title protections.

What specific leverage points can I use to negotiate stronger protections when a seller insists on using a special warranty deed?

Point to any gaps or irregularities in the title as leverage. Ask the seller to fund an enhanced title insurance policy or offer written guarantees for specific concerns. You can also negotiate an escrow holdback that releases to the seller after a set period without title issues. In institutional sales where deed type is non-negotiable, focus instead on adding custom representations and warranties outside the deed.

How do I ensure my title insurance policy adequately covers the gaps in protection created by a special warranty deed?

Request an extended coverage policy that includes prior ownership periods and unknown defects. Work directly with the underwriter to add endorsements for survey coverage, boundary disputes, or access rights. You can also include an inflation rider so the policy covers appreciation and legal defense costs, not just the purchase price. Expect to pay around 20 to 30 percent more than a basic policy, but the protection is worth it.

What historical title issues should raise immediate red flags when considering a property being sold with a special warranty deed?

Watch out for breaks in the chain of title, unresolved liens, or disputes involving boundary lines. Properties that went through foreclosure-especially during the 2008–2010 period-may have documentation flaws. Also be cautious with former trust or estate-owned properties, or those with nonstandard easements. If you see any of these, increase your title insurance coverage or walk away if protections can't be added.