Warranty Deed in Real Estate: Investor Protections, Risks, and Strategies

What is a Warranty Deed?

A warranty deed is a legal document that transfers property ownership and guarantees the title is clear. It's not just a contract, it's a formal promise from the seller to the buyer that the property is free of undisclosed debts, liens, or ownership claims, and that the seller will be legally responsible if title issues arise later.

Warranty deeds protect investors by shifting legal risk to the seller

In a commercial real estate transaction, the type of deed you receive directly affects your exposure to title related risk. A warranty deed shifts that risk from the buyer to the seller. If an old lien, boundary dispute, or unpaid tax surfaces after closing, a properly structured warranty deed gives the buyer the legal right to pursue the seller for damages.

This protection is especially important when buying older properties, those with complex histories, or any asset that's changed hands multiple times. Title issues from prior owners can become your responsibility if the deed lacks sufficient guarantees.

Warranty deeds act like legal insurance, but they don't replace title insurance

A warranty deed is not the same as title insurance, but they work together. The deed gives you legal recourse against the seller, while title insurance provides financial protection from a broader range of title defects, including those the seller may not have known about. Together, they form a layered defense against future title problems.

Key elements to check in a warranty deed

Not all warranty deeds are created equal. To hold up in court, a valid deed typically must include:

- A complete legal description of the property

- Correct identification of both grantor and grantee

- A clause stating the grantor owns the property and has the right to convey it

- A guarantee to defend the title against future claims

- Signatures, witnesses, and notarization as required by state law

Without these elements, the protections in the deed could be weakened, or unenforceable.

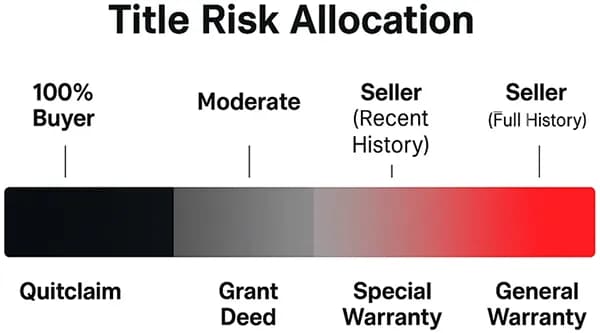

Not all deeds offer the same protection

It's important to understand how warranty deeds compare to other deed types. The table below breaks down the key differences:

| Deed Type | Level of Protection | What It Covers |

|---|---|---|

| Special Warranty Deed | Limited | Only covers title defects that occurred during the seller's ownership period. |

| Quitclaim Deed | None | Transfers whatever interest the seller has, without any title guarantees or warranties. |

| Grant Deed | Moderate | Guarantees the seller hasn't transferred the property to anyone else and that the title is clear of known issues, but may not include a promise to defend against future claims. |

For commercial property buyers, understanding these differences is key. The wrong deed type could leave you responsible for title issues you didn't cause.

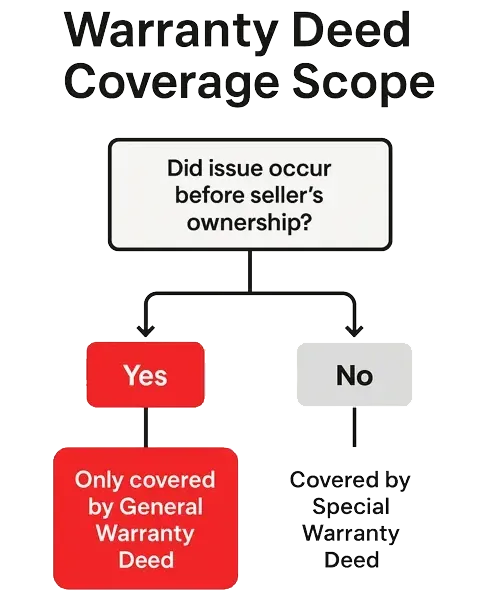

Types of Warranty Deeds: General vs. Special

When someone says "warranty deed," they could be referring to either a general or special type, and that distinction matters. As a commercial investor, the level of protection you get depends entirely on which one you're handed at closing.

General warranty deeds offer the most complete protection

A general warranty deed covers the entire history of the property, not just the period the seller owned it. If a claim surfaces from 15 years ago, before the current owner even bought the property, the seller is still legally responsible.

This makes general warranty deeds the gold standard. They're most common in residential deals, but you'll also see them in commercial transactions involving stabilized assets or institutional buyers who demand full title protection.

The tradeoff? Sellers often resist giving them. They expose themselves to more legal risk, so unless there's competition or a pricing premium involved, most will default to more limited terms.

Special warranty deeds limit coverage to the seller's ownership period

Special warranty deeds narrow the scope. The seller only guarantees that they didn't cause any title issues while they owned the property. If there's a problem from a previous owner, say, a lien that wasn't properly recorded, it's your problem now.

This is the go to deed type in foreclosure sales, REO listings, and any "as-is" commercial deal. Sellers like banks or government agencies use them because they don't want liability for events they couldn't control.

It doesn't mean the deal is bad. It just means you need to compensate with stronger title insurance, a deeper title search, and a more cautious read of the public record.

Choosing the right deed depends on the deal structure

If you're buying a clean office building with long term tenants, a special warranty deed may be fine. The property's recent history is what matters. But if you're planning to redevelop a site or flip it quickly, a hidden title issue can derail everything, zoning, financing, permits, you name it.

That's when a general warranty deed is worth pushing for. It protects you against issues you didn't cause and may not even see coming until it's too late.

Use deed type as a negotiation tool

You might not always get the deed type you want, but you can negotiate other protections. Think title reps in the PSA, indemnity clauses, or funds held in escrow to cover post-closing surprises.

The key is to treat deed type like any other contract term. If you're being asked to take on more risk, that should be reflected in the price, or in the other protections baked into the deal.

There's no rule that says one type is better in every case. The best approach is to align the deed with your investment strategy, risk tolerance, and exit plan.

Commercial Real Estate Considerations

Warranty deeds in commercial transactions operate within a more layered environment. You're not just buying square footage, you're taking on existing leases, easements, environmental exposure, and shared infrastructure. The title must account for all of it.

Easements and access rights affect more than boundaries

In commercial developments, access is often shared. A reciprocal easement agreement might cover parking, driveways, or signage rights between parcels. If it's missing or misrecorded, you could end up legally responsible for maintaining areas you don't own, or worse, lose access your tenants rely on.

This isn't theoretical. In some shopping centers, disputes over cross parcel signage or delivery truck access have delayed tenant move-ins and even triggered legal action. Before closing, confirm that any easements are clearly documented in the title and referenced in the deed's legal description.

Environmental issues are often excluded from deed protections

Older industrial buildings, auto repair facilities, or even dry cleaners often come with lingering environmental exposure. If a prior owner capped a contaminated area or signed a remediation agreement, those obligations may resurface later, even if you had no part in them.

Align deed protections with asset strategy, not just property type

Some investors try to negotiate general warranty deeds for every deal. That's not always necessary, and in some cases, it can spook sellers unnecessarily. Focus instead on deal complexity, risk exposure, and your holding plan.

If you're flipping an underutilized retail center within 18 months, a limited deed might be fine, just make sure your title policy is airtight. But if you're buying a long term cash flow asset like a net-leased industrial site, that broader protection becomes more valuable over time.

Match the legal protection to the real world risk. That's how professionals structure deals that perform, and hold up under pressure.

For quick reference, the table below outlines common commercial risk factors and whether they're typically covered by a warranty deed, title insurance, or both. Use it to identify where you may need extra protection beyond the deed itself.

| Risk Factor | Typically Covered by Warranty Deed? | Typically Covered by Title Insurance? |

|---|---|---|

| Environmental Issues | No | Sometimes (with endorsements) |

| Unrecorded Easements | No | Yes |

| Access Rights (Shared Driveways, Parking) | No | Yes |

| Prior Liens or Mortgages | Yes | Yes |

| Boundary Disputes | No | Yes (if not discoverable by survey) |

Negotiating Warranty Deed Terms

Warranty deeds aren't set in stone. Like any other part of a real estate contract, the terms can, and often should, be negotiated based on deal complexity and risk exposure. If the seller offers a deed with broad carveouts or vague guarantees, you don't have to accept it as-is.

Watch for common exceptions in seller-provided deeds

Most sellers, especially in commercial transactions, will include exceptions in the deed language. These might exclude environmental liabilities, prior encumbrances, or anything the seller believes falls outside their responsibility. Sometimes these carveouts are boilerplate. Other times, they're shielding specific known risks.

Don't skim past them. Each exception weakens the protection you're being offered. Have your legal team flag anything that could become a future liability, and get clarity from the seller before closing.

When you can't get a better deed, shift the risk somewhere else

If the seller refuses to modify the deed, you still have options. You can negotiate indemnity clauses in the purchase and sale agreement that cover specific risks. You can require the seller to place funds in escrow to address unresolved title issues. You can even renegotiate the price to reflect the added exposure.

Tailor protections to the deal, not the seller's default

It's common for sellers to offer the least protective deed they're legally allowed to use. That doesn't mean it's the right fit for the deal. If the property has a long ownership chain, potential boundary disputes, or development plans that hinge on clean title, push for stronger protections, or offset the risk another way.

What you don't want is to accept limited deed terms by default, then uncover a costly problem post closing with no legal or financial fallback.

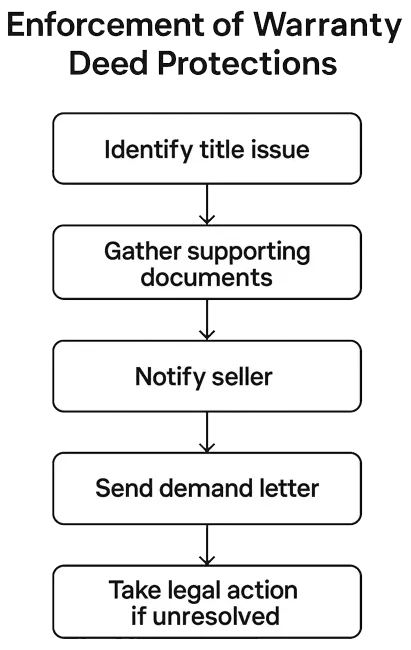

Enforcing Warranty Deed Protections

A warranty deed is only as useful as your ability to enforce it. If a title issue surfaces after closing, your next steps depend on how well you documented the deal, and how quickly you act.

Start with evidence and documentation

Before anything else, gather records. You'll need proof that the issue existed before your ownership and that it falls under the seller's warranty. This could be a lien that predates your purchase, an undisclosed easement, or a title defect that contradicts the deed's representations.

Pull your final title report, the executed deed, any correspondence with the seller, and your closing documents. If you purchased title insurance, notify the insurer immediately as well, there may be overlapping coverage.

Send formal notice before escalating

Most enforcement starts with a demand letter. This outlines the breach, your requested remedy, and the relevant warranty language. You or your attorney should send this directly to the seller, along with supporting documentation.

Many issues resolve here. If the seller agrees they're responsible, they may fund the fix or settle quickly to avoid litigation. But if they deny the claim, your next step is legal action, and that's where your documentation becomes critical.

Pay attention to deadlines

Warranty deed claims fall under the statute of limitations for written contracts, which varies by state. In most jurisdictions, you'll have between 3 and 6 years to file a claim. But waiting too long can weaken your case, especially if the defect causes financial damage that grows over time.

Decide when enforcement is worth it

Not every defect justifies a lawsuit. If the cost to fix is minor or the responsible party is difficult to collect from, it may make more sense to address the issue yourself and move on. But for larger claims, especially ones that affect resale value or financing, pursuing the seller may be necessary to protect your investment.

The key is to stay proactive. The earlier you identify the problem, the more options you'll have to resolve it without costly delays or legal battles.

Frequently Asked Questions

How does a warranty deed differ from title insurance, and do I need both?

A warranty deed gives you the legal right to hold the seller responsible if the title isn't as promised. Title insurance protects you financially if a title problem shows up, especially one the seller didn't know about. Together, they cover different angles of risk. Most investors should secure both, especially in higher-stakes commercial deals.

How can I negotiate stronger warranty deed protections when purchasing investment property?

If the seller won't provide a general warranty deed, ask for alternative protections. That could include indemnity language in the PSA, reps and warranties specific to known issues, or an escrow reserve for title-related concerns. You can also request a longer lookback period in the title search or demand seller cooperation on future claims. It's all negotiable, if you bring it to the table.